Zongyuan Zoe Liu, Senior Fellow for China Studies, Council on Foreign Relations

Jul 18, 2025

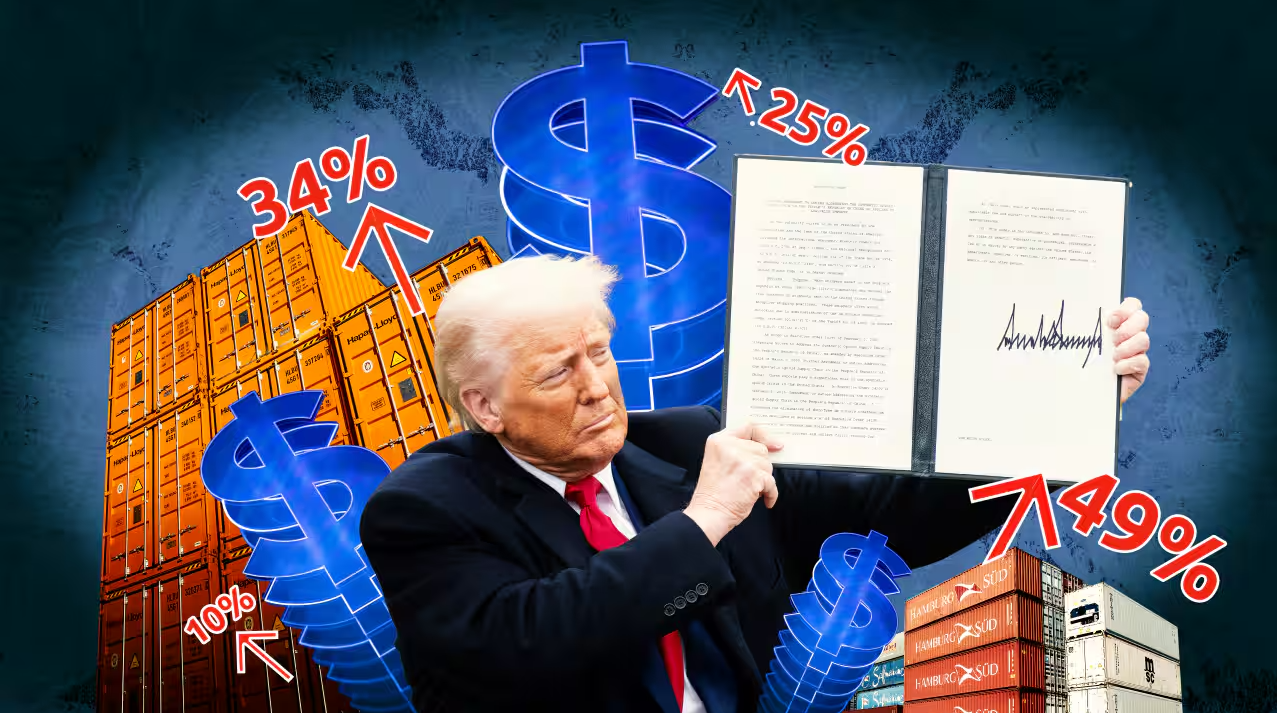

The most recent trade talks between the United States and China in Geneva and London provided little more than temporary relief in the conflict between the world’s two largest economies. Despite US President Donald Trump’s efforts to tout the stopgap measures as a “deal” that benefits America, China reads the scoreboard differently – and believes it is winning. From its vantage point, it has weathered the storm and emerged more confident, more self-reliant, and more convinced that its long game is paying off.

Stephen Roach, Senior Fellow, Yale University

Jun 04, 2025

There is an inherent flaw in US President Donald Trump’s trade policy. While it is all but impossible to know where Trump will settle on most issues – from taxes to immigration – two key objectives of his trade strategy are now coming into focus: setting a global minimum tariff, and imposing a special penalty on China. The flaw lies in the combination.

Wang Yuzhu, Research Fellow, Institute for World Economy Studies, SIIS

Jun 02, 2025

America’s reindustrialization process relies heavily on China’s industrial system support. In an increasingly competitive global market, China’s full-fledged industrial system emerges as the most cost-effective and competitive option.

Zhang Yun, Professor, School of International Relations, Nanjing University

May 30, 2025

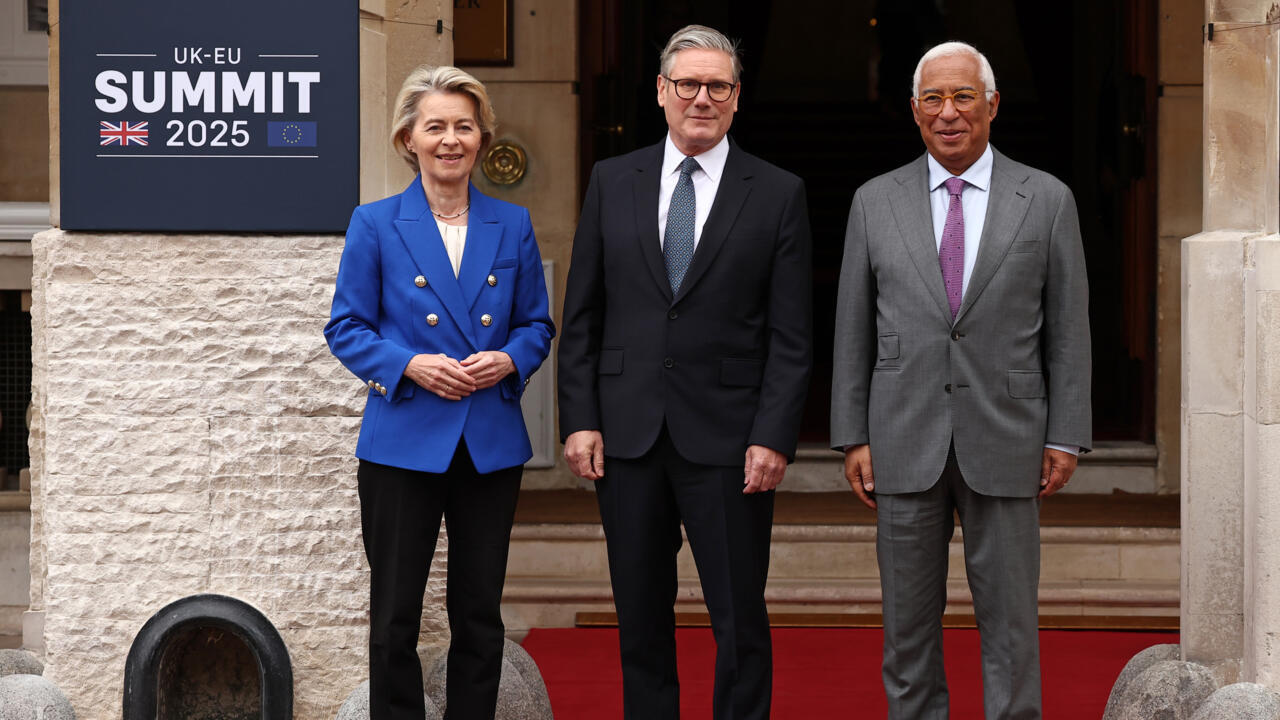

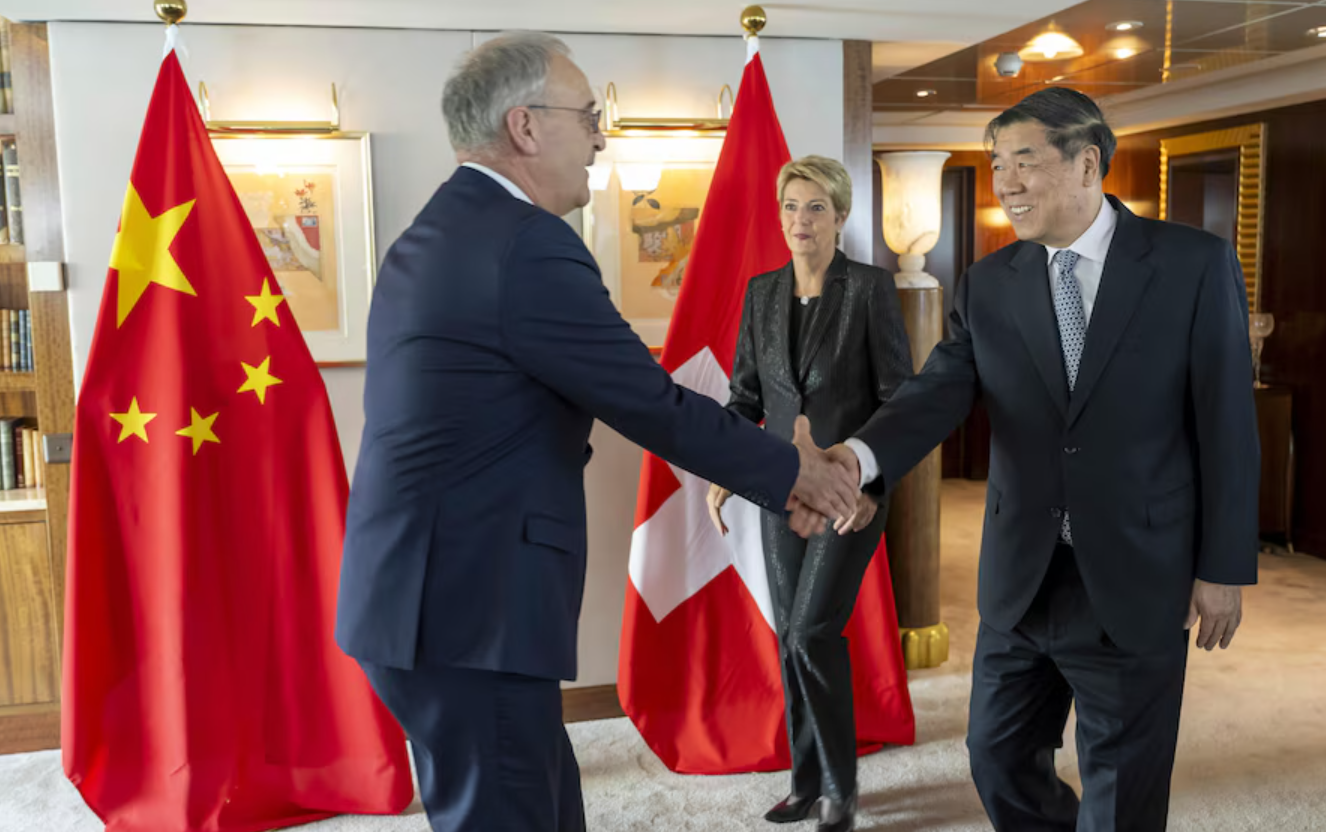

After reaching a consensus in their tariff negotiations in Geneva, China and the United States have significantly reduced their duties on each other. This has awakened countries around the world and inspired them to launch a new wave of regional integration.

Christopher A. McNally, Professor of Political Economy, Chaminade University

May 23, 2025

China’s new export licensing system strengthens its control over key rare earth elements, deepening supply chain risks. Although new processing facilities are emerging abroad, they won’t soon offset China’s dominance, prolonging global uncertainty.

Dan Steinbock, Founder, Difference Group

May 14, 2025

Despite de-escalation in Geneva, trillions of dollars may have been lost in the unwarranted trade wars.

Zhou Xiaoming, Former Deputy Permanent Representative of China’s Mission to the UN Office in Geneva

May 06, 2025

A trade deal between China and the United States is nowhere in sight. The mountain of issues could take a long time and enormous effort to resolve. It’s certainly not going to happen in three or four weeks, as Trump has suggested. More likely, it will be months, if not years.

Xu Qiyuan, Senior Fellow and Deputy Director of the Institute of World Economics and Politics, Chinese Academy of Social Sciences

May 02, 2025

History may rhyme, but the economic drama now unfolding in the United States defies historical reason. When the US Federal Reserve’s technocrats collide with an inexperienced and capricious presidential administration, conventional macroeconomic tools quickly become impotent.

Ding Yifan, China Forum Expert and Deputy Director of China Development Research Center

Apr 30, 2025

There is no winner in a trade war, because sabotaging trade hurts both sides. “Killing 1,000 enemies while losing 800 of one’s own” — a Chinese saying for a scenario in which the cost does not justify the gain — is applicable in this case.

Ma Xue, Associate Fellow, Institute of American Studies, China Institutes of Contemporary International Relations

Apr 30, 2025

Despite the growing risk of economic recession at home, President Donald Trump has done nothing to prepare voters for the pain ahead. He is betting that the Federal Reserve will relax interest rates to mitigate the effect of tariffs, but monetary easing could also trigger an inflation spike.

Back to Top

- China-US Focus builds trust and understanding between the U.S. and China through open dialogue among thought leaders.

- Our Offerings

- Topics

- Videos

- Podcasts

- Columnists

- Research Reports

- Focus Digest

- Stay Connected

-

Thanks for signing up!

- Get the latest stories from China-US Focus weekly.