Polices to address the cost of living and housing in America are central to the White House’s voter outreach, but they are not without risks and potential downsides in the long run. Trump’s policies may win some voter support but will not generate momentum for long-term economic growth.

The administration of Donald Trump, known for its pro-business tax cuts and deregulating economic agenda, recently introduced several focused policies addressing affordability, including capping credit card interest rates at 10 percent, banning large investors from buying single-family homes, and directing Fannie Mae and Freddie Mac to purchase $200 billion in mortgage bonds. These moves have upended Trump’s policy status quo, roiled financial markets and put Wall Street on defense.

The administration’s policy shift is driven by intense election pressure and public frustration over living costs. Despite claims of a robust economic recovery, the data tell a starkly different story. Prices have surged about 25 percent over the past five years, with notable spikes in essential areas such as housing, healthcare, food and energy. In December, while the CPI matched overall inflation, some sectors saw sharp rises: housing and healthcare were both up by 0.4 percent month-on-month, food by 0.7 percent and energy by 1 percent.

Also, the rise in energy-related costs, rent and home insurance far outpaced overall inflation. This structural inflation has hit middle- and low-income groups hard, eroding their income gains. In fact, since May, wage growth has stalled because of rising inflation, and real average hourly wages for production and non-supervisory workers have dipped 0.2 percent. As of December, average hourly earnings had only risen 1.1 percent year-on-year. Missing data due to the government shutdown in October and November has further fueled public anxiety about underlying financial health.

The outcomes of several local and state elections have aggravated the policy pivot. In November, Democratic candidates campaigning on affordability have scored consecutive wins in Virginia, New Jersey and New York City. These victories are viewed as crucial bellwethers for the 2026 midterm elections. For Trump, should the Republicans lose control of Congress, his policy agenda would be severely hampered. He would even face the threat of impeachment.

Against this backdrop, affordability has emerged as a make-or-break issue for Trump to win voter support. The recent policy initiatives are fundamentally aimed at appeasing public discontent over living costs and turning around Republicans’ electoral fortunes.

Trump’s affordability policies are well targeted, but it is by no means a fix-all solution, meaning it could offer short-term relief to specific groups but doesn’t go far enough to address deeper issues. On the upside, capping credit card interest rates at 10 percent could save American households around $100 billion annually, easing debt burdens for middle- and low-income families reliant on credit cards. Additionally, plans for Fannie Mae and Freddie Mac to buy $200 billion in mortgage bonds may lower rates by 0.2 to 0.25 percentage points, slightly reducing monthly mortgage payments. The Trump administration also proposed using tariff revenues to hand out a $2,000 subsidy to households and to control data center electricity costs—attempts to quickly tackle affordability issues through direct market intervention.

However, these policies also pose potential risks and will have long-term repercussions. They have sent shock waves through Wall Street. The proposed cap on credit card interest rates, for example, has dented major credit card issuers’ stock prices, while the ban on institutional purchases of single-family homes has unsettled the real estate market. More critically, the policies have inherent flaws. Capping credit card interest rates can reduce interest payments, but may discourage card issuance to low-income individuals with patchy credit records, pushing them to payday lenders with even higher rates and ultimately worsening their debt burden.

Despite the intent to shore up housing affordability, the ban on property purchases by institutional investors may reduce the rental supply, drive up rental prices and further penalize families that are already unable to afford homes. Moreover, implementing these policies faces some significant institutional constraints. House Speaker Mike Johnson downplayed the prospect of congressional approval of a cap on credit card interest rates, but legal experts see something else. Given the current polarized political dynamics, the legislative process, if needed, could easily go awry.

Long-term, Trump’s affordability policies are fraught with paradoxes that could undermine their viability:

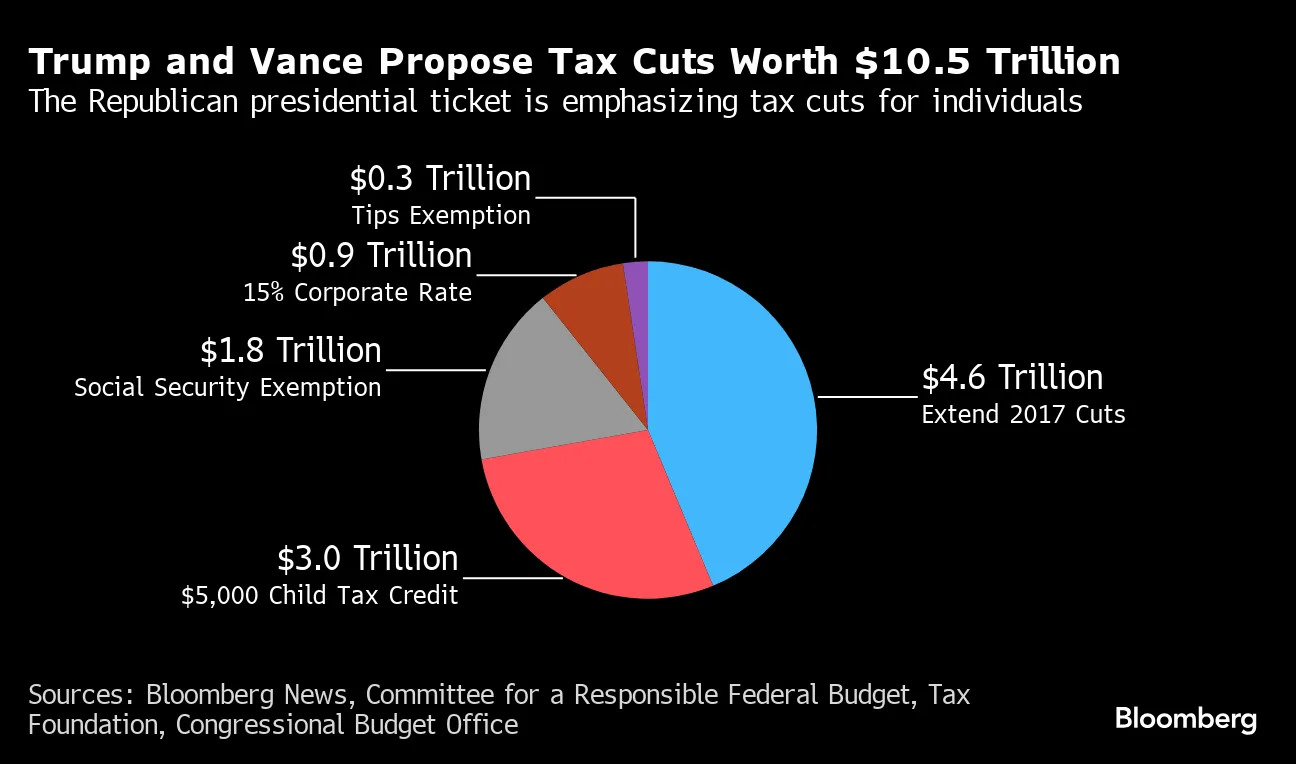

First, there’s a disconnect between policy goals and fiscal reality. With a current deficit of $35 trillion, Trump’s tax cuts and tariff subsidies will only deepen the fiscal hole. Estimates suggest these policies could add $7.5 trillion to the deficit over a decade. This mounting debt not only constrains policy options but also risks eroding market confidence in U.S. fiscal sustainability—its long-term economic competitiveness and the credibility of the dollar.

Second, is the conflict between government intervention and market mechanisms. Trump’s policy shift categorically deviates from the Republican tradition of advocating for small government and minimal intervention. On top of all that is the engineered criminal investigation against Fed Chairman Jerome Powell. All these have shattered the policy stability that anchors market expectations.

Fed independence is sacrosanct in the maintenance of price stability and market confidence; political interference could lead to misaligned monetary policy. JPMorgan CEO Jamie Dimon has warned that political meddling with the Fed would result in higher inflation and interest rates, thereby increasing the cost of living for Americans.

Third is the contradiction between short-term political demands and long-term economic structure. Addressing affordability requires balancing fiscal sustainability, market stability and structural reform—something Trump’s current policies fail to achieve. Exempting tariffs on some agricultural products may temporarily curb prices, but it won’t solve the structural issues such as global supply chain strain and insufficient domestic production capacity. Similarly, less expensive weight-loss drugs may ease medical burdens for some, but it doesn’t tackle the root causes of high health care costs, such as monopolies in the pharmaceutical sector and a cumbersome insurance system. These Band-Aid policies may win voter support before elections but will not generate momentum for long-term economic growth.