Christopher A. McNally, Professor of Political Economy, Chaminade University

May 31, 2023

While the United States is experiencing dramatic levels of inflation, China is facing very low levels. Assessing various forms of economic stimuli, such as quantitative easing, is important to understand and mitigate current levels of inflation faced by economies all over the world.

Ma Xue, Associate Fellow, Institute of American Studies, China Institutes of Contemporary International Relations

Apr 26, 2023

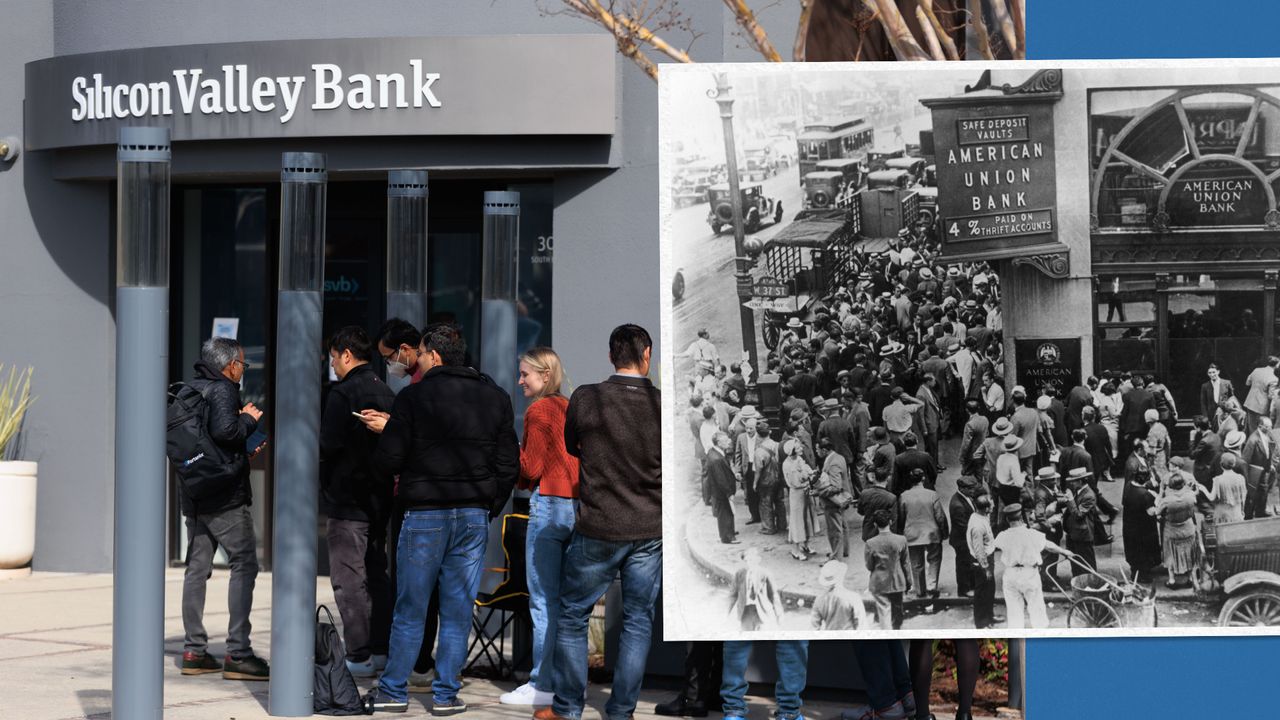

Financial markets are grounded in trust. When trust falters, dislocation follows. Panic in short-term financing markets in the United States could ignite a larger crisis in the overall economy, creating a vicious circle that undermines growth.

Andrew Sheng, Distinguished Fellow at the Asia Global Institute at the University of Hong Kong

Xiao Geng, Director of Institute of Policy and Practice at Shenzhen Finance Institute, Chinese University of Hong Kong

Dec 04, 2022

In 2020, Sebastian Mallaby of the Council on Foreign Relations announced the beginning of the “age of magic money,” in which advanced economies would “redefine the outer limits of their monetary and fiscal power.” By July 2022, Mallaby was predicting that this age was coming to an end. But, while most major central banks are now reversing quantitative easing (QE) and raising interest rates, China may need to head in the opposite direction.

Christopher A. McNally, Professor of Political Economy, Chaminade University

Nov 30, 2021

The global pandemic’s impact on the economy was an issue that governments worldwide had to deal with, amid changing ways that people manage their money. Digital currency may be the next avenue for market stimulation in China, and beyond.

He Yafei, Former Vice Minister of Foreign Affairs

Nov 11, 2015

Fluctuations in China’s currency and economy don’t have the wild effect on the global markets that many critics allege, and such accusations distract from a needed collective focus on maintaining stability.

Zhang Monan, Deputy Director of Institute of American and European Studies, CCIEE

Aug 06, 2015

Concerns about the wealth gap and debt service linger to keep the US economy from growing at its full potential.

Stephen Roach, Senior Fellow, Yale University

Jul 29, 2015

Quantitative easing (QE) is utilized by U.S. and European banks to manipulate asset prices and provide stimulus to asset-dependent economies. China’s market manipulation is no less blatant, but is distinct in its aim to promote new markets.

Stephen Roach, Senior Fellow, Yale University

May 12, 2015

Financial engineering largely benefits the wealthiest class; monetary easing has failed to spur meaningful recovery in post-crisis economies, threatening to keep the global economy trapped in a continuous series of crises. As Chinese Premier Li Keqiang stressed, the answer is a commitment to structural reform – a strategic focus of China’s that, he noted, is not shared by others.

Dan Steinbock, Founder, Difference Group

Mar 09, 2015

The controversial issue of “currency manipulation” has resurfaced. However, Washington and Beijing have very different perceptions about the identity of the “currency manipulator.” The net effect is currency friction that is likely to prevail until the 2020s.

Yi Xianrong, Researcher, Chinese Academy of Social Sciences

Feb 16, 2015

European quantitative easing policy lead to the depreciation of the RMB exchange rate, but this depreciation is being carefully and intentionally observed by China’s central bank to observe the actual impact on the Chinese economy. A more flexible and internationalized RMB will be better to guard against depreciation.