The U.S.’ expanded tariffs under the second Trump administration are reshaping global supply chains by imposing steep, targeted duties and pressuring Asian economies to invest in American production. As manufacturing shifts away from China and its neighbors, countries like Mexico may benefit, while India risks being left behind.

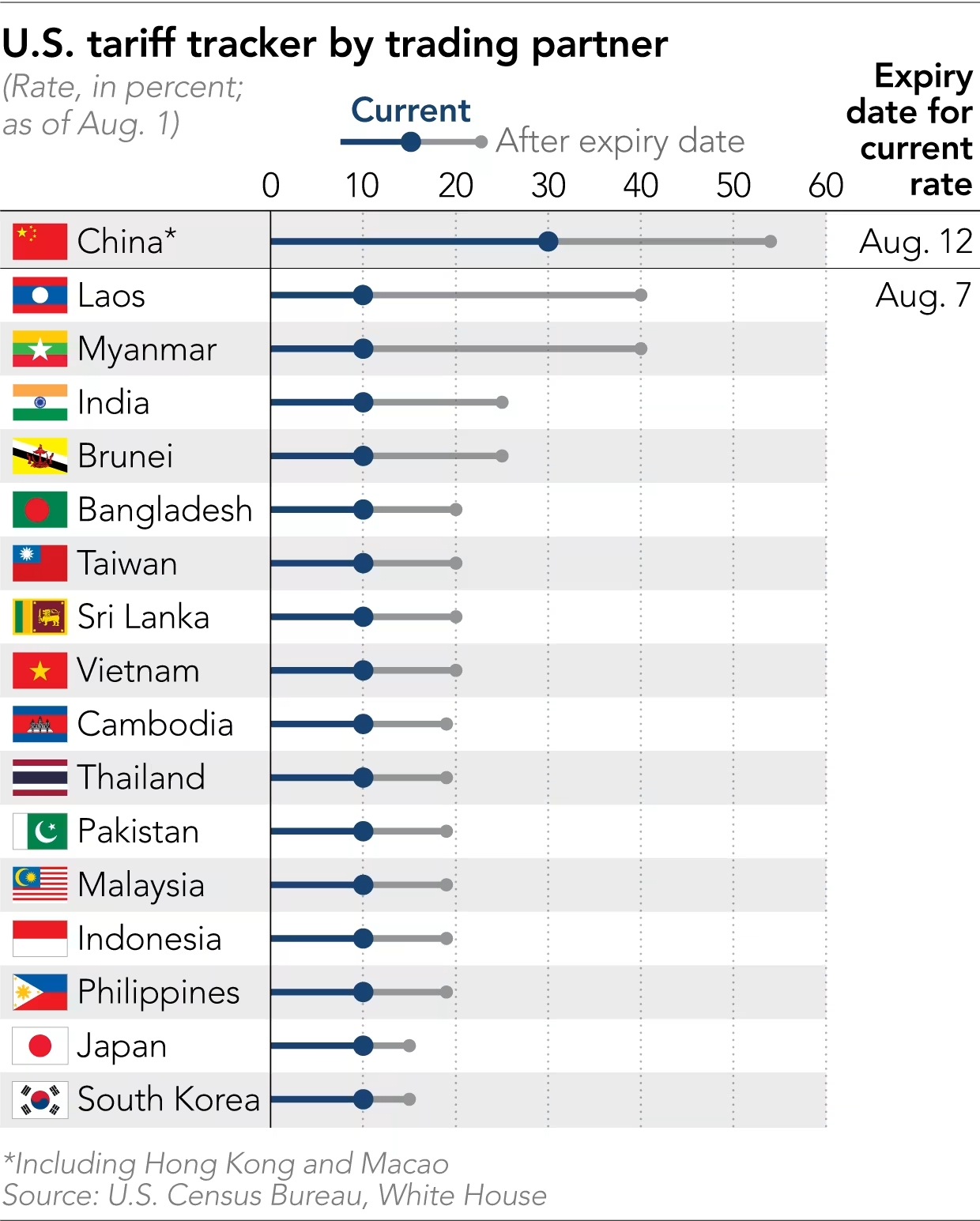

The recent escalation of U.S. tariffs under the second Trump administration includes a blanket 10% levy on all imports, but with clear variations across countries. China faces the steepest tariffs, with an additional 30% added to those from the previous administration (totalling above 50%). Singapore is at the bottom with 10%, and India has fared quite poorly with 25% tariffs, compared to Vietnam (20%) and others. On top of that, the U.S. is also introducing transhipping tariffs, aimed at countering goods routed through intermediary countries to evade higher duties. Additionally, a number of Asian economies, notably the largest net creditors like Japan and South Korea (and potentially Taiwan, once its temporary tariffs announced yesterday are made permanent), will need to invest hundreds of billions of U.S. dollars in the American economy. The stated goal of such large investments is to help create a U.S.-centric supply chain, thereby, reducing dependence on China.

These developments have sent shockwaves through Asia’s economic landscape, and consequences will continue to grow. Firstly, the U.S. appears determined to reduce China’s dominance in global supply chains by building its own systems and reducing China’s importance in other economies’ manufacturing activities. In other words, a massive reshuffling of supply chains is underway, with consequences for companies all over the world, especially multinationals. Such a “tectonic shift” will affect some Asian countries more than others, depending on the openness of their economy and the level of tariffs imposed by the U.S., but no one is spared.

The “China + 1” strategies adopted during the first Trump administration, in which companies diversified production to Southeast Asia to hedge against U.S.-China trade tensions, will now evolve into a broader approach, as the rest of Asia is also hit by U.S. tariffs. Furthermore, the latest tariffs are more granular as they scrutinize not just the final assembly location but also component origins and ownership structures. This means that countries which absorbed part of the production that left China, including Vietnam, Thailand, and Indonesia, will now see some of that activity shift again, this time to countries with lower tariffs. One of the biggest beneficiaries could be Mexico, especially if its current level of tariffs into the U.S. comes down after the renewal of the U.S.-Mexico-Canada Agreement.

Another key factor behind the reshuffling of supply chains are the closer relations between Southeast Asia and China, with increased cooperation in research, production, and distribution capabilities. Malaysia and Singapore, with robust digital infrastructure, are emerging as hubs for high-tech manufacturing. India, in contrast, may be less integrated into Asian supply chains, as it waits for U.S. and European investment that might not materialize in light of high U.S. tariffs. In other words, from a potential big winner, India might now become a loser, unless the U.S. changes its decision to impose such high tariffs. Similarly, the ongoing discussions for a free trade agreement between the EU and India would help reduce that potential isolation, but are not progressing fast enough for India to get out of this potential impasse.

The wave of investment that the U.S. seeks to receive from major Asian economies, as well as the European Union, is by no means a new development. Biden’s Inflation Reduction Act, as well as the U.S. CHIPS Act, acted as a magnet for investment from Taiwan, Japan, South Korea and the EU. Trump’s call for investment is clearly much more forceful (more a stick than a carrot) than Biden’s programs, but the ultimate goal remains the same. Indeed, a number of Asian companies have already responded to Trump’s wishes by announcing multibillion dollar projects in the U.S. This is the case for Taiwan’s semiconductor giant TSCM, Japan’s automaker Toyota, and Korea’s tech conglomerate Samsung, all of which aim to mitigate tariff risks while also responding to Trump’s demand for investment.

Chinese firms face a tougher road. With 54% tariffs and heightened scrutiny, direct investment from China into the U.S. has dwindled, dropping from tens of billions annually to near negligible levels by 2023. However, some Chinese companies are pursuing indirect routes, funnelling investments through subsidiaries in neutral countries like Singapore or Mexico to establish U.S. operations. At the same time, China holds significant leverage. The U.S. has had to engage in a number of bilateral discussions, leading to the reduction of tariffs from very high levels, and more reductions could follow based on the tone of the ongoing negotiations. In other words, while the U.S. tariff strategy appears laser-focused on sidelining China, the U.S. is also very hesitant in pushing further as it needs Chinese goods to avoid an inflation shock as well as more market access in China for American companies. This is especially true for hardware manufacturers in the artificial intelligence sector, where Chinese demand remains huge.

All in all, the U.S. tariff flooding is not just a China problem, but a regional one, and hardly any Asian economy will be spared. The U.S. tariff regime is reshaping Asia’s economic landscape, particularly the structure of supply chains, with large shifts from one country to another. Trump’s push to bring investment to the U.S. will only accelerate this process even further. For Asia, the challenge is to adapt swiftly, leveraging domestic demand and further regional integration. India will find this transition especially difficult, given its current position in this Asia-centric supply chain.