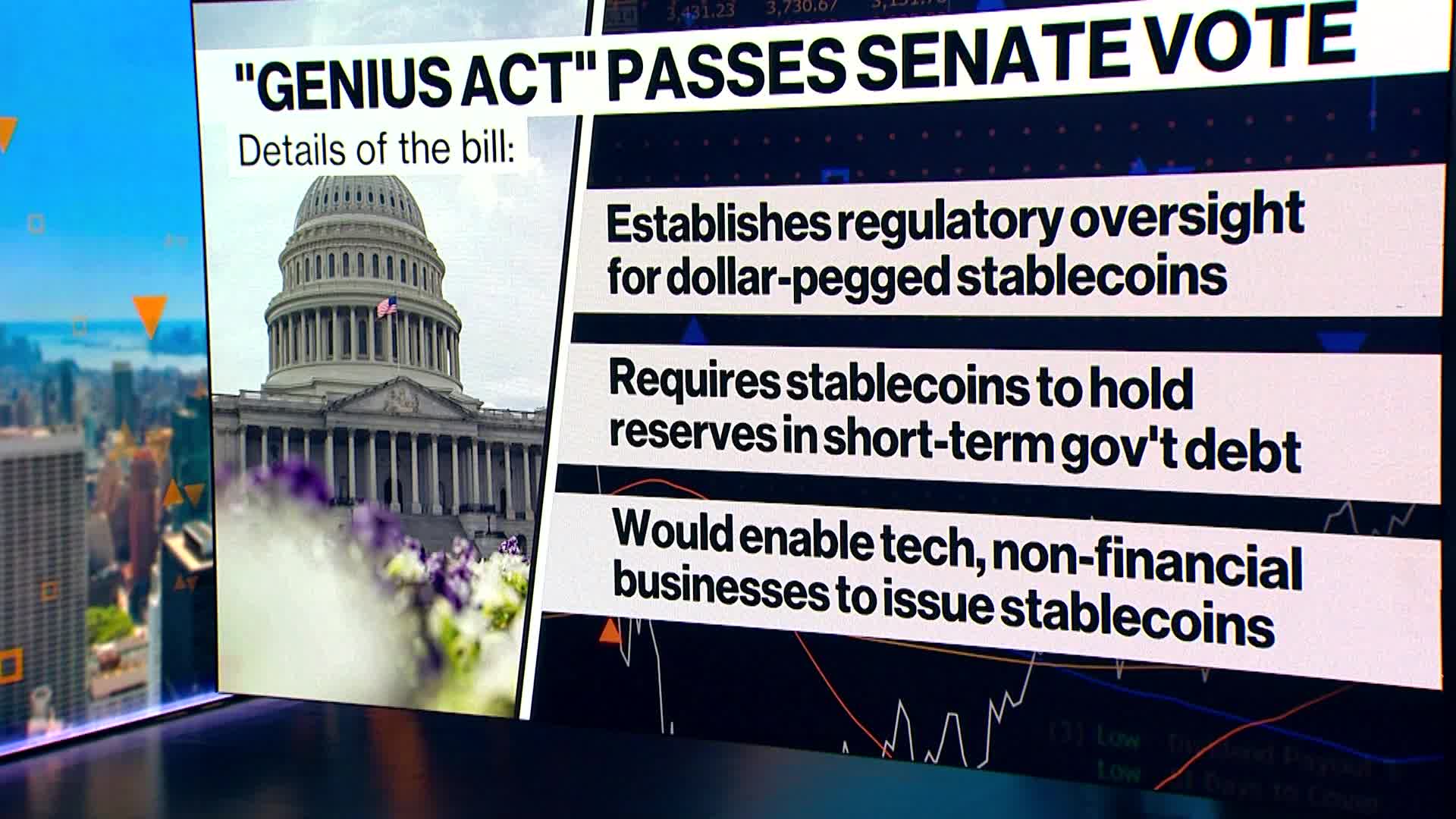

While Washington continues to dress up its economic strategy as innovation-driven and market-oriented, the passage of the so-called GENIUS Act suggests the emergence of a desperation, leading to the reckless engineering of systemic financial instability under the guise of modenisation. By enabling U.S. Treasuries to be used to underpin the issuance of so-called stablecoins, the new laws create a synthetic loop of leverage, which could threaten the very stability of the American and global financial systems.

If only this was an academic concern, or a fringe topic animating discussions at crypto conventions. It’s not. Rather, the move has implications for geopolitical trends with consequences ultimately on economic stability in the United States and globally. In the geopolitical arena, I wouldn’t be surprised if China’s leadership is watching closely and even less surprised if those in Beijing do not interpret this development as both a desperate liquidity manoeuvre, and a dangerous sign of imperial overreach and financial rot.

The Stablecoin-Treasury Loop: A Self-Referential Money Machine

At the core of the GENIUS Act is a mechanism that allows private actors to issue stablecoins backed 1:1 by U.S. Treasuries. Whereas banks use Treasuries as regulatory liquidity buffers, these new stablecoins use them to mint new quasi-currency, which could then be used to buy more Treasuries, backing the next issuance of stablecoins, and so on. The stablecoin issues garner the yield from the Treasuries, while downstream risks are pushed out to everyone else.

Treasury bonds are purchased and placed into reserve by a financial entity. Against that reserve, stablecoins are minted. These stablecoins are then used to buy more Treasuries, which can back more stablecoins, and so on. At each stage, synthetic financial products are built on top of the stablecoins - derivative instruments, tokenised yield products, and option-linked claims.

The end result is a financialised loop, built on sovereign debt, spinning liquidity from nothing and layering private yield extraction atop public obligations. This structure is detached from the real economy (it finances speculation not production) and highly leveraged (each Treasury can support multiple downstream claims). Systemically, this structure is fragile as it is dependent on peg stability and perpetual Treasury issuance.

And crucially, it undermines the perceived safety and utility of Treasuries themselves. Far from being a neutral global reserve asset, U.S. debt is now the feedstock of synthetic risk. In this loop, "risk-free" Treasuries are no longer risk-free. They become the base collateral for an expanding chain of synthetic financial instruments. This, for those with even modest memories will understand to be precisely the kind of opaque web that led to the global financial crisis of 2008.

Seeing Through the Façade

This is where the geopolitics cuts in. China has been steadily reducing its holdings of U.S. Treasuries for over a decade. It has done so not because of some grand anti-dollar conspiracy, but because it has recognised what the GENIUS Act now makes plain. That is, the U.S. is willing to use its sovereign debt not to build productive capacity (it hasn’t done that for decades), but to construct ever more elaborate financial contraptions that benefit speculators while inflating systemic risk.

This is financialised psychosis par excellence, with fictitious capital expansion and over-accumulation reaching its apogee. Set against this backdrop, we have the unfolding tariff negotiations between China and the U.S. The question is, how does this intensified risk feed into these negotiations? One must wonder why would China sign onto any "grand bargain" - whether on tariffs, supply chains or tech transfer - with a counterpart that is so clearly financially unstable by design?

Compounding this, those inside Washington’s Beltway are now reviving the blunt instrument of tariff diplomacy. Senator Lindsey Graham’s recent push to enable the President to impose 100% tariffs on any country purchasing Russian oil is a direct shot across China’s bow. These, for Graham, are “bone crunching” tariffs designed to crush the Chinese economy. He argues that confronted with the prospect of losing the U.S. market or maintaining trade with Russia, China (and India and Brazil - the BRICS nations in large part) will choose the American market. The bill is timed to coincide with the 50 days’ ‘grace’ period Trump announced when he took ownership of the war in Ukraine by announcing a decision to supply armaments to Ukraine.

China has seen this before and didn’t flinch. In response to Trump’s first tariff salvos on Liberation Day (April 2, 2025), China retaliated proportionately and forced a political climbdown. History is likely to repeat itself. China has options - not least in rerouting trade, which it has successfully accomplished over the past three months, deepening South–South supply chains and accelerating de-dollarisation. Gerard DiPippo has recently estimated that in Q2, China found replacement markets for 82% of its lost exports to the U.S.

Fiscal and related measures have also seen the domestic market expand, contributing to ongoing economic growth in China in spite of (or perhaps because of) Trump’s tariffs and associated uncertainties. China’s H1 performance points to growth of 5.3%, underpinned by expansion in consumption expenditure, with retail spending growing by 5%, rising real wages and ongoing capital expansion in manufacturing and technology sectors. Credit growth rates have also reached about 8.9% compared to the same period a year ago, delivering the catalytic impulses that sit behind China’s economic expansion. Interestingly, we can also observe that consumption demand’s contribution to GDP growth has, over the past 5 years, increased to around 60%.

What this shows is that the economic rationale for engaging with the U.S. is eroding. The U.S. market contributes no more than 14% of total global import demand. It is equivalent to about that amount of China’s exports, with China’s trade surplus with the U.S. contributing no more than 3% of total GDP. If America’s Treasury market is no longer a safe haven, and if its macroeconomic policy is weaponised through synthetic stablecoins and unilateral tariffs, then the incentives for trade cooperation diminishes. Instead, while severing trade relations would deliver ‘lose-lose’ outcomes, the calculus could well be that China can cope with the short-term losses and manage a reasonably rapid adjustment. If this calculus plays any role, then strategic detachment will be a viable (if not the first order preferred) option. In this case, Beijing dragging out negotiations, imposing its own import-substitution strategies and continuing to unwind its exposure to dollar-based assets will be telltale indicators.

Systemic Risks, Global Repercussions

The GENIUS Act may appear clever in Washington, but from Beijing - and likely from across many other parts of the world - it looks like financial desperation with global consequences. It further hollows out confidence in U.S. government debt. It undermines the dollar’s credibility as a reserve currency, as if this needed any more undermining given the intensified weaponisation we have seen over the past decade. Of further alarm is the fact that it creates an artificial arbitrage machine that serves Wall Street but not Main Street. And it sends a loud geopolitical signal: America is betting the house on financial engineering.

At a time when U.S.-China tensions are rising, and global tectonic plates are realigning, the United States has chosen to financialise its sovereign debt in a way that repels one of its largest creditors. Worse, it has done so in exchange for… what? Some stablecoin-fueled yield farming? Crypto derivatives? Private gains for fintech platforms? The geopolitical cost could well be staggering. And the consequences - in supply chains, trade balances and diplomatic leverage - are only beginning to be felt.

As China continues its exit from Treasuries, it will not do so in isolation. It will do so as part of a broader decoupling from the U.S. economic orbit. What is unfolding is a production and trade unwinding, and a currency realignment that gradually pulls the world’s most important manufacturing power out of America’s supply chain architecture. For the U.S. economy, this could mean reduced availability of consumer goods, scarcity of strategic inputs (rare earths, APIs, solar panels and electronics), rising costs across key sectors, and longer lead times and lower inventories.

In short, America may find itself with abundant synthetic liquidity, but constrained access to the basic goods it needs to run a modern economy and deliver an affordable standard of living. The adjustment that will become a necessity is one towards a higher cost of living and higher cost economic structure.

The risk isn’t financial collapse per se; the U.S. cannot by definition suffer from involuntary insolvency. The risk is material deprivation. We could end up in a paradox where the U.S. dollar system is awash in tokenised derivatives backed by Treasuries, but shelves remain empty, factories are idle for want of intermediate goods and raw materials, and infrastructure projects stall for want of parts.

For international holders of U.S. Treasuries, this is not the time to wait and see. It is a time for a managed exit, before the de-pegging risk of so-called stablecoins and synthetic leverage spiral out of control. As for China, it no longer needs to call America’s bluff. The bluff is being revealed from within.