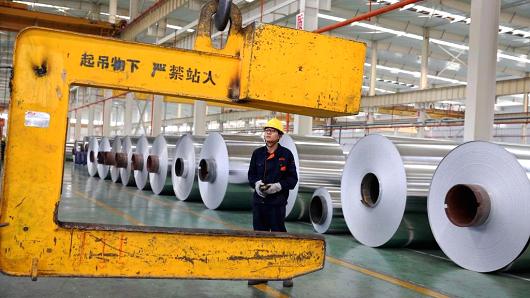

Reuters reports that China said it was "strongly dissatisfied" with the U.S. decision to impose anti-dumping duties ranging from 97 percent to 162 percent on Chinese aluminum foil, urging Washington to correct its "mistaken methods". The preliminary ruling on Friday was a victory for U.S. aluminum foil makers who filed a complaint with the Commerce Department accusing Chinese producers of dumping foil into the U.S. market at below cost or fair market value. In 2016, U.S. aluminum foil imports from China were valued at $389 million, according to the Commerce Department, which said it would issue its final determination for the duties on Feb. 23. Chinese Commerce Ministry official Wang Hejun said in a statement late on Saturday that the United States was still using "discriminatory" surrogate country pricing methods to put high duties on Chinese goods...U.S. President Donald Trump's administration has made enforcement of trade laws a top priority. From Jan. 20, the day Trump took office, through Oct. 25, the Commerce Department said it initiated 77 anti-dumping and countervailing duty investigations, up 61 percent from the previous year.

New York Times reports that China is stepping up its oversight of cash loans offered through the internet amid growing concerns over rapid growth in the lightly regulated industry, a business media report said on Saturday. Caixin, in a report on its website, quoted Ji Zhihong of the central bank's financial markets department as saying it has developed with other authorities a special regulation for controlling online financial risk. According to Caixin, Ji told a seminar the regulation has already achieved some success. Caixin also quoted Ji as saying China will improve regulations for all online financing businesses, and all financing activity should be subject to a basic level of oversight. China's fast-growing online micro-credit firms have been accused of taking advantage of regulatory loopholes to charge excessively high interest rates. Securities Times, a state-backed media, earlier this month said new rules could emerge within six months to tighten controls on online microcredit firms.

- 2017-10-27 China's graft tsar draws remarkable political career to close

- 2017-10-26 China is the largest market for robots in the world right now, ABB CEO says

- 2017-10-25 These Seven Men Now Run China

- 2017-10-24 Trump to press China on North Korea, trade on Beijing visit

- 2017-10-23 China’s Pursuit of Fugitive Businessman Guo Wengui Kicks Off Manhattan Caper Worthy of Spy Thriller

- 2017-10-22 China Says Jobless Rate Lowest in Years, but Challenges Persist

- 2017-10-20 What We Learned on Day Three of China’s Party Congress

- 2017-10-19 What We Learned on Day Two of China's Communist Party Congress

- 2017-10-18 China Is Quietly Reshaping the World

- 2017-10-17 China's Communist Party is holding its most important meeting in years: Here's what you need to know

- New York Times As China's Home Prices Cool, Some Property Companies Seek to Reduce Risks

- Financial Times China's tech titans set sights on car innovation

- Financial Times Chinese capital makes rapid ascent in global aircraft leasing

- Bloomberg China Investors Are More Confident Than the Real Economy

- Forbes Bitcoin Prices Above $6000 On Hopes China Will Lift Ban

- Wall Street Journal Foreign Companies in China Get a New Partner: the Communist Party

- Financial Times Steel industry grapples with curse of oversupply

- Financial Times China to tighten regulation of fintech consumer loans

- The Washington Post Chinese president's former secretary gets top Shanghai job

- Reuters Taiwan president arrives in Hawaii despite Chinese objections

- www.businessinsider.com Mark Zuckerberg is back in China as Facebook eyes opportunity to finally enter the country

- Reuters China's Baidu teams up with Shouqi on driverless cars: Xinhua

- www.cbsnews.com How China is cracking down on poor English translations

- uk.reuters.com North China air quality shows no improvement from last September

- Reuters China's Guangdong gets new party boss, former leader likely to be promoted

- Bloomberg Korea War Seen Killing Up to 300000 in Days Even Without Nukes

- Financial Times Is China's lack of democracy a threat to the west?

- Brookings Institution https://www.brookings.edu/interactives/chinas-new-politburo-standing-committee/