America’s sweeping tariffs are harmful to both the world economy and to America itself and should be revoked. But a bigger trend is emerging: The relevance of the United States is dwindling when it comes to global trade.

A federal appeals court in the United States has ruled that most of Donald Trump’s “reciprocal” tariffs are unconstitutional and must be called off. The tariffs will remain temporarily until mid-October so that the Court of International Trade can weigh in and the Trump administration can appeal to the Supreme Court.

The sweeping worldwide unilateral tariffs are undoubtedly wrong and harmful to both the world economy and to America itself and thus should be revoked. However, a complicated, uncertain scenario lies ahead. Whatever the final outcome of the tariff case, a new trend is floating on the horizon: global trade without the U.S.

Global container shipping demand has been surprisingly resilient outside the U.S. over the past few months, said Vincent Clerc, CEO of shipping giant Maersk, with 4 percent growth expected this year. He also thinks the China-led growth will last a few years. DWS of Germany also found “a dramatic change in China’s trade orientation which points to a broader diversified global footprint.

During the first seven months of this year, Chinese exports to the United States fell 12.6 percent from a year ago. Meanwhile, China’s exports grew by 10.1 percent to Asia, by 5.2 percent to Europe, by 24.5 percent to Africa and by 7.3 percent to Latin America. Hence, China’s global exports during the first seven months of 2025 even accelerated, growing by 6.1 percent year-on-year, compared with 5.9 percent growth for 2024, before Trump’s second term and his tariff.

During this period, the U.S. share in China’s global exports fell from 14.3 percent to 11.8 percent, or 2.5 percentage points off. Asia’s share gained 1.8 percentage points; Europe shed 0.2 percentage points; Africa and Latin America gained 0.8 and 0.1 percentage points, respectively. We have seen a clear shift from America to Asia, Africa and Latin America, with Europe remaining stable.

Again, the U.S. share of China’s global exports shrank to 11.8 percent, or less than one-eighth, while the largest market is Asia by far, accounting for 50.2 percent, followed by Europe at 20.6 percent. Africa and Latin America combined accounted for 13.6 percent, larger than the U.S. market.

Similar trends have been evolving over the past few months in other parts of the world. The European Union has proposed stronger trade ties with the Asia-Pacific region (or a trade alliance between the EU and countries of the CPTPP), and it has invited Canada to Join the EU. China, ASEAN and the League of Arab States announced closer tripartite trade collaboration. Brazil and India, both under threat of 50 percent tariffs by Trump, have discussed enhancing their bilateral trade and lifting bilateral trade volume to $20 billion. There have also been signs of closer trade cooperation between RCEP members — namely, ASEAN plus China, Japan, South Korea, Australia and New Zealand. A clear trend of trade growth without America is on the horizon.

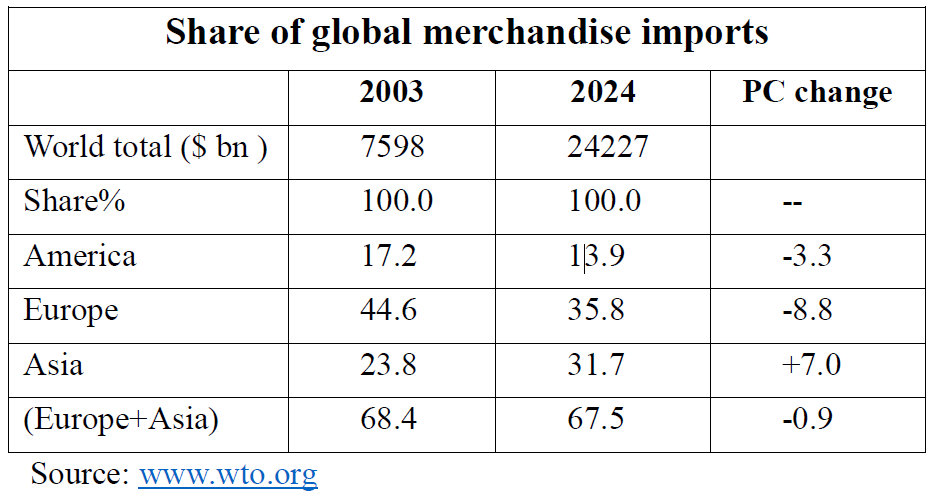

The U.S. is no longer particularly important in world merchandise trade. Last year it accounted for only 13.9 percent of world merchandise imports, while Europe accounted for 35.8 percent, followed by Asia at 31.7 percent. Europe and Asia combined accounted for two-thirds of total world imports, or five times that of the United States. The U.S. has no say in 86.1 percent of the world’s imports. What matters most in global trade is intra-trade in Europe and in Asia, and between Europe and Asia.

A similar pattern holds true in major categories of imports. In agricultural products, America accounts for 10.1 percent of global total, while Europe accounts for 32.5 percent (more than three times larger), and China, with 12.0 percent, is also larger. In minerals, the U.S. accounts for 7.6 percent, compared with 28.7 by Europe and 19.7 by China. In iron and steel imports (on which Trump imposed a 25 percent tariff), America accounted for 8.3 percent of world total, while Europe accounted for 34 percent. Automobiles are another major category subject to high Trump tariffs. However, America only accounted for 20.4 percent of the world’s total imports, compared with Europe’s 36.4 percent.

Frankfurter Zeitung, a leading German newspaper, carried an article on April 18 titled “America is not that strong.” The article held that, compared with China, the U.S. will become increasingly boxed out of world trade.

The possible American isolation is not only likely in world trade flows but also in world multilateral trading mechanisms with the World Trade Organization at the center. Washington’s goal of resetting the world trade rules based on Trump’s “America first” agenda is simply not practical. The U.S. is just one of 166 members of the WTO and thus has no mandate to change any WTO rules. WTO members cover 98 percent of world trade, and 74 percent of world trade is currently still operating on the WTO rules base.

This year marks the 30th anniversary of the founding of the WTO. Globally, merchandise and service trade volume increased fivefold, from $6.3 trillion in 1995 to $31.3 trillion in 2024, which has contributed significantly to world economic growth, employment and poverty alleviation. About 1.5 billion people were lifted out of poverty over the past 30 years partly because of the world multilateral trading system, which provides, among other things, zero tariffs on goods from the least developed economies.

By contrast, Trump’s “reciprocal” tariff charged as high as 40 percent tariff on those countries, although LDCs combined accounted for less than 0.3 percent of American global trade deficit. In this context, large numbers of developing economies, and LDCs in particular, firmly stand with the WTO and the world multilateral trading system it represents.

Furthermore, the world’s multilateral trading system is complemented with 375 regional trade agreements, including with the EU in Europe, ASEAN, the CPTPP and the RCEP in the Asia-Pacific, AfCFTA in Africa, and CELAC and MERCOSUR in the Caribbean and Latin America regions. Trade cooperation and economic integration among those RTA members are also growing without America in the mix.

Adam Posen, president of the Peterson Institute for International Economics, published an article titled “A new economic geography—Who profits in a post American world?” It offered some profound thoughts on the aftermath of America’s tariff and the inevitable U.S. isolation. The Trump administration should correct the mistake as soon as possible and return to the world trade family to the track of the multilateral trading system, which will be good for the world and also good for America.