America’s tariff agenda has taken global trade hostage to begin this year. While the strongman tactics employed by Trump’s administration are netting favorable results in some ways, China has been able to hold out from the pressure, showing flaws in America’s plan.

After a period of relative quiet in the wake of the Geneva agreement to de-escalate the U.S.-China trade war, frictions in bilateral relations are ratcheting up again. In the last week of May 2025, the Trump administration put in place a slew of punitive actions directed against Beijing.

The most headline grabbing moves by the administration are promises to “aggressively revoke visas for Chinese students,” including those with connections to the Chinese Communist Party or studying in critical fields. The U.S. State Department has also announced that it will vet visa applications by Chinese nationals more cautiously across the board.

The administration further announced the suspension of the sale of critical technologies and chemicals to Chinese companies, including new restrictions on the export of chip design software and jet engine parts. U.S.-China cooperation on jet engines had remained a bright spot and key to China’s development of its new single-aisle commercial jet, the C-919. Finally, Washington has sought to curb global uptake of Huawei Technologies’ Ascend AI chips. This is a maximum pressure campaign.

And it’s not only restricted to economic and people-to-people exchanges. Geopolitical frictions are rising rapidly as Trump is planning to step up military sales to Taiwan. Even more ominously, news emerged that already over 500 U.S. military personnelare stationed in Taiwan, while U.S. Defense Secretary Hegseth argued recently in Singapore that China was posing a real, imminent threat to the region, “rehearsing for the real deal.”

The flurry of retaliatory measures taken in late May was prompted by a belief within the Trump administration that China had failed to live up to the commitments reached in Geneva. As Trump himself put it: “The bad news is that China, perhaps not surprisingly to some, HAS TOTALLY VIOLATED ITS AGREEMENT WITH U.S.. So much for being Mr. NICE GUY!”

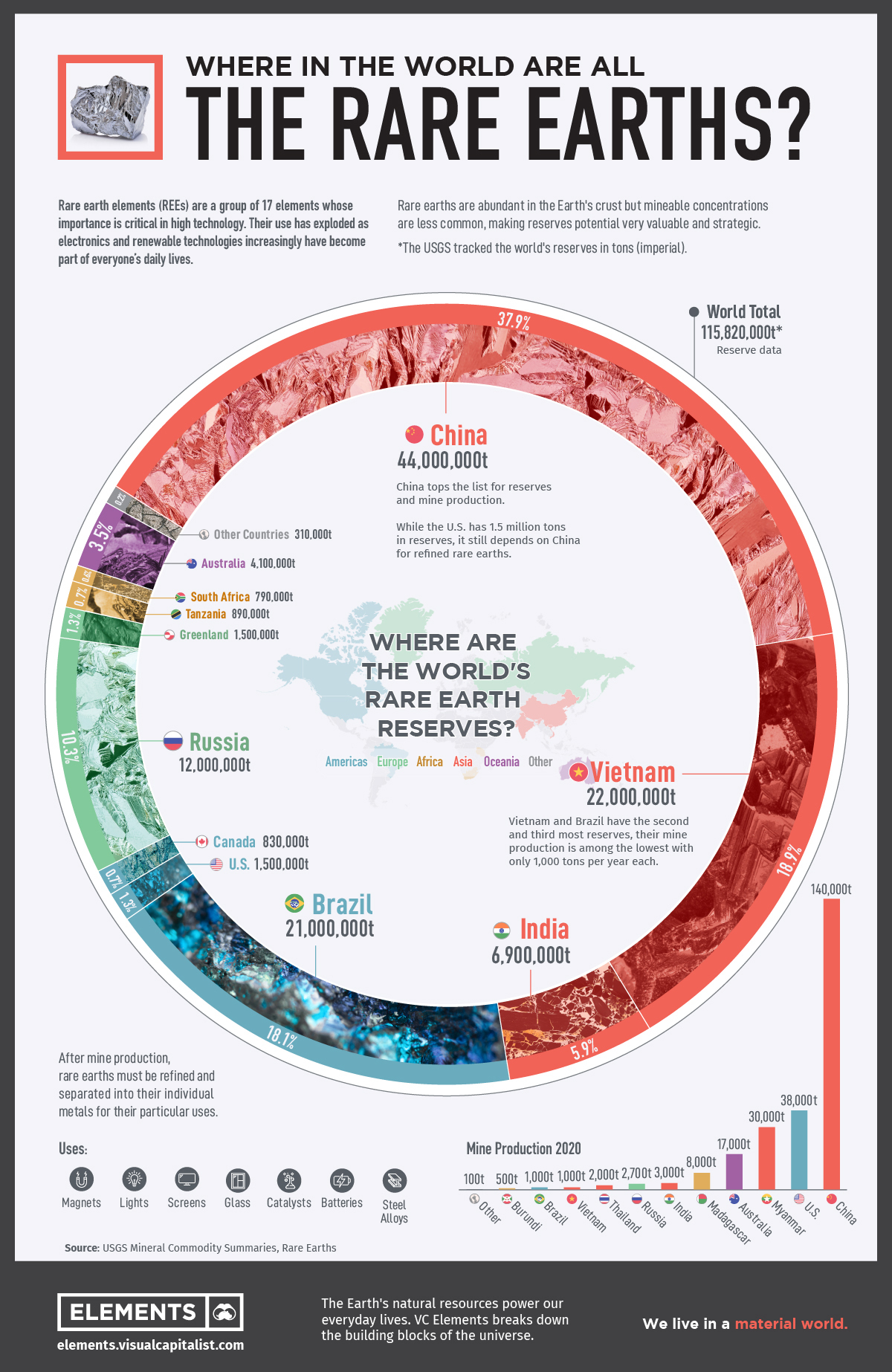

U.S. Trade Representative Jamieson Greer clarified what exactly was irking Trump, complaining that China was not green-lighting exports of magnets needed for cutting-edge electronics. “We haven’t seen the flow of some of those critical minerals as they were supposed to be doing,” Greer said. “China continues to, you know, slow down and choke off things like critical minerals and rare earth magnets.”

Trump seems to hope that applying maximum pressure against China will yield results, specifically direct negotiations between him and Chinese President Xi Jinping. This strategy is unlikely to work.

When the trade war erupted in earnest during early April, Treasury Secretary Bessent said that China’s escalation was a “big mistake,” since Beijing was “playing with a pair of twos,” a losing hand. Bessent argued that since the United States exports merely one-fifth as much to China as the other way around, the high tariffs would hit the Chinese economy much harder.

What the Trump administration seems to have either not planned for or not taken seriously enough, is that Beijing’s new restrictions on the export of certain rare earth elements announced on April 4, 2025 is truly a geopolitical weapon of striking potential. As I argued previously, the licensing system for seven medium and heavy rare earths (samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium) could throttle industries from semiconductors to electric vehicles, robotics, drones, aerospace, and defense.

Put mildly, this provides Beijing with a powerful source of leverage. James Kennedy, a rare earths expert at St. Louis-based Three Consulting, referenced Bessent’s poker analogy to capture the essence of how the game will unfold: “What happened is, they [the Trump administration] picked the fight, thought they had a winning hand, and China politely showed them four aces.”

No wonder the extreme frustration, not only in the White House, but increasingly in various industries across the globe. In fact, it is now clear that U.S. negotiators in Geneva were under the impression that their agreement included a Chinese suspension of export controls. But China only agreed to suspend or cancel non-tariff countermeasures directed against the United States after April 2, 2025. Since the rare earth export licensing system is global in nature, it is excluded from the agreement, at least in the Chinese point of view.

Undoubtedly, the new system is very restrictive. Only a few licenses have been granted to Chinese rare earth magnet producers. Each shipment requires a new license approval, since permits cannot be reused. Exporters and importers also need to prove the exact end use of the magnets, which offers China visibility into where they end up. As a result, Chinese government agents should over time be able to see the whole downstream supply chain, a useful tool to look for further vulnerabilities.

While licenses have been issued for magnet exports to Southeast Asia and Europe, including carmaker Volkswagen in Germany, so far there is no indication of exports to the United States. This is made clear by a May 9, 2025 letter to the Trump administration signed by major car makers and their suppliers in America. This includes GM, Toyota, VW, and Hyundai. The industry stated in unmistakable terms that without reliable access to rare earth magnets, the automotive supply chain will be disrupted, including reduced production volumes or even shutdowns of vehicle assembly lines.

Similarly, Indian auto producers have voiced even more dire predictions, saying that due to Chinese export restrictions, production could grind to a halt during June. Rare earth magnet choke points are also being revealed in the critical semiconductor sector. During a meeting of European semiconductor firms with China's Commerce Ministry in late May, European representatives expressed the urgent need to accelerate exports; otherwise, semiconductor production lines in Europe would come to a halt and supply chains disrupted.

As Beijing is slow-rolling the issuance of rare-earth export licenses, Washington is unlikely to sit idly by. The frustrations expressed by Trump, clearly visible now, could ratchet up further, with his administration lashing out at China and Chinese nationals in unpredictable ways.

But all of this is unlikely to change Beijing’s calculus. In trying to apply maximum pressure, American policy-makers will have to resort to ever more extreme methods. The Pyrrhic threat of revoking visas for Chinese students attests to this. And once again increasing tariffs to astronomical heights would derail financial markets. So would the nuclear option of barring China from accessing the U.S. Dollar and the SWIFT international financial messaging system.

Put bluntly, Beijing can afford to wait. Every new day reveals another supply chain vulnerability exposed by the rare earth licensing system. Going for the big prize — the lifting of all U.S. export restrictions and other punitive measures that have been directed against China since the first Trump administration — could be the only offer enticing Chinese policy-makers into negotiations.

Liu Pengyu, a spokesman for the Chinese Embassy in Washington, said as much: “China has repeatedly raised concerns with the U.S. regarding its abuse of export control measures in the semiconductor sector and other related practices. China once again urges the U.S. to immediately correct its erroneous actions, cease discriminatory restrictions against China and jointly uphold the consensus reached at the high-level talks in Geneva.”

Welcome to what is likely to be the greatest showdown in early 21st Century Geoeconomics! I dare not predict which side blinks first, but Beijing holds the better hand.