President Trump Chooses Slightly Softer Option on Chinese Investment

President Trump Chooses Slightly Softer Option on Chinese InvestmentPresident Trump stopped just short of an aggressive move that would have brought China and the U.S. even closer to a major trade war this week, over measures related to Chinese investment in U.S. high tech companies.

At the start of the week, U.S. media outlets reported that the president was considering plans to block technology exports to Beijing and to prevent companies that had at least 25% Chinese ownership from buying American businesses that possessed, "industrially significant technology." U.S. trade officials quickly denied these reports, including Treasury Secretary Steven Mnuchin, who tweeted, "The stories on investment restrictions in Bloomberg & WSJ are false, fake news. . .Statement will be out not specific to China, but to all countries that are trying to steal our technology." These denials by U.S. officials came despite a late May White House statement which said the U.S. would implement investment restrictions for Chinese entities, to be announced by June 30.

On Tuesday, President Trump released a statement saying he planned to target Chinese investment through the Committee on Foreign Investment in the United States instead, a panel which evaluates acquisitions by foreign companies. As China-US Focus contributor Hua Xin noted earlier this year, the U.S. government has been debating expanding the panel's powers and mandate for months. The administration's mixed messaging over Chinese investment reflects significant divisions over China policy among top trade officials. President Trump's decision to pursue a more moderate route may suggest the U.S. still hopes to keep the door open to negotiation with China, although at present neither side appears willing to budge. On Thursday, President Xi Jinping told a group of 20 mostly American and European CEOs: "In the West you have the notion that if somebody hits you on the left cheek, you turn the other cheek. . . In our culture we punch back."

Conversely, the Chinese government actually announced an easing of restrictions on foreign investment this week, in sectors such as banking, automotives and heavy industries, as part of its drive to open up China's markets.

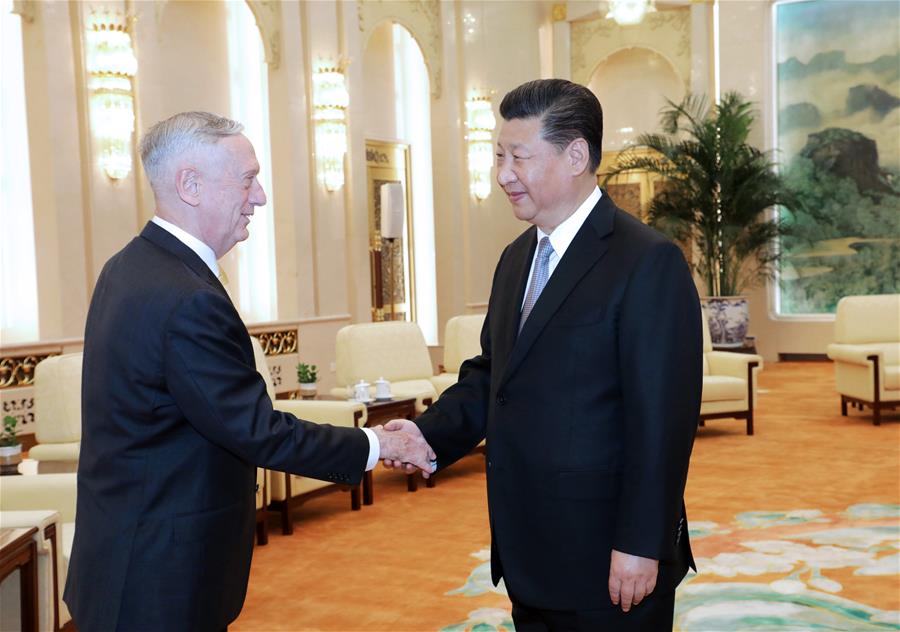

Defense Secretary Mattis Visits Beijing

Defense Secretary Mattis Visits BeijingU.S. Secretary of Defense James Mattis visited Beijing from June 26 to 28, amid rising tensions between the two countries on trade and security matters. It was the first visit to China in 4 years by a U.S. defense secretary. Mattis met with President Xi Jinping to discuss pressing issues, including the denuclearization of the Korean peninsula, differing viewpoints on the South China Sea and Taiwan, and Sino-American military ties.

Mr. Mattis, who has recently been a vocal critic of China's actions in the South China Sea, said prior to the trip that he hoped to bring about a "transparent strategic dialogue" with his counterpart to avoid further escalation of conflict. However, the meeting's dialogue was framed by the China's concern over U.S. policies on Taiwan, the suspected targeting of U.S. aircraft by Chinese lasers in the Pacific, and U.S. suspicion toward Beijing's militarization of the South China Sea. President Xi was transparent in his response, stating: "Our stance is steadfast and clear-cut when it comes to China's sovereignty and territorial integrity. . .any inch of territory passed down from ancestors cannot be lost." President Xi also emphasized the role of bilateral military cooperation in strengthening trust between the United States and China.

As China-US Focus contributor Wu Zurong argued this week, Mattis' visit was a significant display of the two countries' willingness to cooperate and communicate bilaterally, in an effort to stabilize relations and manage their disputes. The Wall Street Journal reported that China's Defense Minister Wei Fenghe has accepted an invitation from Mr. Mattis to visit the Pentagon — a potentially positive sign that talks will continue.

The Fall of the Yuan: China's Weapon or Woe?

The Fall of the Yuan: China's Weapon or Woe?On Wednesday, the yuan fell to a new six month-low against the U.S. dollar, triggering debate as to whether the Chinese government had intentionally devalued its currency as a weapon in the trade war. In the past, some American politicians have questioned whether the Chinese government purposely made its currency less expensive in order to make Chinese exports more competitive on the global market; however, financial bodies such as the U.S. Department of the Treasury have stopped short of labeling China a "currency manipulator." Further, as Derek Scissors argued in a piece on China-US Focus, the yuan has had a stable relationship with the dollar: "The exchange rate has stayed between six and seven yuan to one dollar for the last decade. Beijing does this mostly looking inward for the sake of stability, not outward for growth."

Analysts attribute this recent decline to two main factors. First, investors fear that the tariffs proposed by the U.S. government on Chinese goods, along with promised retaliation from Beijing, will cause damage to China's economy and impair its plateauing growth. Second, the strong performance of the U.S. economy encouraged the U.S. Federal Reserve to raise interest rates, a move that entices investors and increases the value of the dollar in comparison with other currencies.

Could the fall of the yuan be part of a larger Chinese strategy to win the trade war? Strategists say no; the devaluation of the currency is more a result of the tension between the U.S. and China. In turn, investors must wait for the response of the People's Bank of China (PBOC), which is expected to "step up efforts to calm investors and slow the pace of the yuan depreciation," Gao Qi of Scotiabank told Reuters. The PBOC announced mere hours after President Trump escalated tariff tensions last week that it would loan $200 billion yuan to various financial institutions; the type of rapid response that investors hope to see replicated soon to halt the dropping yuan.

China and the U.S. Clash Over Technology

China and the U.S. Clash Over TechnologyThe United States has long enjoyed a reputation as the mecca for global technological innovation. However, with new investments in innovation and high-tech manufacturing as part of the "Made in China 2025" initiative, China looks poised to overtake the United States as the world's foremost technological hub. In our latest explainer video, China-US Focus examines the heated China-U.S. tech rivalry, and explains how the battle to lead the world in tech innovation may be at the heart of the brewing trade war.

Prepared by China-US Focus editorial teams in Hong Kong and New York, this weekly newsletter offers you snap shots of latest trends and developments emerging from China every week, while adding a dose of historical perspective.

- 2018-06-22 Trade Tensions Spark Stock Sell-Off in China

- 2018-06-14 How “Comprehensive” Is the Kim-Trump Agreement?

- 2018-06-08 China Awards Putin First Medal of Friendship

- 2018-06-01 USPACOM Rebranded As U.S. Indo-Pacific Command

- 2018-05-25 Trump Cancels North Korea Meeting

- 2018-05-18 The On/Off Trump-Kim Summit

- 2018-05-11 American Goods Are Stuck at Chinese Ports

- 2018-05-04 China and the U.S. Lay Trade Demands on the Table

- 2018-04-27 U.S. Delegation Will Visit China Next Week

- 2018-04-20 China and the U.S. Seek Allies in Trade Dispute

- 2018-04-13 President Xi Reviews the PLA Navy

- 2018-04-06 China and Russia Pledge Military Cooperation in a Signal to the United States

- 2018-03-30 Kim Jong Un Visits Beijing on First Overseas Visit

- 2018-03-23 President Trump Asks for Tariffs on Around $50 Billion Worth of Chinese Imports

- 2018-03-16 Tillerson to be Replaced by Mike Pompeo as Secretary of State

- 2018-03-09 President Trump Agrees to Meet Kim Jong-Un

- 2018-03-02 U.S. Imposes Tariffs on Chinese Aluminum

- 2018-02-23 A Week of Developments Related to North Korea

- 2018-02-16 Cui Tiankai says U.S. Should Not Advocate Confrontational Strategy Towards China

- 2018-02-09 China Releases the “No.1 Central Document” Containing New Rural Policies