He Weiwen

Senior Fellow, Center for China and Globalization, CCG

Dec 13, 2016

In today’s world trade, the production process — from product design, raw material procurement, financing, manufacturing, final assembly, marketing and logistics — normally stretches across many countries. Many products in international trade are known as “global products”. Globalization has produced huge cost-savings on industrial and consumer goods at every level, and any effort to restrict American businesses to sourcing and production in the US will shrink the domestic economy instead of expanding it.

Sep 13, 2016

Despite the election-year rhetoric in the US, free-trade has been good for both countries and their people, and China and the US should both fight protectionism and support less-restricted trade to lead the global economy back to a path of strong, sustainable and balanced growth.

Aug 22, 2016

Strategies to stabilize world commodities and promote industrialization in Africa are key to achieving the goals of global governance and for sustainable growth. Giving less-developed nations outside the G20 an economic boost is a necessary commitment if any long-term global strategies are to be successful.

May 12, 2016

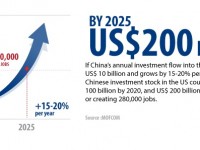

Increasing US technology and equipment exports to China would not only helping Chinese industrial upgrading, but also help US production in a time of sliding Chinese demand for US goods. Finalizing a bilateral investment treaty and closer collaboration between both governments and business to clinch more PPP projects in US infrastructure investments also would benefit both countries.

Mar 16, 2016

The years ahead offer parallel tracks for growth for both countries, and an “early harvest” for US enterprises, if opportunities are seized in areas such as innovation, Internet plus, reducing capacity, expanding the service sector – especially in healthcare -- and developing emerging industries.

Feb 01, 2016

China’s economy will continue to slide for some time in 2016, and the overall growth rate will be even lower than in 2015. However, the economy’s fundamental sectors portend a steady growth rate of 6.5-6.8%, depending on the progress of the reforms and restructuring, and on the developments of world economic situation. In any event, a major slump or “hard landing” seems out of the question.

Sep 24, 2015

China’s stock-market correction was predictable after its wild rise, but it does not signal a sustained economic slump. However, “China shock” did influence the U.S. and European stock markets, despite the effect being psychological and temporary. During the first half of September, U.S. and European markets have been rising steadily, despite the lingering struggles for Chinese stocks. With an expected mild rebound by the end of the year and beyond, it is likely that China’s imports will gradually pick up, thus contributing more to the world commodities demand recovery.

Aug 28, 2015

The shifting exchange rate reflects the strength of the dollar, not weakness of the RMB. The two nations and business communities should focus on identifying the complementary sectors and products of the two countries and seeking a sustainable pattern of stable growth based on mutual benefit.

Mar 06, 2015

Sudden cases of factory relocation and closures has caused China’s foreign investment communities to worry about a “massive foreign capital flight.” With further investigation, foreign direct investment in China is shifting from manufacturing to service sectors. The focus of concern about China’s FDI situation should not be exaggerations of “massive foreign capital flight,” but on the solid efforts to improve China’s investment environment.

Jan 16, 2015

He Weiwen details the monetary values of China’s relentless wave of foreign direct investment worldwide during 2014. China’s structural changes in its economy, which will allow for further growth in 2015, especially between U.S. and Chinese companies, are also discussed.