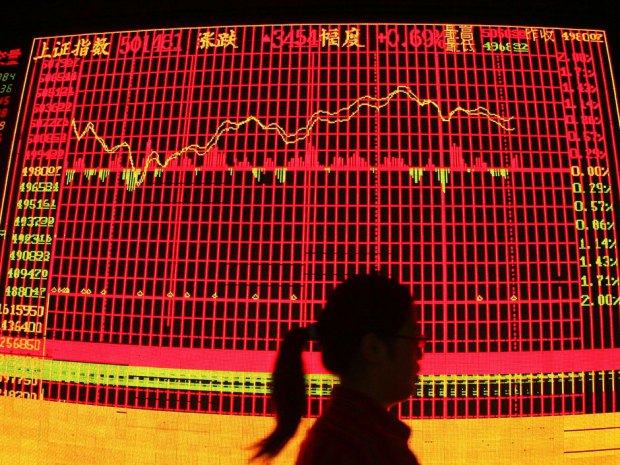

For many China observers and financial analysts monitoring the Chinese A-share markets recently, the question for months has been: ‘When will this bubble pop?’ Historic and rapid gains in both the Shanghai and Shenzhen A-share markets over the past twelve months have many drawing the conclusion that the growth is being driven by irrational exuberance. To understand if irrational exuberance could be driving the Chinese A-share market straight into a bubble, we must understand the unique characteristics of both individual and institutional market participants and what makes China’s A-share market different.

Once indication that irrational exuberance is at play in fueling the A-share returns lies in the dichotomy between market participants in western markets and those in China. In the West, most stock trading involves institutional actors. On the contrary, retail investors dominate the Chinese A-share market. According to a report from the China Securities Depository and Clearing Corporation, around 80 percent of China’s stock trading comes from individual investors.

In a country where personal relationships and the recommendations of friends often drive private business and financial transactions, it would not be a far stretch to attribute some of the recent uptick towards cultural and social factors. This “bandwagon” effect has spurred a record number of new investors to enter the market, most of which lack investment sophistication. According to a study by China’s Southwestern University of Finance and Economics, more than two out of three investors that have entered the market in the last few months do not even have a high school degree.

Chinese investors are also turning to the A-Share market as a way to replace certain other economic activities that have lost their appeal or came under more strict control. For one, Chinese who grew accustomed to profiting from the impressive rise of the domestic real estate market are now faced with more stringent regulation and less lucrative returns. Now hungry Chinese investors are looking for additional revenues to satisfy their investment appetites, and the A-share market has arisen as a seemingly ideal candidate. It is a familiar place to easily move their money. And it is much more convenient than trying to break through outbound capital controls imposed by the government to keep cash in the country.

To many Chinese retail investors, you could even say that they treat stock trading as a game. In a recent interview with CNN Money, Suzanne Duncan of State Street pointed out that gambling is illegal in China, and that stock trading fills that void in some way. “It’s fun. It’s what they do as a hobby,” she remarked. They also trade more often than investors anywhere else in the world. The same firm recently published a poll in which 81% of Chinese respondents indicated they trade at least once a month. By contrast, only 53% of Americans admitted to trading as often.

For retail investors who are typically less well versed in financial principals, it is easier to see investing as a game like gambling, rather than a professional activity, and that mindset can lead to more emotionally-driven decision making. On a macro-scale, this type of investor mentality in a retail-dominated market could conceivably lead to greater exuberance and overconfidence as market participants take the recurring daily gains as of late as an indication of what future returns will be.

Adding to the exuberance is the confidence Chinese investors have in governmental policy-making to avoid instability. To be sure, the Chinese government has developed a good track record to build this confidence. Chinese leaders have been all but complacent in implementing necessary reforms to prevent economic bubbles, or paomo, from disrupting the overall ascension of the Chinese economy. But in the case of the Chinese A-share market, government intervention may help control speculative activity to an extent, but this seemingly iron hand that controls the economy can also contribute to the overconfidence that exists; Chinese citizens commonly shrug of any mention of a bubble remarking that the Chinese government controls the economy and would never allow a bubble to happen.

Finally, it is important to point out the unique institutional characteristics of Chinese capital markets. In the U.S. it is commonly believed that the ability of investors to short sell is a healthy market feature; it helps put downward pressure on company valuations when prices get out of control, as it allows investors to profit from making negative bets on likely overvalued stocks. In contrast, this activity is prohibited in the Chinese market. Interestingly, the absence of this healthy financial innovation has been accompanied by the emergence of a stability-threatening innovation in the Chinese stock market – equity margins. Equity margins are the extension of credit by brokers, collateralized by equity, to investors for the purchase of additional equity securities. Though this practice has existed in the developed markets for a long time, the introduction of additional leverage into an equity market at a time when P/E ratios have reached all-time highs and credit expansion continues unabated only contributes to a complex formula of forces driving up equity prices to unrealistic levels.

If retail investors are not yet concerned by talks of irrational exuberance, institutional investors are beginning to be. Many large security firms, trust companies, and asset management firms are already starting to control how much credit they extend to investors to obtain loans to continue trading in A-shares. For example, starting on April 17, the China Securities Regulatory Commission instructed securities firms to not allow the opening of “umbrella trusts” that have been commonly established for investors to use borrowed money from bank depositors to invest in the exchange.

It is certain that the market cannot continue to grow at this pace, but whether the skyrocketing returns lead to a market crash or a steadier deleveraging, no one can know for sure. It is also hard to prove now that the exuberance in the Chinese A-share market is completely irrational. Surely, it will be important to keep in mind the forces and characteristics that make activity in the Chinese A-share market tick and watch them when the market retracts. If the retraction is harsh, new retail investors may be deterred from playing the game, and future activity could become increasingly dominated by experienced players and institutions. If it is a steady cooling off, we could expect the unique characteristics of the Chinese market to more firmly solidify.