Click to read the latest China-US Focus Digest

On June 8th, the U.S. Senate made headlines by passing the U.S. Innovation and Competition Act (USICA), which is expected to pass the House and be signed into law. The bill, whose $200 billion price tag supports a massive range of subsidies for U.S. tech firms, is sure to have champagne bottles popping in DC and Silicon Valley. The USICA includes tens of billions in funding for research grants through the National Science Foundation, along with subsidies for semiconductor manufacturers, private space companies, and other high technology firms. The strong bipartisan support for the bill is a key indicator that the U.S. drive to protect domestic industries and move away from ‘free trade’—expressed through the lens of competition with China—is only growing in the aftermath of the pandemic.

To understand the significance of the USICA, it is important to look at each of the bill’s key provisions. The biggest portion of the Act is roughly $80 billion to new federal funding for research and development through the National Science Foundation (NSF). $29 billion is slated for a new “Directorate of Technology and Innovation” within the NSF, intended to funnel resources to the development of cutting-edge technologies. Further tens of billions are specifically targeted toward research in supercomputing, robotics, biotechnology, and synthetics. One can expect this funding to accrue to a range of institutions through grants and public-private partnerships, including defense contractors, tech giants, and research universities. Altogether, these initiatives are explicitly framed as an attempt to “maintain U.S. competitiveness” with China by fostering the domestic development of high-tech industry.

One of the more controversial elements in the bill is a huge $52 billion subsidy for semiconductor companies. The rationale for the massive handout is somewhat weak. Politicians and commentators have suggested this is an attempt to address the recent semiconductor shortage—a product of the ongoing economic recovery and ensuing order backlogs. However, it will take many years to build new manufacturing facilities, at which point market conditions will be entirely different. U.S. firms aren’t struggling; they already hold roughly 50% of the global market share. It’s nearly impossible for new firms to break into this market, given that the cost of building a new semiconductor gigafab—one of the world’s most highly-automated and complex manufacturing facilities—can run over $10 billion. Due to a multi-stage process of offshoring, much of today’s semiconductor manufacturing is sub-contracted to producers in Taiwan like TSMC. Taiwan is a U.S. ally and dependency, and shows no sign of halting trade with the United States. Nevertheless, Congress is shelling out enough money to build multiple new, state-of-the-art gigafabs on U.S. soil.

Crucially, the USICA contains a provision that bans technologies developed with this NSF funding from being transferred to China, which was one of China’s main historical strategies for acquiring its own base of technical expertise. Some companies have pushed back against these restrictions, showcasing a key tension at the heart of U.S. industrial policy. While any corporation is more than happy to have free money thrown its way, many are wary of restrictions that could harm their ability to do business in the world’s fastest growing market. For instance, U.S.-based manufacturing of semiconductors could take place under the auspices of a firm like TSMC. Will a Taiwanese company, whose major clients include massive Chinese telecoms firms, be willing to risk those relationships in exchange for subsidies? The upshot could be the favoring of U.S.-based firms like Intel who are already being forced to shed some of their business relationships in China. In any case, the technology transfer provisions in the USICA highlight a rare instance where U.S. policymakers are willing to rank their perceived military-strategic interests (i.e., unrestricted access to semiconductors in a hypothetical war) slightly higher than private corporate ones.

Some of the other major measures in the bill include additional funding for cybersecurity measures and funding for contracts with private space companies. On the cybersecurity front, the bill creates a fund that would allow the Department of Homeland Security to provide support to companies targeted by ransomware attacks, like the recent action against the Colonial Pipeline. $500 million in grants are targeted at improving the cybersecurity infrastructure of other nations, presumably U.S. allies and other upstream targets. Finally, in a move that will no doubt please Jeff Bezos, an additional $10 billion will be allocated to NASA, which will allow it to sign a new contract with Blue Origin, the Amazon owner’s space company.

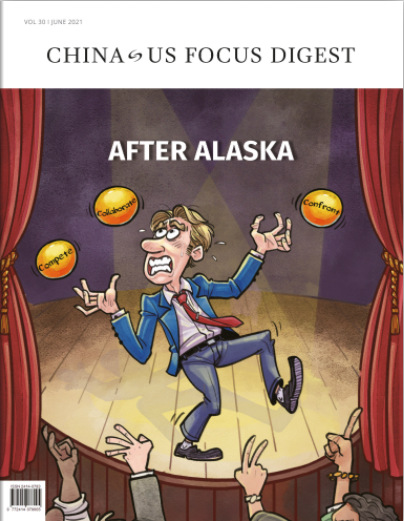

Beyond the grab bag of major handouts for some of the world’s most profitable, highly automated corporations, the USICA is a clear sign that protectionism continues to gain steam within the United States. As we have argued many times, a range of factors from capitalism’s growth regime to strategic competition are pushing the major powers away from the rough ‘free trade’ consensus that defined previous decades. The USICA represents a serious effort to reshore major, expensive manufacturing facilities to the U.S. while further restricting trade with China. It is clear that the main framing of this effort is not “creating jobs”—tech firms are not great candidates for this, given how few people they employ relative to their required investment. Instead, U.S. industrial policy is being framed primarily in terms of strategic competition with China.

As always, there is cause for concern. It’s not hard to see the similarities between today’s protectionist shift and similar trends in the previous grand era of imperialism in the late 19th and early 20th centuries. When the response to a crisis of capitalism is the gradual restriction of markets into competing spheres of influence, there is a seemingly inherent tendency for politico-military competition to increase as well. Whatever the opportunistic motives might be for individual American politicians to support tariffs, subsidies, or economic decoupling with China, the end result is a world in which conflict becomes both more thinkable and less costly to major businesses. The road to calamity is paved with stepping stones such as these.