Introduction

For 2023, the Chinese Government’s target growth rate was 5%. The actual growth rate achieved was 5.2%. This must be considered a success, given the cold spells, the flooding, and other natural disasters during the year. I had forecast 6% growth in January 2023, and subsequently reduced it to 5.5% for the year.

For 2024, the multilateral organisations—the International Monetary Fund, the World Bank and the Organisation for Economic Cooperation and Development (OECD)--have forecast real rates of growth for the Chinese economy of 4.6%, 4.5% and 4.7% respectively. Five international investment banks, including Goldman Sachs and UBS, have issued forecasts that range between 4.2% and 4.9% with a median of 4.6%. The Centre for Forecasting Science of the Chinese Academy of Sciences has issued a forecast 5.3%.

Premier LI Qiang has announced a 2024 target rate of growth of around 5%, at this year’s “Two Sessions” in Beijing. Compared to past growth rates since the economic reform and opening in 1978, this may appear low. However, given the current size of the Chinese economy of approximately US$18 trillion, a 5% real rate of growth amounts to an increase of US$0.9 trillion, which is actually quite respectable and would place China amongst the world’s fastest growing economies.

Moreover, the Chinese Government’s stated objective of emphasising the quality of growth rather than the quantity of growth also leads to a trade-off between the two. For example, increasing provision of clean air and water can incur significant costs but generates no positive real value-add.

The Prospects for 2024

I think 5% growth is eminently achievable, despite all the uncertainties. I would make a slightly more optimistic range forecast—that the rate of growth for 2024 would be between 5% and 5.5%, depending on climate and other factors, and whether there is sufficient aggregate demand. My forecast is based on my own estimate of the potential GDP.

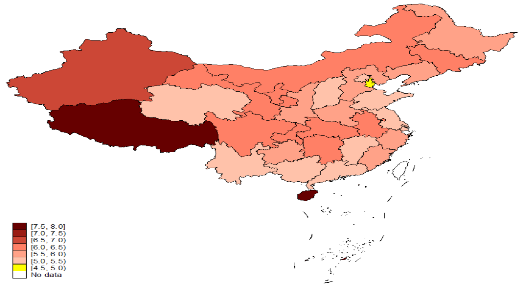

In the following Chart I present a provincial map of China, with the colours of each municipality/province/autonomous region based on its respective 2024 target growth rates, the higher the target rate of growth, the darker the colour.

Note that there is only one municipality/province/region with a target growth rate below 5%, and that is Tianjin, at 4.5% (in yellow). Everyone else has a target growth rate above 5%, and quite a few (20 out of 31) have target growth rates of 5.5% or above.

Using the 2023 actual GDPs as weights, the weighted average of provincial target growth rates is 5.41%. Thus, the aggregate target growth rate of the Chinese Government is quite realistic and supported by the individual provincial target growth rates.

The Geographical Distribution of the 2024 Target Rates of Growth by Province

The Negative Factors

We next identify the following negative factors affecting Chinese economic growth:

(1) Insufficient aggregate demand;

(2) A shrinking population;

(3) The fiscal conditions of the local governments; and

(4) The China-U.S. strategic competition.

Insufficient Aggregate Demand

China is a surplus economy. There is surplus production capacity in almost every sector and industry. If there is demand, there will be supply. What is the empirical evidence that it is a surplus economy? There was deflation in 2023. The GDP deflator actually declined by 0.5%. It is important for China to maintain an adequate level of aggregate demand.

As a large, continental country, the economic growth of China, like that of the U. S., is not sensitive to external economic disturbances, and in particular, not to the rate of growth of its exports.

The Chinese economy is still operating in the range of real GDP per capita within which a 5-6% average annual real rate of growth is possible.

Is there any risk of Japanification, that is, for China to enter a long period of stagnation similar to what happened to the Japanese economy since 1990? No! As long as China can maintain a sufficient level of aggregate demand. Japan’s problem has always been insufficient domestic aggregate demand.

The Work Report at the “Two Sessions” also mentioned the “expansion of domestic demand”. The aggregate demands for both consumption and investment depend on expectations about the future. It is therefore important for the Central Government to try to turn around the currently negative expectations of enterprises and households.

The Shrinking Population

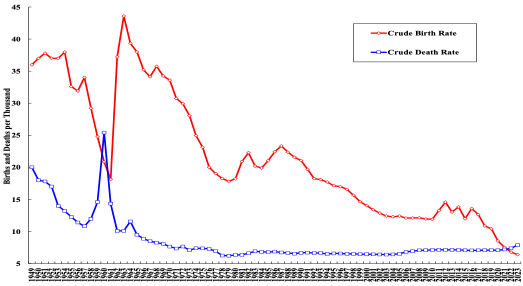

The population of China has been declining for two years in a row (see the following Chart). However, I believe the net fall in the population has been caused, in part, by the COVID-19 epidemic. It has, first of all, increased the crude death rate significantly, by close to 1 per thousand, or 0.1%. Second, because of the COVID-19 lockdown, especially in 2022, a decline in the marriage rate has also resulted, which in turn has reduced the crude birth rate. The latest data suggest that the marriage rate has begun to recover and so the crude birth rate is expected to stop falling soon. However, this would not have any impact on the Chinese labour supply for at least another couple of decades.

There is still surplus labour in the Chinese economy. The primary (agricultural) sector generates only 7.1% of GDP but employs around 24% of the labour force.

The quality of the labour force, measured by its educational attainment and life-expectancy, has also greatly improved since 1978.

Moreover, the retirement ages, which were set in the early 1950s, 50 for women (55 for cadres) and 60 for men, now turn out to be too early given the significant rise in life expectancy. There are currently 70 million people in China between the ages of 60 and 65, and they can be mobilised if there is a real shortage of labour. Postponement of the mandatory retirement ages is being considered by the Central Government.

The Crude Birth and Death Rates in Mainland China

The Fiscal Conditions of the Local Governments

After three years of the COVID-19 epidemic, most of the provincial and local governments are in bad fiscal shape. The situation is worsened by the bankruptcies of many of the Chinese real estate developers. Local resources are almost exhausted and the local authorities are not in a position to undertake new initiatives.

It is unlikely that the local governments will be able to handle their existing debts. It is therefore best if the Central Government simply purchases or assumes the existing local government debts so that they can have a fresh start. One should not worry about moral hazard because no one has any incentive to bring back the epidemic, but as always guard against the misuse of funds.

The Work Report also mentioned the issuance of “ultra-long” treasury bonds. In fact, the Central Government can issue such ultra-long or even perpetual bonds to finance the assumption of local government debts. It can justify doing so because the epidemic is a rare “once every hundred year” occurrence and the cost should be shared by the present and future generations. The Central Government still has more than sufficient debt capacity.

The China-U.S. Strategic Competition

The China-U.S. strategic competition is likely to be the new normal in the next five to ten years. However, a hot war between the two countries is most unlikely because of “Mutually Assured Destruction (MAD)”, just as the former Soviet Union and the U.S. managed to avoid a hot war in the last Century.

As the sole global hegemon, the U. S. cannot allow any other country to say no to it and go unpunished, because that will encourage others to begin to say no too. But the so-called Chinese “threat” to the U. S. is not existential.

Can the U. S. suppression of Chinese economic growth, through controls on exports and technology, be successful?

I believe it will have some short-term effects but will not permanently prevent China’s rise. There are many different ways of doing the same thing, especially after it is known that it can be done. For example, during the Cold War era, the former Soviet Union was able to deliver its nuclear warheads through their more powerful rockets, regardless of weight, and the U.S. managed to deliver its nuclear warheads through the use of microelectronics, minimising the payload for their less powerful rockets. The same objective was achieved by both sides using different means.

De-coupling or de-risking is actually not all bad. It will eventually make economies more resilient and markets much more competitive through multiple sources of supply, and lower prices and improve quality of products for consumers and users worldwide, and everyone is better off.

Long-Term Projections of the Chinese Economy

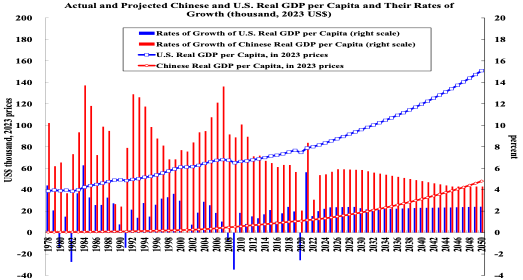

I conclude with some long-term projections of the Chinese economy to 2050.

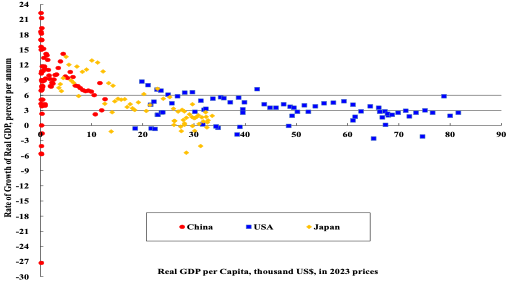

In the longer term, it is true that the Chinese economy cannot continue to grow at an average annual rate of close to 10% indefinitely, as it did between 1978 and 2018. In fact, it is an empirical regularity that as the real GDP per capita of an economy rises, its real rate of growth will decline.

This is demonstrated in the following chart in which the real rates of economic growth of China (red), Japan (yellow) and the U.S. (blue) are plotted against their respective real GDPs per capita. As expected, there is a negative relationship between the rate of growth of real GDP and the level of real GDP per capita.

However, note that China, with a GDP per capita of US$12,626 in 2023, is currently still operating in the range that permitted average annual rates of growth much higher than 6% for both Japan and the U.S. in earlier periods. The real GDP per capita of the U.S. was US$81,610 in 2023, with its economy operating within a range below 3% average annual rate of growth.

Perhaps when Chinese real GDP per capita reaches US$30,000 in 2023 prices, projected to occur around 2040, the Chinese average annual real rate of economic growth will begin to decline to 5% or below.

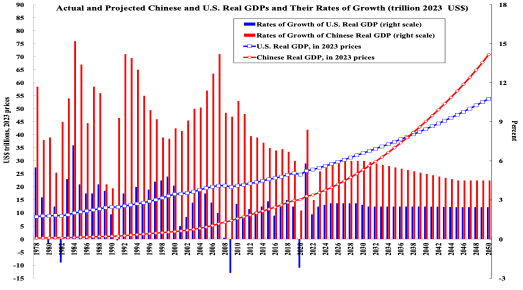

Over the next decade, China's economy will continue to grow faster than North America and Europe, although growth will slow in all three. My personal forecast is that by 2038, real GDP on the Chinese Mainland will reach US$40.9 trillion at 2023 prices, slightly higher than the US$40.2 trillion of the United States. Even so, the projected Chinese real GDP per capita, US$28.367, would still be not quite one quarter of the real GDP per capita of the United States, US$114,232, at that time.

In fact, in which year Chinese real GDP will catch up with the U.S. real GDP is very much related to the exchange rate of the Renminbi against the US$. In March 2023, the exchange rate of the Renminbi against the US$ was 6.32 Yuan per US$. At yearend 2023, the exchange rate of the Renminbi against the US$ was 7.08 Yuan per US$, a difference of 12%. Thus, at 2023 prices and exchange rate, the Chinese GDP is projected to catch up with U.S. GDP in 2038, much later than my previous forecasts.

Of course, in Purchasing-Power-Parity (PPP) terms, Chinese GDP already reached parity with U.S. GDP in 2015. This finding was supported by both the International Monetary Fund and the World Bank.

China's natural resources per capita, such as arable land, clean water, mineral deposits, etc., are far less than that of the United States, so it is not easy for its real GDP per capita to surpass that of the United States. If it can be done at all, it will likely be at the very end of this century.

Concluding Remarks

My forecast is that the Chinese GDP will grow between 5% and 5.5% in 2024, given the many uncertainties. If achieved, it is a very respectable rate of growth for a major economy. The Chinese economy will continue to grow at am average annual rate between 5.5% and 6% for the coming decade.

Maintaining an adequate growth of aggregate domestic demand is essential for continued Chinese economic prosperity.

The provision of public goods that enhance the quality of growth such as clean air and water or mass transit frequently results in negative value-added at market prices and will therefore reduce rather than enhance the rate of growth of measured GDP. However, the supply of such public goods also constitutes a form of re-distribution in kind, for example, clean air and water, which can be enjoyed by everyone, and hence also directly advances the goal of “common prosperity”.

The highly successful Chinese economic reform consisted of two critical components—marketisation coupled with enterprise autonomy and opening up to the world. Both would continue to be needed in the future.