Trade Tensions Spark Stock Sell-Off in China

Trade Tensions Spark Stock Sell-Off in ChinaTrade tensions began to spiral this week in the aftermath of the U.S. announcement of tariffs on Chinese products last Friday, which was followed quickly by China's reciprocal tariff action. On Monday, President Trump pledged to impose new 10% tariffs on an additional $200 million in Chinese goods if China "insists on going forward with the new tariffs that it has recently announced." The White House statement implies that tariff escalations will continue measure for measure, until one side backs down. As China-US Focus contributor James Nolt argued this week, China is not likely to be the first to relent: "Many of Trump's sweeping demands are beyond the power of Beijing to fulfill."

On Tuesday, China's stock market fell to a two-year low, dropping 3.8% amidst fears of a move from threats to a full-blown trade war. Yi Gang, the governor of the People's Bank of China, quickly urged investors to remain "calm and rational." He said that China had the resilience and capability to cope with external shocks, and that the central bank was ready with policy tools to stabilize the market. This week, the bank injected 100 billion yuan (about $15.5 billion) into the economy as officials said that total liquidity in the banking system would rise even further. This move helped to drive down the yuan's value against the dollar to its weakest level in five months, The Wall Street Journal reports.

As Andrew Sheng and Xiao Geng note in an article published on China-US Focus, China's current financial position is marked by a number of extremely complex financial risks. "In addition to structural and cyclical risks, China must address the "gray rhino" (highly likely, but often ignored) strategic risks arising from the intensifying Sino-American geopolitical rivalry," they argue. "The emerging trade war is just the tip of the iceberg."

In the coming months, China's fiscal officials are likely to be kept busy managing the delicate balancing act of continuing the ongoing project to reduce financial risk whilst working to meet annual growth targets. If President Trump goes ahead with an additional $200 billion of tariffs on Chinese goods, analysts estimate this could shave between 0.2 and 0.3 percentage points from China's annual GDP growth.

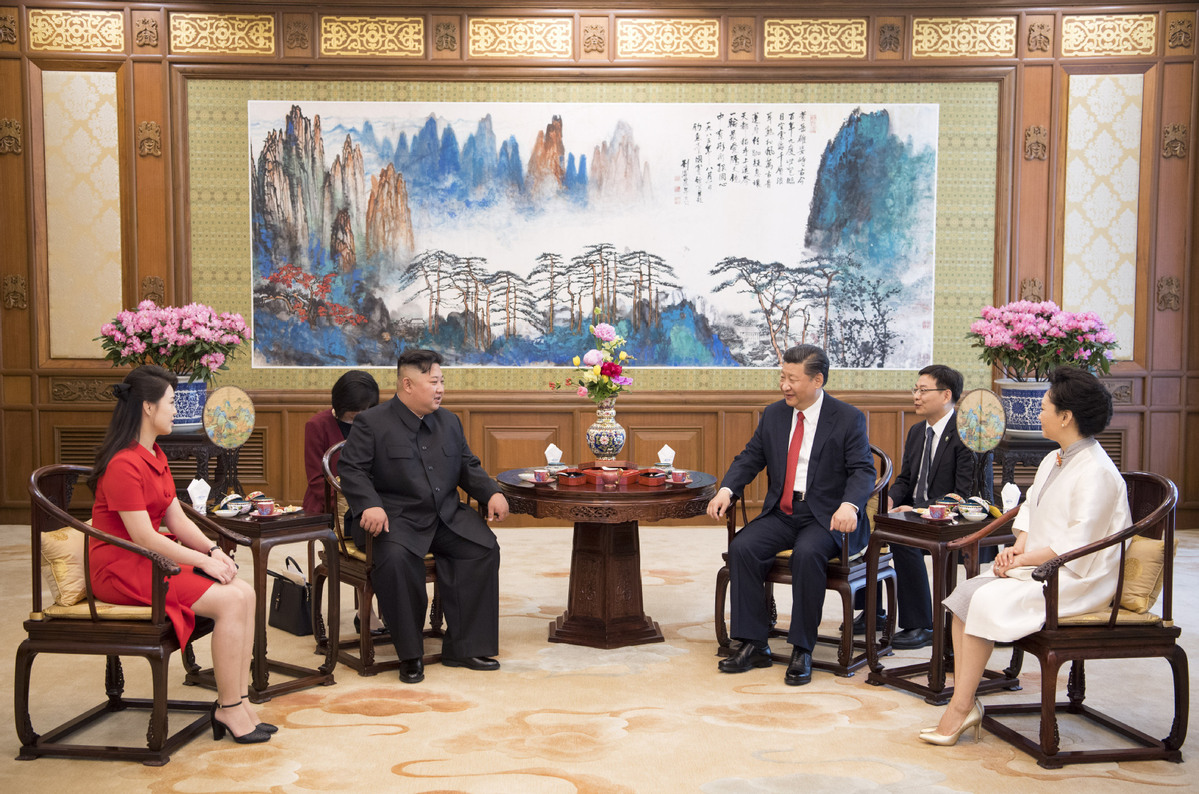

China Ready to School North Korea on Economic Development

China Ready to School North Korea on Economic DevelopmentDuring Kim Jong Un's third visit to China in less than three months this week, Chinese state media outlets lauded Kim's new focus on North Korea's economy. "Kim's latest talks with Xi will have reassured him that China stands behind the DPRK as it switches its focus to economic development," a China Daily editorial said. During his trip Tuesday and Wednesday, Kim visited an agricultural institute and a rail traffic control center, indicating a possible adjustment of his— and therefore the nation's— strategic priorities from nuclear development to economic development, as well as a desire to replicate the methods of China's economic success. Eager to showcase the merits of his country's development model, Chinese President Xi Jinping said Wednesday that "China is ready to share its experience" with Pyongyang.

As China-US Focus contributor Brahma Chellaney noted this week, China stands to benefit significantly from North Korea's denuclearization process, not only in terms of the general benefits of regional peace, but also economically. China's border province of Liaoning may see greater investment and growth if cross-border trade with North Korea resumes in earnest. The Chinese border city Dandong has already seen a boost in house prices since Kim made his first visit to China in March.

However, some critics remain skeptical of Kim Jong Un's apparent desire to focus on economic growth and open up North Korea's economy, noting the domestic political risks he would face with any relaxation of restrictions on policies such as migration. "Kim Jong-un does not seek reform in any meaningful sense of the word, but a jacked-up international subvention scheme," Lee Sung-yoon of Tufts University said to Supchina.

China's Aging Population Could Threaten Future Growth

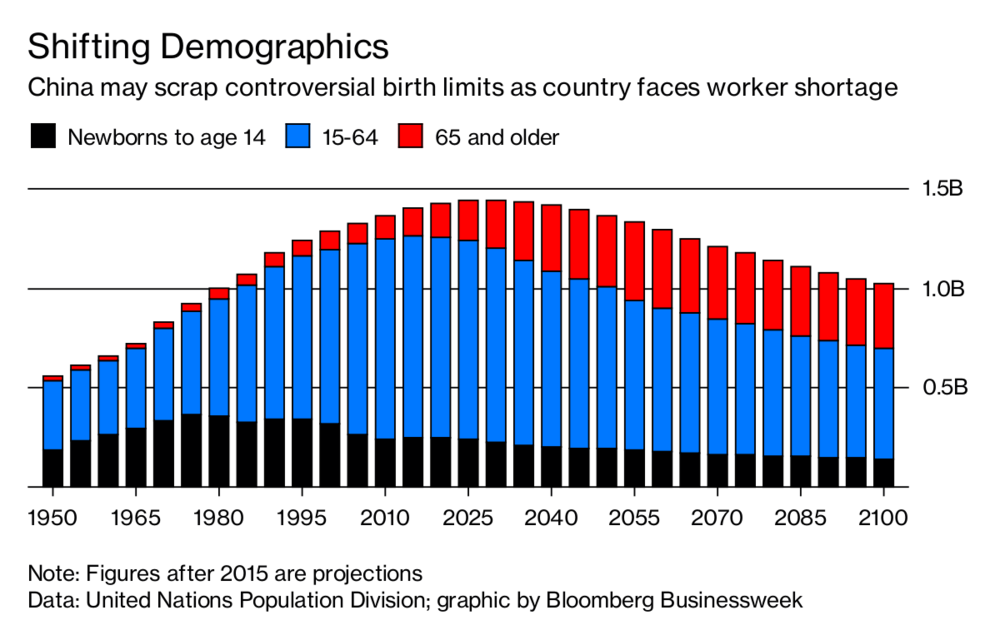

China's Aging Population Could Threaten Future GrowthWhile developments in the China-U.S. trade relationship have taken the spotlight this week, economists are also concerned about another possible indicator of plateauing growth. With the announcement of new rules on family planning, including sex-selective abortions, in Jiangxi province, attention has also turned to a significant demographic trend among the Chinese population: aging. By 2030, there will be more people aged 65 years and older than the segment of the population that is 14 years and younger. This imbalance will place a heavy burden on the younger generations to collectively generate an economy strong enough to support the aging population.

By the end of 2017, 17% of China's total population was 60 or older. This fact, coupled with a 2017 fertility rate of 1.24% (lower than Japan's 1.46%) places China's population at a critical juncture: as adults are aging out of the workforce, there may not be enough young people to replace them. This would endanger China's labor-intensive economic growth, meaning the Chinese government must implement strategies that increase birth-rates, change the nature of the economy, or both.

The demographic shift is also accompanied by softening numbers in other economic indicators. These statistics have caused many to question whether China's dramatic growth is coming to a close. But what can Chinese officials do to stave off disaster? As Jeff Ng argued for China-US Focus this week, the government could offer certain incentives, both monetary and non-monetary, to encourage young couples to start families, and parents to have additional children. Further, "nationally-mandated maternity and paternity leave" could prove an effective policy to alleviate the concerns of working mothers and fathers. Overall, Ng stresses that government actions necessitate new levels of creativity to have a real chance at combating China's age problem.

This Week's Top Commentary

This Week's Top CommentaryThe resilience of U.S. global influence has long been debated in terms of quantitative factors such as demographic trends, military power, and economic dominance. This week, Vasilis Trigkas of Tsinghua University offered a new perspective on the future of U.S. preeminence. Trigkas argues that the fragmentation of American society, and the unprecedented political threat President Trump poses to America's law and constitutional order, could cause irreparable damage in its competition against China.

"Whereas America's society is undergoing political 'trench warfare' with ideological trenches becoming deeper and wider, Chinese society seems united and reinvigorated. Domestic public trust in China's government now outranks public trust in major Western democracies," Trigkas argues. "While this does not necessarily highlight a superiority of the Chinese polity, it does nonetheless showcase that illiberal democracy 'à la Trump' cannot be a beacon for societies across the world." Read the full article here.

Prepared by China-US Focus editorial teams in Hong Kong and New York, this weekly newsletter offers you snap shots of latest trends and developments emerging from China every week, while adding a dose of historical perspective.

- 2018-06-14 How “Comprehensive” Is the Kim-Trump Agreement?

- 2018-06-08 China Awards Putin First Medal of Friendship

- 2018-06-01 USPACOM Rebranded As U.S. Indo-Pacific Command

- 2018-05-25 Trump Cancels North Korea Meeting

- 2018-05-18 The On/Off Trump-Kim Summit

- 2018-05-11 American Goods Are Stuck at Chinese Ports

- 2018-05-04 China and the U.S. Lay Trade Demands on the Table

- 2018-04-27 U.S. Delegation Will Visit China Next Week

- 2018-04-20 China and the U.S. Seek Allies in Trade Dispute

- 2018-04-13 President Xi Reviews the PLA Navy

- 2018-04-06 China and Russia Pledge Military Cooperation in a Signal to the United States

- 2018-03-30 Kim Jong Un Visits Beijing on First Overseas Visit

- 2018-03-23 President Trump Asks for Tariffs on Around $50 Billion Worth of Chinese Imports

- 2018-03-16 Tillerson to be Replaced by Mike Pompeo as Secretary of State

- 2018-03-09 President Trump Agrees to Meet Kim Jong-Un

- 2018-03-02 U.S. Imposes Tariffs on Chinese Aluminum

- 2018-02-23 A Week of Developments Related to North Korea

- 2018-02-16 Cui Tiankai says U.S. Should Not Advocate Confrontational Strategy Towards China

- 2018-02-09 China Releases the “No.1 Central Document” Containing New Rural Policies

- 2018-02-02 Wang Qishan Appointed to the National Legislature