Since Deng Xiao Ping came to power 50 years ago, China has slowly opened up to trade with the West and has become a powerhouse in cheap manufacturing. Through favorable government policy, access to an abundant labor force, and participation in international organizations such as the World Trade Organization, they have become the top trading partner with economic superpowers Japan, South Korea, the European Union (EU), and the United States (U.S.). China has consolidated power by establishing near-monopolies on many critical supply chains, as well as its Belt and Road Initiative, and its trade with the biggest economies in the world. However, China may see these advantages disappear in the coming years.

Monopolies

[Credit: AP Copyright: AP photo]

Several critical supply chains run through China. These include rare earth metals and semiconductor chips that are essential in modern technology and computers, and more recently photovoltaic elements that are essential for solar energy generation. A rapid shock to any of these supply chains will see massive repercussions as we saw in 2021 when COVID-19 interrupted the supply of semiconductor chips from Taiwan.

The Taiwan Semiconductor Manufacturing Corporation (TSMC) produces 90% of the global supply of semiconductors and was forced to slow production during the pandemic. As a result, the supply of semiconductors was drastically constrained resulting in manufacturing shortages and increases in price for products that need them. A key example of this is new and used car prices in the U.S. rose 13% and 27% respectively during this time. TSMC facilities are state-of-the-art and produce the highest quality semiconductors including the very dense 5-nanometer chips. A nation that can exert control over the TSMC foundries in Taiwan and deny them to competitors would have the advantage in new technologies that drive modern economies and power military advancements.

Current events have highlighted the threat of a Chinese invasion of Taiwan which could cut off the supply of semiconductor chips. Speaker of the House Nancy Pelosi’s visit to Taiwan sparked outrage in the mainland, and saw the Chinese Communist Party (CCP) publish a white paper reinstating their right to forcefully reunify Taiwan with the mainland. Any invasion would affect the production of semiconductor chips for the rest of the world.

China also enjoys a monopoly on the refinement of rare earth metals despite only having 36% of the world's rare earth deposits. This monopoly has granted China many advantages in the production of technologically advanced computers, including iPhones. Apple, one of the U.S.’ largest companies with a market cap of $2.55 trillion, produces 90% of its products in China through subcontractors such as Foxconn that rely on these rare earth metals.

China is looking to replicate this monopoly with photovoltaic cells, a device that is made up of semiconductor materials that convert sunlight directly into electricity. According to the International Energy Agency’s first report on photovoltaics supply chains, China owns 80% of the world's manufacturing of solar panels at all stages. China is leading the solar energy sector in

both investment and innovation which could lead to an even greater share of dominance in solar energy manufacturing.

The Belt and Road Initiative

[Source: The World Bank]

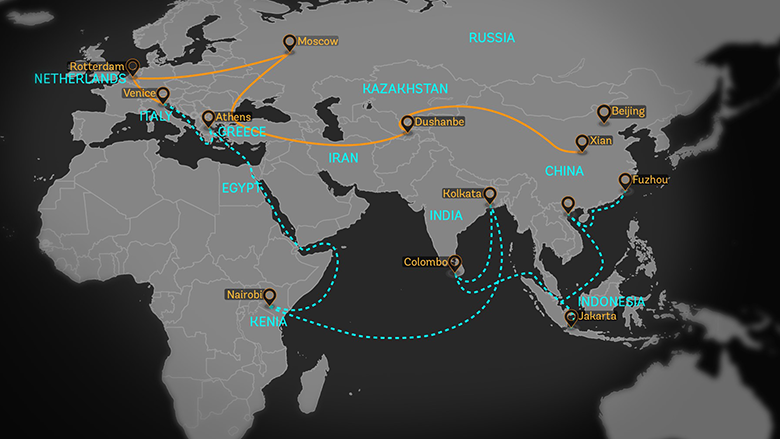

A key effort of the Chinese government to promote trade and gain influence abroad is the Belt and Road Initiative (BRI) which aims to recreate the Silk Road with infrastructure projects in countries in South-East Asia, the Middle East, and Eastern Europe. According to a report by the Green Finance & Development Center at Fudan University in Shanghai, the BRI has loaned out a total of $932 billion since its inception in 2013.

Many countries have sought to receive BRI loans to finance infrastructure investments in their developing countries and have found China to be a favorable partner. BRI loans often do not come with the same due diligence and conditions that U.S. investments normally hold, allowing for countries that are economically poor or ruled by unfavorable regimes to gain BRI loans. Chinese investments do not come with these attachments.

However, the BRI might be facing its most high-stress test so far at a time when China’s economy is slowing due to its Zero COVID Policy, and the impending crash of its real estate development bubble. Some of the nations that have received significant BRI investments are facing defaults on their loans, such as Sri Lanka and Pakistan, which are having leadership and economic crises. Investment in Russia has also lagged due to fears surrounding the war in Ukraine and the massive sanctions leveled against Russia by the West.

These loans defaulting would add more issues to the Chinese economic recovery effort and would harm the government’s ability to respond to the increasingly dangerous real estate development market bubble.

Trading Partners Starting to Push Back

After gaining significant control over much of the world's manufacturing power and creating a large middle-class market, China has begun to use these as weapons to coerce businesses and countries to adopt favorable policies for China. These include the One China Policy, embargos of companies such as the NBA, a pause on the THAAD Missile Defense System in Seoul, and censorship of Disney movies.

China has become the largest trading country in the world and trades billions of dollars with the U.S., South Korea, Japan, and the European Union every year. They have tried to use these coercive tactics with each of these trading partners in the past to mixed success.

The sour taste left by these coercive tactics and the interruptions in supply chains from Trump’s Trade War and China’s Zero-Covid policy have caused these trading partners to begin seeking alternatives to mainland China and Taiwan. Some trade has already been moved to China’s southern neighbor Vietnam, and legislation is looking to provide incentives for alternatives.

The U.S. passed the CHIPs Act which authorized billions of dollars in subsidies and tax incentives to companies such as NVIDIA and Intel to open semiconductor manufacturing foundries in the U.S.

Conclusion

China has built a thriving and powerful economy with several monopolies on key supply chains, significant investment abroad, becoming the top trading country in the world in just 50 years. However, this Golden Era is in danger of coming to an end as trading partners look to substitutes, loans to unstable countries are defaulting, and economic trouble is brewing at home.

If China is unable to overcome these issues, it may see economic contraction and a recession unlike any they have ever experienced in modern history. As troubles and difficulties persist more and more roads may leave Beijing instead of leading there.