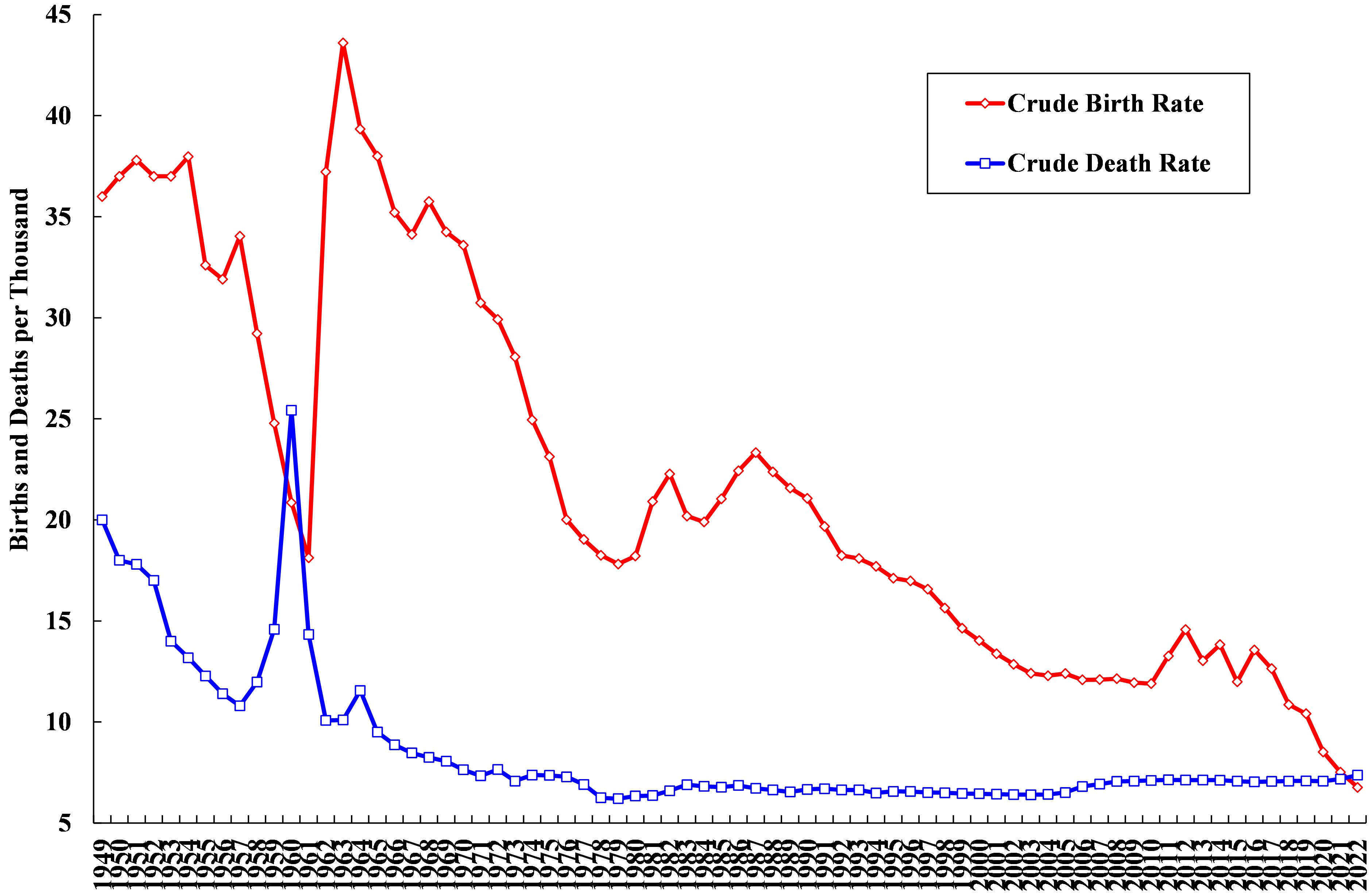

2022 was not a good year for the Chinese economy. In 2022, the COVID-19 epidemic, which started in December 2019, caused significant economic disruptions in the second quarter, especially in Shanghai, resulting in a real rate of growth for the Mainland economy of only 3.0% for the year as a whole. This is the second lowest annual rate since economic reform and opening began in 1978,[1] and only slightly more than half of the original target rate of 5.5%. Moreover, the crude birth rate, which has been declining, fell to 6.77 per thousand, below the crude death rate, 7.37 per thousand, for the first time since 1960 (see Figure 1).[2] The total population declined by 850,000 to 1.411 billion. In the near term, it is unlikely that the Chinese crude birth rate will rise significantly. China is likely to be replaced by India as the most populous nation in the world in 2023.

Figure 1: The Crude Birth and Death Rates of Mainland China

However, 2022 was not all negative. Despite the COVID-19 epidemic, the Russia-Ukraine conflict, and the threat of a worldwide economic recession, total Chinese exports and imports of goods increased 7.7% to exceed 42 trillion Yuan (US$6.0 trillion at the 2022 year-end exchange rate of 6.986 Yuan per U.S. Dollar) for the first time and China remains the largest trading nation in goods in the world. The declining total population does have one advantage—it implies that the Chinese real GDP per capita will rise at a rate faster than the Chinese real GDP.

2023 can turn out to be significantly different. First, given that the lethality of the current COVID-19 virus variant has declined significantly, the Mainland has been undergoing a rapid transition from a strict “Dynamic Zero” policy to an essentially “Living with the Virus” policy. Such a transition may be economically disruptive in the short term, as hundreds of millions of people become infected within a relatively short period of time, but it does accelerate considerably the return to normalcy. As of this writing, some unverified reports suggested that perhaps close to 1 billion persons out of a total population of 1.4 billion on the Mainland may have been infected in some way with the COVID-19 virus, effectively approaching “herd immunity”, but the fatality rate has remained extremely low. Hopefully the transition and recovery will have been completed before the end of the first quarter of 2023.

Second, 2023 is also the first year of a complete transition of the executive branch of the Chinese Government in March, which occurs once every five years. The new administration is ready to launch new initiatives to restart and restore the economy. The focus of the Government will clearly be on economic development—the Mainland GDP per capita in 2022, US$12,270,[3] was only one fifth of the GDP per capita of the U.S. and ranked approximately eightieth among all economies in the world. China has its work cut out to continue to improve the livelihood of the Chinese people. The repeated affirmation of a socialist market economy with Chinese characteristics by various Chinese Government leaders should dispel any anxiety that China would return to a centrally planned economic system. It cannot and will not. The purpose of the Mainland anti-monopoly and anti-trust laws is actually to promote and ensure the efficiency of the competitive market system, similar to that in the U.S. and the European Union. It should be viewed as an attempt to strengthen the market system rather than the opposite. Of course, China also wants to avoid the emergence of a plutocracy on the Mainland, under which moneyed interests control the politics.

According to the report on the Economic Work Conference held in mid-December, the private sector will continue to enjoy support from the Government in the same way as the state-owned sector, and property rights will continue to be protected. “Common Prosperity (gongfu)”, as advocated by President XI Jinping, should not be misinterpreted as “Equalized Prosperity (junfu)”. It simply means that the time has come for people who have not yet become rich to have the opportunity to also become rich. In fact, in the same week during which “Common Prosperity” was first introduced, the brand-new Beijing Stock Exchange was established to enable small and medium private enterprises to raise equity capital for their businesses. It is not something that would have been undertaken by a government intent on discouraging private enterprises.

The Chinese Economic Fundamentals

Are there enough primary factors, capital and labor, in the Chinese economy to enable it to continue to grow? The Chinese national savings rate, currently at approximately 45 percent, the highest in the world amongst major economies, should be amply sufficient to support a high domestic investment rate, even in the absence of inflows of foreign direct investment.[4] There is no shortage of supply of capital.

Current Chinese demographic developments do appear unfavorable—its total population is ageing rapidly and has begun to fall (which is, in part, the legacy of the one-child policy which was in place between 1980 and 2015). However, the labor supply problem is basically manageable. The demand for labor can be satisfied by continued urbanization, that is, by the movement of surplus labor from the rural to the urban areas. There still exists substantial surplus labor—the primary (agricultural) sector generated only 7.3% of GDP but accounted for 22.9% of total employment in 2021. In addition, the gradual raising of the mandatory retirement ages, which have officially remained at 50 for women[5] and 60 for men, a practice inherited from the early 1950s, when life expectancy was in the low sixties, should help greatly. Chinese life expectancy at birth, which was only 35 years in 1949 and 67.8 years in 1981, grew to 77.9 years in 2020 (compared to 72.3 years for the world as a whole). Life expectancy at age 60 was 20.21 years in 2020. In 2022, there were some 70 million persons in China between the ages of 60 and 65, who could be mobilized into the labor force if the mandatory retirement ages are extended. In the report on the Economic Work Conference, mention is made of the possibility of extending the retirement ages. In addition, the recent elimination of restrictions on the number of children per married couple and the possible lowering of the marriage-eligible ages should also help to increase the Chinese birth rate gradually, but it will take a couple of decades before they have a noticeable impact on the labor force. Despite the alarm bells set off by the decline in total population, China is still very far from suffering a serious chronic shortage of labor.

Moreover, the quality of the Chinese labor force has improved significantly through various investments in education and public health. For example, the proportion of the total population with tertiary education increased from 0.6% in 1982 to over 15% in 2020, a huge improvement. The “efficiency-equivalent” quantity of the labor force continues to grow even though in strictly numerical terms the labor force is no longer growing.

Investment in research and development (R&D) is critical to innovation. China’s expenditure on R&D in 2022 was 2.55% of its GDP.[6] Indigenous innovation has been occurring in many areas, for example: 5G communication, the BeiDou Navigation Satellite System, high-speed trains, quantum communication, super-computers, and ultra-high-voltage transmission of electricity. China also enjoys significant economies of scale, learning-by-doing (that is, efficiency improvement resulting from repetitive production of the same good, such as high-speed trains), and the advantage of longer upper tails in its ability distribution because of the size of its population.

The Major Uncertainties

However, even as the COVID-19 epidemic has become “normalized”, the Chinese economy is still faced with significant uncertainties. A first uncertainty is the possibility of a global economic recession, affecting Europe and North America. A pause in the Russia-Ukraine conflict should help. Fortunately, the Mainland economy is no longer dependent on exports—with the main driver of its growth being domestic demand. Moreover, as a large continental economy like the U.S., the domestic Chinese economy is largely unaffected by external disturbances. Thus, while the Chinese rates of growth of exports and imports fluctuate like other East Asian economies, the rate of growth of its real GDP has remained relatively stable.

A second uncertainty is the China-U.S. strategic competition, which is likely to be the new normal for the coming decade, with continuing “wars” in trade, investment, and technology. Some de-coupling of the Chinese and U.S. economies is inevitable under these circumstances, but the economic impacts on both economies will be relatively marginal. The continuing U.S. tariffs on imports from China have had only a small effect on the Chinese economy. Export controls on U.S. high-technology hardware and software can indeed slow down some sectors in the Chinese economy to a certain extent, but not really essential Chinese projects related to its national security, such as the manufacturing of super-computers, for which cost per se is not an important consideration. Chinese super-computers today can be built entirely with domestically produced components.

However, the China-U.S. strategic competition is not likely to result in a hot war because the resulting casualties and losses will be unthinkably enormous on both sides. There will be no winners, only losers. I remain optimistic that rationality will prevail and there will not be a hot war, just as the former Soviet Union and the U.S. managed to avoid a war in the last Century despite their intense rivalry.

A third uncertainty is a long-term one and has to do with the demographic developments. In the short and medium terms, the problems of a potential labor shortage can be mitigated, as discussed above. However, in the longer term, it is in Chinese national interests to try to achieve a net reproduction rate of one, that is, to maintain an essentially stable population. This requires an increase in the crude birth rate to over 7 per thousand in the long run. I believe this is feasible but cannot predict when it will be achieved.

Is There Sufficient Aggregate Demand?

The real question for the Mainland economy is whether there will be sufficient aggregate demand. China is a surplus economy, with not only surplus labor, but also surplus capital, as well as surplus productive capacity. As long as there is demand, there will be supply. The Chinese economy today is mostly driven by internal demand--household consumption, public goods consumption, and gross fixed investment--with gross fixed investment being the most important. However, investment demand is mostly driven by expectations about the future. And expectations, if credible, can be self-fulfilling. This is where the Chinese Government has to exercise leadership and try to change public expectations by its concrete actions, as was done through the 1992 “Southern Tour” of the late Mr. DENG Xiaoping,[7] and the 2008 economic stimulus package of 4 trillion Yuan in the aftermath of the Global Financial Crisis.[8] Monetary policy alone will be insufficient: as is well known, one can pull on a string, but one cannot push on a string. I believe there will be a major effort on the part of the Government to increase aggregate demand directly through gross fixed investment and transform expectations in the coming year.

Two major components of gross fixed investment are infrastructural and real estate investments. Infrastructural investments are needed on climate change, environmental preservation, protection and restoration, and communication, transportation and power. Other infrastructural investment can also include the construction of schools, universities, hospitals, and elderly care homes, especially in the less developed parts of China. Real estate investments may be impacted by the massive failure or insolvency of some of the real estate developers, which will in turn affect the construction and building materials sectors of the Chinese economy. However, the demand for residential real estate investments can be supported by not only owner-occupied housing but also by rental housing. The Chinese Government can promote rental housing under corporate or other institutional ownership as a viable alternative to owner-occupied housing, thus maintaining the demands for housing and hence for the construction and building material sectors. The ultimate total residential housing demand is of course the same, but there can be a different equilibrium between renting and owning.[9]

Forecasts of the Real Rates of Chinese Economic Growth in 2023[10]

For 2023, the Chinese Academy of Social Sciences has made a forecast of 5.1% real growth. The Chinese Academy of Sciences has issued a forecast of growth of around 6%. From multilateral institutions, there are the forecasts of 4.3% by the World Bank, 4.4% by the International Monetary Fund, 4.6% by the Organisation for Economic Cooperation and Development (OECD), and 5.2% by the European Union. Nikkei Asia and Economic Intelligence Unit (EIU), both research institutions, said respectively that growth would be 4.7% and 5.2%. Among investment banks, J.P. Morgan predicted 4.3%, Goldman Sachs, 4.5%, both BNP Paribas and ING 5%, and Morgan Stanley, 5.4%. In summary, the minimum forecast is 4.3% and the maximum forecast is 6%, with a median of 5% and a mean of 4.9%.

Another source of information consists of the announced 2023 target growth rates of the 31 provinces, municipalities and autonomous regions of Mainland China.[11] These target growth rates range between a low of around 4% for Tianjin and a high of around 9.5% for Hainan, followed by Tibet (around 8%), and Jiangxi and Xinjiang (both around 7%). There are four provinces and regions with a target growth rate of around 6.5%, Chongqing at over 6%, and Gansu and Henan at 6%. Then follow nine provinces and regions with target growth rate of around 6%. Three of the four economically most important provinces, Guangdong, Jiangsu, Shandong and Zhejiang, which together account for almost 35% of Chinese GDP, have a target growth rate of above 5%, with Jiangsu at around 5%. Only two municipalities, Beijing and Tianjin, have a target growth rate below 5%, with Beijing at above 4.5% and Tianjin at around 4%.

Since the provinces, municipalities, and regions are of different sizes, the unweighted arithmetic mean of their target GDP growth rates is of little use. The median provincial target growth rate is around 6%. A provincial GDP-weighted average of the target growth rates yields 5.64%.[12] All of this suggests that the national target rate of growth is most certainly going to be above 5%, and possibly close to 6%, especially considering that nine of the provinces and municipalities have committed to try to exceed their respective target growth rates.[13]

Economic Growth Beyond 2023

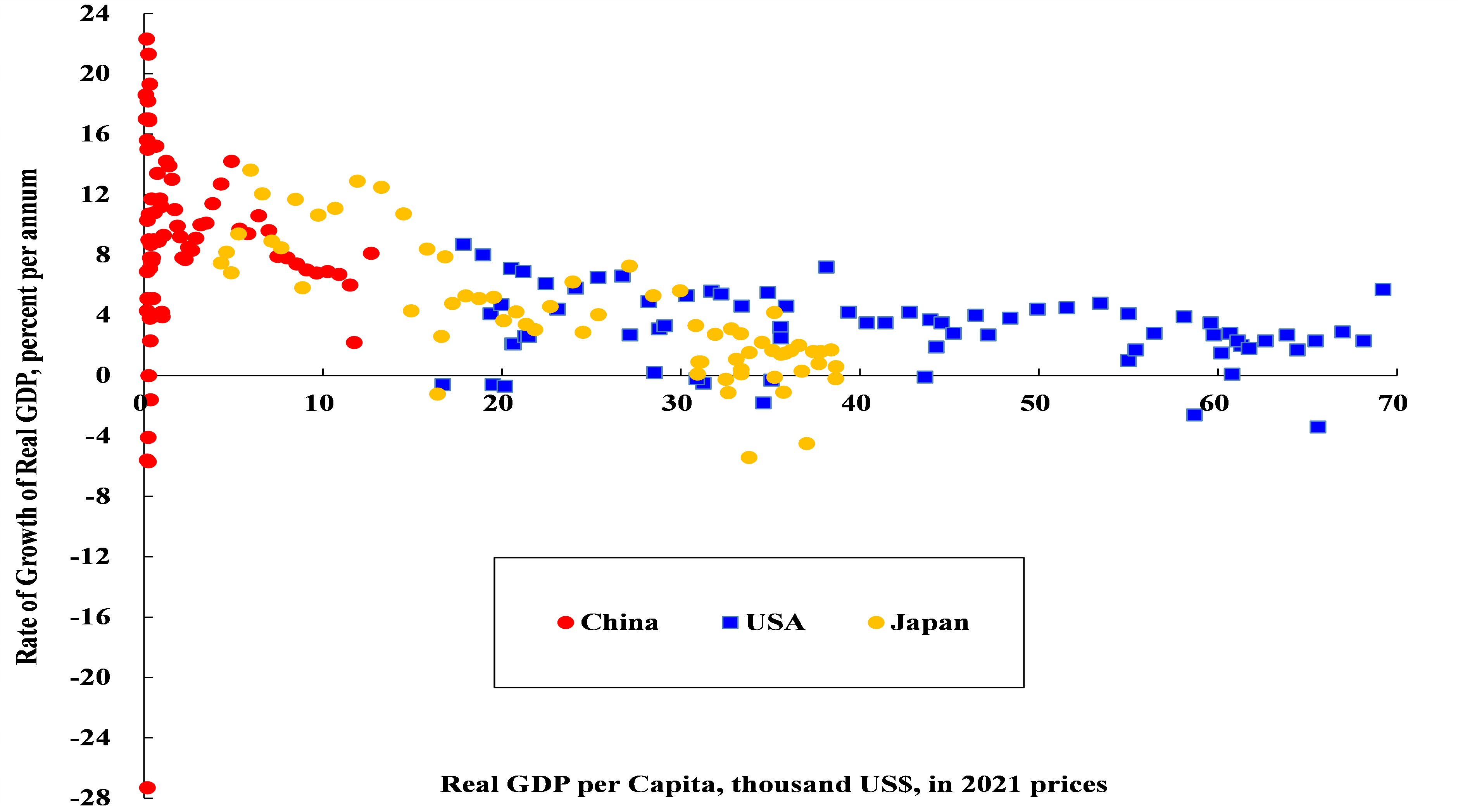

The Chinese economy will be growing faster than those of North America and Europe in the next ten years even though all of them will be slowing down to varying degrees. It is an empirical regularity that as the real GDP per capita of an economy rises, its real rate of growth falls. Thus, the Chinese economy cannot continue to grow at a real rate of over 9% per annum as it did between 1978 and 2018, but its real GDP per capita, around US$12,270, is still in a range that allows its economy to grow at an average annual real rate of approximately 6% for at least another decade. In Figure 2, we have plotted the real rates of economic growth of China (in red), Japan (in yellow), and the U.S. (in blue), against their respective real GDPs per capita. It is clear that with a real GDP per capita below US$20,000, an economy can still grow at an average annual real rate of approximately 6% and the Chinese economy will be operating within that range over the coming decade.

Figure 2: The Rate of Growth of Real GDP versus Real GDP per Capita,

China, Japan and the U.S.

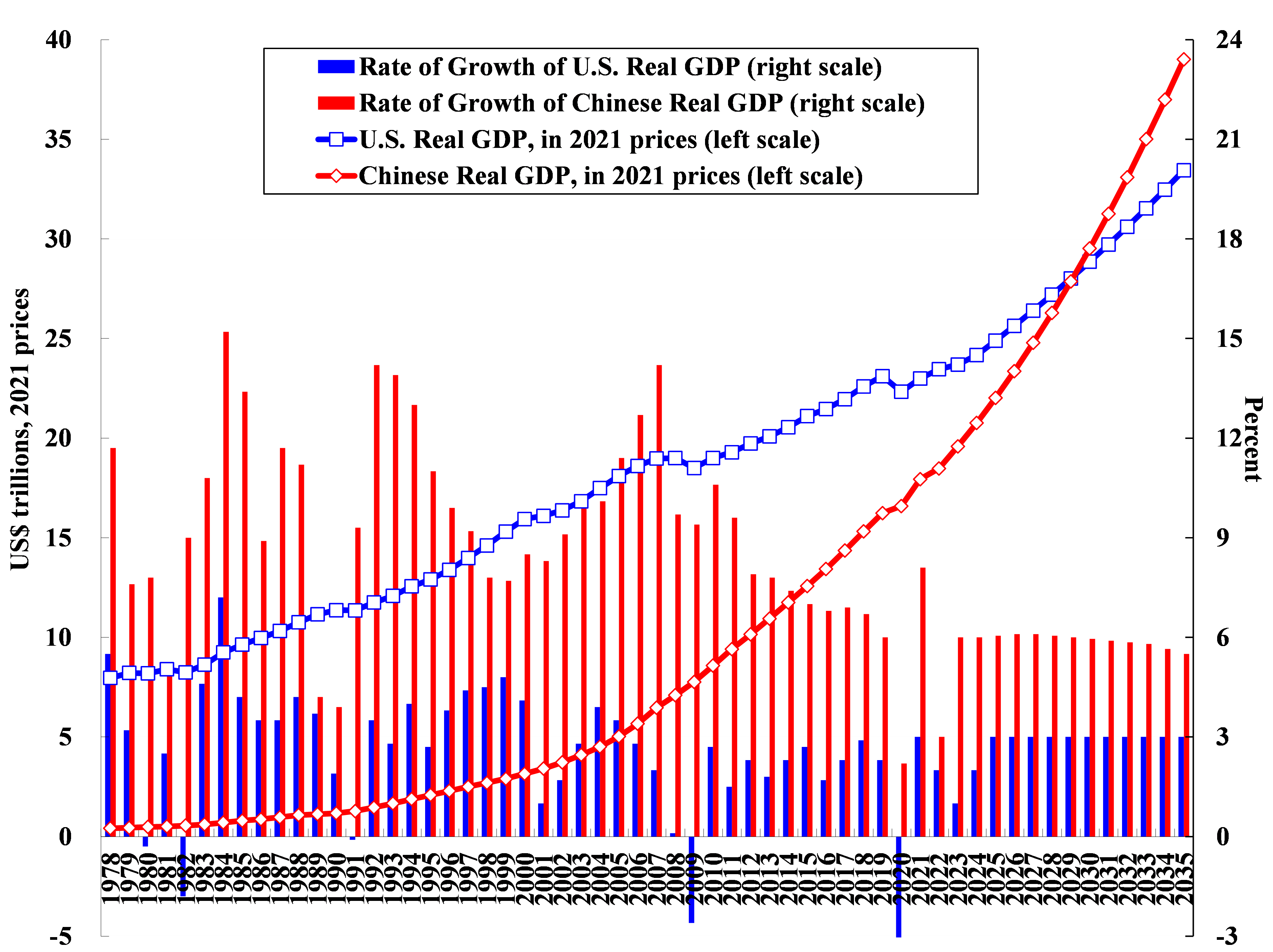

My own forecast is that by 2030, the real GDP of Mainland China at market prices will reach parity with that of the U.S., at approximately US$29.5 trillion, in 2021 prices (see Figure 3). Even then, Chinese real GDP per capita will still be less than 30 percent of the then U.S. real GDP per capita.

Figure 3: Actual and Projected Real GDP of China and the U.S., 2021 prices,

and Their Respective Rates of Growth

Concluding Remarks

Given the facts and uncertainties above, my personal forecast for the Chinese economy in 2023 is a 6% real rate of growth, based on my optimistic belief that there will be a rapid turn-around in public expectations, led by the Government. And for the coming decade, the average annual real rate of Chinese economic growth is likely to lie between 5.5% and 6%.

[1] The lowest was the 2.2% of 2020. The third lowest was the 3.9% of 1990.

[2] It should, however, be recognized that the COVID-19 epidemic and the resulting control measures have also contributed to falls in the crude birth rate as well as marriage rates and to a rise in the crude death rates since early 2020. The rate of growth of the total population is expected to recover to a certain extent now that the epidemic has come under control.

[3] At 2022 year-end market exchange rate.

[4] Foreign direct investment, which accounted for approximately 15% of the gross domestic investment on the Mainland at its peak in 1994, accounts for only slightly more than 2%, including “round-tripped” investment, today.

[5] However, if a woman is a cadre (ganbu), she does not have to retire until 55.

[6] http://www.stats.gov.cn/tjsj/sjjd/202301/t20230119_1892374.html.

[7] The “Southern Tour” was followed by five years of double-digit real rates of growth.

[8] This was followed by five years of average annual real rate of growth of 9.4%.

[9] In some German cities, for example, up to 40 percent of the residents may be renters.

[10] These forecasts have been collected from different reports in the press at various times. They may have been updated by the different organizations since.

[11] These provincial, municipal and regional target growth rates are taken from www.Chinanews.com.

[12] The provincial GDP weights of 2020 are used for this calculation.

[13] These provinces and municipalities include Beijing, Chongqing, Guangdong, Jiangxi, Liaoning, Shandong, Shanghai, Sichuan and Zhejiang.