Zhou Xiaoming, Former Deputy Permanent Representative of China’s Mission to the UN Office in Geneva

Aug 12, 2025

Prohibitive penalties on the poorest countries threaten to destabilize these fragile economies and deprive tens of millions of poor people of their livelihoods. Trump’s tariffs are not only unjustified, but also immoral. And this is just the tip of the iceberg.

Richard Javad Heydarian, Professorial Chairholder in Geopolitics, Polytechnic University of the Philippines

Aug 08, 2025

The second Trump administration has combined aggressive diplomatic engagement with a confrontational trade policy that alienates allies and risks triggering a global recession, despite legitimate concerns about America’s industrial decline. While Trump's trade agenda aims to restructure global commerce to favor U.S. interests, its unilateral execution and failure to build a coalition undermine its effectiveness and may isolate the U.S. rather than restore its manufacturing strength.

Richard Javad Heydarian, Professorial Chairholder in Geopolitics, Polytechnic University of the Philippines

Aug 08, 2025

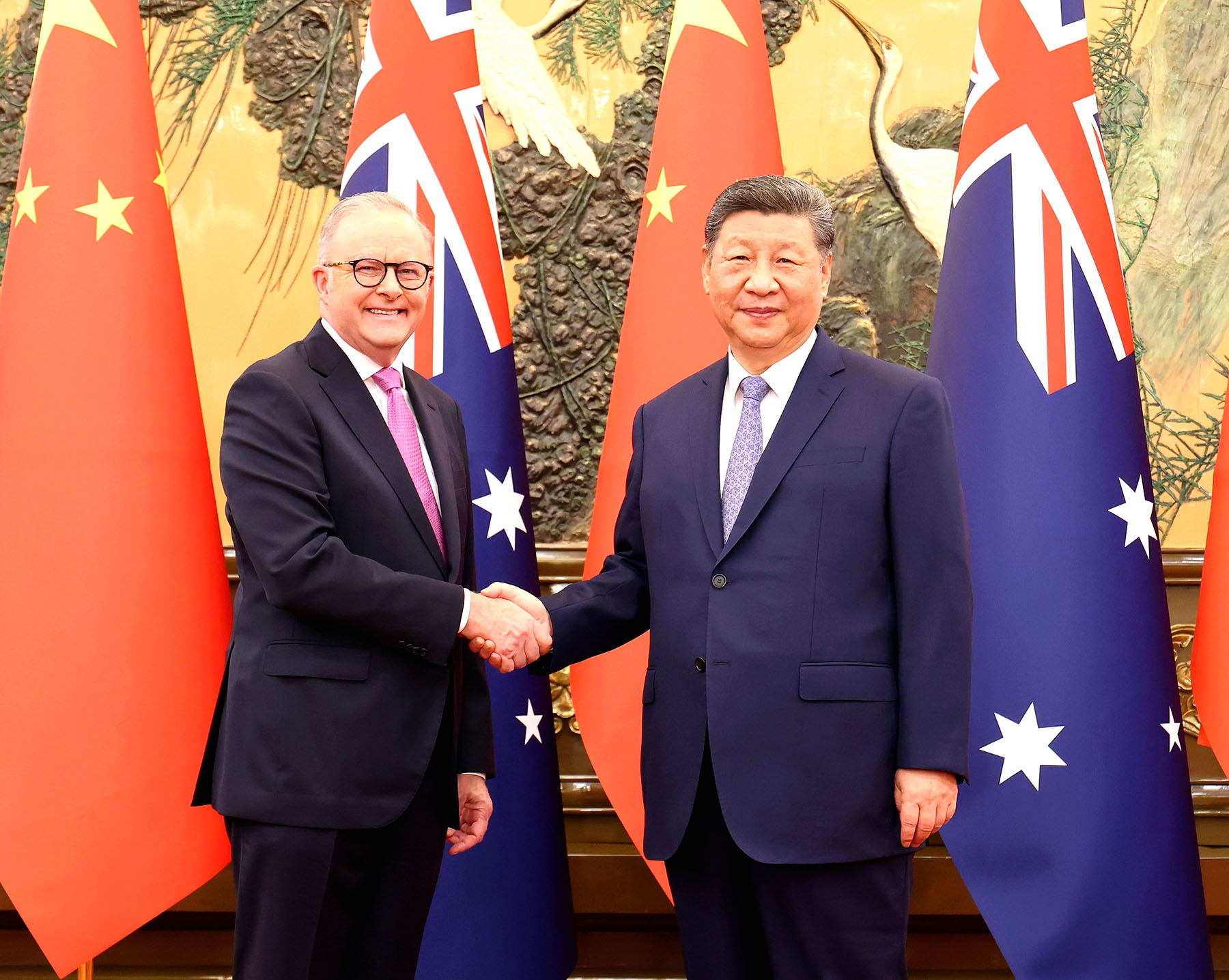

The second Trump administration’s trade policies and assertive defense diplomacy have unsettled key Asian allies, straining some relationships while drawing others into deeper military cooperation. This approach has raised concerns about diminishing strategic autonomy among U.S. partners and the potential for pushing them closer to China.

Wang Dong, Professor and Executive Director, Institute for Global Cooperation and Understanding, Peking University

Zhang Xueyu, Research Assistant, Institute for Global Cooperation and Understanding at Peking University

Aug 07, 2025

The country is steering artificial intelligence toward a more balanced, secure and inclusive development path. In doing so, it is contributing to a global development trajectory that is more intelligent, equitable and sustainable.

Tian Dewen, Senior Fellow, Institute of Global Governance and Development, Renmin University of China

Aug 07, 2025

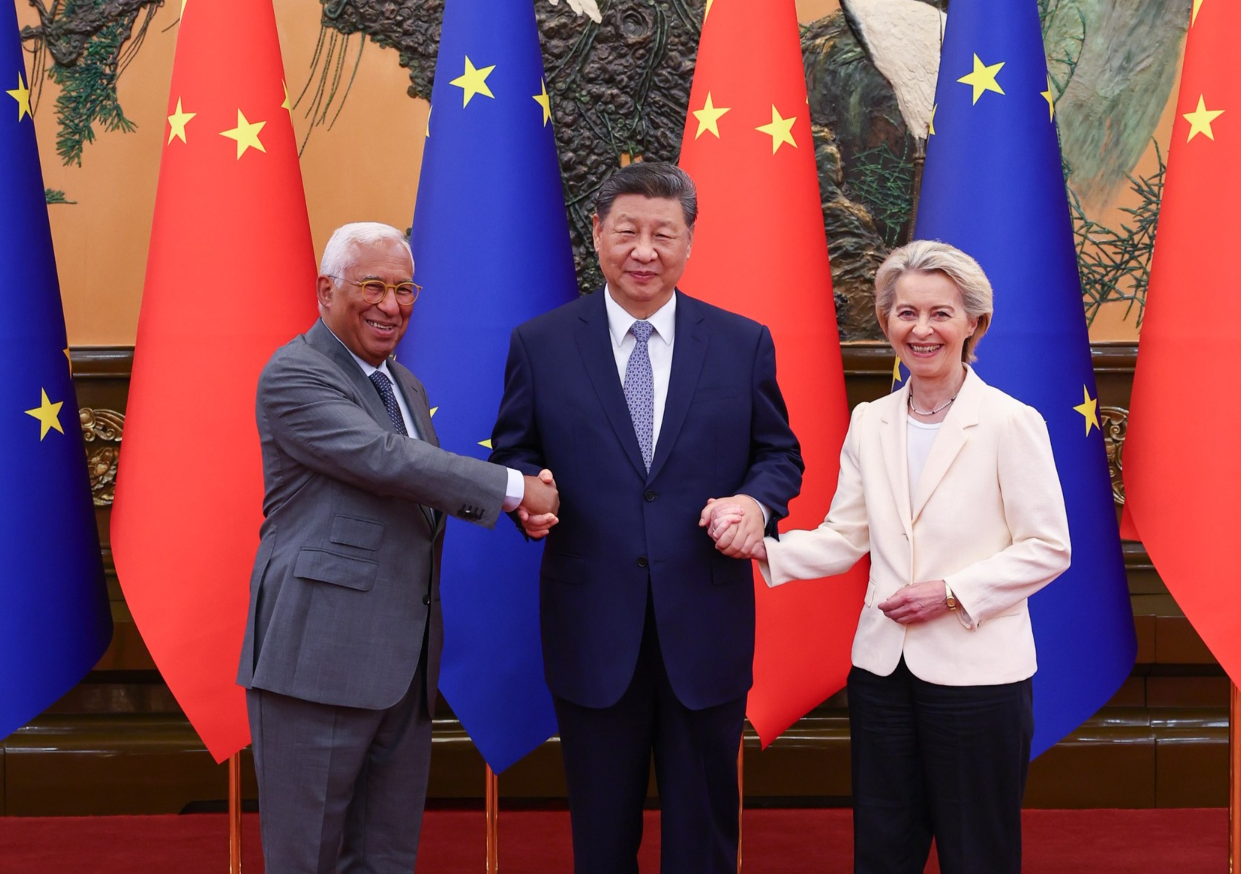

Over the past 50 years since diplomatic relations were established between China and the European Union, differences have never become insurmountable obstacles. This is the proven pattern and the one to which they should continue to adhere in the future.

Alicia Garcia Herrero, Chief Economist for Asia Pacific at NATIXIS and Senior Fellow at Bruegel

Aug 04, 2025

The U.S.’ expanded tariffs under the second Trump administration are reshaping global supply chains by imposing steep, targeted duties and pressuring Asian economies to invest in American production. As manufacturing shifts away from China and its neighbors, countries like Mexico may benefit, while India risks being left behind.

Li Yan, Director of President's Office, China Institutes of Contemporary International Relations

Aug 01, 2025

The U.S. president’s policies have fueled deglobalization and disrupted the existing international order, but they have also pushed countries around the world to explore new models of cooperation and foster new approaches to trade.

Leonardo Dinic, Expert in Geopolitics and International Business, the Future of Work, and Emerging Technologies

Aug 01, 2025

In July 2025, the U.S. and China released national AI strategies with global aims: the U.S. ties AI exports to political alignment, while China promotes open cooperation with fewer conditions. These contrasting approaches reflect broader political differences and may give China an edge in global AI influence.

Yasuto Watanabe, Director of ASEAN+3 Macroeconomic Research Office

Jul 30, 2025

In times of geopolitical uncertainty, regional unity is the surest path forward. In July, the ASEAN+3 Macroeconomic Research Office (AMRO) released its updated outlook for the ten members of the Association of Southeast Asian Nations, plus China, Japan, and South Korea. AMRO revised down its growth forecasts for 2025 and 2026 to 3.8% and 3.6%, respectively, and highlighted the urgent need for greater regional integration.

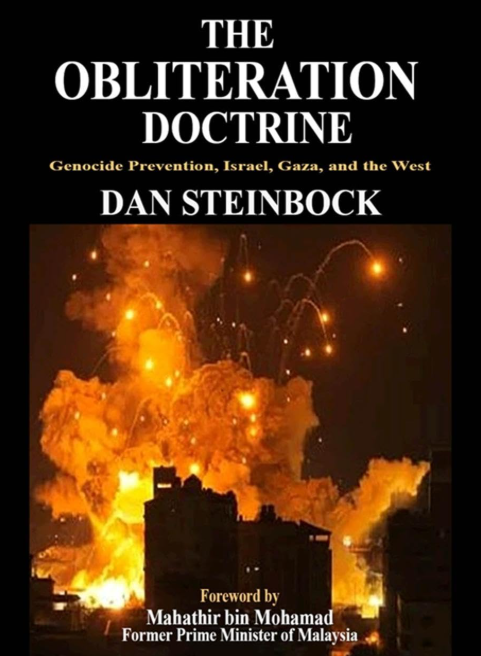

Dan Steinbock, Founder, Difference Group

Jul 25, 2025

Since fall 2023, Israel has engaged in genocidal atrocities in Gaza. So, why hasn’t the Genocide Convention been used to preempt the violence? Why has the Convention proved ineffective since its creation? The West’s long struggle against the Genocide Convention is one of the central questions of Dan Steinbock’s new book, The Obliteration Doctrine.

Back to Top

- China-US Focus builds trust and understanding between the U.S. and China through open dialogue among thought leaders.

- Our Offerings

- Topics

- Videos

- Podcasts

- Columnists

- Research Reports

- Focus Digest

- Stay Connected

-

Thanks for signing up!

- Get the latest stories from China-US Focus weekly.