“Defeated as a general theory, the Protectionist doctrine finds support in particular cases, from considerations which, when really in point, involve greater interests than mere saving of labour; the interests of national subsistence and of national defence.”

John Stuart Mill, Principles of Political Economy (1848)

In 2024, we’re globally witnessing an intense subsidy race driven by economic strategies, technological advancements, and national security imperatives. The convergence of these factors has reshaped subsidies into dynamic instruments, serving as both catalysts for self-reliance and geopolitical weapons. A unified overall strategy for economic stimulus and cooperation in new areas to navigate that complex interplay seems necessary.

In 2023, we observed the ominous consolidation of ‘economic security.’ China’s Foreign Relations Law was followed by the EU’s Economic Security Strategy and Foreign Subsidies Regulation. Simultaneously, the U.S. issued an Executive Order on “Investments in Certain National Security Technologies” targeting “Countries of Concern.”

As we move into the new year, the confluence of economic strategies, national security imperatives, and technological advancements continues to gather momentum, propelling global powers beyond mere economic dominance. This transition blurs the lines between economic prosperity and national security, prompting a recalibration for economic security. The focus shifts to enhancing resilience and autonomy across critical areas to minimize global dependencies.

In this evolving setting, protectionism takes root through various security measures, often disguised as government incentives. Subsidies, traditionally seen as a tool for developing public policies, also emerge as a less confrontational coercive measure. This shift is driven by the pursuit of self-sufficiency amid diplomatic efforts, exemplified by recent China summits with the U.S. (San Francisco) and the EU (Beijing).

Despite consistent expansion of trade until 2022, evidenced by record volumes, current barriers act as a defensive shield, limiting access to strategic goods and disrupting global trade patterns. This protectionist trend is also reflected in investment data, such as the decline of U.S. capital into China—from around 20 billion annually in 2010 to 8.7 billion in 2020, and the fragmentation of European and Chinese FDIs. This is particularly significant considering that investment serves as a precursor in shaping the trajectory of international trade.

Shifting From Safeguarding Domestic Industries and Jobs to National Security

Subsidies have transformed into versatile tools, playing a dual role as catalysts for self-reliance and geopolitical instruments. This evolving function, initially focused on safeguarding interests and jobs, is undergoing a transformative shift. Geopolitically, subsidies now serve as strategic tools to secure both economic and political advantages. Moreover, they play a crucial role in advancing technologies for national defense, strengthening military capabilities, and safeguarding strategic interests.

Looking ahead to 2024, strategic foresight unfolds with substantial investments in national technologies, reducing reliance on foreign sources and enhancing resilience against the unpredictable currents of global disruptions.

Positive effects include support for innovation, economic growth, competition, and reduced prices for consumers. On the other hand negative consequences involve market distortions, less efficient production, trade imbalances, and environmental damage: fossil fuel subsidies cost the global economy $7 trillion in 2022 (7% of GDP), and added to climate change and air pollution.

Global government spending on subsidies, steadily increasing since 2003, peaked at 54% of total government expenses in 2021, impacting economic growth, social welfare, and environmental sustainability.

Subsidies: The Currency of International Power

In a resurgence, Mill’s exception contends that subsidies and protectionist measures are justified when national defense interests are at stake.

Subsidies have become a currency of international power, intensifying amidst rising protectionism. Governments strategically deploy them to secure access to vital resources and technologies. This fosters domestic production of critical goods like semiconductors, pharmaceuticals, biotechnologies, and clean energy resources, reducing dependence on foreign suppliers and mitigating the risk of supply disruptions.

Consistently, China strategically uses subsidies across various industries, intertwining them with national security since the 2006 release of the strategic and heavyweight industries list. Xi’s expanded definition of national security encompasses subsidized sectors, crucial for self-sufficiency, competitiveness, and defense. Heavy subsidies strategically shield the manufacturing base from external pressures.

Departing from traditional support for free markets, Trump accused Europe of an unusual and unjustified claim: that steel exports posed a security threat. In a similar vein, Biden—a critic of China’s subsidies, strategically allocates substantial ones, especially to the semiconductor industry, illustrating how the U.S. leverages this tool for political objectives.

The 2022 Inflation Reduction Act (IRA), a $369 billion subsidies initiative, aimed at addressing inflation and economic challenges, serves an additional purpose, strategically bringing back production of renewables to reduce dependence on China. This move potentially harms foreign companies, particularly European, redirecting green tech resources to the U.S. with attractive incentives, challenging Brussels to compete financially.

The EU contends that specific subsidies jeopardize fair competition. However, the EU, recognizing the need for economic support post-COVID-19, eased stringent state aid rules to empower member states in subsidizing industries. This move has altered the level playing field, overstepping EU regulations, and eroding the single market’s core. Wealthier EU states, notably Germany and France, have extensively supported their companies, allegedly for economic stability, creating imbalances and raising concerns about overall equilibrium.

As Europe justifies substantial investments in the “just energy transition” and enhanced energy security through the Green Deal—supposed to deploy up to $380 billion by 2030, reports from the FT indicate a significant surge in EU state aid expenditure from €103 billion in 2015 to €334 billion in 2021. Additionally, between March 2022 and August 2023, Europe greenlit an extra €733 billion in state support. Notably, half of this amount corresponds to Germany, shedding light on the scale of European state aid.

2024: Subsidies Shaping Global Geopolitics

Analyzing evolving trade dynamics among the U.S., China, and the EU is crucial to understanding how subsidies impact global trade. Since subsidies play a central role in economic strategies, exploring potential trade disputes will shed light on the web of geopolitical relations.

Political uncertainties loom, threatening to intensify reliance on economic security policies. In 2024, as the U.S. and China court the EU, concerns arise about the potential persistence of industry subsidies, posing risks to their prospective ally, and others. Against the backdrop of the China-U.S. rivalry, both nations grapple with significant domestic challenges. The U.S. navigates political polarization affecting governance, coupled with an impending election heightening policy uncertainty and potential legislative challenges. Meanwhile, China confronts macroeconomic hurdles such as a real estate crisis, municipal debt, youth unemployment, an aging society, and economic deceleration.

In Europe, the drive for substantial state aid gains momentum due to competitive pressures, influenced by American green subsidies and enduring Beijing’s support to domestic industries. The EU’s response, reflects uncertainty, illustrated by institutional negotiations on the Net Zero Industry Act—where nuclear energy joins the list of emission-free technologies- or the politically motivated investigation into Chinese EVs. Despite intentions, the EU faces limitations, lacking the fiscal capacity of China and the U.S. for a comprehensive reindustrialization process.

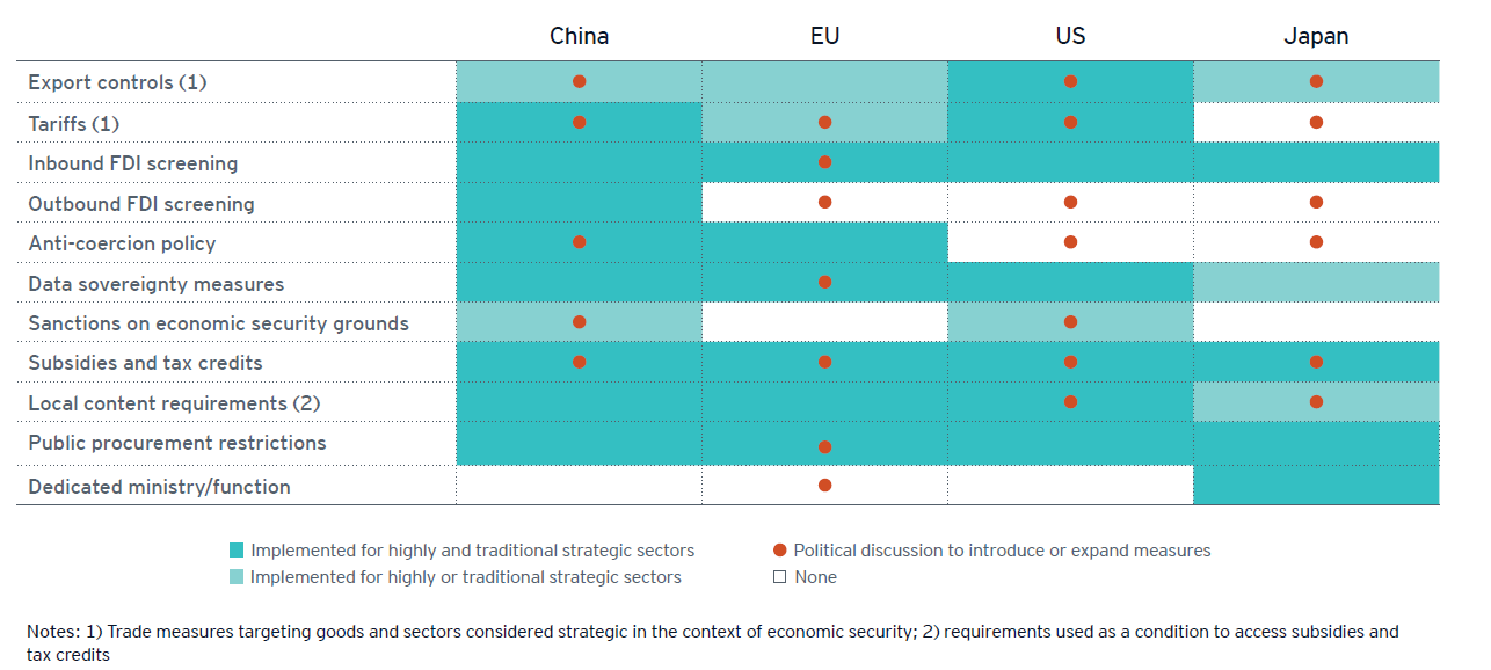

Official policy measures related to economic security, select jurisdictions

Source: EY Geostrategic Business Group analysis. 2024 Geostrategic Outlook

Subsides as a Double-Edged Sword

Navigating the complexity of subsidy usage requires precise policy calibration. The interplay of economic policy, geopolitics, and global trade unfolds intricately, reshaping international competition. While subsidies can stimulate economic development, their drawbacks include market distortions, supply chain disruptions, cost inflation, uncertainty in financial projections, and unsettling investment strategies.

To attain objectives, subsidies should embody transparency, accountability, and non-discrimination in execution. Relying on the national security rationale poses risks, potentially undermining the multilateral trading system’s foundations, fair trade principles, and cross-border transactions.

In a landmark decision, the WTO agreed in June 2022 to curb harmful fisheries subsidies, showcasing the potential for global agreements that benefit us all and contribute to a sustainable future.

Similarly, global powers should unite and craft a comprehensive economic stimulus strategy encompassing prudent fiscal and monetary policies. Cooperation should transcend traditional trade policies, expanding into novel areas. Discussions, given potential inadequacies in the existing WTO framework, should explore groundbreaking approaches, fostering agreements on trade liberalization, financial regulations, investment promotion, and other effective tools. The focus should be on nurturing free trade and open markets globally, committing to reducing or eliminating tariffs on specific goods and facilitating increased FDI.

Traversing the intricacies of our time requires such global alliances, where collaboration flourishes, innovation takes root, and a path towards a more resilient and interconnected future is forged.