When President Richard Nixon unilaterally ended the convertibility of the U.S. dollar to gold in 1971, a price shock reverberated across the world. Initially portrayed as a temporary measure, it made the U.S. dollar a permanently floating fiat money, with the support of the petrodollar following the ‘70s oil crises in the Middle East, giving the U.S. a major global economic advantage. As gold no longer offered a yardstick for value, the perception of value replaced value itself. In geopolitics, the U.S. continued to lean on major Western economies and Japan, but in the international economy it has refused to renounce its exorbitant privilege.

Today, however, Washington’s contested sanctions and tariff hikes are putting the U.S. dollar at risk as a global reserve currency, while the internationalization of the Chinese yuan is fueling complementary globalization.

U.S. Dollar after the American Century

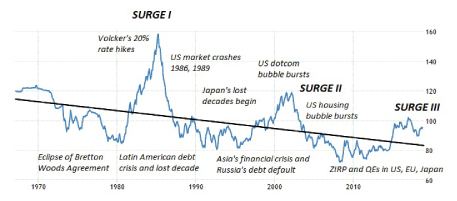

Since the 1970s and the eclipse of the Bretton Woods system, the U.S. dollar has demonstrated continued resilience, as evidenced by the U.S. Dollar Index (DXY), which measures the currency against a basket of half a dozen major currencies. Nevertheless, three periods of dollar surges have been followed by periods of decline that have caused much international collateral damage. Each of these surges reflects the progressive relative erosion of the dollar. What we call a strengthening dollar today is 60% of the 1960s greenback (Figure).

Figure U.S. Dollar Index: Structural Trend, 1970 – 2018

* Trend line in black.

According to SWIFT (Society for Worldwide Interbank Financial Telecommunication), the share of the U.S. dollar as an international payments currency continues to account for more than two-fifths of the global total (42%). Yet, in historical view, the share of the U.S. dollar in the world economy has suffered a massive shrinkage. The world economy is no longer controlled by the U.S. dollar, but a dollar/euro duopoly. The share of the euro (37%) is almost at par with the dollar in international payments. Other major currencies feature the Japanese yen and British pound (4% each), followed by the Canadian dollar, Swiss franc, Australian dollar, and Chinese yuan.

Despite the Fed’s tightening since the middle of 2015, the share of the U.S. dollar as an international payment currency has fallen somewhat, along with the Chinese yuan, whereas the British pound has plunged by 5 percentage points. While the Japanese yen has expanded more than a percentage point, the euro has soared by a whopping 8 percentage points.

Today, America’s sovereign debt is almost $22 trillion. America’s role in the global economy has shrunk to about a fourth of the total. Furthermore, Washington has suffered from trade deficits since the early ‘70s. Yet, this dramatic decline has not been registered by the International Monetary Fund's international currency reserve basket (SDR). The share of the U.S. dollar in the IMF basket remains 42% of the world economy, as it was in 1981, even though the share of the U.S. GDP in the global economy has almost halved.

Eclipse of the Petrodollar, Rise of the Petroyuan

At the same time, over the past few years, the internationalization of the Chinese yuan has accelerated significantly. In addition to its inclusion in the IMF international reserve assets basket, China has established a payment-versus-payment system for transactions involving the Chinese yuan and Russian ruble. The China Foreign Exchange Trade System (CFETS) hopes to launch similar systems with other currencies based on China’s huge multi-decade, multi-trillion One Belt One Road (OBOR) initiatives. As the OBOR expands the connections between major economies in Asia, Africa, Europe and Latin America, member countries are candidates for RMB-denominated payments.

Recently, China has also become the largest global oil consumer. Last year, its oil imports exceeded those of the U.S. With major oil exporters like Russia, Venezuela, Iraq, Iran, and Saudi Arabia, China’s market means leverage, and many of these suppliers have either already agreed to price their sales to China in RMB, or are actively considering it. In turn, major commodity exporters, such as Indonesia, have joined in non-dollar trades.

When a growing share of China’s oil imports will be priced in yuan, it will result in large RMB reserves in oil exporting countries, which will be spent on Chinese exports, or recycled into China’s financial markets. As demand for RMB assets increases, the role of the U.S. dollar for trading purposes will lessen.

In secular terms, the petroyuan will mean a paradigm shift in global asset allocations to China’s financial markets, as long as China continues to remove or significantly reduce capital controls for yuan-priced oil trading. Between 2014 and 2017, global institutional investors already tripled their China holdings of onshore bonds.

Three Future Scenarios

Recently, the Trump White House’s 'America First' stance has led several countries - including China and Japan - to reduce their Treasury holdings, and even dump their Treasuries (as Russia did last spring when it divested some 90% of its holdings). When Washington relies on sound economic policies and international cooperation, most countries rely on U.S. Treasuries. But when economic policies foster dissension and polarization and divide-and-rule geopolitics replace cooperation, many countries are increasingly skeptical about the sustainability of the U.S. economy and the U.S. dollar. Many countries have also expanded their gold holdings, perhaps preparing for a return of a gold standard of some sort. As a result, the reserve status of the U.S. dollar has plunged to a half-a-decade low.

The likely continued decline of the U.S. dollar and the rise of the petroyuan means that, looking forward, the world economy needs a multipolar mix of major reserve currencies that includes both major advanced and large emerging economies. There are three likely scenarios for how and when this transition will occur.

Phased Transition. The change may occur through a Phased Transition scenario over time, which would be the least costly and most cooperative scenario. In terms of global economic outlook, it would be the preferable trajectory. However, it would require international consensus that is currently largely missing.

Disruptive Crisis. Conversely, the transition may materialize through a Disruptive Crisis scenario, which shuns international consensus, and would prove most costly. In this case, Washington would increasingly resort to its military superiority and exploit geopolitics to further its economic ends.

Bumbling Through. Thirdly, the transition may happen through a Bumbling Through scenario, which would combine both offensive and accommodative trial-and-error efforts with the best and worst of the first two scenarios. At times, the transition would seem ideal; at other times, adverse; at all times, inherently erratic and uncertain.

Until recently, the Bumbling Through scenario seemed to be the primary trajectory. But as secular stagnation has spread across the U.S., Europe and Japan, causing increasing growth deceleration in the large emerging economies, Washington’s new insular policies suggest that, in an adverse crisis scenario, Disruptive Crisis could become the primary trajectory.

Nevertheless, in the longer term, only a phased transition makes sense, particularly to the U.S. economy because it would minimize the prohibitive costs that would be associated with panic responses to a Bumbling Through scenario and certainly to a desperate Disruptive Crisis scenario. Indeed, no sound investor would rely on a single stock, which once dominated the markets; investors prefer diversified portfolios. The U.S. dollar had its dominant position in the immediate postwar period, but its fundamentals have been eroding ever since the ‘70s and the petro-dollar arrangement, which has benefited Washington’s geopolitics, but not the global economy. With the rise of the large emerging economies – today China; in the coming decades, India and others – the world economy needs a more diversified multipolar reserve-currency basket.

Regardless of which scenario plays out, the inescapable reality is that the presumed strength of the U.S. dollar no longer relies on America’s economic fundamentals, but on a perception that such fundamentals will prevail, despite drastic shifts in the world economy.

As international reactions to the Trump administration’s ‘America First’ policies suggest, Washington is increasingly isolated within the international community, both among major advanced economies and the largest emerging economies. Since the 2008 crisis, China, Russia, some of the Middle East’s oil-exporting countries, and even Japan have sought more sustainable alternatives to the aging dollar. And this, past fall, outgoing European Commission President Claude Juncker said “It is absurd that Europe pays for 80% of its energy import bill – worth €300 billion a year – in U.S. dollars when only roughly 2% of our energy imports come from the United States.” Like most Europeans, he believes the euro should become the face of a “more sovereign Europe.

The U.S. dollar is no longer a sustained safe haven, but a temporary safe house. That’s why the day of reckoning for the U.S. dollar is just a matter of time.