Economies around the world are experiencing severe inflationary pressures. While supply chain disruptions brought on by the COVID-19 pandemic have had an effect, an arguably larger factor is the enormous stimulus packages enacted by Western governments, not least the large spending measures passed by the U.S. Congress. Fiscal stimulus was super-charged by easy monetary policy, including an enormous program of quantitative easing – measures to inject money directly into the financial system.

China, in contrast, didn’t pass such large spending measures, and has been using measured monetary stimulus over the past years. Consumer inflation is much lower, almost zero at present. However, growth has so far failed to bounce back as strongly as in the U.S. after the lifting of pandemic restrictions.

This contrast provides fascinating insights into different forms of economic stimuli, their efficacy, and their ultimate effects. China and the United States have undertaken three very different forms of economic stimulus over the past 15 years. In each case, policy-makers sought to combat economic downturns and the specter of deflation, a sustained drop in prices.

Consequently, all follow in the footsteps of Sir John Maynard Keynes, the famous British economist who analyzed the problems of persistent and self-perpetuating deflation during the Great Depression of the 1930s. Keynesianism later became associated with economic stimulus, especially fiscal spending, to address even minor economic downturns. Criticisms of the approach thus honed in on yawning budget deficits caused by such spending and the persistent inflation of the 1970s.

What followed were approaches focused on monetary tools, especially the use of interest rates to set the price of money. These tools, though, were insufficient to combat deflationary pressures during the Global Financial Crisis of 2008. Once interest rates hit zero, traditional monetary tools are out of ammunition. The economy hits a liquidity trap, a contradictory situation in which interest rates approach zero but investment and consumption fail to take off.

In response to the major economic downturn in 2008, the United States undertook only limited fiscal stimulus, but the Federal Reserve experimented for the first time with a much more potent monetary tool: Quantitative Easing (QE). The Reserve’s balance sheet increased from around $0.8 trillion in 2008 to $4.4 trillion in 2014, an increase of roughly $3.6 trillion.

This increase in the money supply, despite warnings from hard-core monetarists and bond vigilantes, didn’t result in an inflation boost. It did increase asset prices, first bonds and equities, and then gradually real estate. But its effects on the labor market were tepid and slow.

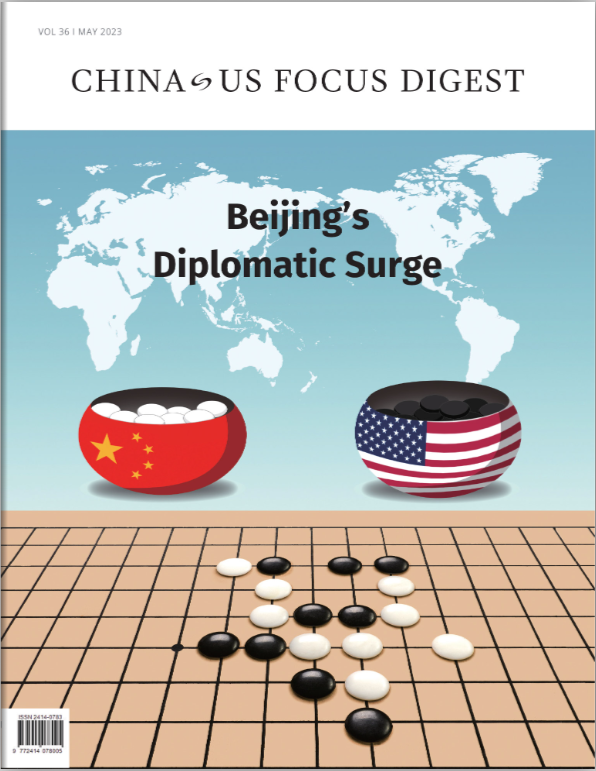

Click to read the latest issue of China-US Focus Digest

This form of stimulus, large monetary but small fiscal, stands in stark contrast to the 2020 stimulus enacted due to the pandemic. The monetary stimulus was again massive, increasing the Fed’s balance sheet from around $3.8 trillion to $8.9 trillion, an increase of $5.1 trillion. It also continued into the summer and fall of 2021 when the economy was already recovering and real estate and stock markets were booming.

But the biggest difference to 2008 was the concomitant fiscal stimulus enacted by the US Congress. Just as a point of illustration, during the Global Financial Crisis weekly unemployment checks were given a miserly $25 per week boost; during the pandemic, checks increased by $600 per week, and then later $300 per week, while the duration and eligibility for benefits were extended substantially.

The third case is China. The financial system differs in important respects from the United States, as the major banks are all state-owned. After the recessionary shock of 2008, the Chinese government directed state banks to extend massive amounts of credit into the economy. QE was not necessary, though the People’s Bank of China expanded its tools to manage liquidity in the economy. Fiscal stimulus played a role as well, but the major force was bank lending for infrastructure, urban renewal, and real estate.

This stimulus was stunningly successful. China became the motor of the global economy for several years. Inflation did pick up, reaching almost six percent in 2011, but it fell rapidly thereafter. The bigger problem was a large stock of bad debts, caused by indiscriminate investments.

Since the mid-2010s, the Chinese government has undertaken various efforts to reduce leverage in the economy and generate a less risky and more stable financial system. But when policy-makers sought to stimulate the economy, the methods have remained roughly the same.

China once more faces the aftermath of an economic downturn, this time created by zero-Covid policies. The economic recovery has begun, but remains weak. Stimulus measures once more focus on infrastructure spending, but bank lending is much more constrained, and countervailing efforts to de-risk the financial system restrict options for strong stimulus.

In fact, one of the biggest drags on the Chinese economic recovery remains the real estate sector. Many large private developers have been caught up in the de-risking campaign and face a tough time restructuring their debts, accessing new finance, and completing housing projects.

Perhaps Chinese policy makers will need to take a page out of the American playbook. One of the insights that emerges from these three very different episodes of economic stimulus is that by far the most effective means is to put money directly into the hands of consumers. What some dub “People’s QE” would even see Central Banks directly issue checks to citizens.

Regardless of the exact methods employed, the case of the United States after 2020 shows that direct consumer support enabled by a large monetary stimulus combined with fiscal spending can defeat the dangers of disinflation and deflation.

Keynes was right. Government spending can dispel the specter of deflation and the liquidity trap. But transmission mechanisms are key. QE itself, as enacted after 2008, only pushes money into the financial system. Much of it actually became stuck in the US banking system, increasing asset prices, but doing little for the broader economy.

Infrastructure spending as undertaken in China, Japan, and many other economies, gradually looses its stimulatory effect. Returns on new projects decline as the capital stock of a country improves. Effects on employment and consumption thus diminish over time.

This is the situation faced by China at present. As stimulus measures still focus on infrastructure investment, much of it in technology, green power, and electric vehicles, the overall effects on the economy are by nature much less than 15 years ago. Their feed through to consumption is especially limited. To reinvigorate the Chinese economy, more direct measures might be needed. Not at the level of the United States after 2020 – no one would want to invite the inflationary pressures face by Americans right now – but in a more measured and targeted manner.