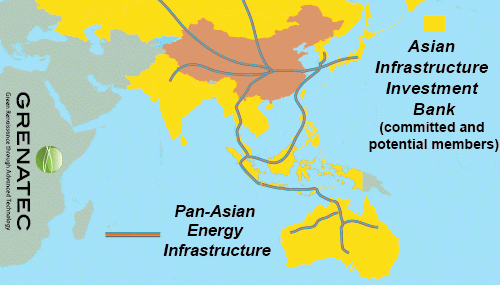

China’s Asian Infrastructure Investment Bank. Countries intending to join China’s AIIB. Its investments in a ‘Pan-Asian Energy Infrastructure’ could create the template for a larger international energy network.

Can China’s Asian Infrastructure Investment Bank (AIIB) fix climate change? Yes. Only if it funds infrastructure encouraging common standards, integrated markets and deeper energy network interconnection.

China’s partners in the bank need to push this, hard. If they do, the benefits to both Asia and the world will be enormous.

To date, AIIB analysis has focused upon shortsighted, geopolitical handicapping of the power balance between China and the United States. This misses the far larger story: the AIIB’s ability to alter 21st Century history through constructive, much-needed energy market reform.

Asia now accounts for a large proportion of the world economy. Supplementing regional infrastructure investment with energy decarbonization will generate incalculable net present value.

The AIIB’s founding members, therefore, should push investment toward creating a “Pan-Asian Energy Infrastructure (PAEI)” of integrated high-capacity cross-border power lines, gas pipelines and the fiber optics to manage them.

This would enable non-discriminatory access to a massive regional market for energy sources ranging from sun, wind, biomass, hydro, geothermal, ocean thermal and others – including ‘closed-cycle’ nuclear.

All energy sources would have access to ubiquitous delivery infrastructure. Winners and losers would then be sifted by price, availability, carbon emissions and distance between producer and consumer.

In other words, a PAEI would create a perfect market in energy in the world’s largest regional economy. It would be based upon innovation, generation and delivery. This will create economic dividends lasting for a century or more. It will virtually solve global climate change.

It would also replace dirty, short-lived, uneconomic bilateral infrastructure like Liquid Natural Gas, a perverse symbol of the status quo energy market.

In the future, what’s needed is an ‘Internet’ of energy with a topology and management to match the ‘common carrier, open access’ principals and geography of the data internet. The benefits of that innovation over the past two decades are indisputable.

Toss in carbon pricing and the positive picture is complete.

Instead of viewing the AIIB as a symbol of looming Chinese economic hegemony, the AIIB should instead be viewed as a global climate change solution (starting in Asia) and major market opener with powerful, vastly distributed benefits.

Seen this way, the AIIB benefits all. That’s particularly so if other members hold a veto over China.

What’s needed now is an intellectual bridge to be made between the AIIB and the COP21 meetings in Paris later this year. At the COP21 meeting, countries must pledge future numerical carbon emissions reduction targets all will ignore.

A far better plan would be to use global need for new and revamped energy infrastructure to remove impediments to better carbon-adjusted creation, valuation and delivery of energy. When this happens, markets – not politicians – can take the lead in reducing carbon emissions.

The timing has never been better.

For China the creation of the AIIB – or something like it – is now an economic necessity. China now desperately needs to recycle its growing and economically destabilizing multi-trillion dollar foreign reserve hoard.

The hoard accumulated during China’s three-decade macroeconomic development policy centered on a weak currency. The result: China stayed employed while the West got cheap consumer products.

But the policy’s now hit a wall.

China must now find other means for ensuring full employment and social stability.

Deploying her now world competitive infrastructure companies to build international infrastructure is that means. Nothing wrong there. Done right, everyone will benefit.

Given this, China’s AIIB partners hold more power in the fledging bank than they might think. That’s because they hold the access keys to their own domestic infrastructure markets.

Without the external labor sink of infrastructure projects, domestic Chinese unemployment will rise. This compromises China’s sullen and brittle social contract: rising incomes in exchange for reduced political freedom.

Handled correctly, an ideal, symbiotic middle course looks to be opening up — with the AIIB front and center.

Under this middle course, China reorients its economy from cheap component assembly to high-tech exports. China’s neighbors get new and upgraded energy infrastructure.

Both sides get a technical standard-setting vehicle in the form of the AIIB.

Markets get greater efficiency through removal of perversities. The world gets a regional solution to climate change replicable elsewhere.