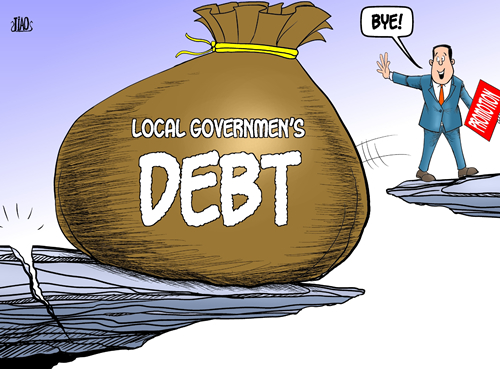

(By Jiao Haiyang/China.org.cn)

China's post-crisis stimulus boosted economic growth in the short run at the expense of long-term growth. Local governments were responsible for building infrastructure in order to increase fixed asset investment. However, due to limited revenues, local governments were forced to borrow in order to build roads, bridges, and buildings. In the face of ongoing slow growth and a continued lack of revenue, local governments have found themselves saddled with debt and interest repayments, unable to get back on their feet. To make matters worse, local governments were forced to spend in order to maintain employment during the US-China trade war. Now, the central government is attempting to rein in excessive debt by better monitoring debt and by sending officials to local provinces with the task of improving the financial outlook in these areas.

Bad debt, big time

The central government affirmed its commitment to reducing financial risks in December 2017. There have been many risks to address in recent years, including shadow banking risks and state enterprise indebtedness, which have created challenges in allocating funds and innovation for any single area. However, local governments have found themselves in great financial trouble, as they have insufficient revenue to cover their debts. Since they are at the heart of China's policy transmission scheme, they must remain financially viable in order to continue to implement government policy. Therefore, they require major focus.

China's central government has already sent officials to 15 provincial governments to take on the challenge of reducing debt despite stagnant growth in some regions. For example, Tan Jiong, a vice-president of the Industrial and Commercial Bank of China; Li Bo, former chief of the central bank’s monetary policy department; and Ge Haijiao, the former president of China Everbright Bank, have all been appointed to top provincial-level government positions. With many years of financial experience, these officials are considered the best candidates to address the insidious debt issue.

Within the provinces, a large debt load has led to solvency issues among small and medium-sized banks. In turn, China's local governments have helped to bail out some small and medium-sized banks by purchasing products that include non-performing loans. Local governments may be held responsible for the viability of smaller banks in the coming months due to a draft policy that may force local governments to merge or restructure these entities. Small and medium-sized banks are considered critical for lending to local small and medium-sized enterprises. However, smaller banks are becoming a liability; already, three regional banks have failed for the first time in 25 years and have been nationalized.

China's local government debt has manifested itself under municipal bonds and local government financing vehicles, corporations which borrowed extensively from banks after the global crisis to fund local government policy projects. The debt situation has gotten out of control. To address this issue, a monitoring system that tracks information including debt amount and type, maturity, repayment information, and asset quality has been put in place for China's 700,000 local government financing vehicles.

Cloudy skies ahead

The outlook for local government financials is not positive. So far, over one third of China's provinces have not met growth targets this year. Many of the provinces experiencing slow growth are those poorer regions that have been left behind. This means that local governments will continue to have relatively low levels of revenue while under a massive debt overhang.

The trade war with the US hasn't helped. Local governments took responsibility for maintaining employment in the face of the trade war by boosting business tax cuts and ramping up infrastructure spending once again. This was funded by the sale of municipal bonds. The scale of municipal bond debt has risen massively from $34 billion in 2017 to $183 billion in 2019. Supply has mounted while demand for municipal debt has declined. It seems likely that state-related entities will be forced to hold municipal debt if market demand is insufficient, but this will only exacerbate the drag on growth.

Short-run challenges may create yet another stumbling block for local governments. Most ominous is the fact that local government municipal debt matures in 2020. This debt load amounts to $283 billion. Circumstances under which local governments took on the debt are not much different from the current situation, meaning that there are few to no sources of new growth. Although the central government has canceled a scheduled decrease in revenue sharing to local governments, the local government fiscal burden is high.

The local government debt burden is likely to persist due to the overall revenue shortfall and high debt loads faced by local governments. Something has to give, whether it is debt repayments, maintaining full employment, or buoying GDP. It may take more than a financial expert to get local governments on the track to fiscal sustainability once and for all.