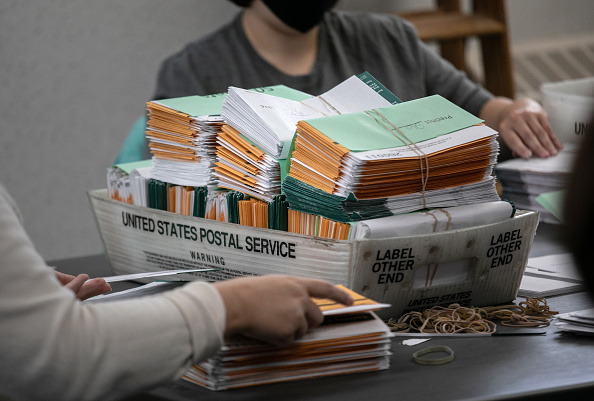

Battleground Ballots

Battleground BallotsAs uncertainty around the United States Presidential elections continues, China's future relationship with the U.S. is in flux. At the time of writing, six key battleground states have yet to be called; Biden holds a razor-thin lead in Pennsylvania, North Carolina, Georgia, Arizona, and Nevada, and Trump is winning in Alaska.

One of the most pressing issues facing the next U.S. President will undoubtedly be the U.S.-China relationship, and Beijing is watching closely. A Trump reelection would almost certainly be just as unpredictable towards China policy; whereas some analysts see a Biden win as a "double-edged sword", according to Christopher McNally in his latest article for China-US Focus. A Biden win would likely bring pragmatism and diplomacy back into American foreign policy, but would also mean better coordination with allies for a measured, targeted set of policies towards China.

Volatility in China's yuan also increased earlier this week to the highest level since 2011. Earlier this week, when more states were being called in favor of Donald Trump, the yuan dropped to 1.4%– the largest drop in a single day in over five years. Chinese media is taking a hands-off approach towards the election, waiting for a final answer and avoiding coverage on tight state races for fear of being seen as supporting a certain candidate or, worse, meddling with the U.S. election.

Anticipating Ant

Anticipating AntAs political uncertainty in the U.S. lingers, international market watchers have also been focused on Ant Group's hamstrung IPO. Just two days before Jack Ma's Ant Group, an affiliate of his star e-commerce company Alibaba, was set to list on the Hong Kong and Shanghai stock market at a record-breaking $35 billion, Chinese regulators suspended the fintech company's IPO over new capital shortfall regulations.

The regulations, which require Ant to make capital increases to its micro-lending systems and reapply for various licenses, were unveiled days before the company was set to go public, leading many onlookers to question the motives behind the suspension. Specifically, many are backtracking to Jack Ma's October 24 speech at a financial summit in Shanghai, where the fintech giant opined that Chinese banks functioned as a "pawnshop" and that China "lacks a financial ecosystem." Despite Ma's standing as China's top business tycoon, his speech, which some anonymous sources called a "punch in their faces", may have been too sensational to let go. Alibaba stocks dropped dramatically after the suspension, while Ma's personal wealth declined by over $2 billion.

Tensions Down Under

Tensions Down UnderTensions between China and Australia continued this week, with China stepping up trade restrictions on agriculture, wine and other food imports. Australian winemaker Treasury Wine Estates may face retrospective tariffs from Beijing on Australian wine, leading the winemaker to pause plans to expand its business. Amid trade restrictions, Chinese customs officials have also warned domestic importers to stay away from Australian commodities, including barley, sugar, and copper ore, according to Australian media.

Australia, which sells roughly one third of its exports to China, is under significant economic pressure from Beijing. Tensions between the two neighbors peaked this year after Australian Prime Minister Scott Morrison called on a public investigation of China's coronavirus origins.

As U.S. election results near, a Biden win may be able to mitigate or provide a buffer for Australia's disputes with China. The U.S.'s upcoming joint naval exercise with India, Japan, and Australia in the Bay of Bengal, as part of the multilateral naval training Exercise Malabar, may also be a signal of Washington's commitment in the region.

Prepared by China-US Focus editorial teams in Hong Kong and New York, this weekly newsletter offers you snap shots of latest trends and developments emerging from China every week, while adding a dose of historical perspective.

- 2020-10-30 Knock Knock

- 2020-10-24 Looking Back and Moving Forward

- 2020-10-16 COVID Cluster

- 2020-10-10 Election Looming

- 2020-10-03 Golden Week Kicks Off

- 2020-09-26 Virtual Diplomacy

- 2020-09-18 Digital Domain

- 2020-09-12 Reframing the Ground Rules

- 2020-09-05 Reciprocity in Action

- 2020-08-29 Who’s Tougher on China?

- 2020-08-22 To Talk, Or Not To Talk

- 2020-08-15 Domestic Circulation

- 2020-08-07 Fraying Relations

- 2020-08-01 Turning Tides

- 2020-07-24 Up in Smoke

- 2020-07-17 Status Stripped

- 2020-07-10 A Historic Moment

- 2020-07-03 Handover Tested

- 2020-06-27 Relationship Spiral

- 2020-06-20 Bolton Bombshell