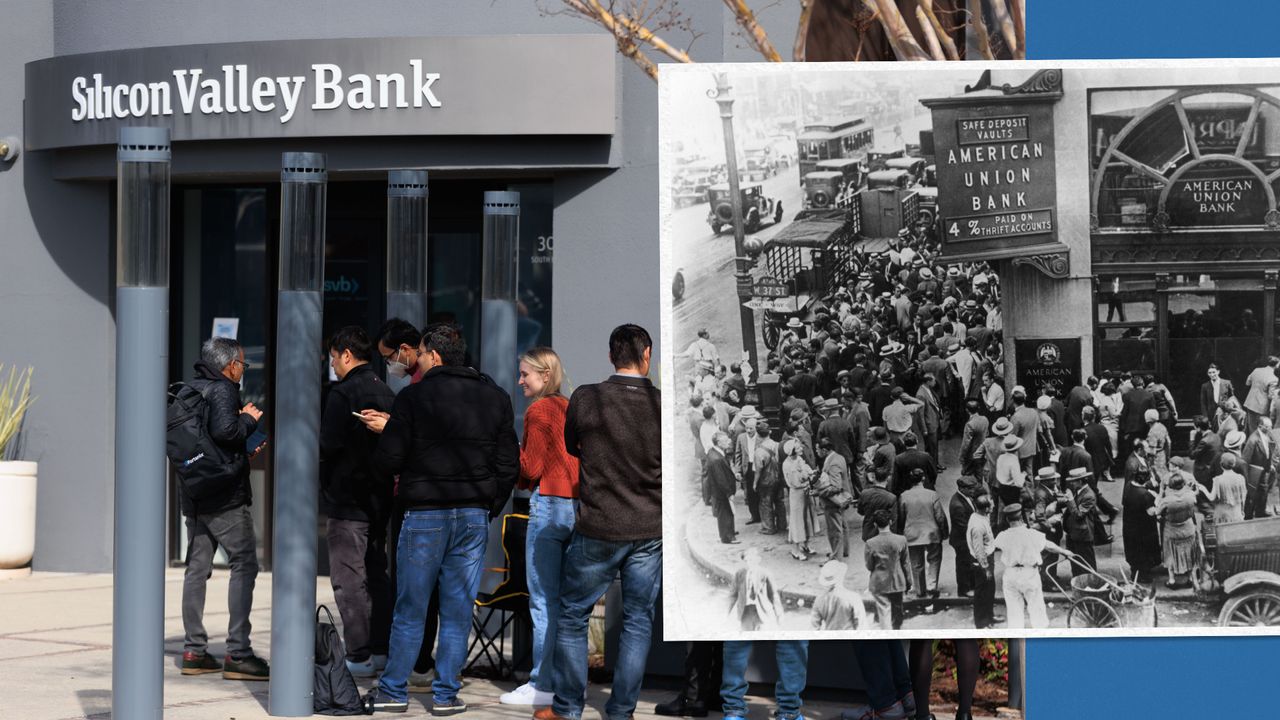

Silicon Valley Bank's downfall is the largest failure of a financial institution since Washington Mutual collapsed at the height of the financial crisis more than a decade ago.

With the memory of the global financial crisis still raw, the recent banking turmoil sounded the alarm on new financial risks — another sign that financial security has become the Achilles’ heel of the U.S. economy.

Financial risks are still in the background. For one thing, the banking turmoil stems from the influx of deposits during the pandemic. Households in the United States accumulated some $2.3 trillion in excess savings in 2020 and 2021, and U.S. businesses also plowed cash into banks because of a scarcity of high-yielding options.

Second, banks bought U.S. treasuries in big quantities with their deposits, though not likely to trigger any credit crisis; but market risks cannot be ruled out. Rapidly rising interest rates have caused steep fall in the price of safe government bonds. These debts will be repaid by the U.S. government, but the bond resale price is speculative and therefore volatile. It tends to surge in line with market expectations of the future trajectory of interest rates. Banks therefore purchased treasuries as a safe haven against their lending activities and speculative activities, albeit still exposed to interest rate risks.

Third, banks also purchased large amounts of mortgage-backed securities (MDS). By the end of 2022, banks had invested $2.8 trillion in MDS, fueling a real estate boom during the pandemic. However, since February this year, U.S. home sales fell by 22.6 percent year-on-year, and the median sale price fell year-on-year for the first time in 11 years. Unrealized losses on MDS held by banks were in the ballpark of $368 billion. Rising interest rates could force banks elsewhere to sell their holdings at a loss, further depressing securities prices.

Be it the Federal Reserve’s bailout of troubled banks, or the release of dollar liquidity by the central banks of Canada, the United Kingdom and Switzerland, it is a stopgap solution for a short-term crisis that can only provide temporary palliative relief. The potential contagion risks behind many banks, particularly those with maturity mismatches, complex asset structures and risk exposures, are insidious before they are exposed. Market volatility exacerbates shrinking bank earnings, which in turn will amplify the liquidity crisis for banks.

More important, central bank rescue measures have come under much fire. On one hand, they may create incentives for risk-taking, giving banks the impression that a central bank bailout is a given in the event of a financial panic, and thus encourages bets on risky investments, leading to moral hazards and a never-ending demand for emergency loans from the central banks.

On the other hand, by using a bazooka on what appears to be apparently manageable problems, the central banks may inadvertently send a signal to the financial markets that the situation may be worse than previously thought and that the financial system is more fragile than perceived, thus triggering a further spread of panic.

In the face of uncertainty, American households may save more and spend less, and businesses may reduce hiring and investment, which threatens to interrupt the U.S. economic expansion and tip the economy into recession.

On one hand, banking sector turmoil is a test for U.S. consumers. Any spillover effects from the banking sector could imperil consumer spending, which accounts for about 70 percent of U.S. output. Banking turmoil could make it more difficult for consumers to access loans to buy homes, cars and other big-ticket items. In 2022, about 80 percent of new car transactions and about 40 percent of used car transactions in the U.S. involved loan financing, with more than half sourced from banks and credit unions and another quarter from automaker subsidiaries such as Honda Financial Services or Ford Credit, according to credit reporting firm Experian. Credit contraction not only leads to postponed spending on large purchases but will also lead to a loss of consumer confidence and thus a reluctance to take another financial leap.

The staying power of U.S. personal spending has been supported by three factors over the past year. One is excessive savings during the pandemic; second is income growing faster than inflation at year-end 2022; third is that consumers received additional credits. With credit becoming increasingly limited, personal spending power is driven by the first two factors.

Currently, U.S. consumers still have savings totaling around $800 billion, and if they continue to rely on excess savings, and income growth continues to outpace inflation, then U.S. consumption growth could remain relatively stable. In fact, wages in the U.S. rose at a historically strong pace in 2022, although it failed to keep pace with inflation. According to the U.S. Department of Labor, average hourly wages for private sector employers rose by 5.1 percent in November compared with a year earlier, while consumer prices rose by 7.1 percent over the same period.

On the other hand, a panic in the banking sector could hit U.S. corporate profits broadly. Banking problems could affect all types of corporate profits. The biggest risk is that banks will lend less, thus weakening the overall economy. As bank customers look for higher yields on money market funds, it will leave banks with two options: either bear with the outflow of deposits and further drains on lending power, or pay higher interest rates on deposits at the cost of their own profit margins.

In such an environment, banks may become more conservative regarding who they lend to, which in turn creates a vicious cycle. Higher restrictions on bank lending would make it more difficult for businesses to obtain car loans, mortgages or small business loans. Economists at Goldman Sachs estimate that tighter standards would be equivalent to a quarter or half a basis point increase in the Federal Reserve’s benchmark interest rate.

According to FactSet, earnings per share for S&P 500 companies in 2023 have fallen by about 11 percent over the past year. The Fed’s ongoing rate hikes, designed to curb inflation by curbing demand in the economy, have already begun to erode company sales. Higher financing costs are putting pressure on company earnings. Reduced lending by banks could suppress profits even further.

The real capital in financial markets is trust. When trust falters, dislocation is in the offing. Panic in short-term financing markets could ignite a larger crisis in the financial markets and the overall economy. As market panic intensifies, the economy and credit markets could be trapped in a vicious circle of spiraling self-destruction, depriving the economy of the vigor it needs for growth.