Yu Xiang, Senior Fellow, China Construction Bank Research Institute

Dec 21, 2023

Carefully parsed economic data may serve as a smokescreen to conceal the genuine state of the U.S. economy and mislead investors. The fog confuses both the observers and the promoters of perceptions, rendering everyone incapable of gauging the seriousness of underlying issues.

Fernando Menéndez, Economist and China-Latin America observer

Oct 03, 2023

China's economic growth has slowed while American politicians continue to advocate for protectionism, which is concerning as history shows that free markets are key to prosperity. China's struggles underscore the need for more economic freedom, not less.

Yu Xiang, Senior Fellow, China Construction Bank Research Institute

Sep 22, 2023

The United States has seen consistent monthly growth throughout the year, but certain risk factors are accumulating. The future trajectory of the U.S. economy will depend on the relative development of economic growth drivers and the potential risks. China must respond thoughtfully.

Benn Steil, Director of International Economics, Council on Foreign Relations

Aug 25, 2023

At the end of World War II, the United States accounted for more than half the world’s economic output and gold reserves. The United Kingdom was effectively bankrupt, with the remnants of the sterling area bound together by capital and trade controls. Once the British pound became convertible in July 1947, owing to US insistence, it succumbed to overwhelming selling pressure. The dollar, which was pegged to gold at $35 an ounce, was buoyed by America’s privileged position within the newly formed International Monetary Fund and quickly established itself as the bedrock of global trade and finance.

Stephen Roach, Senior Fellow, Yale University

Apr 28, 2023

Five years into a once-unthinkable trade war with China, US Treasury Secretary Janet Yellen chose her words carefully on April 20. In a wide-ranging speech, she reversed the terms of US engagement with China, prioritizing national-security concerns over economic considerations. That formally ended a 40-year emphasis on economics and trade as the anchor to the world’s most important bilateral relationship. Yellen’s stance on security was almost confrontational: “We will not compromise on these concerns, even when they force trade-offs with our economic interests.”

Ma Xue, Associate Fellow, Institute of American Studies, China Institutes of Contemporary International Relations

Apr 26, 2023

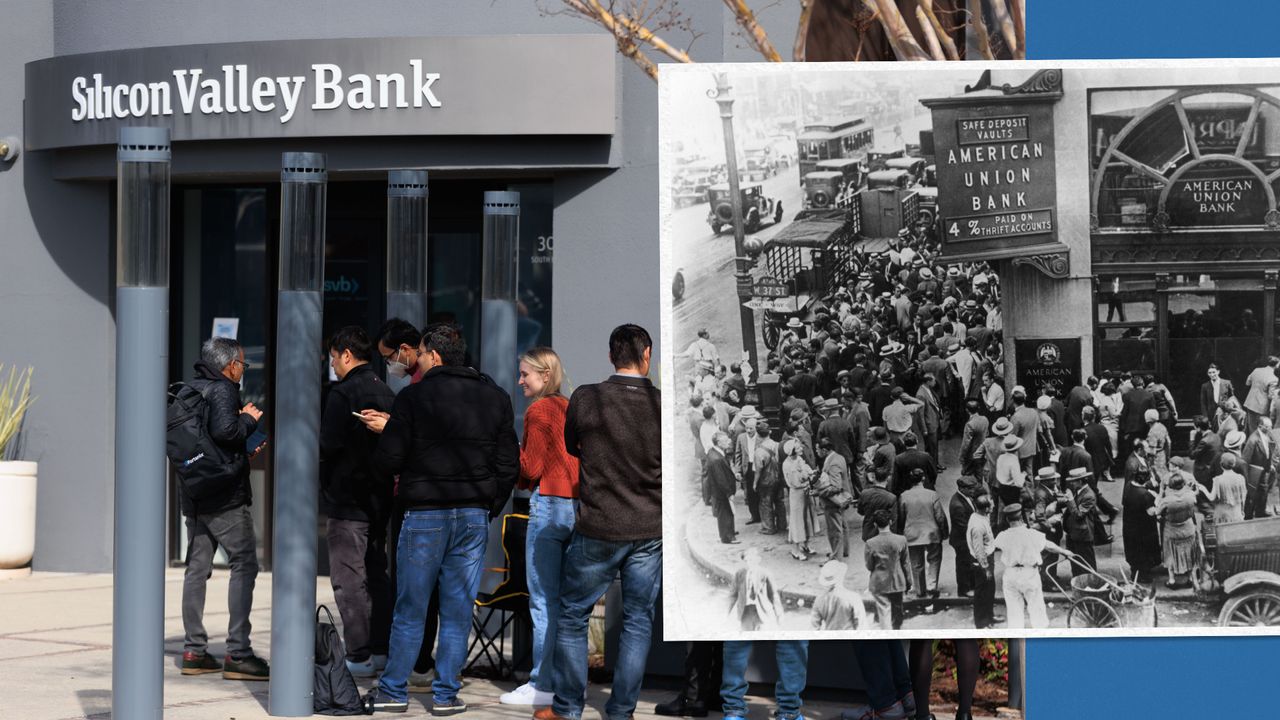

Financial markets are grounded in trust. When trust falters, dislocation follows. Panic in short-term financing markets in the United States could ignite a larger crisis in the overall economy, creating a vicious circle that undermines growth.

Dan Steinbock, Founder, Difference Group

Mar 01, 2023

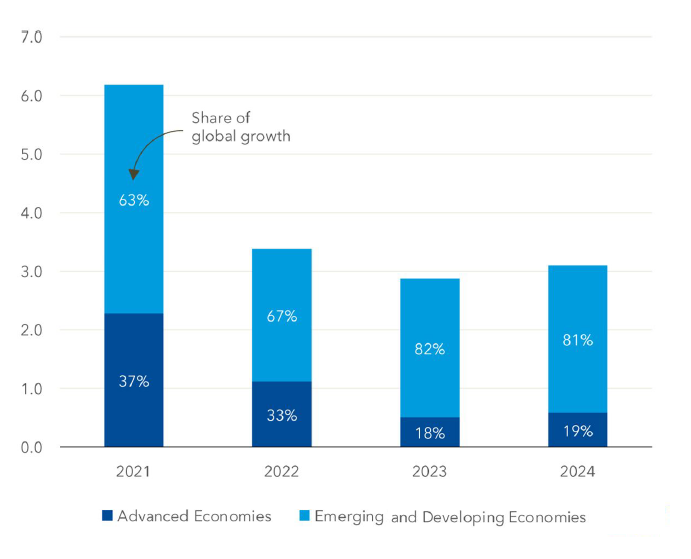

The year 2023 represents a turning point. If economic realities guide global prospects, it will be a positive turnaround. If geopolitics will continue to penalize economic prospects, a negative inflection point is more likely.

Lawrence Lau, Ralph and Claire Landau Professor of Economics, CUHK

Nov 04, 2022

We are living in a very different world. Shifting macroeconomic trends including diversification and second sourcing because of de-globalization and de-coupling have significant implications for the global economy. The strategic competition between the United States and China and other major geopolitical developments will fundamentally shape the world we live in.

Zhang Monan, Deputy Director of Institute of American and European Studies, CCIEE

Jul 07, 2022

The American economy will inevitably experience a Volcker-style contraction — think early 1980s — and it will have a global impact. Today’s inflation is stubborn and structural, and it will be virtually impossible to bring it down to 2 percent without tipping the economy into recession.

Zhang Yongjun, Deputy Chief Economist, China Center for International Economic Exchanges

Feb 20, 2022

Doing the math, we find that Chinese GDP looks better and the United States looks worse for last year than has been reported in some quarters. The U.S. is paying a steep price with its bloated money supply. Now it’s facing interest rate hikes to control inflation.