Ghulam Ali, PhD, Monash University, Australia

Feb 26, 2026

China’s expanding visa‑free regime is no longer just a tourism measure; it is emerging as one of Beijing’s most agile tools of economic statecraft, deepening global connectivity at a time when many countries are turning inward.

Lawrence Lau, Ralph and Claire Landau Professor of Economics, CUHK

Yanyan Xiong, Associate Professor, School of Economics, and Research Fellow, Center of Social Welfare and Governance, Zhejiang University

Feb 23, 2026

2026 is the first year of the Fifteenth Five-Year (2026-2030) Plan for National Economic and Social Development of China. There is intense interest in the target rate of economic growth as well as the actual rate for 2026, given the continuing slump of the real estate sector in China, the apparent lack of sufficient domestic aggregate demand, and the many different challenging geo-political uncertainties. The official target rate will be announced at the “Twin Conferences (the National People’s Congress and the Chinese People’s Political Consultative Conference)” in early March.

Robin Rivaton, CEO of Stonal, an AI sherpa to MEDEF

Feb 13, 2026

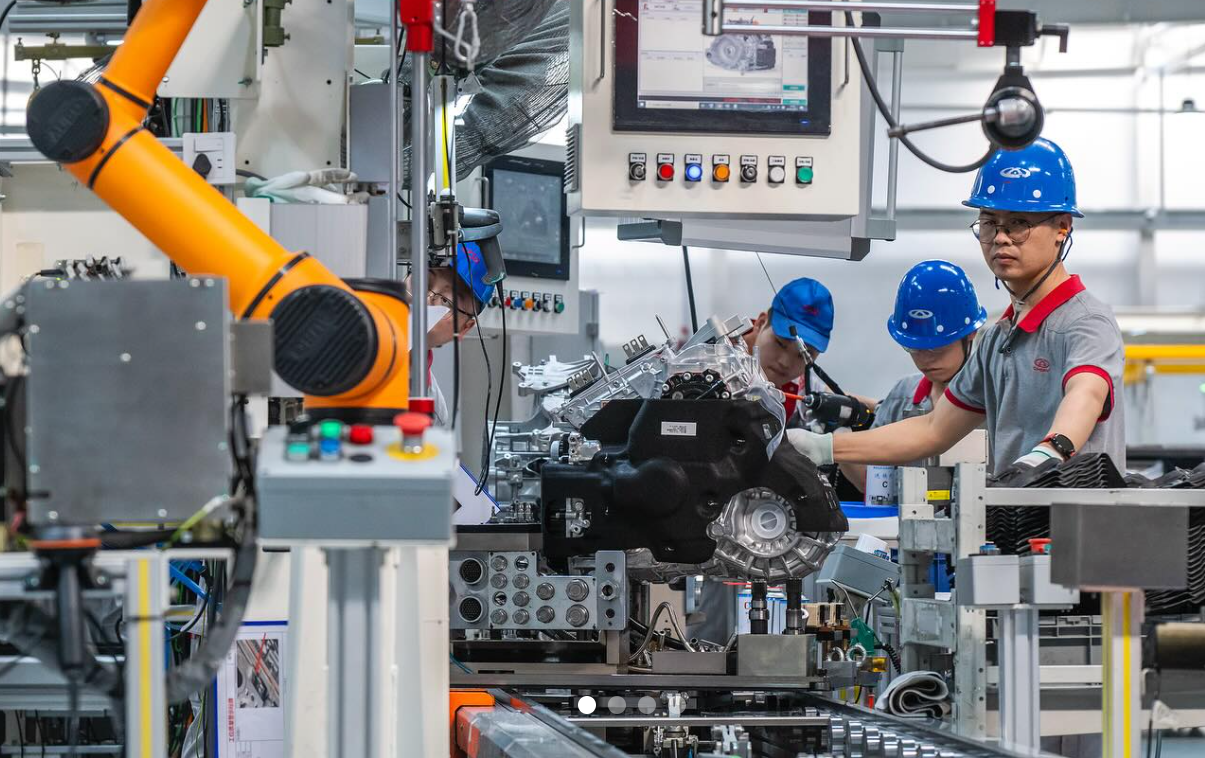

When Western politicians and business leaders discuss China’s manufacturing prowess, they typically invoke images of colossal steel mills flooding global markets, dark factories run by robots, and state-owned champions sustained by subsidies. This supports the view that tariffs and anti-subsidy measures can erode China’s industrial dominance. But while this logic may be comforting, it is wrong.

Yu Xiang, Senior Fellow, China Construction Bank Research Institute

Feb 03, 2026

The layering and reconfiguration of connectivity is underway. History warns that declaring the end of globalization too early obscures the institutional and regulatory restructuring processes that are already in motion.

Ma Xue, Associate Fellow, Institute of American Studies, China Institutes of Contemporary International Relations

Jan 30, 2026

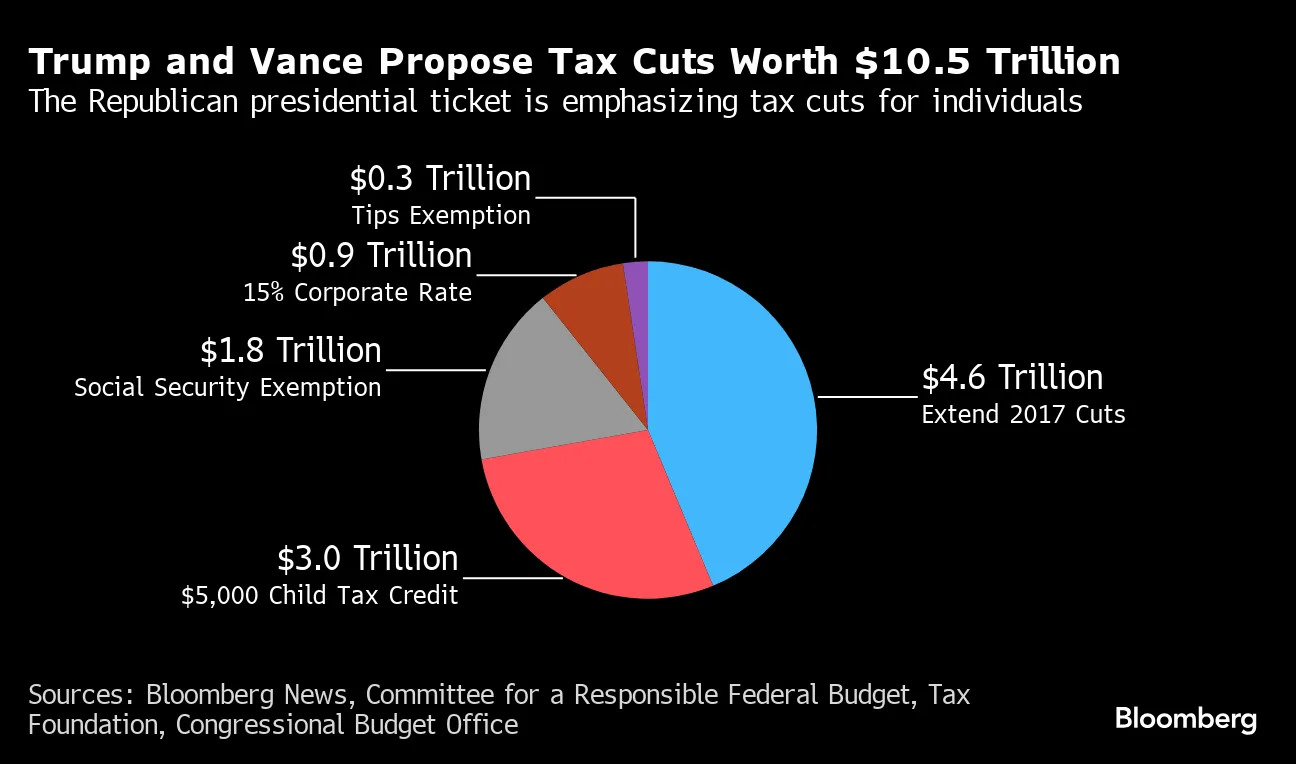

Polices to address the cost of living and housing in America are central to the White House’s voter outreach, but they are not without risks and potential downsides in the long run. Trump’s policies may win some voter support but will not generate momentum for long-term economic growth.

Matteo Giovannini, Senior Finance Manager at Industrial and Commercial Bank of China

Jan 30, 2026

China’s creation and evolution of the Asian Infrastructure Investment Bank illustrates a strategy of shaping, rather than overturning, the global financial order by working within multilateral norms while highlighting the limits of existing development institutions. The AIIB’s growth, governance practices, and partnerships show how China is advancing influence through institutional participation and reform by example, underscoring both the opportunities for engagement and the risks of exclusion for the United States in an increasingly multipolar financial system.

Dan Wang, China Director, Eurasia Group

Jan 05, 2026

China has deliberately kept the yuan stable in recent years, prioritizing currency credibility and controlled internationalization over export-driven devaluation, as a weaker currency now risks trade tensions, regional instability, and undermining long-term strategic goals. Rather than challenging the dollar outright, Beijing is pursuing a state-led, sanctions-resilient financial system and gradually re-anchoring its exchange rate away from a tight dollar peg toward a more multipolar framework.

Chen Xi, Professor at Zhejiang International Studies University, Dean of Institute for City Internationalization

Wang Dong, Professor and Executive Director, Institute for Global Cooperation and Understanding, Peking University

Jan 05, 2026

The American experiment will foster new realities through a low-cost, efficient model for connection nations. The Zangezur Corridor represents more than a transportation route. It is likely to become a crucial variable shaping the future geopolitical landscape.

Zhang Monan, Deputy Director of Institute of American and European Studies, CCIEE

Dec 22, 2025

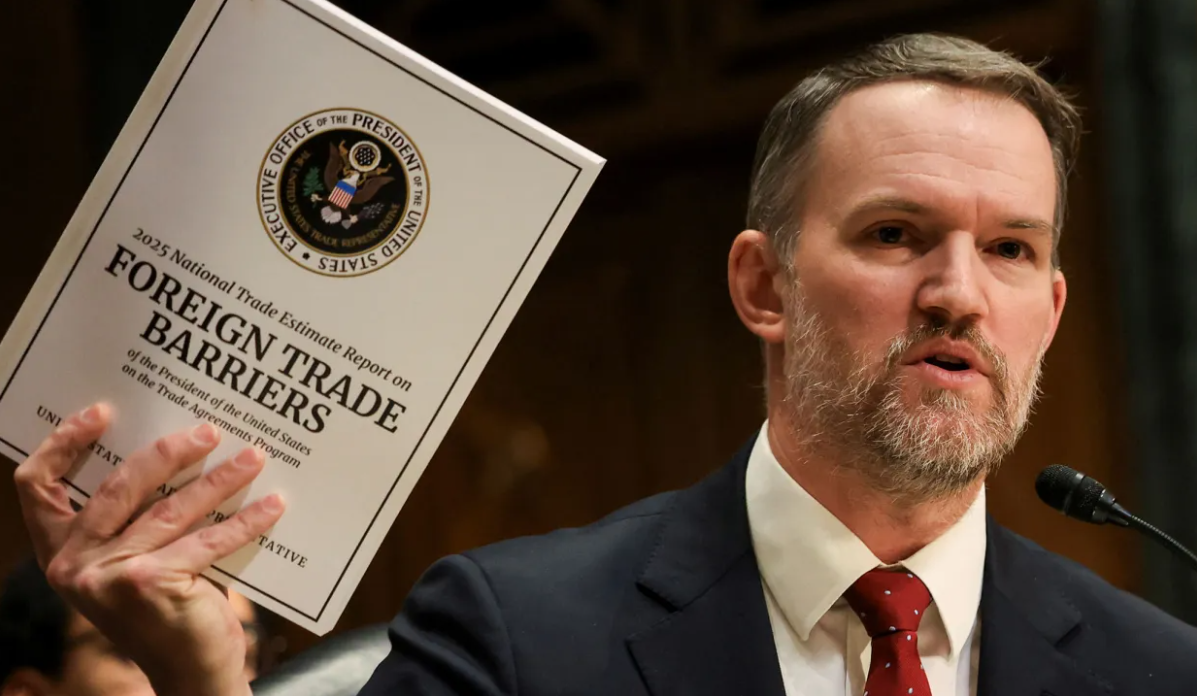

The Turnberry System is a way to replace the WTO-based postwar multilateral trading system with bilateral agreements. It marks a significant turning point in global trade rules and will profoundly impact the global trade landscape.

He Weiwen, Senior Fellow, Center for China and Globalization, CCG

Dec 22, 2025

It is highly anticipated that even with a continued mix of tensions and collaboration, 2026 will see more of the positive and less of the negative, thus benefiting the people of both countries and the world at large.

Back to Top

- China-US Focus builds trust and understanding between the U.S. and China through open dialogue among thought leaders.

- Our Offerings

- Topics

- Videos

- Podcasts

- Columnists

- Research Reports

- Focus Digest

- Stay Connected

-

Thanks for signing up!

- Get the latest stories from China-US Focus weekly.