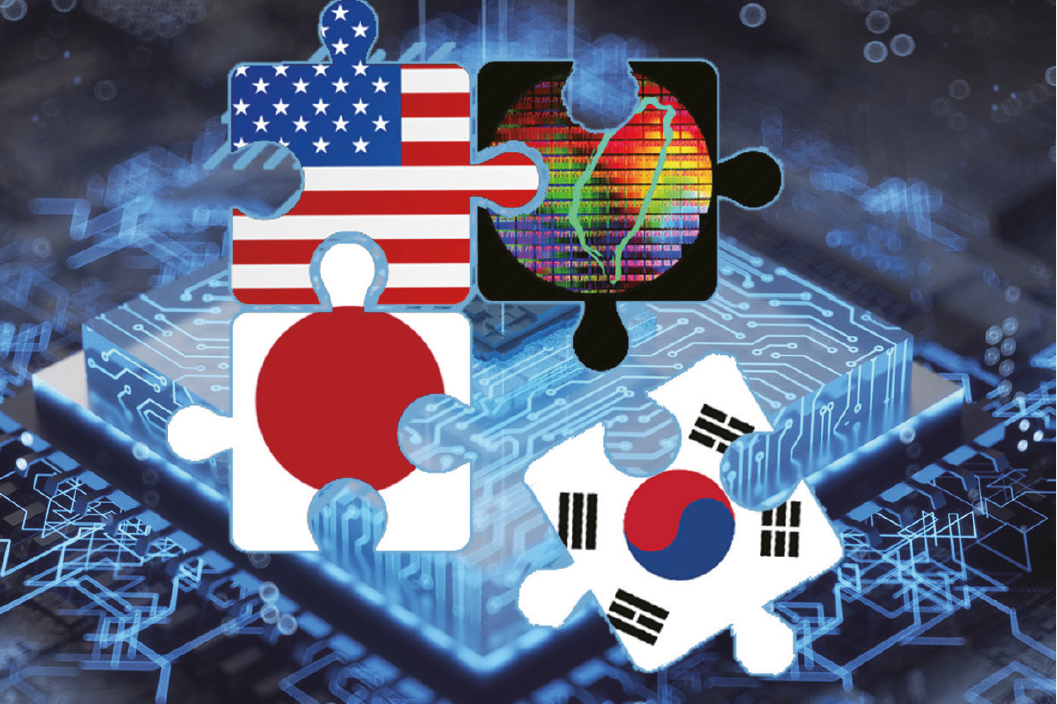

Chip 4 Alliance

Dual-use technologies are of critical importance to national security due to their applications in both civilian and military contexts. The strategic competition between the U.S. and China is centered around these cutting-edge technologies, particularly in the semiconductor chip sector. In recent years, Washington has tightened export controls against China to impede its technological progress. For example, in October 2022, the Bureau of Industry and Security issued a rule that restricts China’s access to advanced semiconductors and manufacturing tools. However, in today’s globalized world, no single country possesses a complete ecosystem for chip production. The U.S. excels in chip design software and research and development, South Korea and Taiwan lead in manufacturing the most advanced chips with sizes below 10 nanometers, and Japan specializes in manufacturing materials. Thus, the U.S. alone cannot effectively contain China, and collaboration among these three tech leaders is crucial in shaping the future trajectory of technological competition between China and the U.S.

In 2021, the U.S., South Korea, Japan, and Taiwan contributed to 84% of total semiconductor sales, while China contributed only 7%. This context underpins President Biden’s push for a “Chip 4 Alliance” to persuade East Asian tech leaders to join the coalition aimed at curbing China’s semiconductor ambitions. As a decoupling trend emerges in the tech sector, these economies face a choice between aligning more closely with the U.S. or China.

It is increasingly evident that the U.S. is successful in securing semiconductor allies at both the national and industrial levels. For Taiwan, the National Science and Technology Council plans to unveil a list of core technologies safeguarded from the reach of China by the end of 2023, aligning with the U.S. in efforts to curb China’s technological influence. In July 2023, Taiwan Semiconductor Manufacturing (TSMC) extended its semiconductor collaboration with Purdue University in Indiana in research and development until 2031. TSMC is also investing in a new fabrication facility in Arizona, which is estimated to cost $40 billion.

Japan, as a key leader in semiconductor materials, is similarly aligning with the U.S. rather than China. In December 2022, U.S.-based IBM and Japan’s Rapides entered into a partnership to manufacture 2-nanometer chips. The following month, Minister of Economy, Trade and Industry Yasutoshi Nishimura emphasized the importance of reinforcing partnerships with the U.S. in export control and next-generation semiconductors during his visit to Washington DC. Furthermore, Japan has taken measures to restrict China’s access to crucial semiconductors by planning to implement export controls on “23 types of essential chipmaking equipment.”

In contrast to Taiwan and Japan, which have contentious relations with China, South Korea finds itself in a dilemma between its most significant economic partner, China, and its critical military guarantor, the U.S.. China has been South Korea’s top chip consumer, with over 50% of its chip shipments going to China in 2022. Both Samsung and SK Hynix have NAND and DRAM chip plants in China, located in Wuxi and Dalian, respectively. Nevertheless, South Korea’s semiconductor policy is shifting towards the U.S.. The Yoon-Biden joint statement aims to deepen security and economic ties between South Korea and the U.S., with both countries confirming partnerships in technology and seeking to expand “cooperation on critical and emerging technologies.” Additionally, Samsung is building a new chip plant in Texas with an estimated cost exceeding $25 million. All three economies are advancing their cooperation with the U.S., not only at the government level but also at the industry level.

So why is China falling behind in this popularity contest? First, the U.S. plays a much more critical role in the semiconductor industry as an indispensable partner. The U.S. leads in chip design, while China specializes in assembly, testing, and packaging (ATP). While the U.S.’s role in software and intellectual property is irreplaceable, China’s contribution is relatively minor, as ATP is labor-intensive with a low entry barrier. As Yeo Han-Koo, a former South Korean trade minister, noted, “China has the market, but the U.S. has the technology. Without technology, you have no product. Without a market, at least you can find a way to diversify and identify alternatives.” In short, China’s role is replaceable, while the U.S.’s role is not.

Second, the U.S. is also providing substantial subsidies to attract tech companies and intellectuals, such as the CHIPS and Science Act. While specific conditions must be met to receive this funding, it presents a significant opportunity for tech companies to establish chip factories overseas and enhance their competitive advantage. In contrast, China often uses coercive measures to influence other countries, instilling fear among its neighbors. China has employed economic sanctions to express dissatisfaction over South Korea’s THAAD deployment, the Diaoyu Island dispute with Japan, and Taiwan’s closer ties with the U.S.. These instances illustrate China as an aggressive and unpredictable neighbor, posing risks for collaboration.

Third, China has lost credibility as a business partner due to its handling of COVID-19. During the pandemic, China’s zero-covid policy led to lockdowns across the country and frequent closures of companies, significantly impacting foreign investors. Apple, for instance, began shifting its manufacturing operations away from China, opting for locations like India and Vietnam. This decision was prompted by a violent protest that erupted in Zhengzhou, home to one of the world’s largest iPhone factories. To maintain operations during the pandemic, factory workers were compelled to stay on-site, which eventually led to protests that disrupted the supply chain. China’s handling of the pandemic highlights its arbitrary implementation of domestic policies, making it a risky business partner, particularly in sectors with vulnerable supply chains, such as semiconductors.

South Korea, Taiwan, and Japan are all increasingly aligning themselves with the U.S. in the realm of technology rather than leaning toward China. This shift is driven by sound reasoning and self-interest. Without access to chip design and advanced chips from foreign suppliers, China encounters substantial challenges in its national ambition to achieve technological advancement. This challenge is further compounded by the fact that China has lagged behind the U.S. and its allies for two decades in the tech race. Despite a period of cooler relations with East Asian economies during the Trump administration, President Biden has been successful in fostering warmer relations and solidifying alliances with tech leaders in East Asia. This achievement grants the U.S. a significant advantage in the ongoing tech competition with China.