Zhang Monan, Deputy Director of Institute of American and European Studies, CCIEE

Dec 22, 2025

The Turnberry System is a way to replace the WTO-based postwar multilateral trading system with bilateral agreements. It marks a significant turning point in global trade rules and will profoundly impact the global trade landscape.

He Weiwen, Senior Fellow, Center for China and Globalization, CCG

Dec 22, 2025

It is highly anticipated that even with a continued mix of tensions and collaboration, 2026 will see more of the positive and less of the negative, thus benefiting the people of both countries and the world at large.

Gu Bin, Associate Professor, Beijing Foreign Studies University

Dec 02, 2025

A world order without the United States has been discussed widely. One example relates to reform of the World Trade Organization, whose dispute settlement mechanism has been paralyzed by the U.S. since 2019. Now there could be a solution.

Zhou Xiaoming, Former Deputy Permanent Representative of China’s Mission to the UN Office in Geneva

Nov 21, 2025

High import duties on Chinese goods have become the new normal for the United States. While there’s lots of talk about renewed stability with China after the presidents met in South Korea, but the world’s two largest economies appear to be learning how to live apart.

Christopher A. McNally, Professor of Political Economy, Chaminade University

Oct 10, 2025

After months of escalating tariffs and retaliatory measures, China and the United States have reached a fragile truce that has begun to stabilize their trade and technology relationship. While tensions over chips, rare earths, and agricultural exports persist, both sides now recognize their mutual vulnerability, creating a cautious but potentially durable détente rooted in economic deterrence rather than dominance.

He Weiwen, Senior Fellow, Center for China and Globalization, CCG

Oct 09, 2025

China’s decision to forgo special rights in the WTO shows that it takes its great power responsibility seriously. It wants to advance trade cooperation with developed economies and with Global South. A trade upturn with the United States in 2026 is much anticipated.

Zhang Monan, Deputy Director of Institute of American and European Studies, CCIEE

Oct 08, 2025

Beijing’s announcement regarding future World Trade Organization negotiations is strategic. It represents both a willingness to promote WTO reform and an institutional adjustment to support high-quality domestic development and opening-up to the world.

Brian Wong, Assistant Professor in Philosophy and Fellow at Centre on Contemporary China and the World, HKU and Rhodes Scholar

Sep 19, 2025

China’s economic struggles have implications for its trading partners across the globe, notably in Europe. What can Beijing’s fight against ‘involution’ tell the world about its future trading prospects?

He Weiwen, Senior Fellow, Center for China and Globalization, CCG

Sep 05, 2025

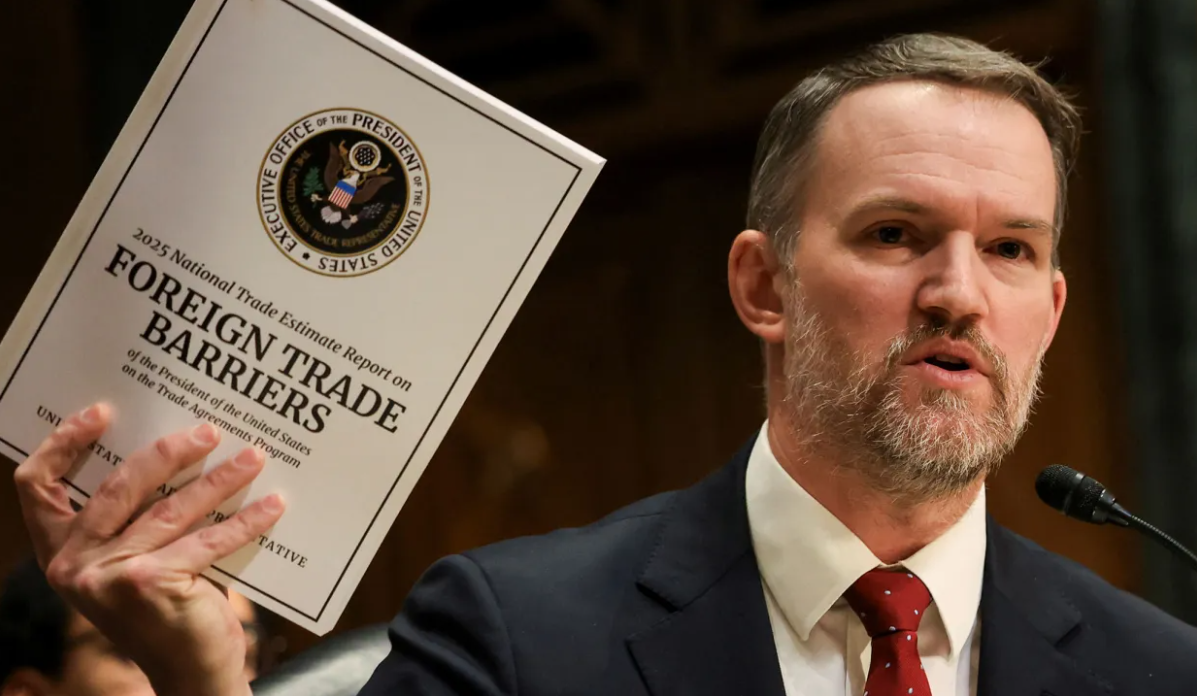

America’s sweeping tariffs are harmful to both the world economy and to America itself and should be revoked. But a bigger trend is emerging: The relevance of the United States is dwindling when it comes to global trade.

Dong Yifan, Associate Research Fellow, Belt and Road Academy of Beijing Language and Culture University

Aug 22, 2025

The European Union’s ongoing pursuit of an economy-first strategy continues to encounter significant obstacles, especially the erosion of its economic autonomy resulting from the strategic concessions it has made to the United States.

Back to Top

- China-US Focus builds trust and understanding between the U.S. and China through open dialogue among thought leaders.

- Our Offerings

- Topics

- Videos

- Podcasts

- Columnists

- Research Reports

- Focus Digest

- Stay Connected

-

Thanks for signing up!

- Get the latest stories from China-US Focus weekly.