The shift of the US policy from engaging China to containing China can be traced back to the Obama administration and his pivot to Asia strategy in 2009. It coincided with the Chinese economy surpassing 10% of global output in real terms, and becoming the second largest economy a few years earlier. In 2020, China even surpassed the economic size of the EU at 18% of global output. The containment policy went into high gear during Trump’s administration with the trade wars of 2018. The tension deepened further with restrictions imposed on Chinese companies operating in the US, particularly those in the technology sector (eg. Huawei and ZTE), which led to discussions on the decoupling of the China-US economic relationship. COVID-19 added further cracks to the relationship. While the Trump administration took on China on its own, his successor chose to rally other countries to join the crusade against China. The re-emergence of the Quad (US, Australia, India and Japan) and the establishment of AUKUS (Australia, UK and US) are good examples of such alliances. China’s increasing influence around the world, on the one hand, can be traced back to President Xi’s flagship project, the Belt Road Initiative, and on the other, China’s ambition to dominate in several key industries as outlined in the Made in China 2025 document.

The Impact of the China-US Geopolitical Tensions

The impact of a tensed relationship between the two superpowers on their respective economies is obvious. Numerous studies point to negative impact of the trade war on both countries. Abiad et al. (2018) showed that trade tensions can result in the loss of both output and employment with minimal impact on trade imbalances. Huang et al. (2018) studied the impact of the trade war on the stock market responses of firms and found that financial market losses were experienced by not only by those dependent on the China-US trade, but also a host of other firms that are indirectly linked through the global value chains (GVCs). Tam (2020) in fact claimed that the move by the US to re-direct investments away from China would actually hurt the US and worsen its trade imbalances. Thus, economic reasons seem insufficient to explain these geo-political tensions.

The impact of a trade war between the two superpowers is not limited to their own economies, but also to every other economy linked to this relationship in various degrees. Fajgelbaum et al. (2021) calculated that the trade war will decrease the trade between the two warring countries, but the exports of bystander countries as a whole (the study considered 48 other countries) will in fact increase. These bystander countries, in general, reduced their exports to China but increased exports to the US and other countries. However, the effect was heterogeneous across countries depending on the rate at which the bystander country can substitute goods from China. Ferchen (2022) stated that Southeast Asia is the region that will experienced the most intense impact (compared to Africa and Latin America) from the US-China rivalry due to the neighborhood effects and the intensity of economic relationship among the three entities. China and the US made up 16% and 15% of total ASEAN exports in 2020, respectively. Imports from China has been growing in the past decade and is significantly higher (24%) than the US (8%). However, as far as FDI is concerned, the stock of US FDI is much greater than China, simply because the investment relationship goes back to the 1970s. Chinese FDI is more recent, particularly in the infrastructure and energy sectors (Ferchen, 2022).

Choosing Between China and the US

A few countries in the region have outwardly shown their support for either party. By joining AUKUS and the Quad, Australia’s support for the US is clear. The military alliances that Japan and South Korea have with the US, allow limited options in their own backyard. Myanmar supports China’s position vis-à-vis the interference of the US into China’s domestic issues when it comes to Taiwan (Tiezzi, 2022). Laos and Cambodia often defend China in ASEAN summits with respect to maritime issues in the South China Sea (Sutter, 2021).

However, other countries in East Asia prefer not to take sides. Singapore, for example, is trying very hard to be friends with both superpowers. Despite having a defense memorandum with the US, it also conducts joint military training with China (Choong, 2021). A survey by Pew Research Center in 2022 provides further support to the findings above (Silver et al., 2022). Among the countries in the Asia Pacific included in the survey, unfavourable views of China above the median (68%) were found in Japan (87%), Australia (86%) and South Korea (80%), compared to Malaysia (39%) and Singapore (34%). Another survey of opinion makers, policy makers and thought leaders in the ASEAN region conducted by the ISEAS-Yusof Ishak Institute in 2022 found that 76.7% of the respondents admitted that China is the undisputed influential economic power in the region, although a majority of them worry about its growing economic influence. As for the US-China rivalry, 57% prefer if their country aligns itself to the US. Among countries, the choice of the US ranged from 83.5% in the Philippines to 18.2% in Laos (Seah et al., 2022).

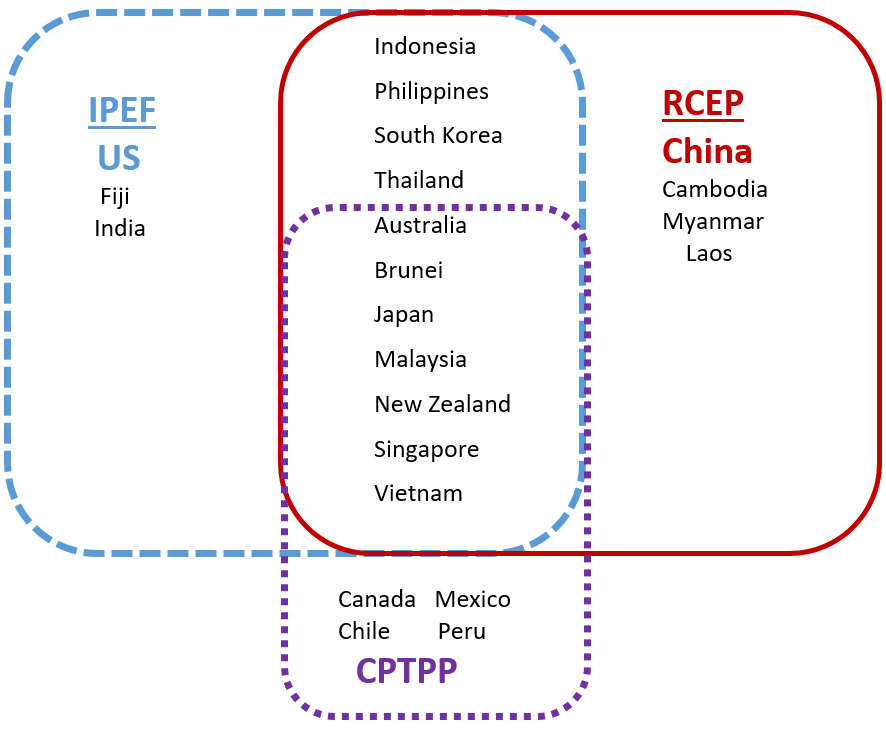

On the economic front, both the US and China have been lobbying the Asia Pacific countries to choose sides. A good example is in regional economic cooperation. China spearheads the Regional Economic Cooperation and Partnership (RCEP) while the US once led the Trans Pacific Partnership (TPP) and now the Indo-Pacific Framework for Prosperity (IPEF). The RPEC focuses more on enhancing trade among member countries, while the IPEF focuses on how business is done. Although these two initiatives can be complementary, but since they are led by one superpower without the other, a tacit competition emerges. Figure 1 below shows the members of the three groupings. Most of the countries in the Asia Pacific region are in all or two of the groupings. It is not surprising that countries may prefer to be non-aligned as China and the US are significant trading partners as described earlier.

Figure 1. Membership in Key Regional Agreements.

Forced to make a choice

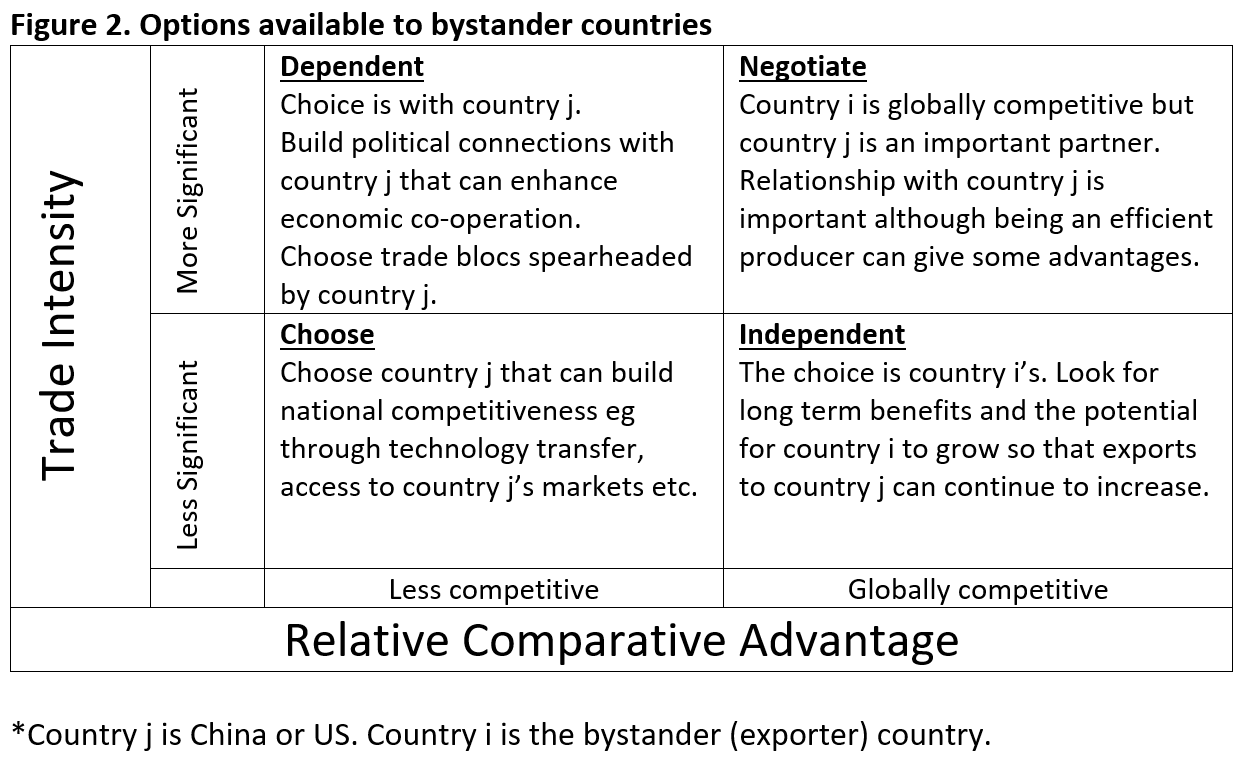

What if countries need to take sides? Do these bystander countries have a choice? Which superpower should countries align themselves to? We address these questions using a framework introduced by Dawar and Frost (1999) that described strategies available to local companies in emerging markets when large multinationals enter their home markets. The framework is based on two factors: the pressure on the firm to globalize their operations and the extent to which the firm’s capabilities (or firm specific assets) are internationally transferable. The former deals with external pressures, while the latter, the firm’s internal capabilities. Mapping these into a 2x2 matrix results in 4 distinct strategies available to local firms when faced with competition from large multinationals: defend, extend, dodge, or contend. The strategies based on Dawar and Frost’s typology include focusing on market segments where multinationals are weak, expanding into similar markets abroad, entering into a joint venture with the giant firm and focusing on niche markets locally and abroad, respectively.

In the context of the availability of options among bystander countries when faced with the choice of the two giants - China or the US- two main factors would have to be considered. One, is the importance of the superpower in the trading regime of the bystander country (i.e. the external pressure). Since many of the East Asian countries are open trading economies, trade is an important feature of their respective economies and as shown earlier, China and the US are important trading partners. Two, is the extent to which the bystander country’s exports has a comparative advantage compared to other countries (i.e. the internal capability). A bystander country would have a stronger bargaining power if it is an efficient producer. Mapping these two factors into a 2x2 matrix results in 4 available options, as shown in Figure 2.

The top right hand quadrant is a scenario where the superpower is a significant market to the bystander country, but it has an above average comparative advantage. This provides the bystander with some negotiating power, and allows the country to remain quite neutral. However, the bystander has to ensure good relationship with the superpower. The quadrant on the bottom left is when neither power is a significant trading partner and the bystander has little comparative advantage. While the superpower may be interested in the support of the bystander in international organizations like the UN or WTO, it would be advisable for the bystander to choose the partner who is willing and able to help build long term capabilities like infrastructure, education or technology. The top left quadrant is where the bystander is dependent on the superpower that dominates the trade relationship. There is little negotiating power for the bystander and there is little option but to look for opportunities to please the partner like closer political relationships or supporting trade blocs that is spearheaded by the power. In the bottom right quadrant, the bystander is in a position to remain independent or choose the superpower to build closer relationships. The bystander may even have capabilities that the superpower is interested in.

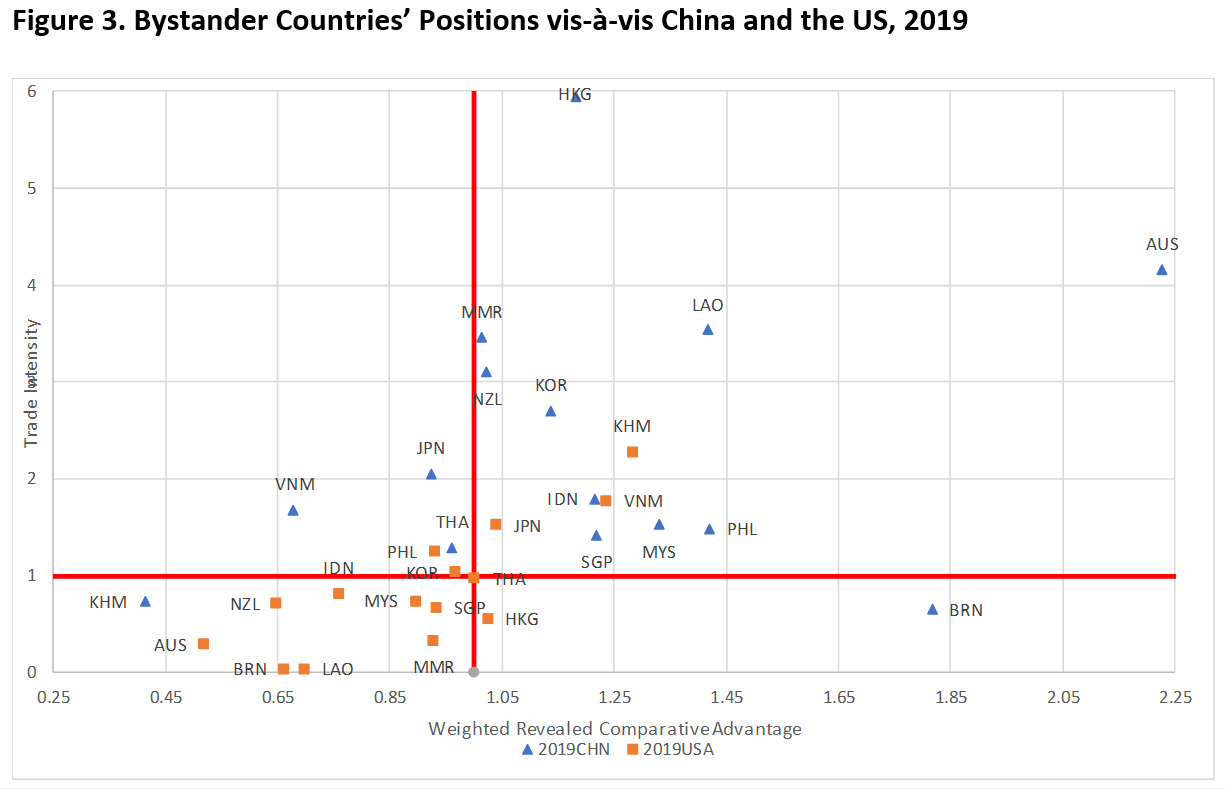

Next, we map a few selected Asia-Pacific economies by using the following measures. For trade intensity, we simply use the proportion of exports to China (US) as a proportion of total exports of the bystander country. As for the comparative advantage measure, we use the well-known Revealed Comparative Advantage (RCA). A country is said to have a revealed comparative advantage in product x when the ratio of exports of the said product to its total export of all good is greater than the same ratio for the world as a whole. When the RCA is above 1, it is considered to be a competitive exporter and producer of that product relative to other countries whose RCA is lower. The higher the RCA, the more efficient the country is in producing product x. Since the RCA is for a particular product category, we aggregate the RCAs of all products (using SITC 2 digit aggregation), weighted by the importance of the product in China’s (US) imports. Thus, the weighted RCA considers the comparative advantage of the bystander country relative to the importance in China’s import basket.

The result of our analysis is shown in Figure 3.

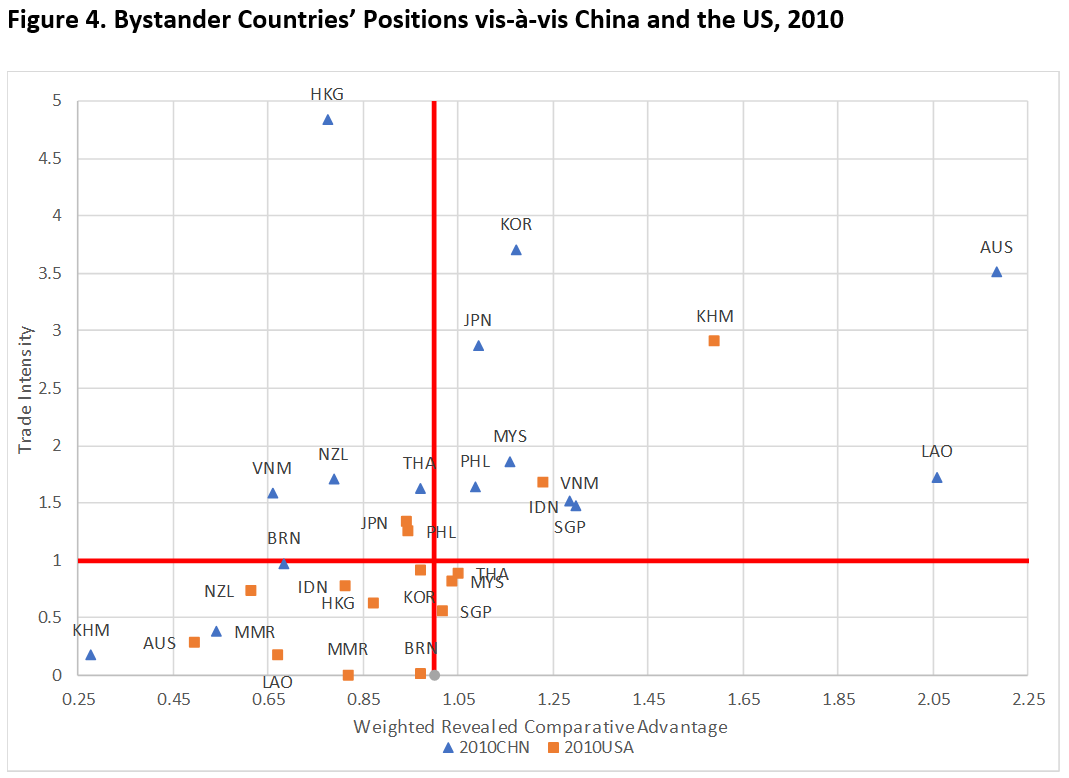

The position of the selected bystander countries with respect to the US are clustered in the bottom left quadrant while the relationship vis-à-vis China is mainly in the upper right quadrant. Thus, China is a more important trading partner and many bystander countries are efficient producers for the needs of China. The bystander countries in the upper right quadrant should be able to negotiate with China since the outcome could be a win-win for both parties. However, with respect to the US, most bystander countries (except Vietnam and Cambodia) may not have the bargaining power as they are relatively inefficient. If the bystander countries hope to improve their positions vis-à-vis the US in the long term, this may not be likely since the situation in 2010 was not much different from 2019 (see Figure 4).

An extreme example is Australia. The position of Australia with respect to the superpowers are at the opposite ends. China is an important trading market for Australia, but it also has its comparative strengths. In other words, both countries need each other. Negotiation between the two countries would be beneficial for both parties. The US is neither an important partner nor is Australia an efficient producer for the needs of the former. The current international relationship of Australia with the two superpowers i.e. favoring the US over China, is confusing. Clearly, in this situation ideology seems to trump economics.

Japan, on the hand, need both China and the US since its position with respect to both countries is rather similar. Note that Japan’s position vis-à-vis China has deteriorated over time and marginally improved with the US. In addition to the defense alliance, Japan’s affinity to the US seems appropriate. South Korea’s position is more complexed compared to Japan. While China is an important market and the US is rather neutral, its non-economic relationship with the latter, creates a difficult choice.

As for the ASEAN countries, Indonesia, the Philippines, Malaysia and Singapore would find it relatively more fruitful if they negotiate with China, compared to the US. Not only is China a more important market, these bystander countries also have their relative strengths that caters to China’s needs. Thailand is in a more precarious situation as its position with respect to both superpowers is somewhat similar. Thailand needs to be friendly with both countries. Our analysis confirms Vietnam’s international relations position that is more skewed towards the US. Similarly, Laos and Myanmar will find it more beneficial to continue to deepen its ties with China. Cambodia, on the hand, seems to favor China, although our analysis suggests an opposite policy.

Non Aligned Movement 2.0

Countries in Asia-Pacific should not have to choose between China and the US. Singapore Prime Minister, Lee Hsien Loong wrote in 2020, “Asian countries do not want to be forced to choose between the two. And if either attempts to force such a choice – if Washington tries to contain China’s rise or Beijing seeks to build an exclusive sphere of influence in Asia – they will begin a course of confrontation that will last decades and put the long-heralded Asian century in jeopardy” (Lee, 2020). But the reality is that these bystander countries may not have a choice in the matter due to the worsening ties between the two superpowers (Weiss, 2022; EIU Update, 23rd October, 2020). The Asia-Pacific countries are right in the middle of the crossfire between China and the US. The US tries to lure the bystander countries by guaranteeing military assistance if their sovereignty is compromised, while China offers tangible economic sweeteners like infrastructure investments and a growing market for exports. Both types of assistance are attractive and necessary, particularly for developing economies. Economic growth depends on political stability and security, and vice-versa. For either superpower, offering both economic and international security assistance can tilt the balance. On the other hand, creating an alliance among bystander countries to preserve their neutrality seems to be a necessity. Perhaps it is time for a Non Aligned Movement (NAM) type of organization in the Asia Pacific.

References:

Abiad, A., Baris, K., Bernabe, J.A., Bertulfo, D.J., Camingue-Romance, S., Feliciano, P.N., Mariasingham, M.J. and Mercer-Blackman, V., The Impact of Trade Conflict on Developing Asia. Working Paper No. 566. ADB Economics Working Paper Series.

Choong, W. 2021. Chinese-US Split is Forcing Singapore to Choose Sides. Foreign Policy, 14 July, 2021. https://foreignpolicy.com/2021/07/14/singapore-china-us-southeast-asia-asean-geopolitics/

Dawar, N. and Frost, T. 1999. Competing with Giants: Survival Strategies for Local Companies in Emerging Markets. Harvard Business Review March-April 1999: 119-129.

EIU 2020. EIU Global Outlook: Siding with the US or with China, 23 October, 2020.

Fajgelbaum, P., Goldberg, P.K., Kennedy, P.J., Khandelwal, A. and Taglioni, D. 2021. The US-China Trade War and Global Reallocations. Working Paper 29562, NBER Working Paper Series.

Ferchen, M. 2022. Growing US-China Rivalry in Africa, Latin America and Southeast Asia: Implications for the EU. MERICS China Monitor, March 24, 2022.

Huang, Y., Lin, C., Liu, S. and Tang, H. 2018. Trade Linkages and Firm Value: Evidence from the 2018 US-China Trade War. CTEI-2018-04. CTEI Working Papers.

Lee, H.L. 2020. The Endangered Asia Century. Foreign Affairs, 99 (4).

Seah, S., Lin, J., Suvannaphakdy, S., Martinus, M., Thao, P., Seth, F. and Ha, H. 2022. The State of Southeast Asia: 2022 Survey Report. ISEAS-Yusof Ishak Institute, Singapore.

Silver, L., Huang, C. and Clancy, L. 2022. Negative Views of China Tied to Critical Views of its Policies on Human Rights. Pew Research Center, June 29, 2022.

Tam, P.S. 2020. Global Impacts of China-US Trade Tensions. The Journal of International Trade & Economic Development, 29 (5), pp. 510-45.

Tiezzi, S. 2022. Which Asian Countries Support China in the Taiwan Strait Crisis – and Which Don’t? The Diplomat, August 13, 2022.

Weiss, J.C. 2022. The China Trap: US Foreign Policy and the Perilous Logic of Zero-Sum Game. Foreign Affairs 101 (5).