Brian Wong, Assistant Professor in Philosophy and Fellow at Centre on Contemporary China and the World, HKU and Rhodes Scholar

Sep 19, 2025

China’s economic struggles have implications for its trading partners across the globe, notably in Europe. What can Beijing’s fight against ‘involution’ tell the world about its future trading prospects?

Zhang Monan, Deputy Director of Institute of American and European Studies, CCIEE

Aug 22, 2025

The special administrative region has become a pioneer in institutional and technological innovation. Its recent initiative represents a significant opportunity for the region and a crucial step in China’s broader efforts toward the internationalization of the yuan.

Zhang Jun, Dean, School of Economics, Fudan University

Jul 18, 2025

Chinese manufacturing has come a long way – and by some measures, it is stronger than ever. Whereas foreign-invested enterprises were the driving force behind China’s manufacturing exports 20 years ago, most of these firms are now leaving China, having lost their market share to domestic competitors. And these dominant Chinese companies are not limited to the low-value-added production of the past. They are global leaders in many high-tech industries, such as semiconductors and electric vehicles, where they hold an absolute price advantage.

Yi Fuxian, Senior Scientist at University of Wisconsin-Madison

Jul 07, 2025

China’s economy today bears an unsettling resemblance to Japan’s in the 1990s, when the collapse of a housing bubble led to prolonged stagnation. But Japan’s “lost decades” were not the inevitable result of irreversible trends; they reflected policy blunders, rooted in a flawed understanding of the challenges the economy faced. Will Chinese policymakers make the same mistakes?

Ghulam Ali, PhD, Monash University, Australia

May 23, 2025

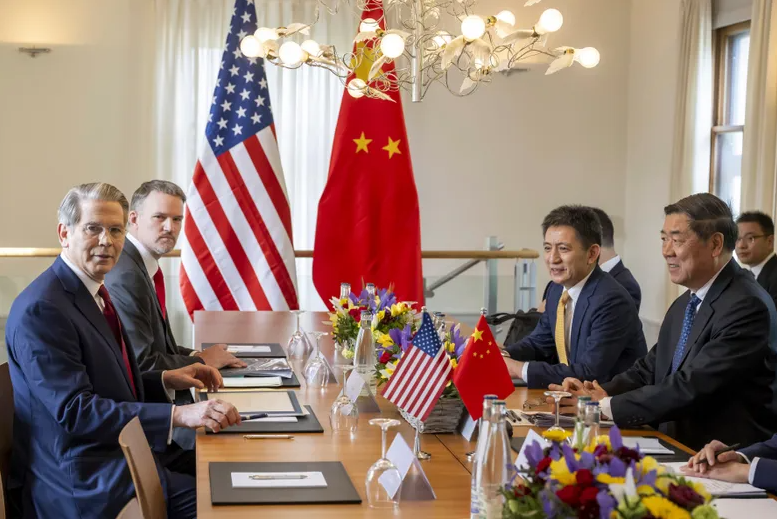

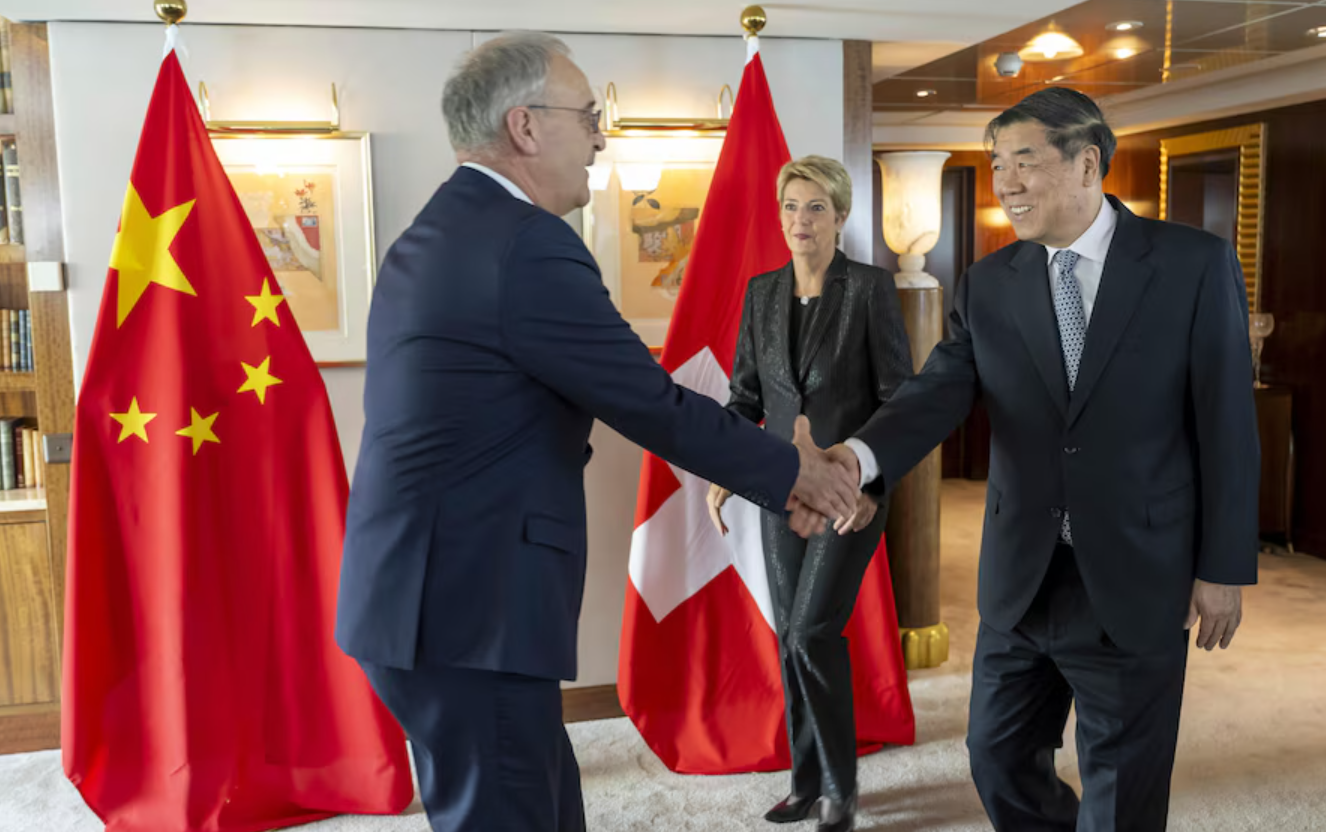

U.S. President Donald Trump’s unwarranted global tariff war, which began on April 2, 2025, with steep 145 percent tariffs on China, alerted economists to unforeseen global consequences. As China’s economy relied heavily on manufactured goods, and with the U.S. as its largest export destination, the Trump administration believed that imposing tariffs could weaken China and compel it to comply with its terms and conditions. Beijing, well-prepared in advance, proved this belief wrong. China’s resolute response within weeks forced the U.S. to enter negotiations, which took place from May 10 to 12 in Geneva, in which the two sides agreed to suspend tariffs for 90 days. The success of Beijing’s policy relied on several factors.

Dan Steinbock, Founder, Difference Group

May 14, 2025

Despite de-escalation in Geneva, trillions of dollars may have been lost in the unwarranted trade wars.

Zhou Xiaoming, Former Deputy Permanent Representative of China’s Mission to the UN Office in Geneva

May 06, 2025

A trade deal between China and the United States is nowhere in sight. The mountain of issues could take a long time and enormous effort to resolve. It’s certainly not going to happen in three or four weeks, as Trump has suggested. More likely, it will be months, if not years.

Zhang Monan, Deputy Director of Institute of American and European Studies, CCIEE

May 02, 2025

Donald Trump’s “reciprocal tariff” policy is intended to push back against globalization, but its inherent structural problems will only accelerate the trend of “de-Americanization” worldwide.

Shang-Jin Wei, Professor, Finance and Economics at Columbia University

Apr 22, 2025

China has taken a tough stance against US President Donald Trump, matching the last two rounds of US tariffs with tariffs of its own. The US tariff on goods from China is now 145%, while China’s is 125%. Why does China take such a position, and are there any off-ramps that would allow it to mitigate the costs of a prolonged trade war?

Zhang Jun, Dean, School of Economics, Fudan University

Apr 22, 2025

There are signs that the Chinese economy has been improving, owing to the government’s September 2024 stimulus package. Year-on-year GDP growth in the first quarter of this year reached 5.4% – continuing the marked acceleration from the third quarter of last year.

Back to Top

- China-US Focus builds trust and understanding between the U.S. and China through open dialogue among thought leaders.

- Our Offerings

- Topics

- Videos

- Podcasts

- Columnists

- Research Reports

- Focus Digest

- Stay Connected

-

Thanks for signing up!

- Get the latest stories from China-US Focus weekly.