CLAREMONT, CALIFORNIA – Now that U.S. President Donald Trump has imposed a 10% tariff on yet another $200 billion worth of Chinese imports, the U.S.-China trade war has entered a costly new phase. As China follows through on its pledge to retaliate, the casualties will include more than half the bilateral trade between the two countries, with China itself suffering the most losses.

Whereas China exported $506 billion worth of merchandise to the United States in 2017, it imported just $130 billion of American goods. That means that, in a dollar-for-dollar slugging match, China will quickly run out of steam. Lacking powerful counterpunches, China now has some of its most creative political minds searching for novel means of retaliation.

One idea, in particular, has attracted a lot of attention in the press, mostly because it comes from Lou Jiwei, a former minister of finance who now heads the National Council for Social Security Fund, China’s national pension fund. In a defiant speech delivered at the high-profile China Development Forum on September 16, he proposed withholding exports of goods that American companies need, thereby severely disrupting U.S. supply chains for 3-5 years, at least. Such a maneuver, Lou mused aloud, would be economically painful enough to influence US elections.

True, many products manufactured in the United States depend on imports of intermediate goods from China. Should China cut off those supplies, under the legal fig leaf of “export restraint,” U.S. companies would be unable, at least in the short term, to find alternative sources that could cover all of their needs.

The disruption to the U.S. economy would, no doubt, be severe. But the damage to China’s economy would be worse, because the U.S. produces even more critical intermediate goods that China needs and would be unable to get anywhere else.

Of course, proponents of Lou’s approach know that China would suffer. They have faith in the deterrent of “mutually assured destruction” (MAD) – the principle that, if an attack by one country means the decimation of both, neither will make the first move.

During the Cold War, the concept of MAD helped, counter-intuitively, to maintain peace, as both the Soviet Union and the US knew that, if they deployed any of their 30,000-plus nuclear warheads, the other would mount a devastating retaliation. But trade is not nuclear war, and in this conflict, the U.S. possesses a much bigger arsenal than China. If one side’s destruction is not so assured, the logic of MAD breaks down.

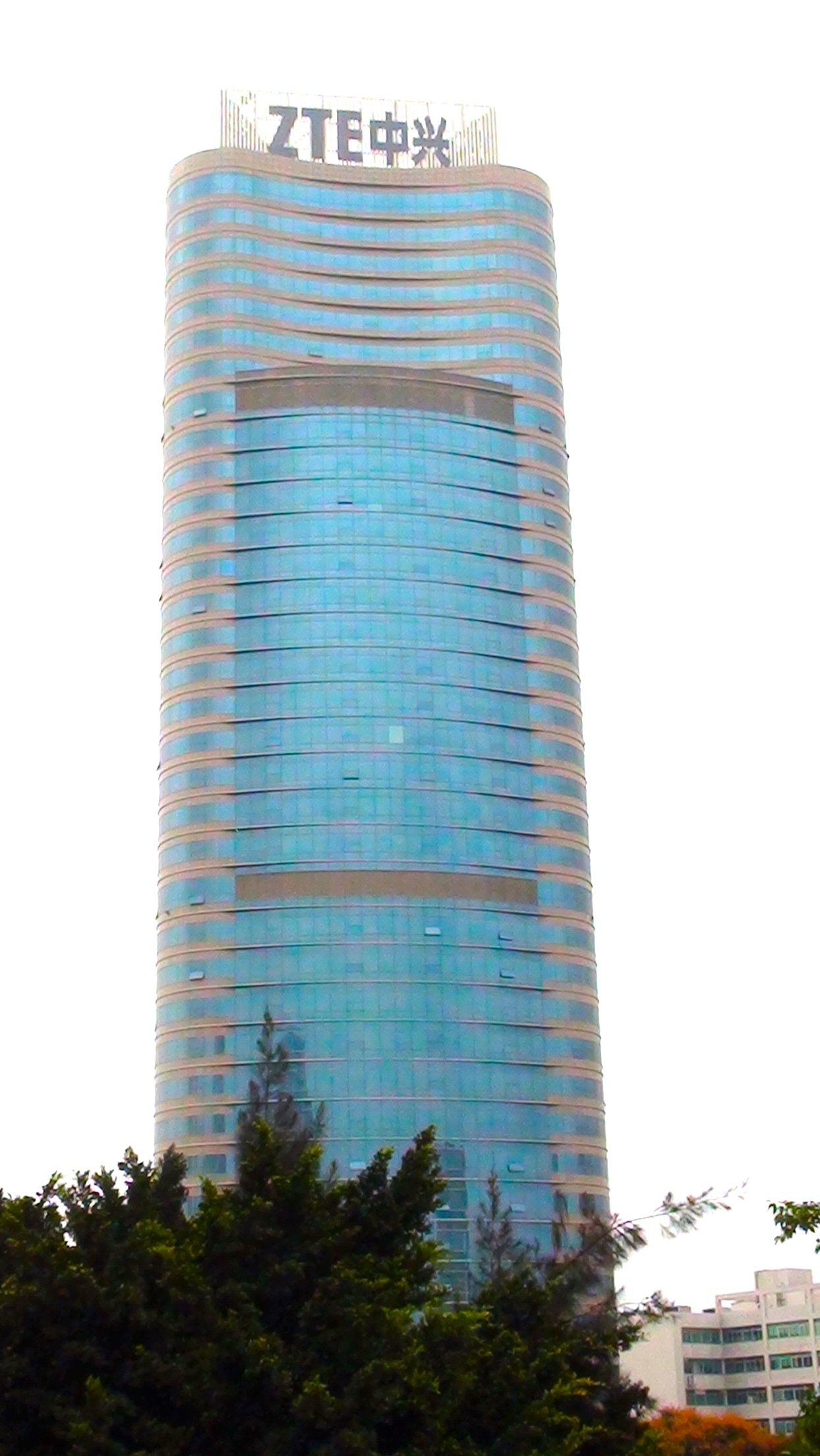

The most crucial intermediate good the U.S. can withhold is advanced semiconductor chips. In April, the U.S. banned the sale of such chips to the Chinese telecom giant ZTE as punishment for the company’s violations of U.S. export rules. Almost immediately, ZTE’s operations were effectively shut down. Had Trump not given the firm a reprieve – in exchange for a $1 billion fine and an agreement to adhere to strict compliance rules – ZTE would not have survived.

Beyond advanced microchips, the U.S. government could order Boeing and United Technologies to withhold aircraft parts and jet engines on which China’s large commercial fleet depends, effectively grounding many Chinese jetliners. The U.S. could also forbid Google from offering support to Android smartphone software in China. All of this would impose much higher costs on China than on the US.

And the direct economic costs of such actions are just the beginning. Continued retaliation from China of the sort Lou has proposed would accelerate the country’s economic decoupling from the US, with both countries creating safeguards that reduce their dependence on each other.

This would please America’s trade warriors and national security hawks, who believe that such a decoupling would limit the growth of Chinese power. But it would make the world much more dangerous, as the unfolding strategic conflict between the US and China would no longer be constrained by shared economic interests.

The good news is that China’s leaders, realists that they are, probably recognize that, when facing a far stronger adversary, it is not advisable to bet on the MAD strategy. Instead, they should take Trump’s recent escalation as an opening to end the trade war, initiating a ceasefire that will enable the real peace negotiations to begin.

Copyright: Project Syndicate, 2018.