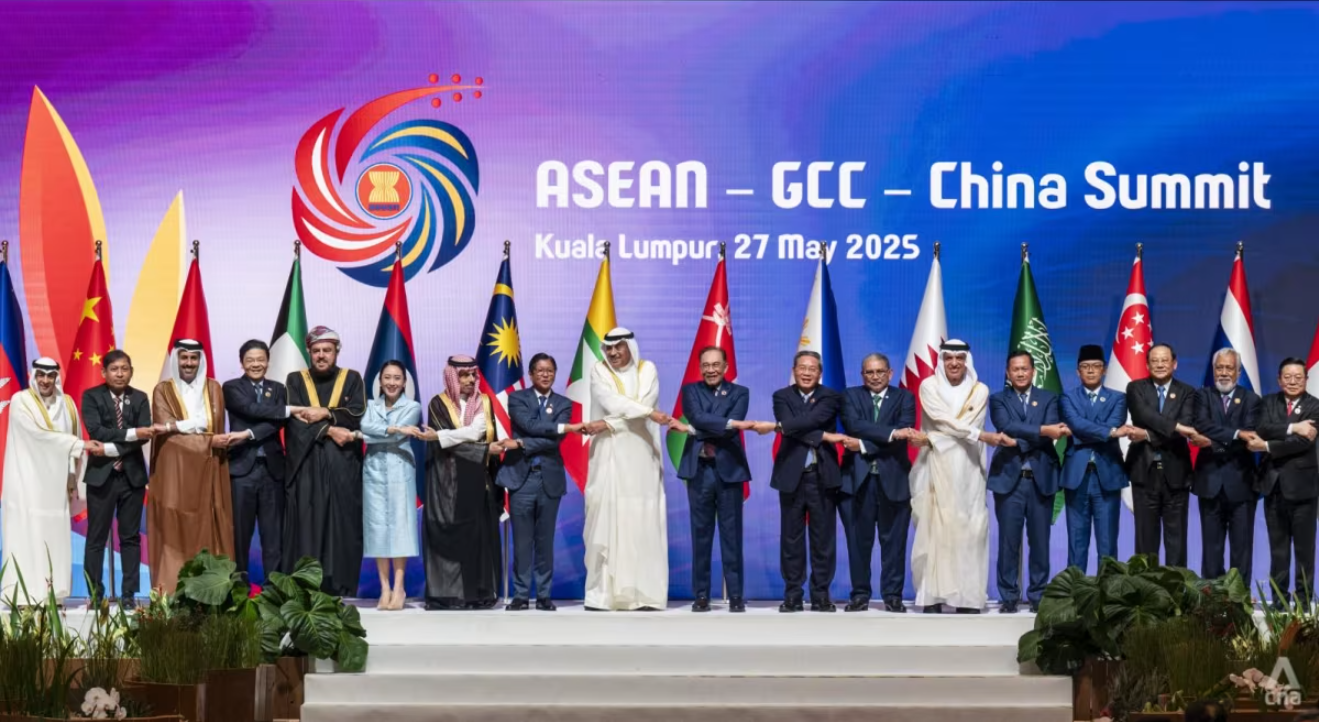

The ASEAN-Gulf Cooperation Council (GCC)-China Summit was held at the Kuala Lumpur Convention Centre in Malaysia, May 27, 2025. Held under the theme ‘Synergising Economic Opportunities towards Shared Prosperity,’ the Summit provided a platform for the Leaders of ASEAN, GCC, and China to exchange views on ways to strengthen economic resilience and shared prosperity across ASEAN, GCC and China, as well as for global prosperity.

In the week of 25th May 2025, Kuala Lumpur played host to a landmark event: the inaugural ASEAN-GCC-China Summit. It brought together Southeast Asian nations, the Gulf states, and China - three pillars of the emerging multipolar order - in a signal moment of strategic realignment. While headlines may focus on trade, energy, and infrastructure cooperation, the deeper story lies in a quiet revolution in how the world’s fastest-growing economies trade, settle, and invest - increasingly without the U.S. dollar.

At the centre of this shift is a web of local currency settlement mechanisms, swap lines, and institutional agreements designed to make cross-border trade smoother, cheaper, and most importantly, less vulnerable to U.S. pressure. Just days before this summit, the central banks of Indonesia and China signed a Memorandum of Understanding to settle $150 billion in bilateral trade using their own currencies - the rupiah and the renminbi. This is just the latest step in a broader architecture of financial cooperation that includes currency swap agreements, payment infrastructure integration, and the expansion of non-dollar capital markets.

If Donald Trump hoped to slow this trend, his latest comments are having the opposite effect. The U.S. president threatened to impose tariffs on BRICS countries - a group that includes Brazil, Russia, India, China, and South Africa - if they move away from the U.S. dollar. His justification? That de-dollarisation threatens American economic power. But these threats are not stemming the tide - they’re accelerating it.

From Petrodollars to Multipolar Payments

For nearly five decades, the global economy has revolved around the petrodollar system, a structure cemented in the 1970s through a U.S.-Saudi arrangement that mandated oil sales be priced in U.S. dollars. That system not only gave the U.S. unmatched monetary privileges; it allowed Washington to weaponise the dollar through financial sanctions, account seizures and systemic exclusion (like cutting nations off from SWIFT).

But those very tactics have taught the world a lesson: monetary dependence equals strategic vulnerability. The U.S. has overplayed its hand. Countries now want out; not in opposition to the dollar per se, but in defense of their own sovereignty and economic security.

China, for its part, has spent the last 15 years preparing for a post-dollar world. It has built the Cross-Border Interbank Payment System (CIPS) as an alternative to SWIFT, expanded its currency swap lines with over 30 countries, and promoted the use of the renminbi in trade settlement - especially in energy markets. ASEAN countries like Indonesia, Malaysia and Thailand already use local currency settlement mechanisms with China and with each other. Gulf states, particularly the UAE and Saudi Arabia, are increasingly accepting RMB for oil, investing in Chinese capital markets, and deepening energy-finance ties with Beijing.

This is not mere hedging. It is a deliberate transition.

ASEAN, China, and the Gulf: A New Economic Triangle

The ASEAN-GCC-China axis represents one of the most dynamic and strategic economic triangles of the 21st century. Each region brings distinct strengths:

● ASEAN offers population scale, strategic geography and manufacturing capability;

● China supplies industrial depth, infrastructure capacity, green energy technologies and knowledge, R&D depth and financial technology; and

● The Gulf brings capital, energy resources and sovereign wealth firepower - and a strong consumer market to boot.

The upgraded ASEAN-China Free Trade Agreement, concluded this month, adds further heft. With provisions like to expand to cover digital trade, green energy and rules-of-origin harmonisation, the FTA enables a shared regional production platform more capable of internal coordination - and external insulation from systemic shocks, including sanctions and currency volatility.

The Kuala Lumpur summit will further entrench this cooperation. Discussions reportedly include RMB oil settlement, green industrial zones and GCC-ASEAN investment vehicles. Importantly, these initiatives are increasingly settled through local currencies and alternative payment platforms, reducing reliance on Western-controlled clearing systems.

Add to this the recently signed MOU between the People’s Bank of China and Bank Indonesia to expand trade settlements in national currencies, and we are witnessing a profound reconfiguration of regional - and international - settlements. Indonesia is ASEAN’s largest economy. Its bilateral trade with China is almost US$150 billion. With Indonesia experiencing a small trade surplus, national currency-based settlements face few fundamental hurdles.

Of all Asian nations, Indonesia was the most impacted by the liquidity crisis occasioned by the Asian financial crisis of 1997. The exodus of U.S. dollars at the time exposed Indonesia to severe balance of payments problems, which resulted in large borrowings from the IMF. The lessons of over-exposure to the USD from that time have not been lost on regulators and central bankers across the region.

The emerging new institutional infrastructure allows countries to trade and invest on their own terms, and marks the resurgence of South-South cooperation on equal footing - not through IMF conditionalities, but through mutual strategic interest.

A Return to Pre-Colonial Economic Geography

What we are witnessing is not simply geopolitical rebalancing. It is in a sense, a civilisational reconnection. The trading routes between China, Southeast Asia, and the Gulf predate the Western-dominated global order by centuries. During the Tang and Song dynasties, Chinese junks, Arab dhows and Malay traders crisscrossed the Indian Ocean, linking ports like Guangzhou, Malacca, and Muscat in a web of maritime commerce grounded in mutual exchange, not imperial dominance.

Today’s financial and institutional arrangements mirror those earlier flows, but in a modern key. Sovereign digital currencies, cloud-based logistics and a growing network of rail and maritime links now join the dots. And while the West often views these developments through a Cold War lens - casting China as the new hegemon - what’s unfolding is in fact a horizontal, post-colonial alignment of emerging powers. They are not rejecting globalisation, but reformatting it to better reflect their values, needs and histories.

This is globalisation with multipolar characteristics.

Trump’s Threats: A Symptom of Strategic Decline

Donald Trump’s threats to impose tariffs on countries that move away from the dollar are revealing in their desperation. In an effort to bully others into propping up an increasingly unstable U.S.-centric financial order, the president exposes a fundamental truth: the U.S. no longer sets the terms of global trade.

And these threats are counterproductive. Countries do not want to be trapped in a system where policy changes in Washington can freeze their reserves, block their payments or weaponise their integration. When Trump speaks, the message that many capitals hear is not American strength, but American risk. Washington epitomises capriciousness rather than a pillar of stability.

Rather than maintaining dollar primacy, Trump’s rhetoric hastens its erosion. Nations double down on bilateral and regional arrangements. They diversify reserves. They integrate more deeply with each other, and less with the United States.

The Isolation of the Isolator

The irony is stark: the U.S., in seeking to isolate rivals, is increasingly isolating itself. As groups like BRICS expand, and as ASEAN-GCC-China coordination deepens, a new financial world is coming into being. It is not anti-Western, but it is post-Western. It does not reject American participation, but no longer defers to American dominance.

This world is defined by:

● Currency multipolarity, not dollar monopoly;

● Institutional diversification, not IMF centrality; and

● Civilisational inclusivity, not ideological hierarchy.

In this context, threats like Trump’s are not a deterrent. Rather, they are a wake-up call. For BRICS, ASEAN, and the Gulf, they reaffirm the logic of cooperation and self-determination. And for the rest of the world, they underline the risks of putting all their financial eggs in one basket.

The petrodollar age is ending. In its place, a new networked economy is rising. This new configuration is rooted in regional strength, historical memory and financial innovation. Those who understand this are moving forward. Those who don’t are left shouting from the sidelines.