President Trump has tweeted that the U.S. can win a trade war with China. China’s President Xi, on the other hand, has said that nobody wins a trade war, a sentiment echoed by many around the world. Based on these statements, it might seem implausible to consider that China could win. Neither side is claiming that publicly. Within countries, there is no doubt that, like any economic policy change, a trade war will produce both winners and losers, though the net economic effect of a big trade war is likely to be negative worldwide, perhaps even provoking another world recession. Among countries, winning and losing is relative. China may indeed be a net winner and the U.S. a net loser, for the following reasons.

One reason for U.S. weakness is the scope of Trump’s attack. Last week Trump intensified trade pressure against various countries. He said he’d decide by June 15 whether to impose $50 billion in tariffs against Chinese goods. He also threatened to further restrict Chinese investments in U.S. high-tech industries by June 30. But he has not confined his new trade actions to China; he also imposed steel and aluminum tariffs on key U.S. allies that had previously been exempted, including Canada, Mexico, and the European Union. Most devastating of all, he announced a plan to consider new tariffs against auto imports from all countries, most of them U.S. allies. U.S. vehicle imports are huge, almost $300 billion in 2017, double the value of his highest tariff threat against China. Trump’s protectionism would be the largest increase in tariffs since World War II. It would hit U.S. car buyers hard by raising prices by as much as 20%. Its worldwide scope would ensure that it would hit U.S. allies even more than it would impact China, so it will likely isolate the U.S. instead of China.

Another key reason Trump will lose in a trade war is that much of the U.S. business establishment opposes such drastic trade action. Most large American corporations operate globally, sourcing inputs from dozens of countries to assemble in the U.S. and selling or manufacturing in various countries. Putting up barriers to the movement of goods fragments the carefully developed global supply chains of hundreds of corporations. They will fight back through their friends in Congress and by curtailing investment, production and foreign sales (the latter because of countervailing tariffs abroad). U.S. job losses will certainly exceed job gains in newly protected industries. Farmers will suffer as well. Many of those adversely impacted by Trump’s protectionism have been part of his political base or that of his Republican Party. A disastrous trade war could ensure massive Republican losses in this year’s Congressional elections. The Republicans could lose their majorities in both houses of Congress.

Trump’s trade war might mobilize a veto-proof majority of Republicans and Democrats in both houses of Congress to strip the president of his power to set tariffs. According to the U.S. Constitution, Congress has the power to set tariffs. However, in a series of laws since 1934, Congress has increasingly delegated its tariff-setting power to the president. The Reciprocal Trade Agreements Act of 1934 allowed the president to unilaterally lower tariffs to facilitate bilateral trade agreements with other countries. The trade acts of 1962 and 1974 added the executive power to raise tariffs, first for national security reasons and second to retaliate against foreign violations of trade agreements. Trump is now invoking these powers to unilaterally raise numerous new tariffs. If he acts too recklessly, Congress could take back its constitutional power.

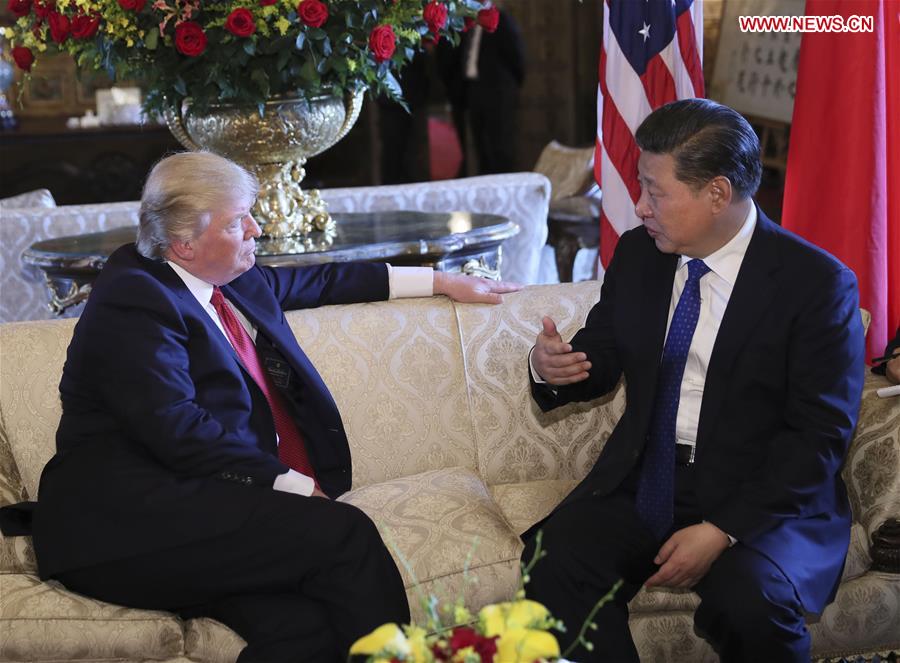

China’s leaders are better prepared than Trump to deflect domestic pressure arising from the economic disruptions of a trade war. President Xi was re-elected to another five-year term last fall, so he does not have to worry about any near-term challenge to his power. The Chinese Communist Party has no effective domestic opposition. Even more important, Chinese leaders can rightfully blame Trump for initiating the trade war, not only against China, but against all major trading countries. The anger of the Chinese people is easily focused against Trump and the U.S. rather than their own leaders.

Most importantly, China has considerable ability to retaliate against U.S. interests that will quickly increase the domestic pressure on Trump to back down and desist from trade action against China. If Trump imposes $50 billion in new tariffs on China, China has already promised to retaliate with $50 billion in tariffs on U.S. exports. Trump said if China does that, he will impose another $100 billion in tariffs on Chinese exports to the U.S. He believes then he could “win” because that total of $150 billion in tariffs would be greater than all current U.S. exports to China. China could put tariffs on all U.S. exports to it and still not match the U.S.

However, China has an even more powerful weapon. Although China has a massive trade surplus with the U.S., the investments of U.S. corporations in China are vastly bigger than Chinese investments in the U.S. China could squeeze many leading U.S. firms with major investments in China, including General Motors, John Deere, Yum! Brands, McDonald’s, Starbucks, Apple. Some of these even earn more profit in China than they do in the U.S. China could take any number of actions to restrict their operations, encourage consumer boycotts, increase their taxes, or impede their profit repatriation, perhaps even to the point of forcing their sale at a loss to new Chinese owners. The business and capital of such U.S. companies would remain in China even if the American owners lose their stake. Chinese pressure on such powerful companies would induce them to pressure the U.S. government and political parties for relief, including an end to the trade war.

Trump’s political situation is tenuous now. He must win big or back down. He doesn’t have the patience for a long fight. With so many powerful interests arrayed against him, he might even face impeachment this year if enough Republican Congress members, angry over his trade stance, join Democrats in voting for it. Although many interests in the U.S., China, and around the world will be damaged if the world’s two largest economies engage in a trade war, it is likely that Trump would have to back down first, increasing China’s global power and influence.