—— Interview with Lawrence Lau,

Ralph and Claire Landau Professor of Economics, CUHK

SPEAKERS:

Lawrence Lau, Zhiguo He

This is a transcript of the first one of the series of webinars, titled “China in Today’s World”, hosted by Professor Zhiguo HE of the University of Chicago Booth School of Business, on behalf of the Becker-Friendman Institute (BFI)-China. The guest in this webinar was Professor Lawrence J. LAU of the Chinese University of Hong Kong and Stanford University.

Lawrence Lau:

It is my honor and a pleasure to be here today. And the topic I'm going to speak on is China's economic growth in the next decade. And I will post this PowerPoint on my webpage in a couple of days, so you can feel free to download. One of the things that I want to point out is that China is today the second largest economy in the world, with over 16% of world GDP. The U.S. GDP is about 24% of world GDP. China is also the second largest trading nation in 2019, accounting for 10.7% of our total world trade, with the U.S. accounting for 11.3% of total world trade. So you know, they are number one and number two. China is the fastest growing major economy in the world over the past 40 years, averaging around 9% per year. But Chinese per capita GDP is still very low. It is about $10,000, slightly above $10,000 U.S. dollars. And this is actually only less than one sixth of the U.S. per capita GDP.

I want to show you these slides on the economic fundamentals of China going forward.

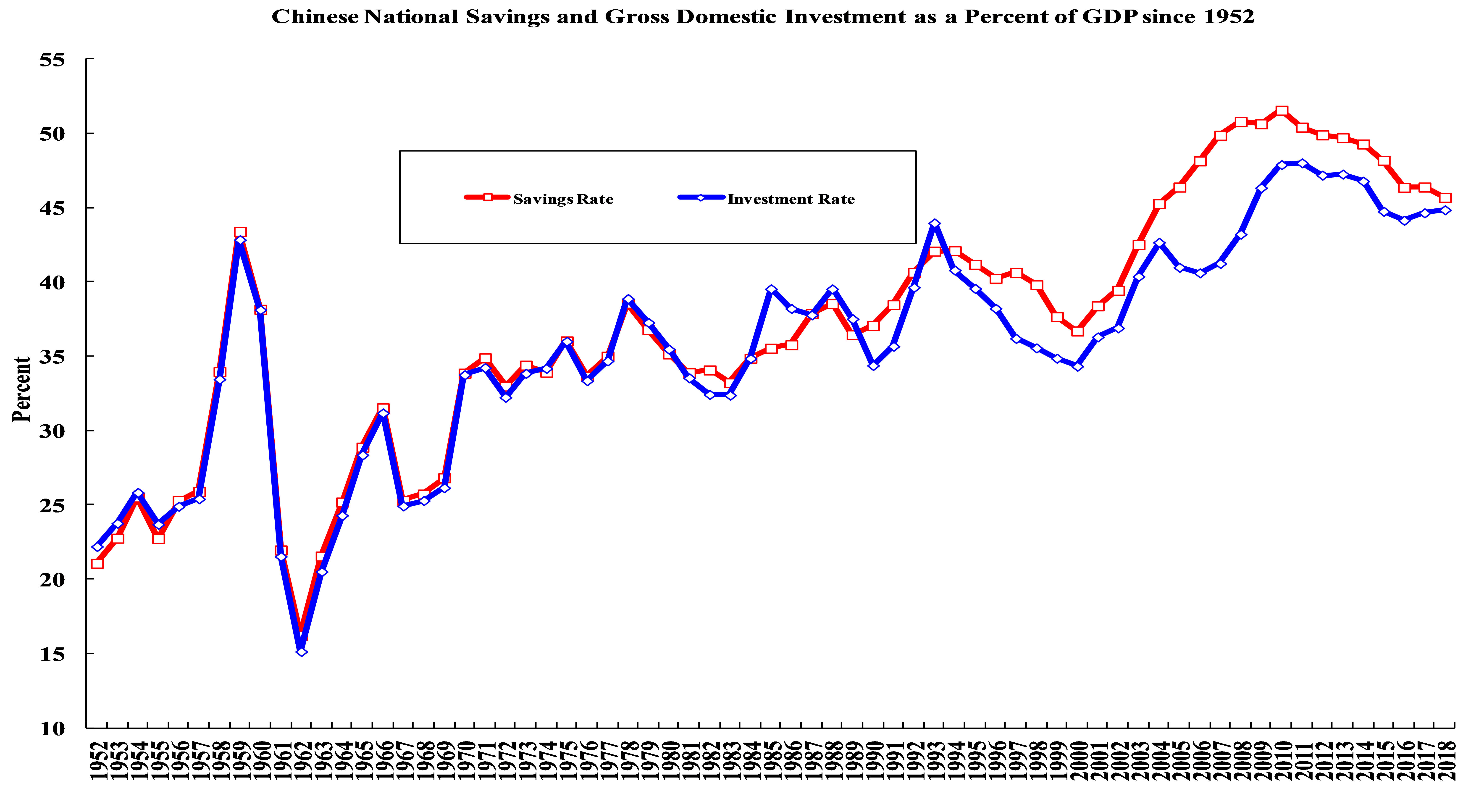

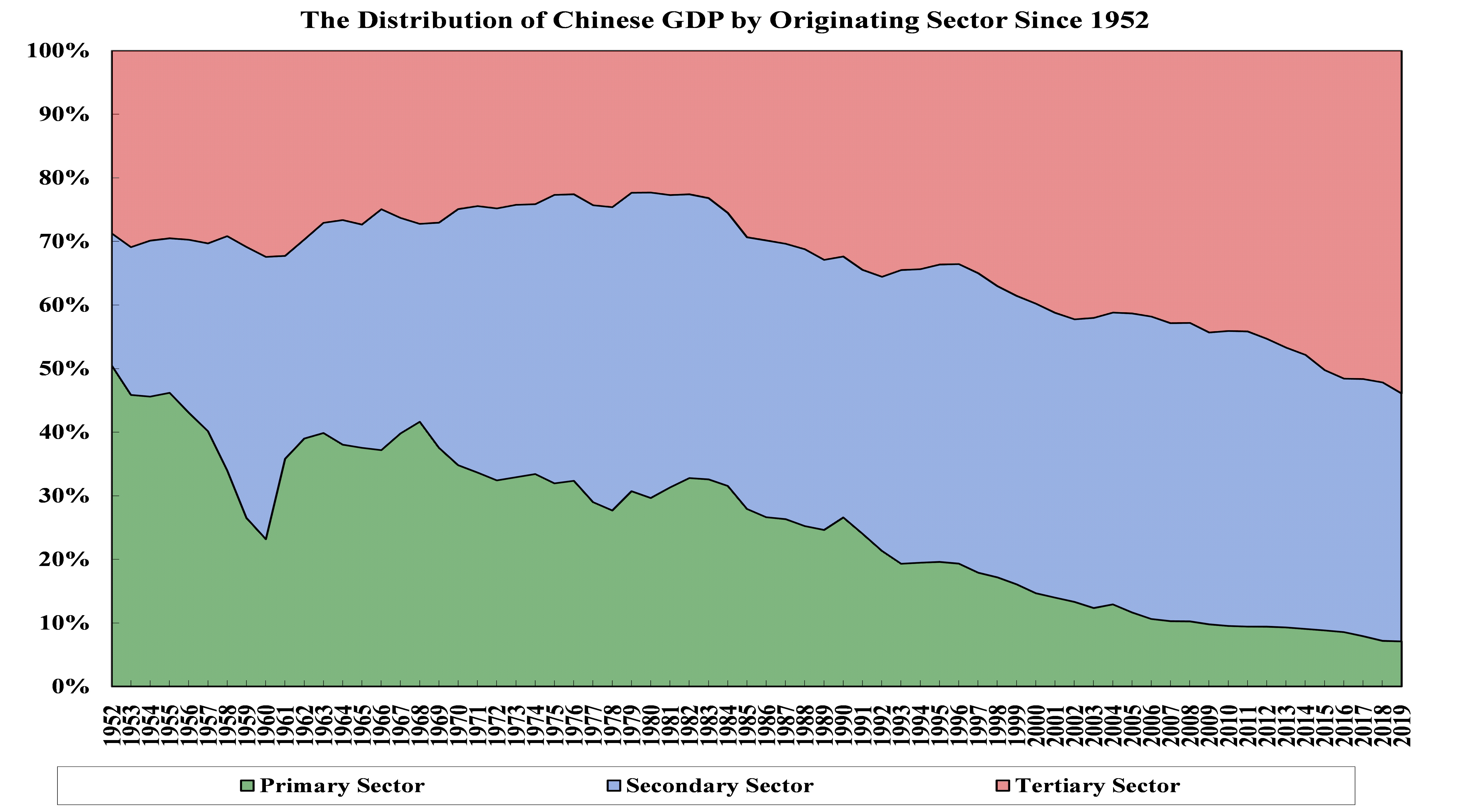

What you see in the red line is the savings rate, the national savings rate, not the household savings, the national savings rate. And the blue line is the national investment rate. And you can see that they're both very high. They are around 40%. Okay, and savings is slightly higher than investment. And what this says is two things. One is that there will be lots of savings available for investment going forward. So we expect that capital is not a problem. [INAUDIBLE] The other thing is that China is actually self-sufficient in terms of, say, demand for savings. So it is very different from the U.S. situation, where investment will exceed national savings. So that's one part of the fundamentals, the capital will be available. The other part has to do with labor. Okay, and there are really two points to make here. One is that the GDP originating from the agricultural sector, what you see in the chart is the green part. Okay, it's now less than 10%. I think it's a little bit above 7% of GDP.

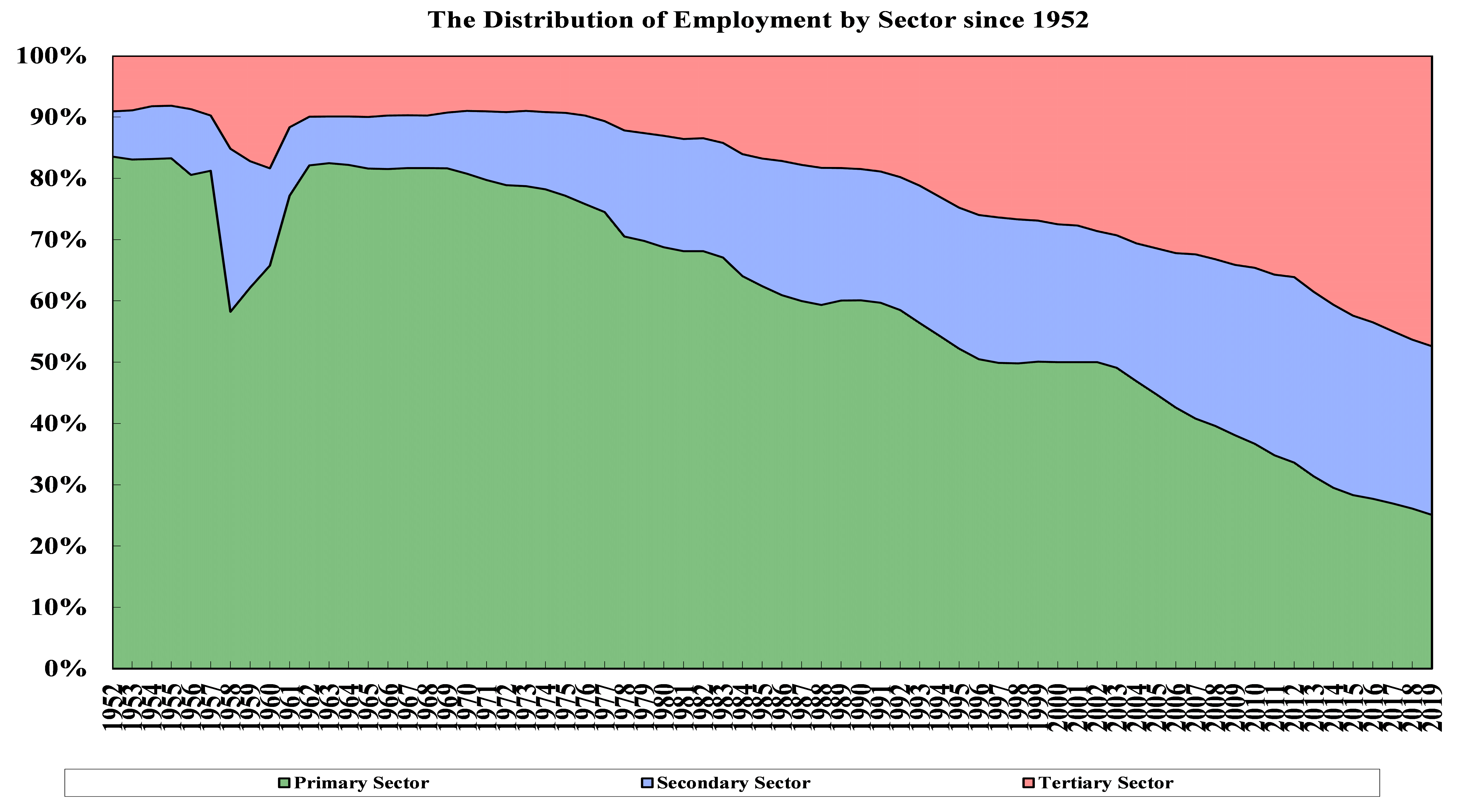

But the agricultural sector, you see, in the next slide, actually still takes about 25% of the labor force or employment. Okay, what does that tell us? That tells us that there is still surplus labor, that can be transferred from the agricultural sector to the industrial sector, and to the service sector. So there is no shortage of labor supply, certainly, in the foreseeable next decade or two.

But in addition, I want to also emphasize that the Chinese working age actually is defined as 16 to 60. Now, this is an old definition, that probably was adopted in the '50s. And now 60 is way too soon. And all China has to do is to lengthen the retirement age, by five years, perhaps even 10 years. Gradually, they would also provide another source of labor. So neither capital, nor labor is a problem. Neither is a constraint to further growth.

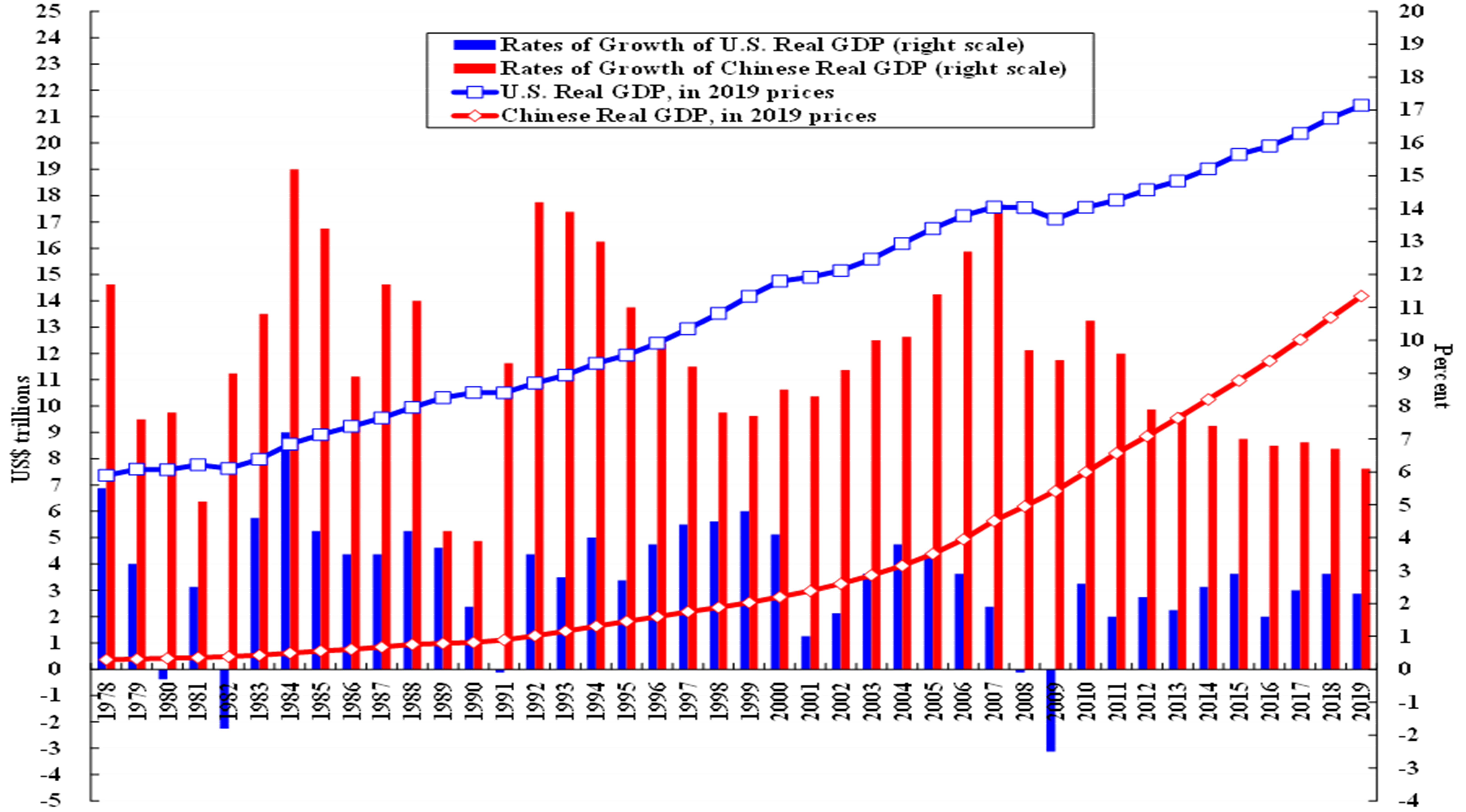

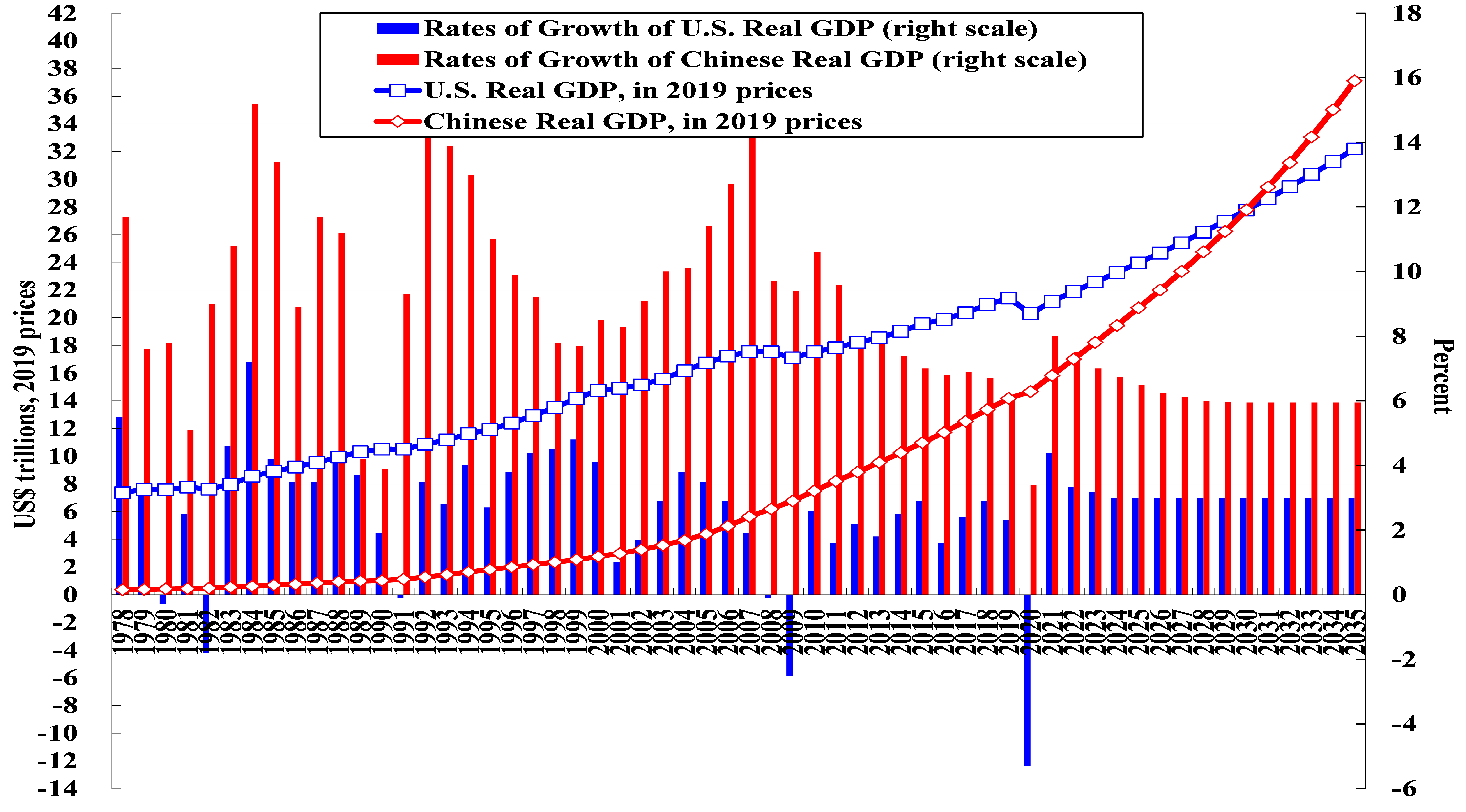

I want to also show you that China has been growing really very fast. What you see in the graph, the blue line up there is the U.S. GDP, the red line is the Chinese GDP. U.S. GDP is still higher by about one third of the Chinese GDP. But the growth rate, the growth rate on the columns - the red columns and the blue columns, you can see that the growth rates have been much higher in China than in the US, okay, even though the Chinese growth rate has been coming down. It is still around 6%.

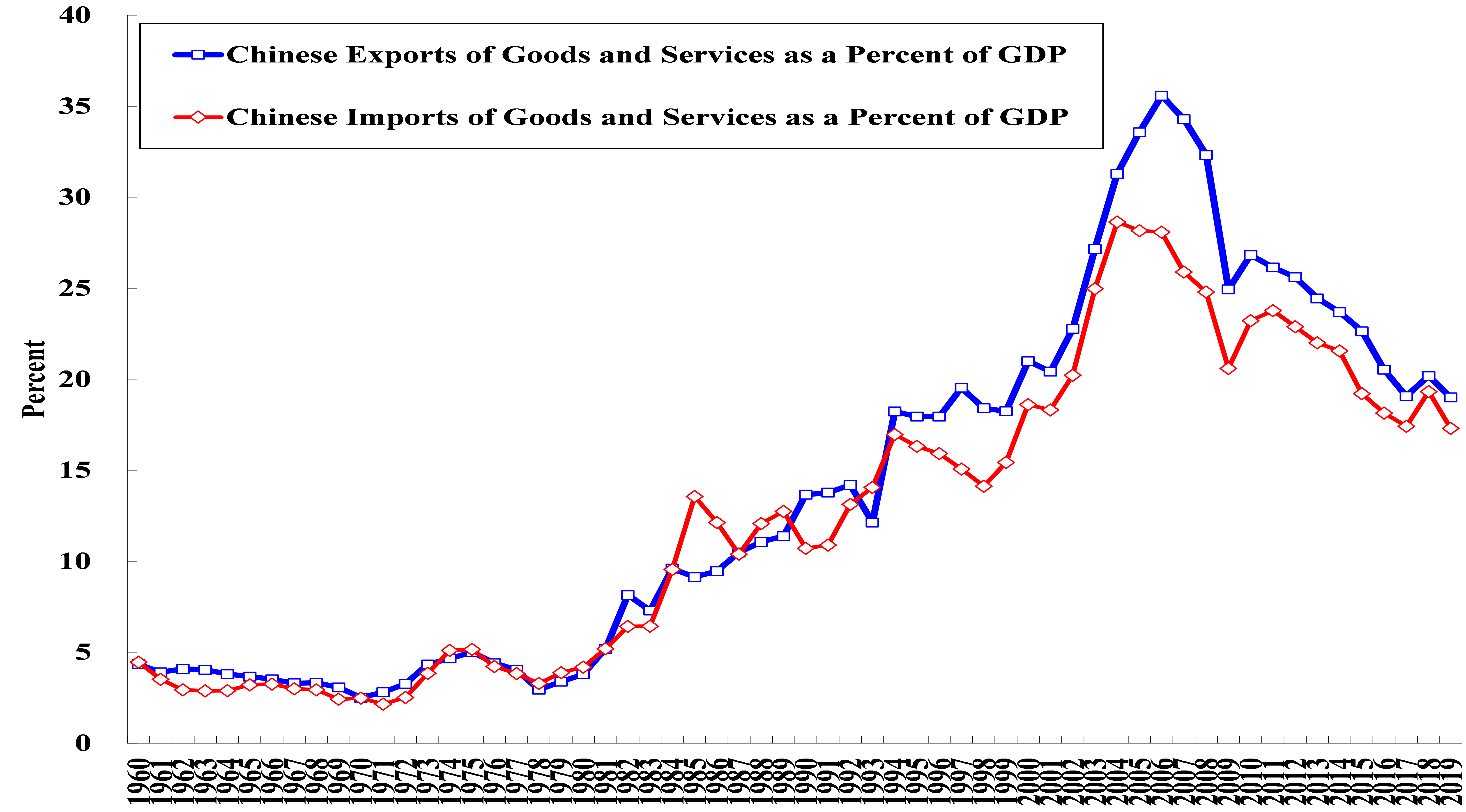

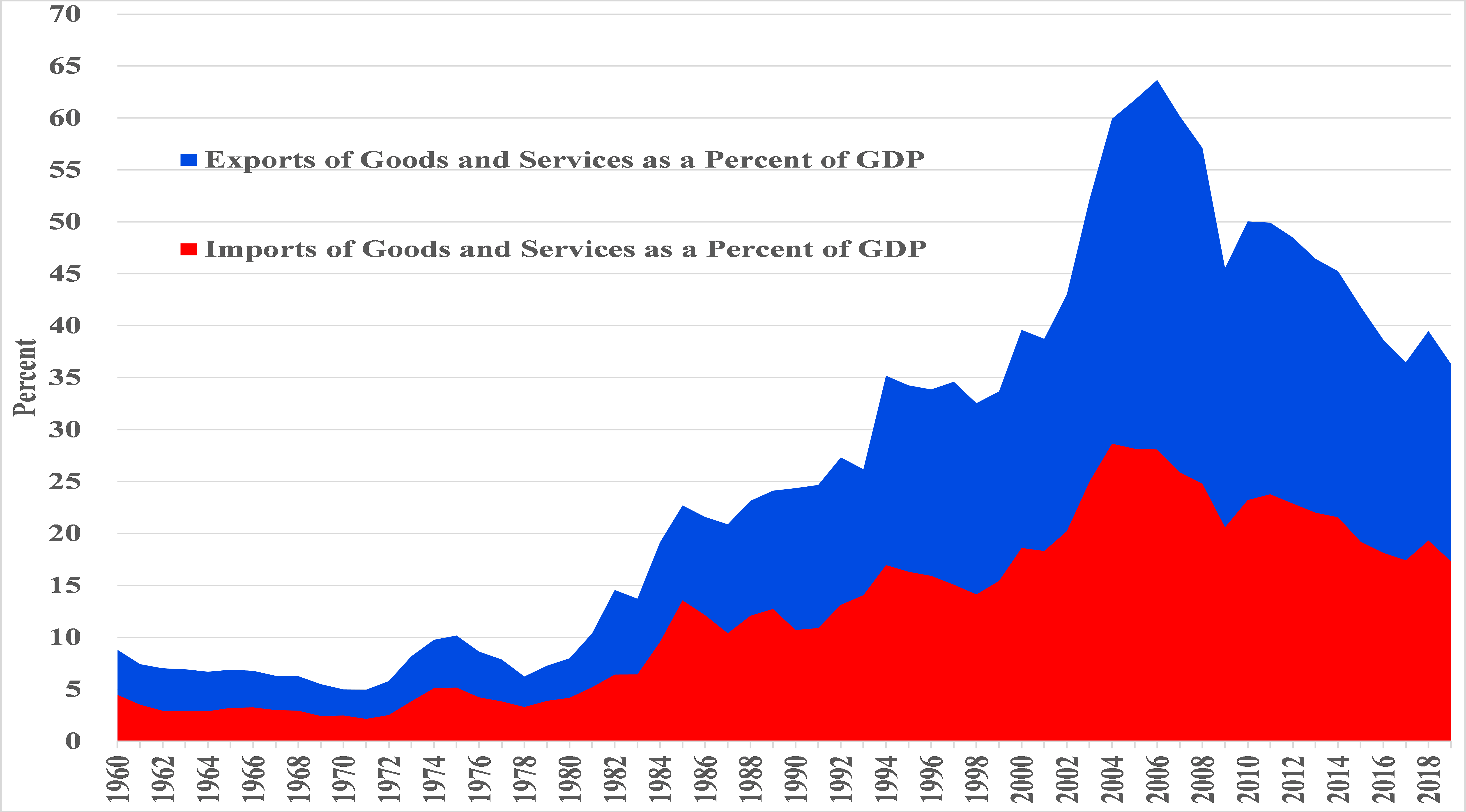

Now, the other thing to notice is that Chinese reliance on exports and imports have been coming down. The blue line is the ratio of Chinese exports to GDP. At the peak, it is almost 35%. I mean, it's very high. It's really come down now to just below 20% which means that the dependence is actually not that high.

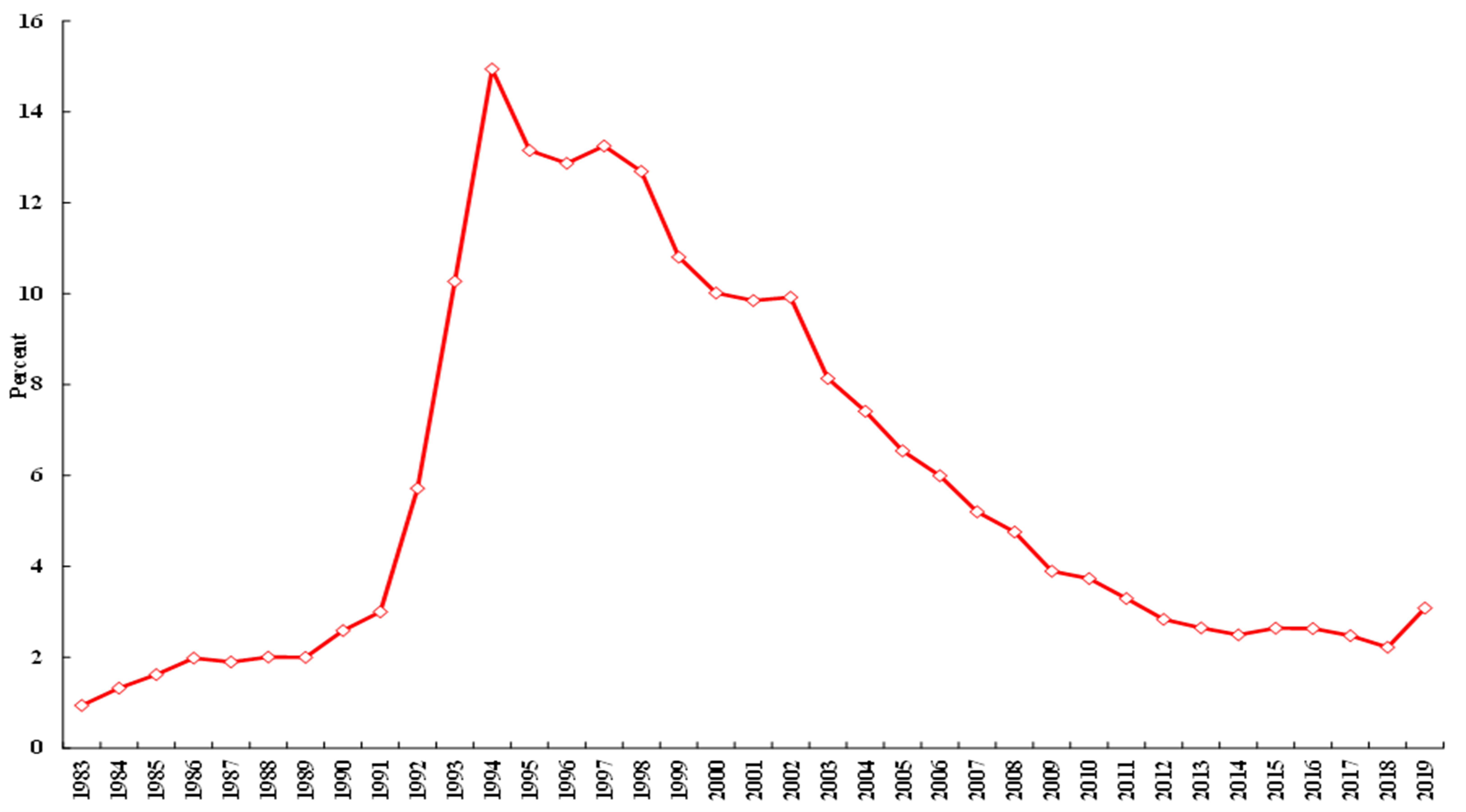

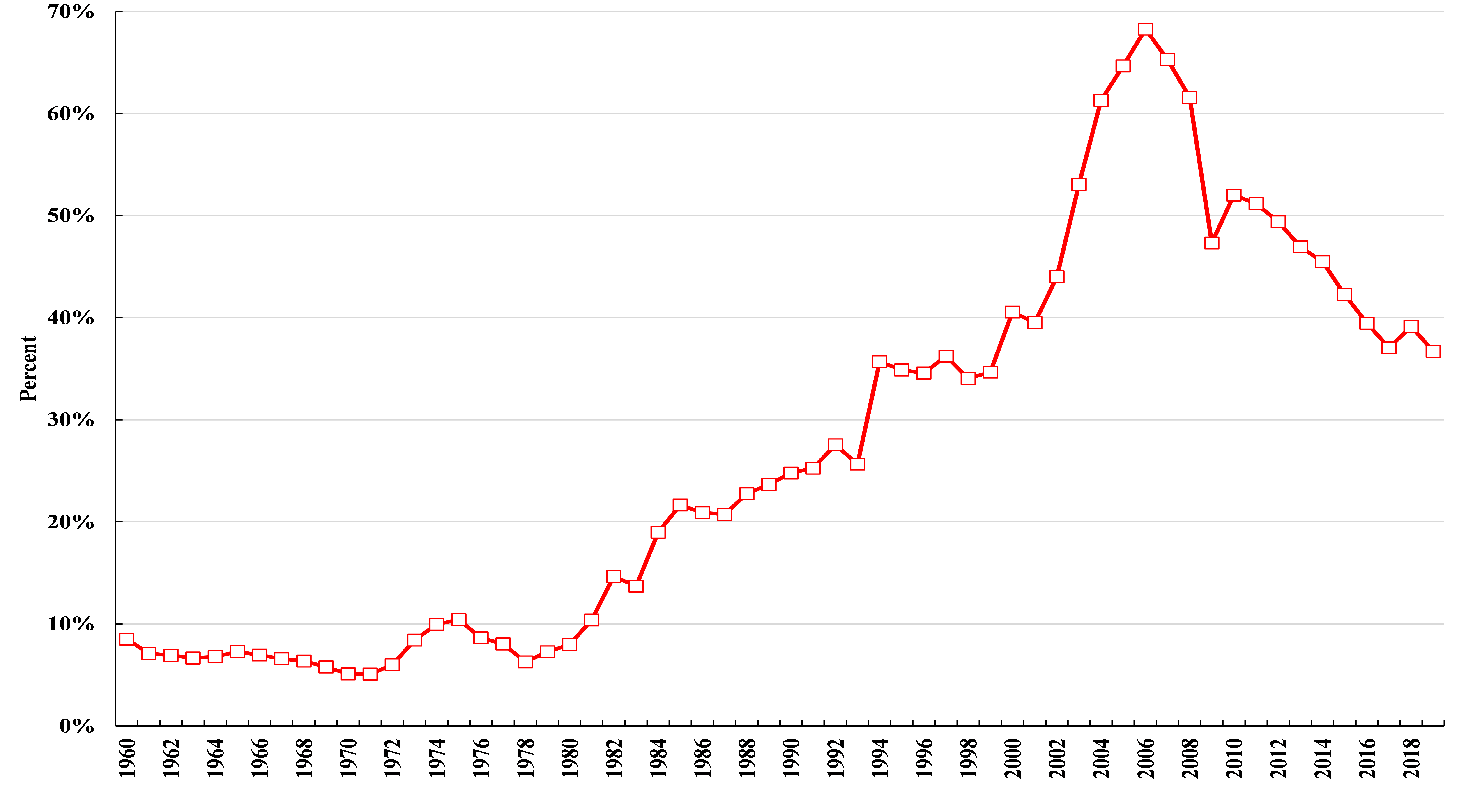

This next chart is also interesting because it shows that Chinese dependence on inbound foreign direct investment has also been declining, okay. And this is a percentage of foreign direct investment, FDI, as a ratio of gross domestic investment, you can see that it is now around 3 or 4%. Whereas at one time, it was actually quite high, almost 15%.

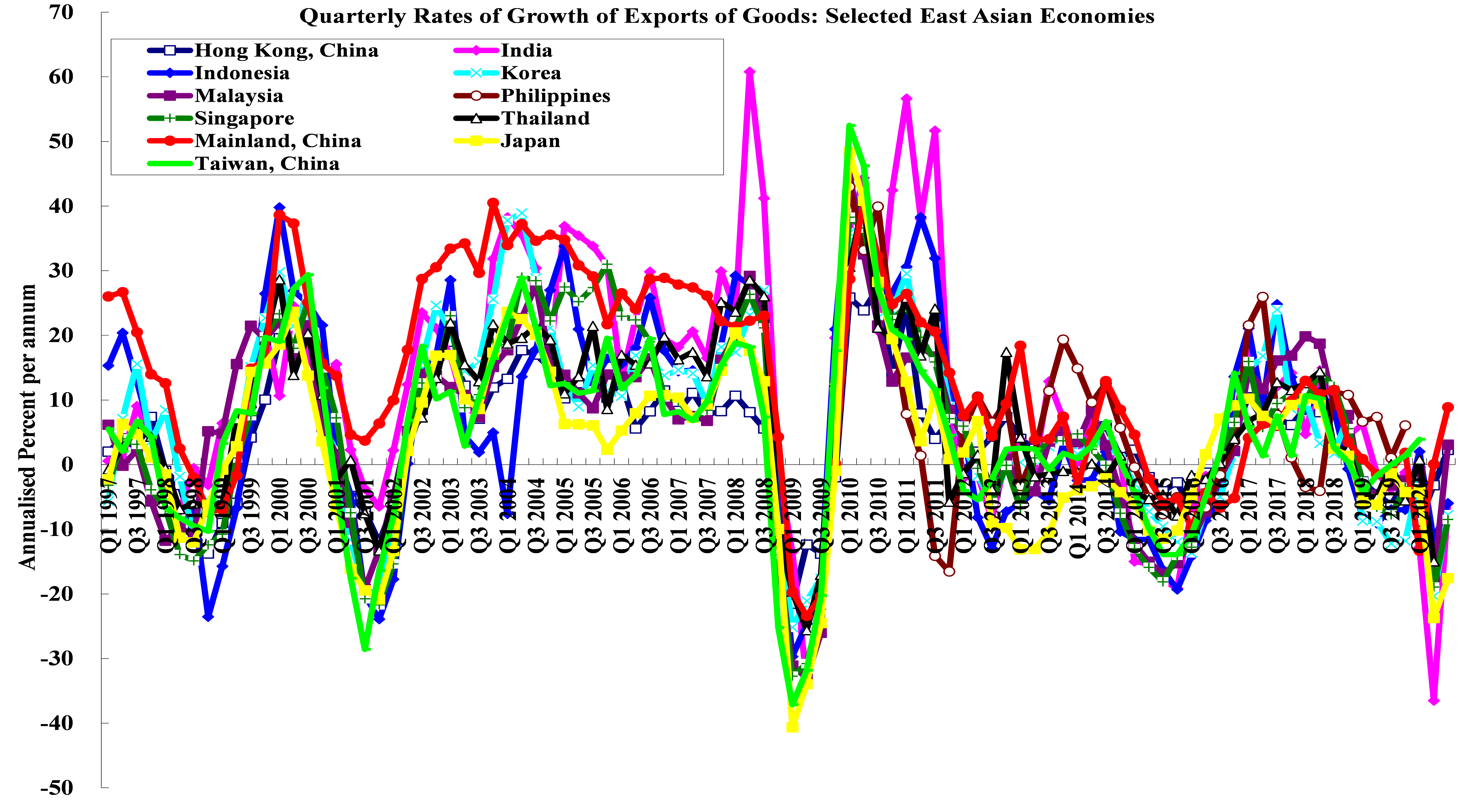

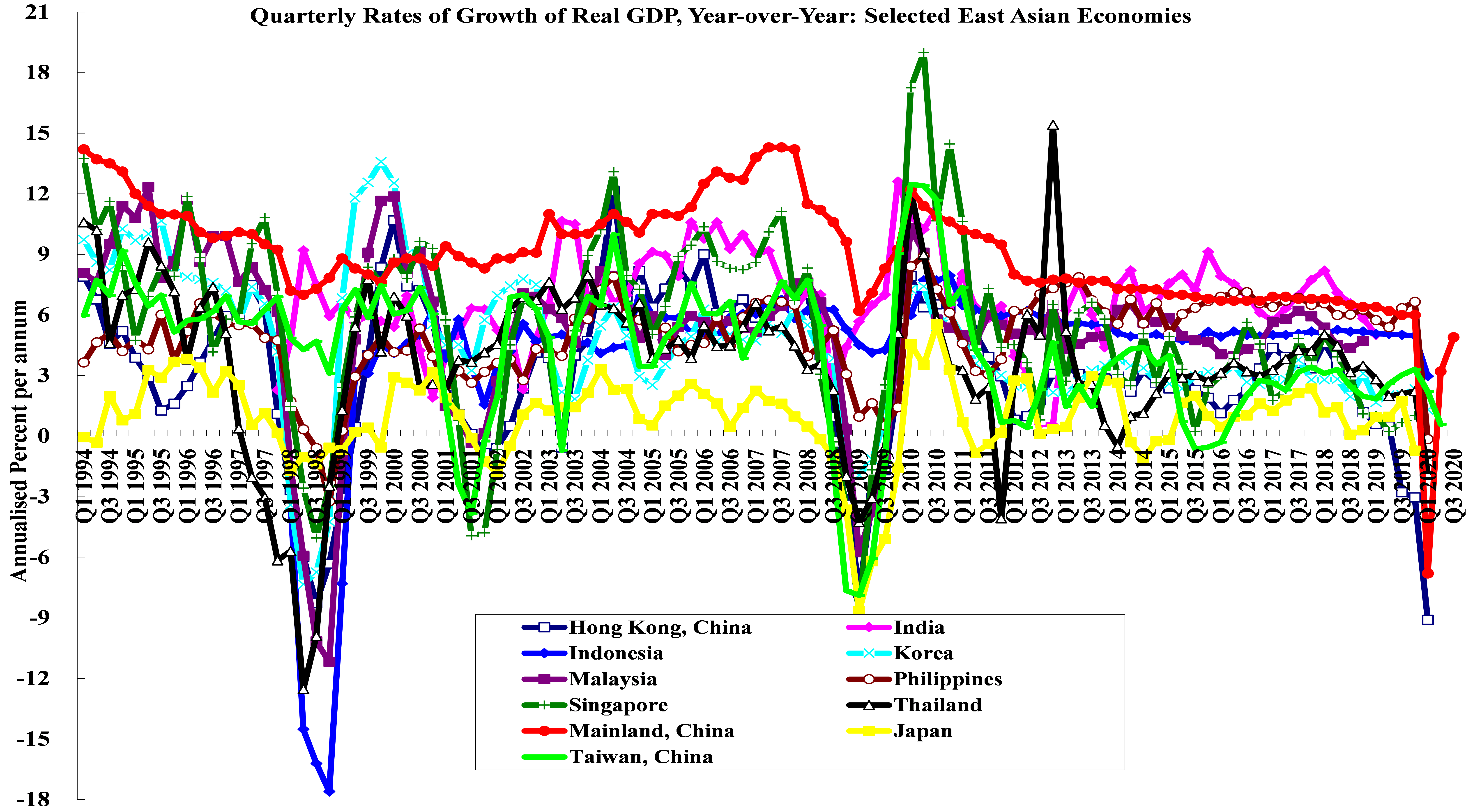

Okay, so the dependence on foreign direct investment has declined. The other thing I want to point out, and that's really quite interesting is that China, the Chinese economy, is actually not very vulnerable to whatever happens in the rest of the world. It's not vulnerable to external disturbances. Now, what I have shown you is now is the quarterly rates of growth of exports of goods in selected Asian economies. You can see that Chinese exports fluctuate like everybody else, okay. So you can see all the fluctuations: 1997, 2000, 2008. And so you can see all the ups and downs, just like everyone else.

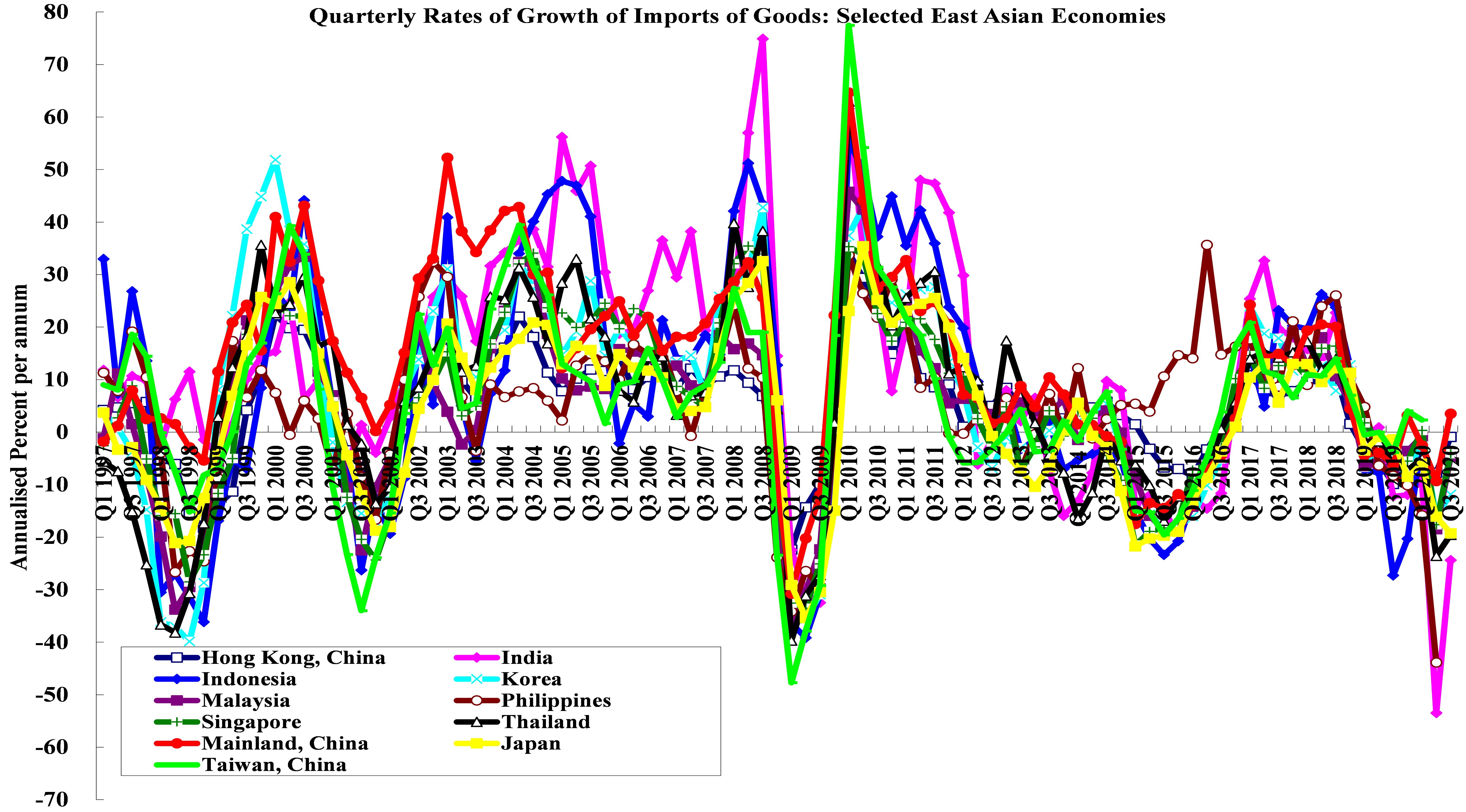

And imports is the same thing. Okay, you have huge fluctuations.

But now we look at GDP, you can see the red line is to China. So you can see the red line actually fluctuates, but it's relatively stable, relative to the other countries, okay. So this shows that it is actually not very vulnerable to external disturbances, I might add that the United States is the same. The U.S. economy is basically pretty well independent of whatever happens outside, all right, because it's large enough. It's the same thing. Now you can see a big dip in 2020 Q1. And that is because of the COVID. And the COVID actually is much more or just as much domestic as it is external, because what's happening to the supply and demand within your country, as well as outside your country.

Now next, I want to turn my attention to what is called twin circulations or dual circulations. This is a concept articulated by President Xi Jinping of China sometime last year, but what he said is the following: "China should promote the formation of a new pattern of economic development with the domestic circulation as the principal focus, and that, and with the domestic and international circulation, mutually reinforcing one another." I want to emphasize that this dual circulation does not mean that China aims to be self-sufficient. It isn't. China tried it before, and self-sufficiency didn't work. We need to make a careful distinction between self-sufficiency and self-reliance, they are really two different things. And I think we can see, in many cases, that China continues its economic reform and continues to open up its economy. Now, what I want to show you here is the Chinese exports and imports as a percentage of GDP. Okay, and you can see that at the peak, more than almost two thirds of the economy is involved in what is called international circulation, but you can see that it's actually been coming down.

And if you define international circulation, as the total imports plus exports, relative to total domestic demand, as consumption, government consumption, plus investment, this is what you get, pretty much the same. And it is really the international circulation is around 40% of the economy.

But what I also want to show you is that China is continuing to open up. First of all, there was the RCEP, the Regional Comprehensive Economic Partnership Agreement, you know, that is among 15 countries, concluded last November, including ASEAN, as well as China, Japan, Korea, Australia, and New Zealand. India did not join at the last moment, but still it is actually the largest free trade area, accounting for 30% of the world's GDP. Secondly, just at the end of last year, China and the European Union reached agreement on the Comprehensive Agreement on Investment. I think that is actually very positive, a sign that China is not closing up, you know; it wants to increase cooperation with other countries who want to continue to economic liberalization. China is actually one of the major, major beneficiaries of economic globalization. We should also see that in a meeting in December, I think in the Economic Work Conference, there was actually an indication that China might want to join the CPTPP, the Comprehensive and Progressive Trans-Pacific Partnership. All right, I think all these are actually very positive signals that economic reform isongoing, and economic opening will continue.

Now, unfortunately, there is an economic decoupling between China and the United States that's going on, on various fronts. But I actually also want to emphasize that while decoupling is costly in the short run, it is just like second sourcing, and just like insurance, it has benefits. Okay. And you may recall that in the aftermath of earthquakes, tsunamis, and so forth, most enterprises begin to think about: 'Hey, wait a minute, we need a second source,' you know, and that is basically decoupling of some sort, you need a second source. But decoupling can take two forms, at least, you know, imposition of tariffs and non-tariff barriers, which has happened, and also the use of export controls. That has also happened in the decoupling between the Chinese and U.S. economies. I think cross-border direct and portfolio investments have been coming down between the two countries, and for many reasons, I mean, the tougher approach of CFIUS, you know, in the United States, and now all these sanctions on Chinese firms, preventing their listing in the U.S., or forbidding American citizens and organizations from purchasing Chinese shares, okay. I think China, the Chinese economy will survive all of this. But obviously, these are lose-lose, both sides lose. If you think of economic globalization as something that everyone can benefit, this de-globalization, decoupling, actually, would be lose-lose on both sides.

I want to talk a little bit about access to international clearing and settlement systems, and I don't think I have time to cover educational exchanges, but they're also being affected. There were 360,000 Chinese students in the U.S. And I don't know whether this number will be going up in the near future. It actually might be going down for a variety of reasons. But okay, we talked about the decoupling of supply chains, but I think that actually could happen, and China would survive, but at the end, it would be lose-lose. Let me just give you an example. If Google cannot sell the Android operating system to Huawei, okay, Huawei will have to develop its own, and in the short run, that's costly, and possibly disruptive. But in the long run, Google would actually lose the whole future revenue stream from Android. Okay, Huawei is the best-selling cell phone brand in China. So I think both sides would lose, and it really doesn't stop, you know, the growth of a technology industry in China in the long run. I think instead, actually, it is really a Sputnik moment, just like 1957, you know, all of a sudden the former Soviet Union launched a satellite into space. And America woke up and said, 'Hey, wait a minute, we better catch up.' Okay. And I think that is actually what is happening in China.

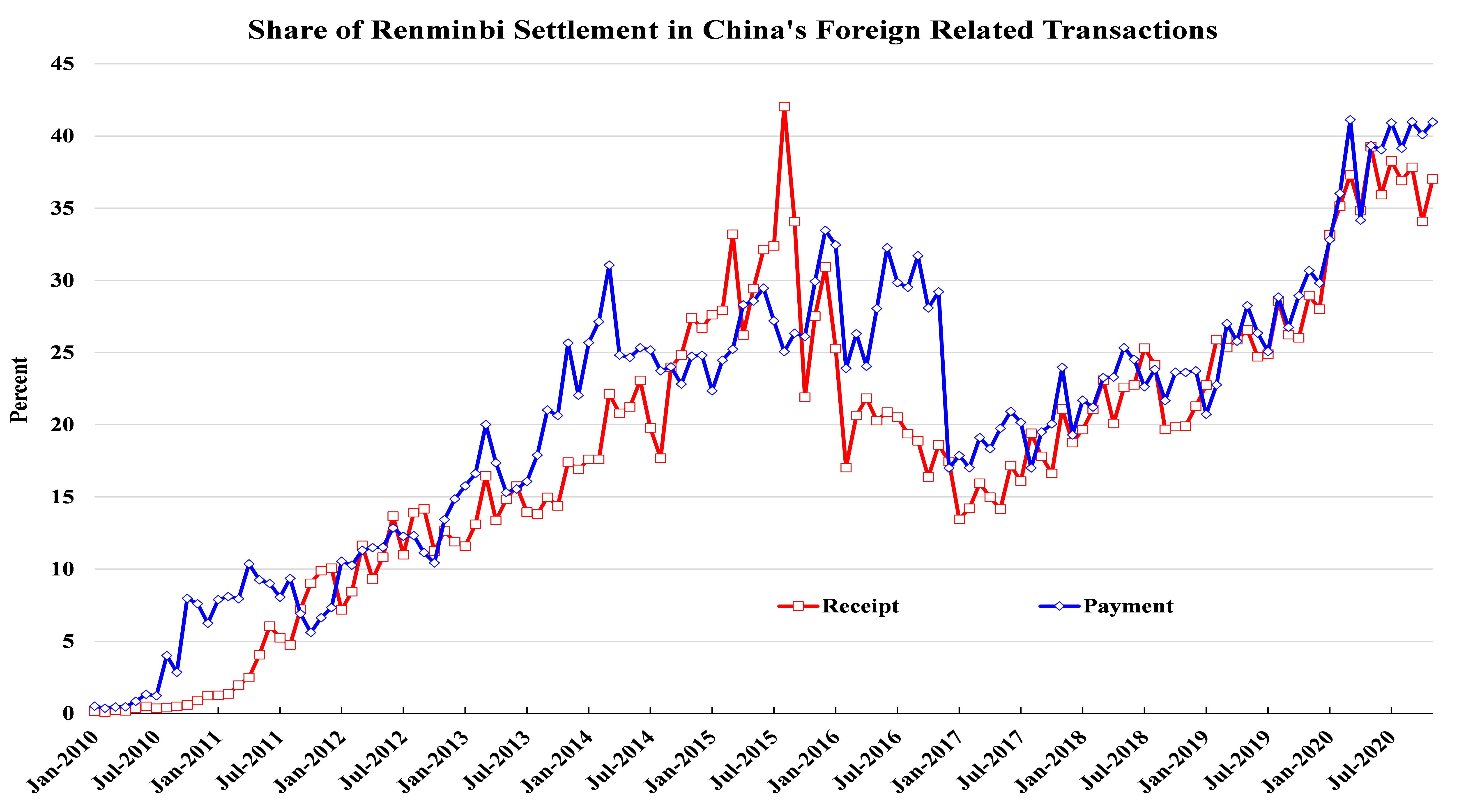

Now I want to talk a little bit about the access to international clearing and settlement systems, because basically, the United States controls the use of the U.S. dollar for clearing and settlement, as everything, even when it goes through the SWIFT system, will eventually have to go through New York. And by denying any firm or any country use of New York, it would actually effectively stop these countries from using the SWIFT system for clearing and settlement in U.S. dollars. And this is a very powerful instrument, a very powerful weapon, if weaponized. Now, I want to show you the following slide. Before 2010, its quite recent, 10 years ago, everything, all international transactions done by China, would be settled in US dollars, everything. Okay. And beginning in 2010, China began to settle some of its foreign related transactions that include mostly trade, but there were some capital transactions in Renminbi. And it reached a peak around 2015, about 30-40%, you know, but then it dropped because of the sudden Renminbi devaluation in mid-2015. And it took a long time, before it actually just recovered back to around just below 40% recently. And I expect this will go up, okay.

Because actually, there are inherent advantages in settling in your own currency. I mean, you know, if you use your own currency, and you trade with somebody else, there is, for either country, there's only one single currency exchange. Okay, but if you use a third currency, third country currency, like the Dollar, you have to exchange your own currency to Dollar, and then the recipient in the other country would have to exchange the dollar into its own currency. So there are basically two transaction costs. And also, for the same reason, there will be two exchange rate risks, because there's always some lag between placing of the order and delivery. And also, if you can use your own currency for clearing and settlement, you don't need to keep so much foreign exchange reserves. Okay, so, the argument for using your own currency is clear. All right. Now, why is it that people don't use their own currency? And that is because the two countries, they don't trust each other's currency. Okay, let's say if I trade with you, and I don't trust your currency and you don't trust my currency, we have to pick a third currency that both sides would trust, and the U.S. dollar plays this role. Okay. And, and in some sense, this is the seigniorage that the U.S. gains by providing the international medium of transfer of exchange, I think that's fair, that the U.S. can benefit from providing the seigniorage. Then we'll see how this works.

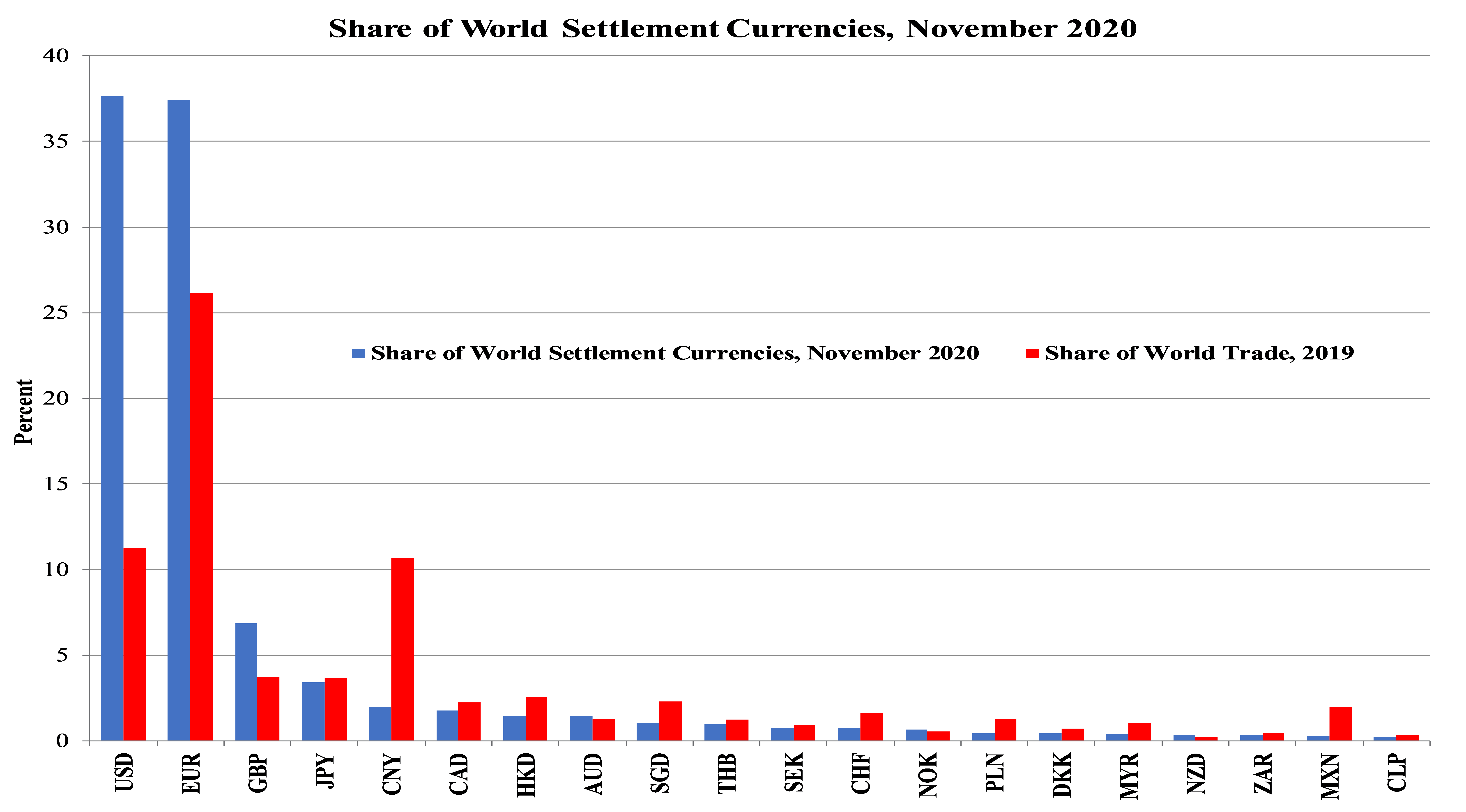

I'm showing you a chart that actually has two columns for each country/currency. The blue column is the percentage of world settlement of that currency in November, in that one month, okay. The red column is the trade, the share of world trade of that country in 2019. Okay, you know, and you can see the following, both the U.S. dollar, the first column, and the second column, the Euro, both actually command a large share in world settlement, slightly less than, I think, 40%, okay. 37% thereabouts. This is for the blue columns. But the red columns show that the EU actually has much more international trade, world trade, than the U.S. All right. Now, you look at number five. Number five is China. China accounted for almost 11%, almost as much as the U.S., in terms of world trade, but in terms of world settlement, it’s only about 2%. Okay, now, that says that even if you only talk about settling your own trade, okay, there's lots of room for the Renminbi to increase its usage. Okay, now China's neighbor is Japan up there. You can see that Japan actually accounted for around 3.7% of world trade, and the Yen was used in around slightly less than 3.7% of world settlement. Okay, that actually shows you, there is still lots of room for the Renminbi to grow. I mean, never mind about serving as a third currency for other countries. Just concentrating on settling your own trade in your own currency, would actually allow a great deal of increase, but you can also see that the seigniorage that the US dollar has, that is, you know, the U.S. only accounted for 11+% of world trade, but the U.S. dollar was used in the settlement of, you know, almost 40% of world settlement. Okay.

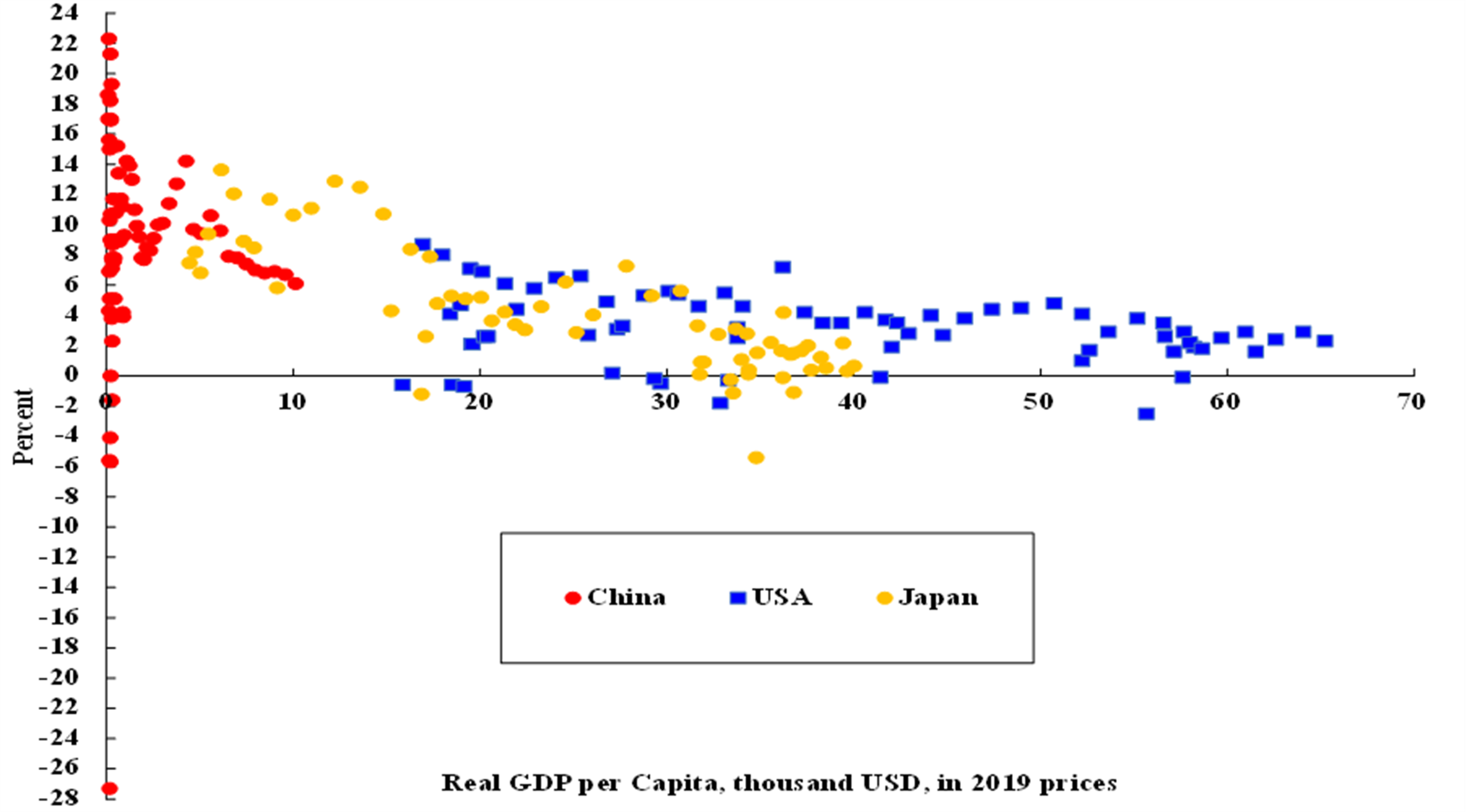

Now, next, I want to show you some long-term projections of the Chinese economy. And this is an interesting chart. On the vertical axis is the real rate of growth, okay, of GDP, okay? And on the horizontal axis is the per capita, real GDP per capita, in 2019 prices. Now, the red dots are China, the yellow dots refer to Japan, and the blue dots are the United States. Now, you can see that the red dots do not extend beyond $10,000. That's because China's per capita GDP is still very low. And the blue dots extend all the way over past $60K, around $65,000. Japan is in the middle. But what I want to show you in this chart is the following. First, we expect that the rate of growth will come down as per capita GDP goes up. Okay, many reasons. I don't want to explain it now. I'm sure you understand. But it's an empirical fact that the rate of growth goes down as per capita GDP goes up. All right, first thing. The second thing is to observe that China actually is at the level of per capita GDP that still allows it to grow relatively fast. You can see that the Japan at the comparable stage, yellow dots, still had a much higher growth rate. And the U.S. also, at a comparable point, had also a much higher growth rate. So it is not out of the question for China to grow, and I predict that China would actually be growing, between 5% and 6% in the next decade, or even two decades.

Now then, let me show you some of my projections. One of my projections here, is that around 2030, okay, plus or minus a couple years, no one can be that accurate, Chinese GDP will catch up to U.S. GDP. And the assumed growth rates are down there, you can see the red columns are the assumed growth rates for China and the blue columns are the assumed growth rates for the U.S. And the red line crosses the blue line around 2030.

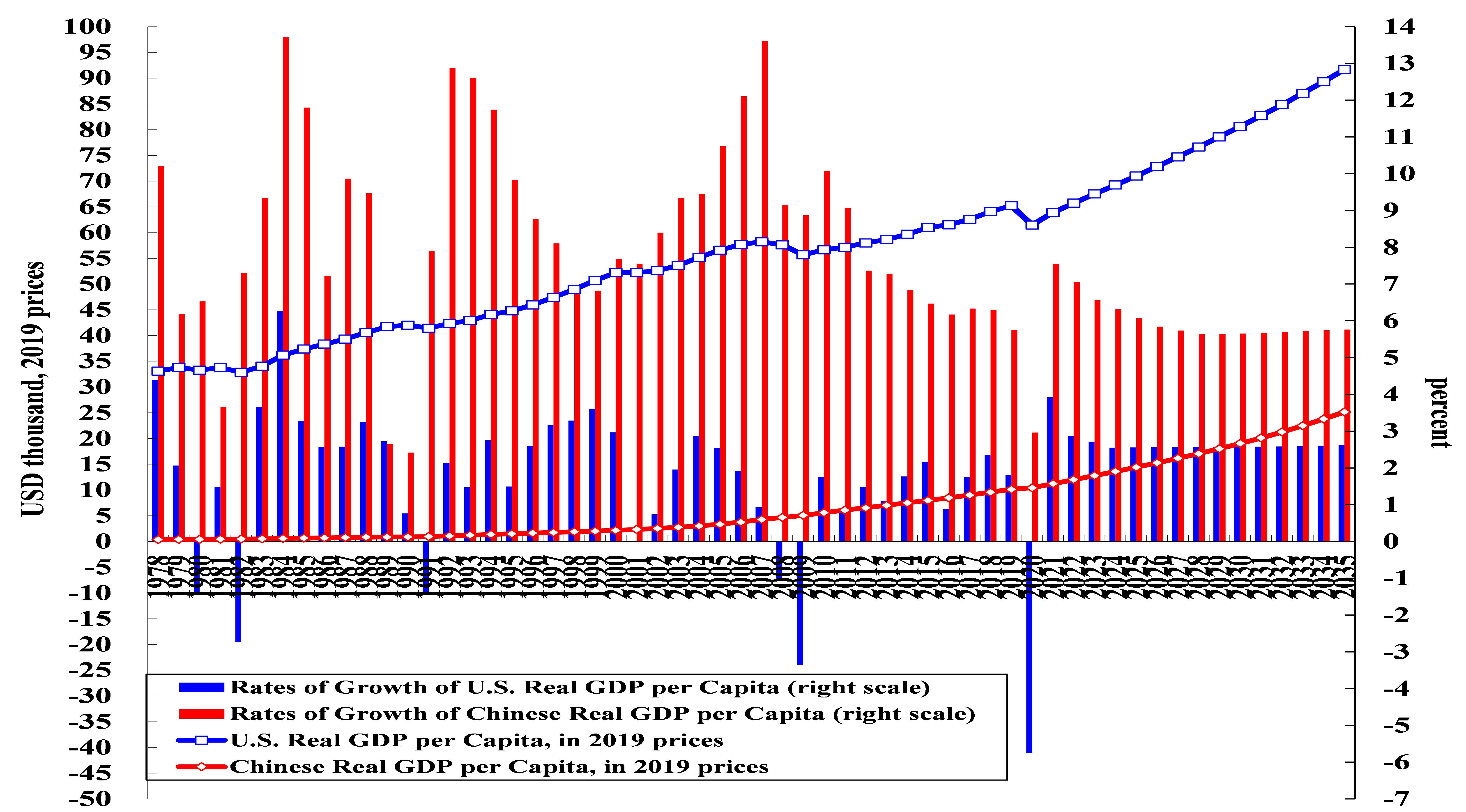

However, this next chart is actually very interesting, because it shows that even at 2030, even then, the U.S. GDP per capita will still be more than four times the Chinese GDP per capita. More than four times. And I've done some calculation that, I think, for Chinese GDP per capita to catch up to the U.S. GDP per capita, it will take until the end of the century, okay, if ever. I won't see it, all right. But it is possible that it will never happen. Okay, it will never happen because the U.S. economy is much better endowed than the Chinese economy. Okay, with arable land, water, minerals, other natural resources. So I think it might never happen. And I think the U.S. GDP per capita will still remain the highest of all major economies for a long time. Okay, this is basically what I just said.

Now, beyond economics, what can we say? Well, I think China and the U.S. can cooperate in controlling future pandemics. My view is that COVID-19 could be one-off, but there will be other epidemics coming in the future. And we really have to get ready to prevent the next one from becoming as destructive and as disruptive as this current one. Okay. Secondly, I think that China and the U.S. working together can prevent further climate change. China, actually, has committed to two things. One is to peak its carbon emission in 2030. That is, carbon emission would be peaked. You know, today, China is the world's largest carbon emitter in the world, accounting for 28%. So it's a serious commitment to say that by 2030, the growth of carbon emission will be zero and then turn negative. All right, total growth of the carbon emission. And by 2060, China has committed that by 2060, it will be carbon-neutral, meaning that net carbon emission will be zero. Okay. Now, this is a huge commitment, you know. Fhe E.U., actually some time ago, has made a commitment of being becoming carbon neutral, in 2050. And after China made the commitment, Japan has come out to say that it will also become carbon neutral by 2050. So, I think if this all happens, I think it would be very good. We would actually be able to achieve limiting global warming to less than two degrees. And the third thing is halting further nuclear proliferation. I think this is actually very important, because I think the real threat from nuclear proliferation is really not from nation states. As no nation state would want to start something like that, all right, in its right mind, would start something like that. But it's the rogue states and terrorists. And I think that is very important. Now, finally, let me say that with China's continuing participation in world economy, and given this rate of growth, I think, in the next decade, China will actually become both the largest economy, as well as the largest trading nation. And, you know, but I think that China and U.S. are complementary, in many ways, economically. So they can both benefit, if they will just trade normally, and it will be win-win. And finally, I think if they work together, they can actually solve many problems of the world. I think one thing that actually begs for reform is the World Trade Organisation, their operating rules, and how they would settle disputes. I think we need to change those rules, because WTO has this antiquated decision-making process that requires unanimity. You cannot have unanimity among 150 nations. Trying to get unanimity among 15 people in your department is impossible. So 150? Forget it. All right. So I think that requires change. So let me just stop here. Thank you very much.

Zhiguo He:

Thanks a lot for the very enlightening talk. So Larry, you cover many, many things. And I feel like you're captured at a little bit of macro level of the forecast, you know, the past and the future. I just cannot help wondering in the sense that there must be that the Chinese government have to do something to make sure this growth will continue. Right. Otherwise, why do we talk about those things? Right. So in a way that I see that this seems to be a prediction with some, right policy direction and etc. So we were having a little bit of discussion on that. Seems like everything that I heard from the Beijing, state media, and as well as my own thinking study is on this reform? And what is on your mind of reform like in the past? And what do they need to do in the future? Or in what way, how do you connect this reform to the statistics, all these statistics that you're writing to us today?

Lawrence Lau:

Well, I think one of the things you have to, we have to, take into account is the following. And it is the importance of the private sector. And this really means leaving the plan. Yingyi Qian, Gerard Roland and I had a paper on how China abandoned the plan, slowly and so forth. But basically, in 1980, urban employment was 100% from the state and the state-owned and the collective sector, 100%. All right, and this is because the whole industrial sector was owned by the government. And this includes all the government units, collective units, and so forth in urban sector, 100%. You know, what the percentage is today? Little bit above 7%. Okay, that tells you what huge changes have occurred. I actually tried to get some numbers on the share of GDP, but I wasn't able to get the most recent numbers. But even that number of the state owned sector has been coming down, share of GDP. Now, if you look at the aggregate, I think it might be rising. Okay, the economy is growing at 9% per year. So even if your share has been coming down, the aggregate would be going up. So I think we have to take that into account. You know, Alibaba, Tencent, Baidu, these are all private firms. They are not state owned firms, [EDIT CUT] But I think what has really happened, if you want to focus on the reform over the last 40 years, it is really allowing the market to play a role. The market plays a very important role instead of central planning. Now, you may argue, and I think it's with justification, that the market has not been allowed to play its full role. That's why people still continue to talk about it. That's why there are so many zombie enterprises. So most of the zombie enterprises are state owned. But most of them are not central government owned. State ownership has many levels. Okay. The central government basically controls directly 97 enterprises today, down from 150 enterprises in 2008. These are the enterprises controlled by SASAC, you know, State-owned Assets Supervision and Administration Commission. Okay. Yeah, exactly. But, but most of the other state-owned enterprises are controlled at the provincial and local levels. You asked, why not let them go bankrupt? Okay, which is a sensible question. [EDIT CUT] I think the answer is the following. The natural thing to do, if you have a pure market economy, they will go bankrupt, someone will consolidate them and so forth. But the problem really is that it is a political issue. And the local government, no local government, will want to, number one, close it up. It affects local employment. Number two, if we're going to merge, I want to be the surviving enterprise, not you. So decentralization doesn't really work. Yet actually, to handle these issues, you need to have re-centralization. I mean, let's say, you and I were both running loss-making enterprises. Okay? What has to happen is that you and I should merge. And, okay, [EDIT CUT] well, we want to, but I want to be the survivor. And you want to be the surviving enterprise too. So it cannot happen. But what's interesting here is that in the early phase of Zhu Rongji's reform, right, those things actually happened. I know. I know. You have to understand the following though. What is the difference between Premier Zhu's time and now is really the following. It's that the local governments, they discover land. They said, "under Zhu Rongj, no one is allowed to touch the land." No one was allowed to touch land. But afterwards they discovered, "Oh, okay, I don't have resources, I cannot increase taxes, but I have land. And I have zoning powers." Okay. So that is how they managed to find the resources. And they are not going to give that up easily. So I think the reform really has to come, in some sense, from some sort of re-centralization.

Zhiguo He:

But you were saying that in some of the things you needed recentralization to address this question.

Lawrence Lau:

Exactly. Precisely. And if you really think about, let's say, carbon neutral, carbon neutrality, that actually requires central directives.

Zhiguo He:

Interesting. Yeah.

Lawrence Lau:

I mean, you do a carbon tax, you need to do it from the center. But I think the localities on their own cannot do very much on carbon emission. Now, on other things, I think the local government can do a lot. And that is, okay, if you want blue skies, you know, clear water, and clean environment, that is very much a local thing. I want to share a joke with you. I said, if you really want to improve the quality of drinking water at the local level, what you really should do is anytime you go down to a locality, have the local party secretary drink the tap water directly. That will make sure that he will have every incentive to clean up the water. You know? I mean, that will focus their attention. So anyhow, it's complicated. I mean, even though people like to think of China as an authoritarian government, which it is, but it is also not true that the government can move everything.

Zhiguo He:

Yeah, I totally agree with you. Government are faced by market discipline in a way, so great, thank you. So, let me let me just ask another question, which is also showing up in the q&a. And then, you know, open to other more freestyle questions. So let me read, this is also my question. So many examples as a mogul, argue that good institutions are vital to economic growth? Well, you know, that China, in a way is, in a way they're providing, I won't say counter, but I would say fresh perspective to this question. Right? And how do you think about it? Is this just a different direction, but to get to the exact same solution or?

Lawrence Lau:

Now I want to make a couple points. First of all, I think fighting COVID is like fighting a war. Okay, you have to recognize that fighting COVID is fighting a war and when you are fighting a war, you need a centralized government. You cannot have a divided government, and that is what's happening in the U.S. You need a centralized government; you need a centralized approach. All right. So I think that now when you're not fighting a war, I will not insist on it. It's very different. Okay. And I think that you have to say that for the Chinese government, it is very much a war. Because if you think you are going to close down Hubei, on Chinese New Year's Eve, when everybody or family is supposed to get together, do you think how popular it would be? It's just like before Thanksgiving, no travel. No one is allowed to travel. It's not going to be that popular.

Zhiguo He:

Yeah, I was here. All these media is just a really bashing you.

Lawrence Lau:

Yeah, it's not going to go. But I think if you really look at the results, that had accomplished the results, not letting what happened in Hubei spread to the rest of the country. If the COVID virus, nonetheless, were allowed to spread to the rest of the country, China today would be like Europe or the U.S. It's hopeless. Right? Because the gestation period is so long, could be as long as 28 days. So even if I'm infected, I can go around for up to 28 days without having any symptoms. And in the meantime, how many people would I see in 28 days? I don't know. It will be 1000s. And those 1000s who see another 1000? So I think that is really my first point. It is like a war. All right. Now, I think you're right that governance is important. Institutions are important. And I won't deny that there are governance problems in China. If you actually look at the previous, the first five years of President Xi’s administration, when you had the anti-corruption campaign resulted in a large number of people being purged, you know that there's a problem. There was a problem. Okay. And I think that, you know, we have to thank Wang Qishan, the current Vice-President, for doing all this.But I don't think corruption has been completely eliminated. It's a continuing thing. And one just has to be, continue to be vigilant. Now, but I want to add one thing, though. The interesting thing about China is the ability to alleviate and to eliminate poverty. And by the end of last year, supposedly, there were no one under the poverty line. But, do you know how it was accomplished? Every state-owned enterprise has a responsibility. Okay. They are given one county. And if they are better off, two or three, four counties. They say, "okay, it's your responsibility to make sure that the people in this county are lifted out of poverty." I mean, all the SOEs have special duties. [EDIT CUT] I mean, in addition, that duty is not to maximize profits, but to lift these people out of poverty. And I think that, the enterprises take that seriously. So I think that that's a different kind of governance. But I have actually one thing that I've been urging for a long time, which hasn't happened. I think the problem with corporate governance in China, that is, even the non-state-owned enterprises, is the following, is that shareholders hold their shares for too short a period. I mean, the average holding period on Shanghai Stock Exchange is about 20 days, I understand. This is from a survey a couple years ago. [EDIT CUT] I don't think it's improved, quite, anyway. But think about it. If you really hold the shares for 20 days, more or less, do you care how the enterprise is managed? You might not even know what the enterprise does. And never mind about ESG (Environmental, Social and corporate Governance). Okay, so I think that needs to be changed. What I have been urging for a long time is to require cash dividends, okay, require payment of cash dividends, so that people would have an incentive to hold long term. And only long-term shareholders have any interest in governance. It's hopeless to think that you can improve governance, if most people just buy and sell within 20 days, this is really not possible. So you know, I'm very honest here, I'm saying that this is work in progress.

Zhiguo He:

Great. So there are a bunch of questions flowing in. [EDIT CUT] I believe that the audience, Larry, the audience seems to be more U.S. based. So, you know, this platform is really trying to tell you my mind and the true side, or balance the side of China's perspective. So one question is about unfair trade practice that is accused by Donald Trump, like IP protection, those things. What's your view?

Lawrence Lau:

Well, I think I would begin by saying that I'm all for IP protection. Actually, back in 2014, a group of people and I, we actually did a study on China-U.S. economic relations, and we recommend two things. One is that China should set up a special IP court. Okay, in 2014. And secondly, that we should have much easier...

Zhiguo He:

Wait, so in 2014, you did a study?

Lawrence Lau:

Yeah. And they did set up a special IP court. The average judge knows nothing about IP. Right? Right. Okay. The average judge is hopeless. So they have a special IP court to look at these things. And I believe that some U.S. plaintiffs actually have won, you know, significant judgments. Now, it's a piece of work, again, work in progress. But I want to say that China today awards the largest number of patents in the world. Okay. And what that tells you is that there is a constituency in China that will press for enforcement of IP, which is true, right? And if you look back to Taiwan in the 60s and 70s, Taiwan is known as the intellectual piracy capital of the world, which it was in the 60s and 70s. And I still remember Paul Samuelson complaining to me bitterly that his book was being pirated, and sold for about, I think, one or two dollars in Taiwan, complaining bitterly. Why, his book is very good, I must say. But anyway, that has completely changed. So there is a process. And even you look at Japan in the 50s. Very few people know this. But a city in Japan renamed itself, Usa. So they can say Made in USA. So I think this is really a process. All right. I mean, I can't defend it, but it happened everywhere. But I want to say that it's now on track. Okay, there is a legal process, and what people should do is to use the courts.

Zhiguo He:

Oh, yeah. But then you need to develop into the courts in an effective way. So often times I just tell my students, it's just that it's a lot of a chicken-and-the-egg thing that you needed some spike, so that the things setting up but then the other things you have to set up and then just hosting.

Lawrence Lau:

Yeah, you know, but I think if you actually look at what happened since 2014, okay, huge improvement.

Zhiguo He:

Okay, I see. So that's 2014 Okay, good. There are some people, also like to let me talk a little bit still internal, this debt problem. You know, you mentioned the land, obviously immediately once you mention land, local government immediately you get to the question of this debt province. And you also mentioned zombies. So it's all the same. I'm trying to ask you, is what's it like for the future, next decade? Can you tell us a little bit of our next decade?

Lawrence Lau:

Well, I don't think you can solve all the problems. Okay. But the debt problem in China is actually, I think, compared to other countries, is relatively benign. Okay. Let me explain why. Central government debt is about 20% of Chinese GDP. Okay. If you say, let's add in the local government debt. All right, that will add another 20%. So the total, let's assume that the central government assumes all of the local government debt, right, which I don't think is advisable. But anyway, if it does, for political reasons, it will be 40% of GDP. Now, do you know what that Japanese debt to GDP ratio is?

Zhiguo He:

Debt to GDP? Public debt. That should be very high. Right?

Lawrence Lau:

250%. Okay. Yeah. Rising.

Zhiguo He:

Rising, and that's really owned by themselves, right? Self-financing.

Lawrence Lau:

Well, that is also true of Chinese debt. I'll come back to Japanese debt later. But you know what, it's the U.S. public debt to GDP ratio that is exceeding 100% of GDP. Okay. So if you look at it in that context, it is not a serious problem that China cannot handle. Okay, there's that problem. But let me go back to explain what you just said. Which I will try to explain to people all the time. You look at Japanese debt. Okay, you get scared? 250%? What am I going to do? Now? Think about that as intra-family debt. Okay. Now, the son borrows from the father. The father wants repayment. All right, which is reasonable. The son would go to the mother and the mother will ask the father for money. And so the circle would be completed. All right. So, as long as it is intra-family, and that is basically how you would characterize Japanese debt. Because it's all issued, number one, it's all issued in Yen. Which it can print. And secondly, it's all owed to Japanese nationals. There are very few outside holders of Japanese public debt. Very, very few, I would say probably less than one percent. So as long as the interest rate is very low, which it is, you can play this game forever. So you have nothing to worry about. And I think that U.S., to a certain extent, can also play this game almost forever. There are more outside holders of U.S. debt, but U.S. debt is all in dollars, which it can also print. Right? Oh, you want me to repay? Sure. Here's the money. So it's not a problem. Okay, so I would say that it is in some sense a problem, but it's not a problem that cannot be effectively handled.

Zhiguo He:

It's good. Here is another important issue that a bunch of questions get to. You're touching on the point of private sector. As a researcher, actually, you know, there's a lot of media talk saying, "Oh, it's a state retreat." What's it called? State advances; private retreats. Right. I tried to get the data. It's not clear at all. You know, it is not hard to torture the data to show the picture you want. But let's just take that. Take the kind of government position, which seems to be that we want our state-owned sector stronger. That's very clear. Note, I am not sure whether they want the state-owned sector bigger. But stronger, that has been clearly shown. And that seems like a lot of times leads to the private sector shrink in some circumstances. I would like to know whether you did some other kind of research on this. Is this true? First of all, is this true? Second, that if it's true, what do you think?

Lawrence Lau:

Well, I think we have to start from the premise that if you are the manager, or the CEO, of a state-owned enterprise, you want to get bigger. Every CEO wants to get bigger. All right. So it starts with that. Right? Now, I think what we have to remember, though, is that the private enterprises are also very large, very big, like Alibaba. And they are possibly already too big. And the government is finally waking up to the fact that they are too big, and has to apply anti-monopoly law and antitrust law to these enterprises, just like in the U.S. We're also waking up to the same fact.

Zhiguo He:

Yeah, come on. It's the same. It's the same.

Lawrence Lau:

Yeah, same. Facebook is too big. And I think that is very important. And I think that Ant Financial got in trouble because they have been skirting the laws on banking and lending. So anyhow, I think it's not the case. If you look at the financial sector, it's not the case that guo jin min tui ["the state enterprises advance, the private sectors retreat"]. That's really not the case. And in fact, they are fighting a rearguard action to make sure that the laws are complied with. So I think there is more than meets the eye. But let me give you one example, which I actually find very encouraging. You know that a couple months ago, a new company was formed, I think it's called PipeChina or something like that. [EDIT CUT] They took all the oil and gas pipelines of the three large state-owned oil companies and formed a public company,

Zhiguo He:

Yeah.

Lawrence Lau:

And that is a natural monopoly, no question about it. They will be open to everybody and is sort of like the national grid. All right. And the advantage of that is that it opens up opportunities for everyone, because I can go to Sichuan to explore shale gas. And then I could just go on that pipe network, just like everybody else. Before that, I cannot do it, you know, the three giant state-owned oil companies, they say, "Who are you? Of course, I won't let you use my pipeline." Yeah, well, or they will quote a very high price. So that is actually very positive that many small and medium enterprises can enter the oil and gas business both upstream and downstream because you have a national pipeline.

Zhiguo He:

[EDIT CUT] You know, that China Tower company, it's the same idea.

Lawrence Lau:

Same idea. I think that's great. Because it eliminates duplicative infrastructure. But what is more important, that promotes competition.

Zhiguo He:

Yes.

Lawrence Lau:

Here, promotes competition. So I think we need to think, really, in those terms. And it's okay to have a natural monopoly, provided it is properly supervised, regulated, and not allowed to charge monopoly rents. It's actually very positive.

Zhiguo He:

Okay, so let me just finish with two questions. One is, how do you think about the future of China/U.S.? And the second question is, I just put it here, is that if you can give President Xi some advice, let's say two or three, what do you want to give?

Lawrence Lau:

You know...

Zhiguo He:

First is the U.S./China, then is advice.

Lawrence Lau:

I think the China U.S. relations, you know, will be competitive in the next decade. That's the new normal. Okay. There's economic competition. There's technological competition. There is geopolitical competition. Okay, I think it's not going to overnight to change. I think in the U.S., the idea that China should be contained for various reasons, is actually shared by both parties. I mean, think about “Pivot to Asia”, and the TPP, the original TPP. Yeah, they were President Obama's initiatives. And I don't understand why Trump decided to scrap them. Correct. But I think that's the case. But I basically think that China actually does not pose an existential threat to the U.S. [EDIT CUT] China doesn't want to change the U.S. If you listen to what the Chinese leaders say, they always say that we have a socialist market system with Chinese characteristics. Which means that it's not good for you. It won't work for you. Right? I mean, that's always what they say. It's always with Chinese characteristics. So unlike the Soviet Union, Khrushchev said “We will bury you”. Right? The struggle between the former Soviet Union and the U.S. is really existential. But certainly from the Chinese side, it's not existential. So I think, eventually, the U.S. would have to learn to live with China, live with a peaceful China. Now, let me actually add one more insight that's very important. If you look at China, look at China's history, China has never had to deal with a friendly country as an equal. When China was very strong, all the other countries, Japan and so forth, they were vassal states. Okay. When China was very weak, oh, my God, you know, all the foreign countries were masters. China has never dealt with another friendly country as an equal. So it has to learn. But on the other hand, neither has the U.S. You look at Europe, to the UK, that we saved two or three times; to France, we saved you two times at least; to Germany and Japan, we defeated and occupied you. So which country does the U.S. regard as equal? There was only one but it's not friendly: the former Soviet Union, I think the U.S. treated the former Soviet Union as an equal adversary. But it's an adversary, not a friend. So both sides have to learn how to treat someone, a friendly country, as an equal. That takes time. Okay, but like I said, I mean, this is what I thought.

Zhiguo He:

Okay. So, before we finish, two advices to Xi.

Lawrence Lau:

I think the most important thing for Xi internationally is to support the international economic order. Okay, China has been the beneficiary, major beneficiary, of economic globalization, and should promote a rule-based international economic order going forward. Okay, reform of the WTO. China should support okay, because I think this economic globalization has brought great benefits and prosperity in China. It will bring great prosperity to India, and then to Africa. We have to open it up so they have their chances, their opportunities. So I think continuing opening is the right thing to do. The other thing is continuing to rely on the market. And that really means doing things like the PipeChina, but also enforcing antitrust laws. You know, I have one thing that I worry, it is the following: once someone like Alibaba or Amazon has so much information, you know what they can do? They can price discriminate perfectly. Right? So I go into Amazon, and I want to buy something. Let's say you go on Amazon, and they say, okay, Zhiguo He, you shop at LVMH, Hermes, Chanel, we should quote you a high price. And Larry, you shop at Costco, we will quote you a low price. They could perfectly price discriminate. And what does that mean? That means the market is nothing, right? Because they will tax away all our consumer surplus. All of our consumer surplus, right? So we really should regulate this. Otherwise, we all become slaves.

Zhiguo He:

Yes. So you seem to be saying you are very much supportive of the recent regulation on FinTech? Good. I mean, great. Thank you so much, Larry. It's such a great start. And a lot of the points that I learned, and I know quite a bit. And a lot of questions, q&a's, you know, I can't cover everything, but some of them are really, I feel like very deep points. I was trying to contact with Gloria I saw that she was typing a lot of other things and just you know, if you have more questions, or you feel like it was not answered, send an email to me, I will forward it to Larry or, you know, I can provide and just have some email chain to click to keep the discussion. Thank you so much. Thank you.