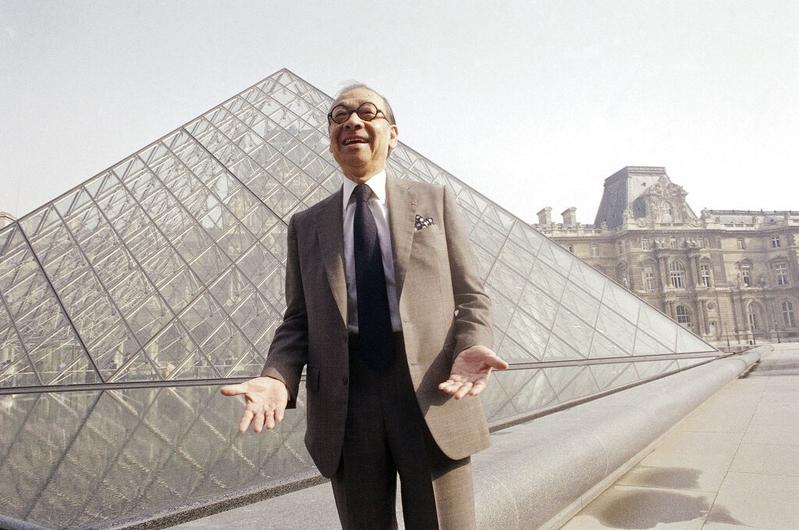

- The New York Times reports, "I. M. Pei, who began his long career designing buildings for a New York real estate developer and ended it as one of the most revered architects in the world, died early Thursday at his home in Manhattan. He was 102. His death was confirmed by his son Li Chung Pei, who is also an architect and known as Sandi. He said his father had recently celebrated his birthday with a family dinner. Best known for designing the East Building of the National Gallery of Art in Washington and the glass pyramid at the entrance to the Louvre in Paris, Mr. Pei was one of the few architects who were equally attractive to real estate developers, corporate chieftains and art museum boards (the third group, of course, often made up of members of the first two). And all of his work — from his commercial skyscrapers to his art museums — represented a careful balance of the cutting edge and the conservative."

The Washington Post reports, "Caught in a sprawling trade dispute with U.S. rival China, President Donald Trump decided against declaring commercial war on America's friends: The White House said Friday that he is delaying for six months any decision to slap import taxes on foreign cars, a move that would hit Europe and Japan especially hard. Trump is hoping to use the threat of auto tariffs to pressure Japan and the European Union into making concessions in ongoing trade talks. 'If agreements are not reached within 180 days, the president will determine whether and what further action needs to be taken,' White House press secretary Sarah Sanders said in a statement. The president has dusted off a rarely used weapon in the U.S. trade war arsenal — Section 232 of the Trade Expansion Act of 1962 — to investigate whether auto imports are a threat to U.S. national security, justifying tariffs. The Commerce Department sent its recommendations on the issue to the White House in February."

- Reuters reports, "Shares of China's Luckin Coffee Inc surged 47% in their market debut on Friday, indicating strong investor demand for the self-declared challenger to Starbucks Corp in the Asian country. The stock opened at $25, well above its IPO price of $17. On Thursday, the company raised around $561 million after pricing its offering at the top of the anticipated price range, giving it a market value of $4.2 billion, in the biggest U.S. float by a Chinese firm this year. The money raised from the IPO gives Luckin more firepower to fuel its ambitious plan of overtaking Starbucks in China this year as the largest coffee chain by number of outlets. Luckin has 2,370 stores in China and plans to open 2,500 more this year to go past Seattle-based Starbucks that has long dominated China's coffee scene and has over 3,600 stores in the country."

- 2019-05-16 China Arrests 2 Canadians on Spying Charges, Deepening a Political Standoff

- 2019-05-15 Trump Moves to Ban Foreign Telecom Gear, Targeting Huawei and Escalating Battle With China

- 2019-05-14 U.S. prepares to slap tariffs on remaining Chinese imports,

- 2019-05-13 Trade row deepens as China ups tariffs on $60B in US goods

- 2019-05-10 Trump Renews Trade War as China Talks End Without a Deal

- 2019-05-09 Trump Says China Tariffs Will Increase as Trade Deal Hangs in the Balance

- 2019-05-08 Trump Taunts China as Negotiators Prepare for Another Round of Trade Talks

- 2019-05-07 U.S.-China Trade Talks to Resume Despite Trump’s Tariff Threat

- 2019-05-06 Stocks Slump as Trump Threatens New Tariffs on China

- 2019-05-05 Trump Issues Tariff Threat and China Considers Pulling Out of Talks

- The Washington Post Trump delays imposing tariffs on auto imports and parts

- The New York Times I.M. Pei, Master Architect Whose Buildings Dazzled the World, Dies at 102

- Reuters Starbucks' China rival Luckin serves up a hot debut

- The New York Times As Trade War Rages, China's Sway Over the U.S. Fades

- CNN Blacklisting Huawei takes the US-China trade war to a dangerous new level

- The New York Times Wall St. Falls After China's Tough Talk on Trade

- CNN Trump's trade war shows how China has lost all its friends in Washington

- Bloomberg Trump Tariffs Seal Deal for Companies Looking to Quit China

- Bloomberg Baidu Posts Loss as Search Giant Grapples With Slowing China

- The Wall Street Journal Iran Foreign Minister Asks China to Help Save Nuclear Deal Amid Rising Tensions

- The Washington Post U.S. reaches deal with Canada, Mexico to lift steel, aluminum tariffs

- MarketWatch Why this country could emerge as a surprise winner from U.S.-China trade battle

- Reuters Chinese firms' missing $6 billion tests regulators' resolve

- The Wall Street Journal China Steel Boom, Supply Problems Drive Iron-Ore Price to Five-Year High

- The New York Times Did China Break the World Economic Order?

- The Wall Street Journal The Global Crisis of Democracy

- Foreign Policy China's Global Investments Are Declining Everywhere Except for One Region

- Financial Times Why China will not dump US Treasuries in retaliation

- The New York Times America Needs Huawei

- Forbes China Threatens To Cut Rare Earths Supplies To The U.S. -- Bad Idea