European Union leaders’ proclamations of supply autonomy sound great under the spotlight, but don’t hold up under the microscope. The truth may be that China already has won the game with its vice-grip on rare metal exports.

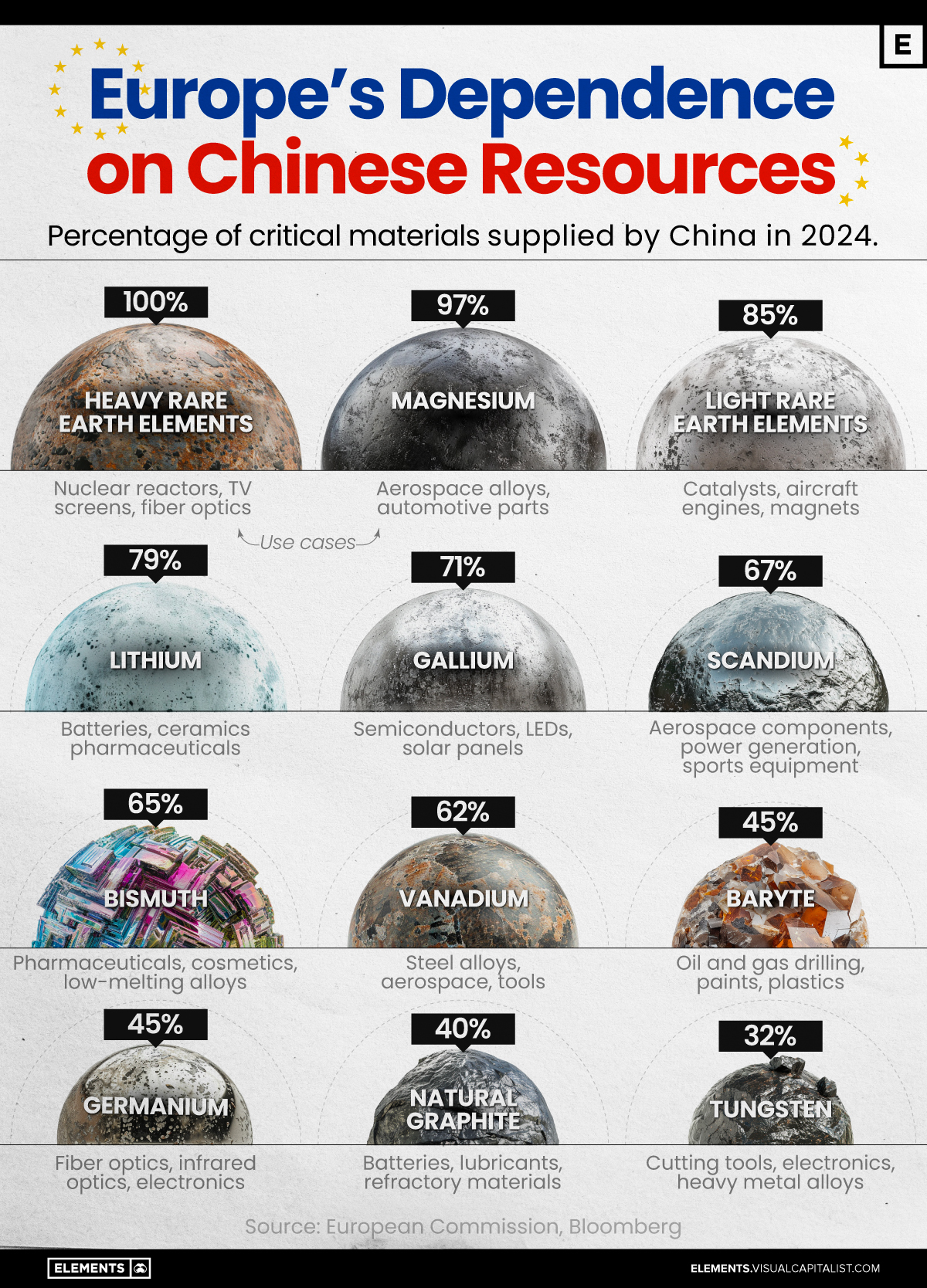

Europe’s Dependence on Chinese Resources (Graphics copyright: VC Elements)

When performance takes the lead, truth has already left the room.

Ursula von der Leyen’s G7 speech last June was a study in deception, theatrics, double standards, and desperation. The centerpiece captured it all.

She held up a permanent magnet, produced in Estonia from Australian ore by a Canadian firm, and declared it a milestone in European sovereignty. It was meant to symbolize independence. Instead, it revealed the delusion that gestures can replace industrial reality.

To put it bluntly, the magnet was ‘made in China’. Brussels still depends severely on Beijing for rare earths. Every claim of values-based industrial or foreign policy collapses under that fact. What autonomy exists when Chinese export licenses dictate EU production timelines?

As Oxford’s Philip Andrews-Speed notes, Beijing’s export controls are much more powerful than tariffs. The European Association of Automotive Suppliers warned that the last restrictions disrupted production and threatened manufacturing continuity across the EU. Indeed, what Brussels calls green transition has become a subsidy to China’s dominance—each wind turbine, each solar panel, each EV deepens Europe’s reliance on Chinese supplies.

Strategic autonomy demands more than jingles. It starts with treating resource dependency as a security threat and accepting the cost of regaining control. That means rebuilding industrial capacity—fast, and at scale. It means rejecting the market dogma that offshored critical sectors, and recognizing that any plan hinging on Beijing’s cooperation in dismantling its own advantage is not a plan at all.

However, the magnet prop moment captured everything Europe gets wrong about China. While Beijing controls 92% of global rare earth processing and tightens its grip, Brussels clings to symbols, illusions—and now, outright fabrications. It wasn’t a breakthrough, but another monument to European delusion.

Europe’s Critical Dependency

The numbers tell a story of collapse by design. China controls 61% of global rare earth extraction—but more critically, it dominates the entire chain from mine to magnet. Europe imports 99% of its rare earth feedstock and 98% of its magnets from China. The dependency is so brutal it borders on the absurd.

This is the result of Beijing’s effort to control the raw materials that power 21st-century technologies. While Europe outsourced mining and processing to lower costs and polish its environmental optics, China weaponized rare earths with long-term intent.

The warnings came early. In 2010, China halted rare earth exports to Japan during a diplomatic dispute, triggering a global price shock. Japan learned the lesson and diversified, secured alternatives. Europe watched—and did nothing.

Now, Xi Jinping’s export restrictions on gallium, germanium, and rare earth magnets confirm what was always clear: control over inputs becomes control over outcomes. Beijing didn’t even need an outright ban—a single bureaucratic decision is enough to stall not just U.S. production, but Europe’s entire industrial core, from wind turbines and cars to defence systems and medical equipment.

Chinese Foreign Minister Wang Yi meets with European Council President Antonio Costa in Brussels, Belgium, July 2, 2025. (Photo: REUTERS/Yves Herman)

Brussels’ Masquerade

Europe’s response remains mired in contradiction. While denouncing China’s weaponization of trade, Brussels deepens its reliance on Chinese production. €5.5 billion is pledged for alternative supply chains—projects without processing capacity and years from operation—yet presented as if they already offset the dependency. Worse than denial, the gap between rhetoric and reality is fabrication.

The distortion wasn’t hidden—it was broadcast: “We were first to act swiftly on Chinese EV subsidies.” In fact, Türkiye and Russia imposed tariffs in July 2023. The U.S. acted in May 2024 with 100% duties, Brazil reintroduced tariffs in January, and Canada followed in August. Brussels launched its investigation in October 2023 and waited until mid-2024 to implement measures, effective from October 30. This was the usual pattern: follow Washington, delay, repackage, declare victory.

The rhetoric now mimics the same tactics once mocked—delivered with theatrical defiance. The claim that “China flooded global markets with cheap rare earths to wipe out competitors. Western mines and processors closed, leaving China to dominate” ignores the truth: Western firms abandoned mining because it wasn’t profitable. And it was dirty. Chinese companies stepped in where others saw no return. This was a vacuum filled by those willing to endure risk over quarterly rewards, not a conspiracy.

And all this was said just as the U.S. and China secured a deal to ease rare earth restrictions—Washington begged, Beijing conceded, and Europe, judging by the timing of the speech four days later, hadn’t even noticed.

Subordination by Choice

With striking selectivity, the Commission condemns China for a “pattern of dominance, dependency and blackmail” yet says nothing as the U.S. tears through the single market in plain sight.

Trump imposes 50% tariffs without justification, enacts sanctions and export bans, coerces allies to decouple from China, demands 5% of GDP to buy American weapons, and uses subsidies to drag European industry across the Atlantic. It seems every major power exploits their leverage. Calling this uniquely Chinese isn’t analysis—it’s denial.

Brussels continues to brand China as a systemic rival and flirts with labelling it a security threat, yet remains dependent on Chinese inputs across critical industries. Foreign policy chief Kaja Kallas calls for confrontation while European industrialists plead for pragmatic engagement to keep production running.

Von der Leyen—who weeks earlier stated that she “believe[s] we must engage constructively… deepen our relationship with China… and even expand our trade and investment ties”—now shifts tones like a geopolitical Dr. Jekyll and Mr. Hyde. Was the performative outrage triggered by Trump’s presence in the room? “Donald is right,” she said. This goes beyond hypocrisy—it’s self-inflicted harm that exposes the incoherence at the core of Europe’s China policy.

This dissonance carries costs far beyond trade. China exploits Europe’s fractures with precision. Brussels speaks of unity while its largest economies pursue divergent tracks. Beijing isn’t just leveraging rare earths—it’s testing whether Europe can act as one when pressure lands unevenly.

Washington, facing the same vulnerabilities, has at least responded. Domestic legislation backs new processing capacity, investments target rare earth refining, and trade deals aim to dilute Chinese control. Slow and partial, these measures still reflect a basic fact: supply chain dependence on a rival power is a weakness one imposed on itself.

Deng Xiaoping’s 1987 remark—“the Middle East has oil, China has rare earths”—was not just prophetic. It became doctrine. What began as an industrial edge is now Beijing’s most effective non-military weapon: China doesn’t just dominate supply; it commands leverage over Europe’s energy transition, industrial base, and defense production. There is no partial fix to asymmetric dependency; bold statements in friendly rooms change nothing.

Europe’s options are, therefore, narrowing. One remains available, and ignored: direct negotiation.

Negotiation or Irrelevance

The U.S. is already pressuring Europe to escalate its stance on China while expanding its own trade restrictions. Direct engagement with Beijing offers the EU a way to avoid being conscripted into a binary confrontation it never chose. If Europe wants to defend its industrial base, it must act as a sovereign power—not collateral in someone else’s conflict.

Negotiation also secures breathing room. Diversification is essential, but alternative sources won’t materialize fast enough to meet immediate needs. China still dominates the processing of critical raw materials. A temporary agreement could ensure supply continuity during the transition, shielding Europe’s production lines from further shocks.

Engaging China would also reinforce Europe’s geopolitical agency. In an international order shaped by rising unilateralism, dialogue becomes leverage. Europe cannot claim autonomy while outsourcing its China policy to Washington, echoing rhetoric and postures. Keeping diplomatic channels open with Beijing is the baseline for defending European interests on European terms.

Do the Work or Stay Down

This requires that European leaders stop mistaking speeches for strategy, performance for policy, and symbols for solutions. The Estonian magnet isn’t a sign of resilience, but a symptom of decay.

Governing means anticipating shifts, not scrambling after them. It requires coherence, not improvisation; honesty, not theatre. A Commission that distorts under geopolitical pressure has forfeited credibility. No slogans. No stagecraft. Do the work.

Until Brussels handles material dependency as the threat it is, Europe will remain captive to decisions made in Beijing. Rebuild industrial sovereignty—or surrender it. There is no third option.