It is highly anticipated that even with a continued mix of tensions and collaboration, 2026 will see more of the positive and less of the negative, thus benefiting the people of both countries and the world at large.

As 2025 approaches its end, it’s clear that it was the most extraordinary year in the 47-year history of China-U.S. trade since formal relations were restored. The year started with a violent storm and ended with a much calmer and positive tone.

Immediately after U.S. President Donald Trump re-entered the White House for a second term on Jan. 20, Washington launched its new “America first” trade policy agenda. Unilateral tariffs were announced by Trump, who characterized tariffs as the “most beautiful word.” China was the first target, with a 10 percent tariff announced on Feb. 1, two months before worldwide “reciprocal tariffs” were announced. The highest tariff target was 145 percent. Parallel to the tariffs, a series of export restrictions on high-tech items followed.

China immediately responded with strong verbal opposition and powerful countermeasures that Washington had not expected. With five phone calls between Chinese President Xi Jinping and Trump, as well as five meetings on trade between the two governments, the two sides reached constructive agreements. Washington called off most of its tariffs and suspended 24 percent for one year. Port fees and the high-tech penetration rule were also suspended for a year. In return, China called off most of its counter-tariffs and suspended a new rare earth export restriction and port fee for one year.

This year saw the biggest drop in bilateral trade volume since 1979—the year when China and U.S. established formal diplomatic ties—as well as a partial shift in the supply chains linking the world’s two largest economies. However, as the year ends, the overall relationship and its ballast—trade—has become steady and constructive.

No winner in tariff war

The initial tariff rate Trump imposed on Chinese goods was an aggregate 54 percent—including 30 percent on fentanyl ingredients and 24 percent reciprocal tariffs—in hopes that China would yield. Washington, however, did not expect that China would retaliate with tariffs of 10 to 15 percent on selected U.S. goods and a 24 percent overall tariff.

Furious, Washington escalated by another 50 percent (for a total 104 percent), only to be met with the same 50 percent additional retaliatory tariff. Then Washington added another 21 to 125 percent and China did the same. Then again, Washington added another 20 to 145 percent in April, but China shrugged this off as meaningless because any rate above 70 percent is enough to block trade.

Contrary to a general “block” effect, Chinese exports to the U.S. did not fall to zero after that. Instead, April and May saw respective falloffs of 28 percent and 33 percent year-on-year. There was general anxiety among the U.S. importers. I had a working lunch with President Eric Zheng of the American Chamber of Commerce in Shanghai and a group of American executives who unanimously their trade with China was indispensable and hoped for a sharp drop in tariff rates. A story reported in March by the New York Times—headlined “How are we going to afford this?”—told of the great distress of American small businesses under Trump’s tariffs, based on a survey of about 100 American small businesses importing goods from China.

Unlike Trump’s repeated false messaging, tariffs are paid by American importers, not by Chinese exporters. The importers, with tens of thousands small businesses among them, were forced to reduce their earnings or pass along the additional tariff costs to consumers. According to the American Chamber of Commerce, there are 33.2 million small businesses (fewer than 500 employees) in the United States, accounting for 99.9 percent of all businesses, and 44 percent of the country’s GDP. The U.S. Census Bureau reports that small businesses account for 41.2 percent of imports from China. At the end of 2024, there were 254 items for which the U.S. relied on China 100 percent, 1,006 items at 80 to 99.9 percent reliance and 1,607 items at 50 to 79.9 percent reliance.

Subsequently, the White House announced exemptions for information and telecom products because Apple imported billions of them from China. Wal-Mart, Home Depot and Target also obtained exemptions after heated lobbying.

Finally, the 91 percent escalated tariff was dropped and the 24 percent reciprocal tariffs were suspended, bringing the combined rate back to 30 percent at China-U.S. trade talks in Geneva on May 11—exactly one month after its announcement. This showed the world that the extremely high tariffs on Chinese goods were totally absurd and unworkable.

Even after the talks in Kuala Lumpur, the aggregate U.S. tariff on China remained at 37.3 percent, including Trump’s first term tariff—more than double the U.S. average tariff globally (17.3 percent), leading to a sharp reduction in Chinese exports to the United States. According to China Customs, merchandise exports to the U.S. during the January to November period this year ($385.91 billion) fell 18.9 percent year-on-year and was 28.0 percent less than three years ago, which was the historic high.

China’s loss in the U.S. market is nothing short of phenomenal. Yet, ironically, this did not change China’s uninterrupted growth in the global market. Global exports from China during the same period rose by 5.4 percent year-on-year, with its trade surplus breaking $1 trillion for the first time. The U.S. share of global exports from China shrank to 11.3 percent, compared with 14.7 percent a year ago and 16.3 percent three years ago.

American businesses and families also suffered badly from Trump’s tariffs. The first 11 months of 2025 saw U.S. exports to China off 13.2 percent from a year ago and off 20.9 percent from three years ago. Notably, U.S. soybean exports fell to zero and only resumed after the Kuala Lumpur talks.

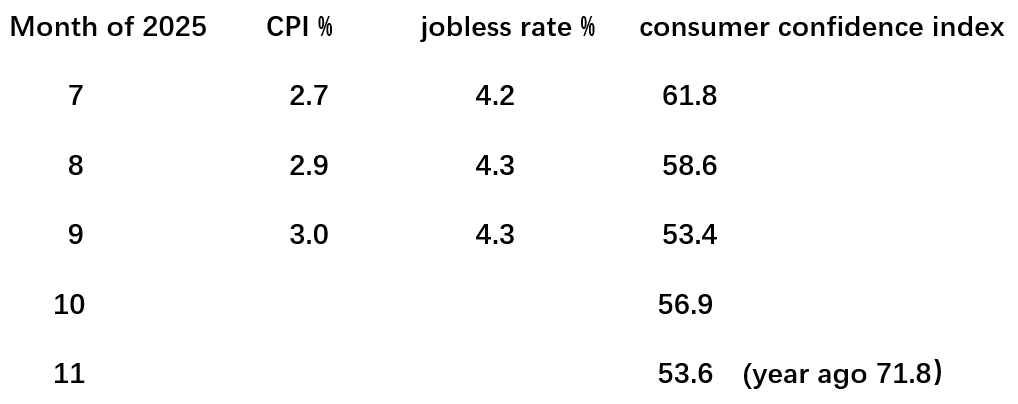

The worldwide tariff has hit the U.S. relentlessly. According a U.S. State Department estimate, the average U.S. worldwide tariff rate is 17.3 percent, the highest since 1935. Of the total tariff cost, 14 percent has been paid by foreign exporters, 64 percent by U.S. businesses and 22 percent by U.S. consumers. As a result, there has been rising inflation, rising jobless rates and lower consumer confidence.

High tariffs have not brought manufacturing back to the United States. Instead, the latest Congressional Joint Economic Commission report estimated that the tariff will cut U.S. manufacturing investment by 13 percent per year up to 2029.

Lessons from chips and rare earths

This year has also seen an intensive confrontation between the two countries—the U.S. high-tech bans/restrictions and China’s export controls on rare earth minerals.

Washington banned ethanol and electronic design automation (EDA) software/hardware, as well as high-performance chip exports to China. China, in turn, heightened rare earth export controls. Again, Washington announced a penetration rule covering all subsidiaries of Chinese parent companies on the entity list in September, thus prompting China’s most severe rare earth restrictions. It was a painful blow to the U.S. economy, as China controls 87 percent of world’s rare earth refinery output, 78 percent of refined lithium, 98 percent of oxidized gallium and 65 percent of processed cobalt; it also has an overwhelming monopoly in magnetization technology. All of these are crucial to the U.S. semiconductor, motor vehicle and defense industries. And so, inevitably, Washington first revoked or suspended all restrictions; China, in turn, suspended its latest rare earth control for one year.

High-tech or resource restrictions are all trade tools for specific purposes but imposed dramatically this year in the China-U.S. trade confrontation. However, the ultimate removal or suspension of restrictions tells us that both sides could find a better, mutually beneficial solution.

President Trump announced on Dec. 8 the allowance of Nvidia H200 chips to approved customers in China—a significant sign of positive cooperation, not decoupling. It also confirms the fact that the semiconductor industry and market in both countries are in fact complementary.

The U.S. Semiconductor Industry Association (SIA) report for 2025 showed that the global semiconductor sales hit $630.5 billion in 2024, up 19.7 percent from 2023. The U.S. is the world’s largest semiconductor maker, accounting for 50.4 percent of the global market. However, China was the world largest market overall. It grew by 20.1 percent in 2024. Of Nvidia’s global sales, 22 percent came from China.

On the other hand, the U.S. chip ban has triggered rapid growth in China’s own semiconductor industry. During the first 11 months of this year, the Chinese semiconductor industry saw its output increase 10.2 percent year-on-year, with related exports up 24.7 percent. If H200 of Nvidia remains banned for China, China will soon not need it; rather, it will take the Huawei Ascend 910C.

Professor Richard Baldwin of IMD Business School in Lausanne, Switzerland, posted an article on LinkedIn on Dec. 4 saying that the U.S. offshore policy has in fact not cut China out but has resulted in higher dependence on China and lower dependence on its friend-shoring allies. Thus, the ups and downs of 2025 have provided a good lesson: China and the U.S. have the ability to change their perspective on trade from a climate of confrontation to real collaboration.

Common interests in AI era

China-U.S. trade has been mutually beneficial for decades. Two-way merchandise trade hit $688.3 billion in 2024, 275 times what it was in 1979 when formal diplomatic ties was established. It was the fastest growth in a span of only 45 years in world trade history. Exports to China supported some 930,000 jobs in the United States and the China market offered another $490.7 billion outlet for U.S. businesses in China in 2022.

The world is at the threshold of an era that will be dominated by artificial intelligence. AI will bring fundamental changes to the world economy and to human lives. China and the U.S., without any doubt, are by far the world’s leading AI powers. A SIA report estimated that AI technology and industries will contribute $15 trillion by 2030. Jensen Huang, CEO of Nvidia, said that China is only a nanosecond behind the United States. The combination of China and U.S. accounted for more than 75 percent of world’s unicorn companies in 2025. Many of the leading AI engineers in Silicon Valley are ethnic Chinese.

Working together, China and the U.S. will create tremendous new economic arenas and will see unprecedented productivity growth on this new track of the globe’s fourth industry revolution. The SIA report calls for cooperation with China. The current China business delegation was received warmly by the USCCC and USCBC in Washington.

New page anticipated for 2026

The dramatic ups and downs in the China-U.S. trade relationship have provided much valuable experience and many lessons. Following the strategic guidance of both heads of state, a new page is turning for 2026.

First, China and the U.S. need to stick to the basic principle of equality and mutual respect, managing differences while seeking mutual benefits. Both sides will continue to have significant differences, as they have in past decades However, both sides should maintain an open, constructive approach, taking into full account the concerns of each other as they try to hit upon practical solutions.

Second, all the unilateral tariffs imposed in violation of WTO rules should be called off, no matter how the U.S. Supreme Court rules. On this basis, two-way trade could see a gradual recovery, even back to 2024 pre-tariff levels. Governments and businesses on both sides should lose no time in working out more trade deals or investment projects to secure a steady trade increase.

Third, governments—national or local—and businesses of the two countries should work out a master blueprint on overall AI cooperation. They should advance trade and investment cooperation to a much higher level, including cooperation in such fields as the semiconductor industry, quantum computing, AI models, industrial robots, AI design, smart manufacturing and AI medical services. Chinese investment should be encouraged in U.S. rust-belt areas to transform and upgrade traditional manufacturing to a much more advanced and profitable style of smart manufacturing. U.S. investment should also be encouraged in China’s new productive engines and green transition.

Beijing and Washington could work on an overall cooperation vision on AI collaboration for the next decade to accelerate economic growth in both countries. The collaboration should include a permanent dialogue mechanism on national security boundaries and policies in the AI realm.

Fourth, more energetic cooperation between state and provincial governments, businesses and people should be further encouraged.

It is highly anticipated that even with a mix of tensions and collaboration over the next decade, 2026 will be characterized by more collaboration and less tension—as well as working together at a higher level—thus benefiting the people of both countries and the world at large.