Vikram Nehru, Nonresident Senior Fellow, Carnegie Asia Program

Jan 11, 2017

Given their economic and geographic proximity to China, Southeast Asian countries are beginning to warm up to the Chinese renminbi. At this stage, however, it would be premature for Southeast Asian governments to do much more than they have already done.

Dan Steinbock, Founder, Difference Group

Sep 27, 2016

On October 1, the Chinese renminbi officially becomes the fifth international reserve currency. Until recently, Washington played geopolitics to defer the renminbi’s internationalization. But what about Wall Street?

Jul 27, 2016

We often hear that China “manipulates its currency” and harms the U.S. economy. Some say if we punish China as a manipulator or slap tariffs on Chinese goods it would reduce our trade deficit. But what does currency manipulation mean? More importantly, would tariffs on Chinese goods help our economy?

Dean Baker, Co-director, Center for Economic and Policy Research

Jul 04, 2016

An outflow of capital from China, and the trade deficit it has created for rich countries and especially the United States, has led to an enormous gap in demand. The key route to reducing the trade deficit is a lower value of the dollar, which would require China to decrease its foreign reserves. As negotiations work, this would mean the United States would have to make concessions in other areas of the bilateral relationship.

Jun 22, 2016

The People’s Bank of China is considering allowing foreign companies to issue shares on the mainland as part of its drive to reform the convertibility of the yuan and open up China’s capital market.

Lawrence Lau, Ralph and Claire Landau Professor of Economics, CUHK

Mar 18, 2016

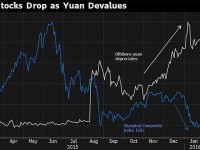

The Renminbi surprised the world markets by its unexpected devaluations first in August 2015 and then in January 2016. The author argues that the Renminbi is unlikely to devalue abruptly and significantly going forward, even though there may be small fluctuations in the Renminbi exchange rate.

Yi Xianrong, Researcher, Chinese Academy of Social Sciences

Feb 25, 2016

Expectation management is key to the stability of the yuan, and the central bank should give priority to the offshore yuan market, because this is not only a highly free and liberalized market, but also an important venue where international speculators would try to attack or manipulate the exchange rate of the yuan.

Zhang Monan, Deputy Director of Institute of American and European Studies, CCIEE

Feb 04, 2016

Systemic risks like a new round of global currency devaluation and capital outflow could threaten economic stability and growth. In the past two years, the spree of short-term speculative capital and the RMB arbitrage rose and accumulated a lot of risks. A new global monetary management mechanism and a more stable global exchange rate structure are urgently needed.

Yi Xianrong, Researcher, Chinese Academy of Social Sciences

Jan 27, 2016

Stabilizing the RMB exchange rate not only requires comprehensively striking back the short-selling speculation but, more importantly, reversing the expectation of RMB depreciation and well managing the expectation. Substituting a new exchange rate index for the old exchange rate index has not impressed the international market. The RMB exchange rate should be anchored to the USD exchange rate to build confidence.

Yi Xianrong, Researcher, Chinese Academy of Social Sciences

Jan 05, 2016

If China’s economic growth is still under a big downward pressure and China’s central bank further imposes an easy monetary policy, the RMB will go through an increasing pressure of depreciation. Therefore, the inclusion of China’s currency in the SDR basket would be a double-edge sword.