Zhang Monan

Deputy Director of Institute of American and European Studies, CCIEE

Jan 30, 2018

A solution to local government debt is strengthening the central bank’s supervision over it.

Jan 23, 2018

China is easing its trade restrictions. The US should too.

Jan 15, 2018

With China’s economic development and transformation, as well as the stronger domestic consumption and innovation, US enterprises are still willing to increase direct investment in China.

Nov 10, 2017

Here’s what the US and Chin can do to deepen economic cooperation.

Oct 19, 2017

Once the US corporate tax rate falls to 20% (the same as China’s and the OECD average), the tax rates of countries around the world will plunge, like they did in the post-Reagan era.

Sep 25, 2017

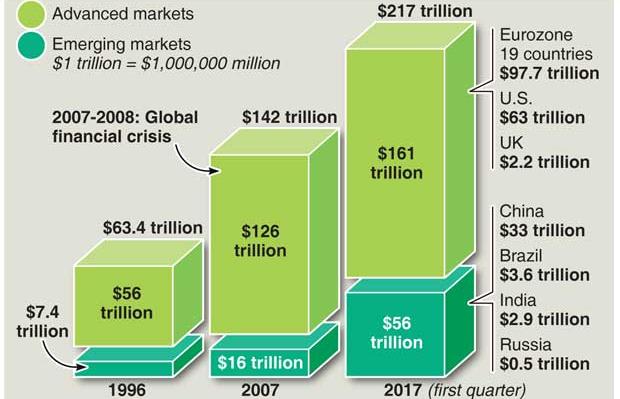

The scale of all sorts of debt in the US, including federal government debt, corporate debt, household debt, and private debt is nearing an all-time high. Evidence suggests a new debt crisis is mounting.

Sep 06, 2017

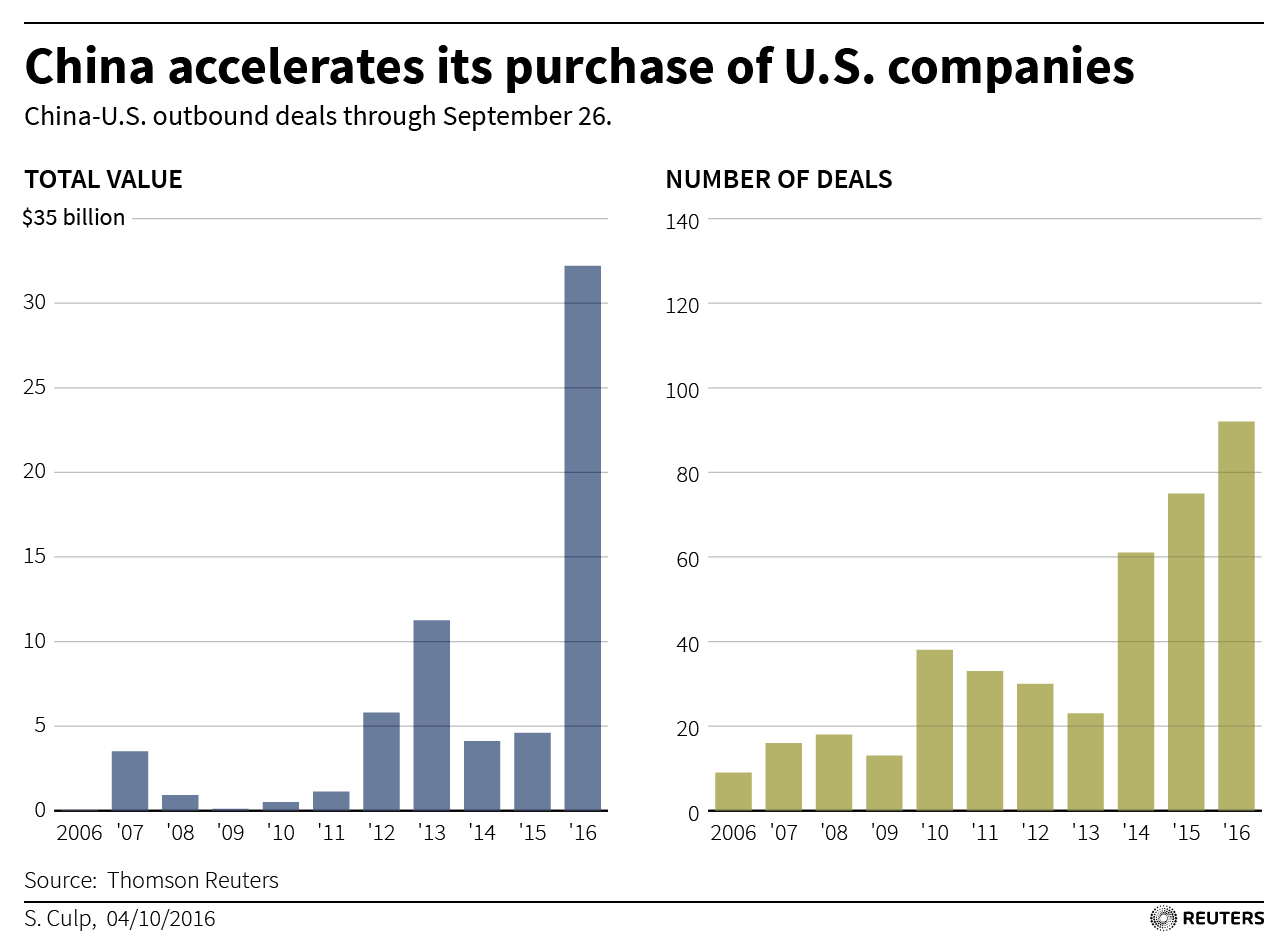

The US government is using national security arguments to justify protectionism against Chinese investors.

Aug 10, 2017

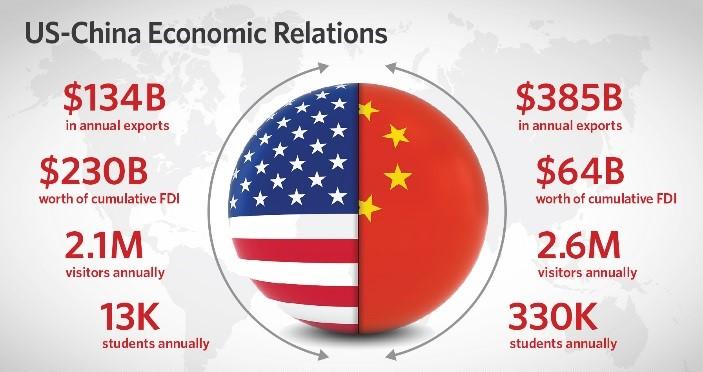

China-U.S. relations should not be confined by the so-called “trade balance.” Their relations should go beyond the 100-day action plan, and they should reassess and redefine the “economic balance.” By doing so, it will help lift China-U.S. economic cooperation and trade onto the track of “win-win” and sustainable development. Republican presidential candidate Donald Trump speaks Wednesday during a campaign rally in Miami. (EVAN VUCCI, ASSOCIATED PRESS)

Jun 29, 2017

As economic and trade relations between these two great nations evolves toward benign interaction, both countries should transcend the 100-Day Economic Plan and promote implementation of a post-100-day plan. In terms of broad prospects for cooperation, they should deepen industrial cooperation to promote the integration of a range of high-quality factors of production and innovative resources.

May 19, 2017

Giving priority to important institutional innovations and rule-making will not only provide opportunities for promoting China’s industrial capacity cooperation and manufacturing upgrading, but also promote a new round of prosperity-oriented growth for global trade and new globalization.