Yu Xiang, Senior Fellow, China Construction Bank Research Institute

Dec 19, 2025

The recently released 2025 NSS, shows the limits of decoupling. Defending core interests while designing layered mechanisms that preserve cooperation is the only rational way for the United States and China to avoid mutual destruction and global stagnation.

Zhu Zhongbo, Director, Department for International and Strategy Studies, China Institute of International Studies

Dec 18, 2025

The national development strategy advocates for a multipolar world and seeks to implement global initiatives on development, security, civilization and governance. It opposes hegemony, defends justice and promotes a world of lasting peace, prosperity, openness and sustainability.

Ghulam Ali, PhD, Monash University, Australia

Dec 18, 2025

Two separate announcements tell how Trump’s tariffs left China’s exports unscathed while quietly taxing American households.

Bibek Raj Kandel, New World AsiaGlobal Fellow Energy and Climate Policy Expert

Diana Teoh, Asia Global Institute Fellow

Dec 15, 2025

For decades, Western multinationals and tech firms built Malaysia’s export base while China financed its railways, ports, and industrial zones -- a balance Kuala Lumpur managed with unusual ease. Now, rare-earth ambitions are pulling that equilibrium in new directions, intensifying debates at home over control, national interest, and how far neutrality can stretch.

Nancy Qian, Professor of Economics at Northwestern University, Founding Director of China Econ Lab

Dec 09, 2025

As geopolitical tensions rise, competition for the cutting-edge science and talent that underpins advanced technology has heated up. The United States, China, and other major powers now regard leadership in areas like AI, semiconductors, quantum technologies, and biotechnology as central to military capability, economic security, and ideological influence.

Ludovic Subran, Chief Investment Officer and Chief Economist at Allianz

Dec 09, 2025

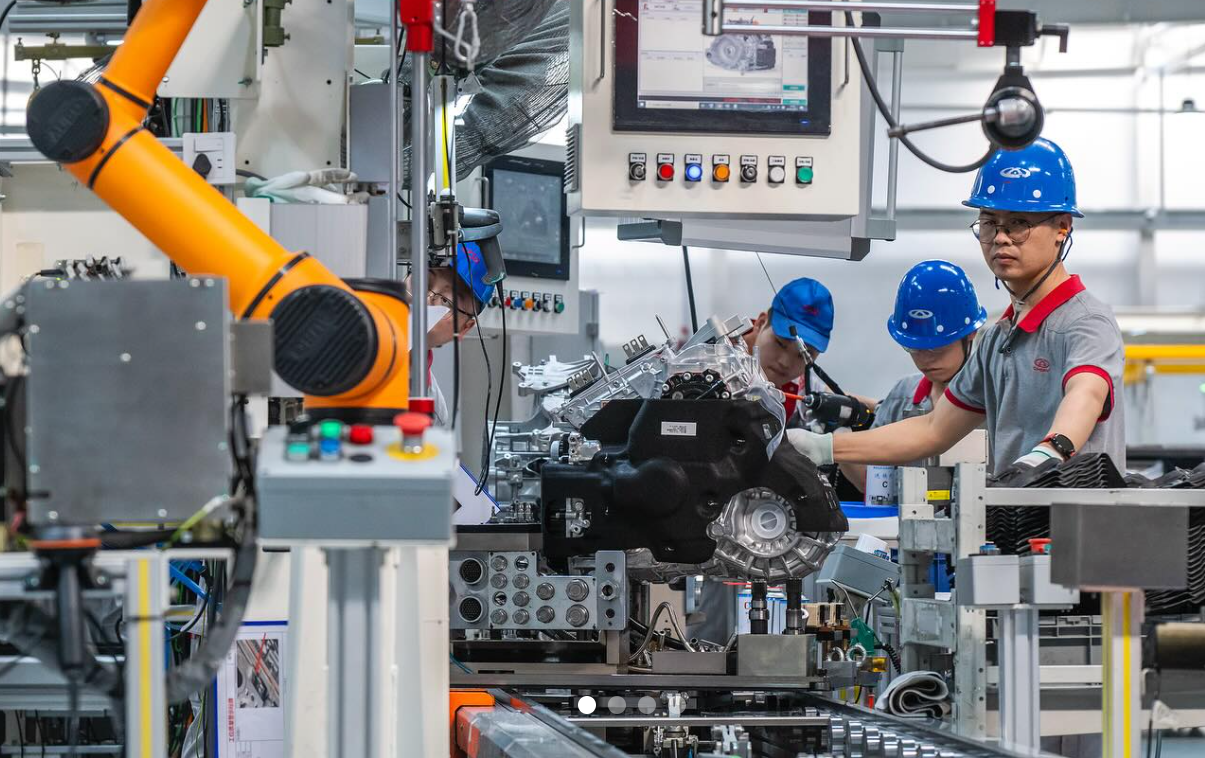

Another great transformation is underway in China. The world’s factory is fast becoming its first electro-state, with an economy increasingly built on clean energy, AI, advanced manufacturing, and control of key strategic materials. This new model is full of promise, though it faces major challenges.

Gu Bin, Associate Professor, Beijing Foreign Studies University

Dec 02, 2025

A world order without the United States has been discussed widely. One example relates to reform of the World Trade Organization, whose dispute settlement mechanism has been paralyzed by the U.S. since 2019. Now there could be a solution.

Zhou Xiaoming, Former Deputy Permanent Representative of China’s Mission to the UN Office in Geneva

Dec 02, 2025

Brussels is retreating from the very multilateral order it once championed. The challenge now is enabling European companies to thrive within a competitive environment. True strategic autonomy will not be achieved through protectionism disguised as regulation.

Zhang Monan, Deputy Director of Institute of American and European Studies, CCIEE

Nov 28, 2025

The impact on the global economic and trade landscape is unmistakable. These tariffs will establish trade frictions a a new normal and drive global supply chains toward some form of decoupling. They may also provoke countermeasures from other economies, especially given the constrained role of the WTO.

Dan Steinbock, Founder, Difference Group

Nov 28, 2025

When Japan’s new prime minister Sanae Takaichi took office, she pledged to focus on economic improvement. After her Taiwan comments, new missteps could prove costly to Japan, the region, even the world.

Back to Top

- China-US Focus builds trust and understanding between the U.S. and China through open dialogue among thought leaders.

- Our Offerings

- Topics

- Videos

- Podcasts

- Columnists

- Research Reports

- Focus Digest

- Stay Connected

-

Thanks for signing up!

- Get the latest stories from China-US Focus weekly.