Ben Reynolds, Writer and Foreign Policy Analyst in New York

Feb 22, 2016

China now seeks to export its excess industrial capacity as a means to cope with its economic troubles. The problem is that China is trying to export its way out a local crisis caused in large part by a global glut of commodities. Whatever the case, we should expect Chinese foreign investment to continue to grow, spurring a commensurate rise in its political influence.

Liu Youfa, Senior Fellow, Shanghai Institutes for International Studies

Feb 04, 2016

Despite the slowdown, there is plenty of room for sustainable growth in the country, and the leadership’s newly announced plan promises to stabilize and expand China’s potential based on a solid foundation that’s often overlooked.

Justin Yifu Lin, Former Chief Economist, The World Bank

Feb 03, 2016

There are many good investment opportunities during the present economic slowdown, and that is the major difference between China and the developed countries. Even if external conditions do not improve and export growth is weak, China's economy may still grow at 6.5 percent by relying on domestic investment and consumption growth, thus contributing around 30 percent of global growth annually.

Yi Xianrong, Researcher, Chinese Academy of Social Sciences

Feb 02, 2016

There is no need to worry about the slide in China’s GDP growth and its turbulent financial markets, because the market economy has taken root across the country — a market of 1.4 billion consumers. Pressures from regional setbacks can be absorbed by the greater national economy, as long as the government pursues its transition from a real estate-driven economy.

He Weiwen, Senior Fellow, Center for China and Globalization, CCG

Feb 01, 2016

China’s economy will continue to slide for some time in 2016, and the overall growth rate will be even lower than in 2015. However, the economy’s fundamental sectors portend a steady growth rate of 6.5-6.8%, depending on the progress of the reforms and restructuring, and on the developments of world economic situation. In any event, a major slump or “hard landing” seems out of the question.

Stephen Roach, Senior Fellow, Yale University

Jan 27, 2016

The fears about the economic meltdown in China are overblown. The mismatch between progress in economic rebalancing and setbacks in financial reforms must ultimately be resolved as China transitions to new growth model. But it does not spell imminent crisis.

Yi Xianrong, Researcher, Chinese Academy of Social Sciences

Jan 27, 2016

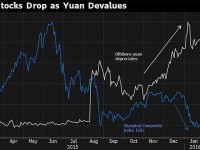

Stabilizing the RMB exchange rate not only requires comprehensively striking back the short-selling speculation but, more importantly, reversing the expectation of RMB depreciation and well managing the expectation. Substituting a new exchange rate index for the old exchange rate index has not impressed the international market. The RMB exchange rate should be anchored to the USD exchange rate to build confidence.

Qin Xiaoying, Research Scholar, China Foundation For Int'l and Strategic Studies

Nov 20, 2015

Except for the disruptive years of the “cultural revolution”, the five-year planning system has given the country a unified strategic outlook, especially in the recent years of opening up and development. The current CPC Central Committee is steering the Chinese government, in the coming five years, to emphasize people’s livelihood and well-being, and to effectively promote economic transformation and consolidation.

Keyu Jin, Professor, London School of Economics

Nov 12, 2015

When it comes to economic rebalancing, China will need to be patient, recognizing that the current generation is simply too fixated on saving to provide the kind of surge in consumption that is needed. There are steps policymakers can take to accelerate progress, but, until the next generation grows up, real progress will have to wait.

Anatole Kaletsky, Chief Economist and Co-Chairman, Gavekal Dragonomics

Oct 19, 2015

China certainly experienced a turbulent summer, owing to three factors: economic weakness, financial panic, and the policy response to these problems. But none on its own would have threatened the world economy. The assumption that China is now the global economy’s weakest link is highly suspect.