Ghulam Ali, PhD, Monash University, Australia

Dec 18, 2025

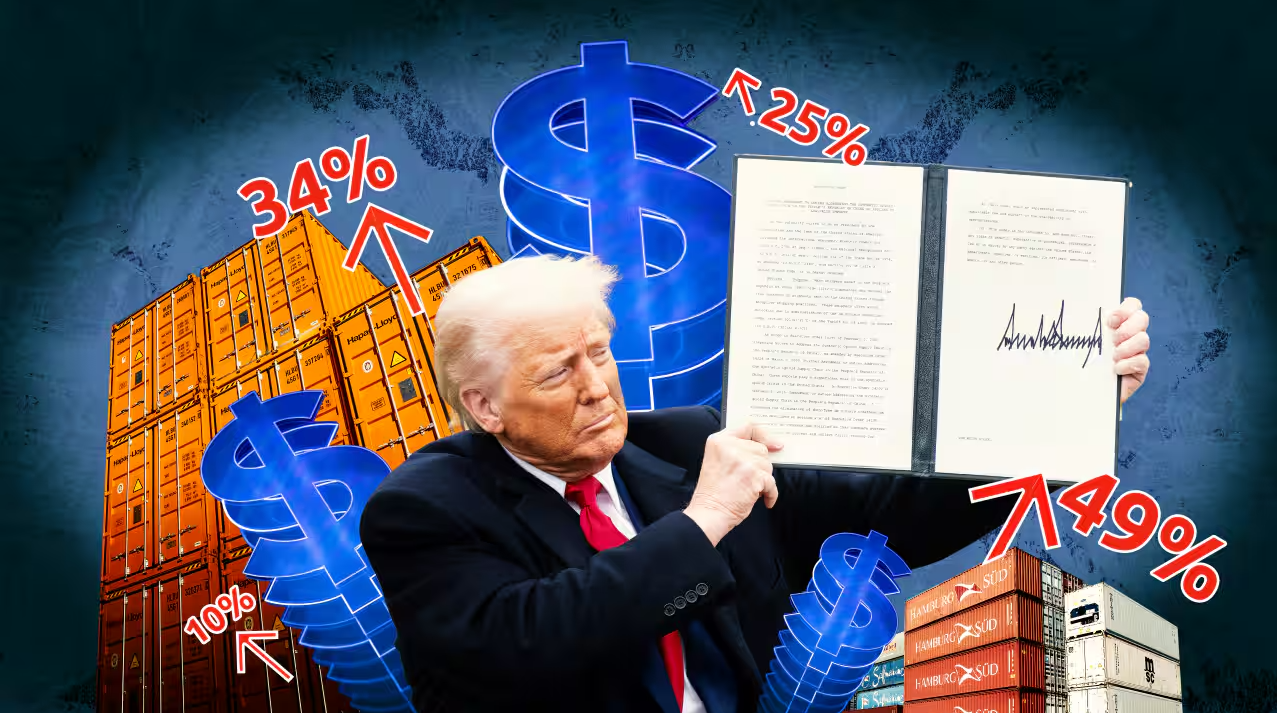

Two separate announcements tell how Trump’s tariffs left China’s exports unscathed while quietly taxing American households.

Warwick Powell, Adjunct Professor at Queensland University of Technology

Nov 10, 2025

In the geopolitical theater of 2025, the United States’ trade posture toward China exemplifies a pattern of escalating threats that yield diminishing strategic returns.

Warwick Powell, Adjunct Professor at Queensland University of Technology

Oct 27, 2025

John Maynard Keynes’ The Economic Consequences of the Peace (1919) remains one of the most prescient critiques of postwar settlement in modern history. In it, Keynes warned that victory can hollow itself out when the victors lose their sense of humility. The punitive reparations imposed upon Germany after World War I, he argued, sowed the seeds for future instability by humiliating and impoverishing a nation that, once stripped of dignity and hope, would not long consent to the order imposed upon it. His insight was both economic as well as moral and political: sustainable peace requires magnanimity, not vengeance; it presupposes an architecture of inclusion, not one of exclusion. In today’s parlance, it rejects blocs aimed at those outside and seeks to ground relations in the idea of indivisible peace.

Sajjad Ashraf, Former Adjunct Professor, National University of Singapore

Oct 17, 2025

China’s new rare-earth export controls have turned its dominance in the sector into a powerful strategic tool, extending restrictions to technology, equipment, and expertise that tighten global dependence. The move has intensified tensions with the United States and its allies, highlighting how control over critical minerals now defines the balance of economic and geopolitical power.

Lucio Blanco Pitlo III, President of Philippine Association for Chinese Studies, and Research Fellow at Asia-Pacific Pathways to Progress Foundation

Sep 12, 2025

America’s tariffs have remained a centerpiece of discussion in global trade since the White House announced them, with a clear, coherent path forward yet to emerge. In these first few historic months, how has the aggressive trade policy affected U.S. positions in Asia?

He Weiwen, Senior Fellow, Center for China and Globalization, CCG

Sep 05, 2025

America’s sweeping tariffs are harmful to both the world economy and to America itself and should be revoked. But a bigger trend is emerging: The relevance of the United States is dwindling when it comes to global trade.

Dong Yifan, Associate Research Fellow, Belt and Road Academy of Beijing Language and Culture University

Aug 22, 2025

The European Union’s ongoing pursuit of an economy-first strategy continues to encounter significant obstacles, especially the erosion of its economic autonomy resulting from the strategic concessions it has made to the United States.

Zhang Monan, Deputy Director of Institute of American and European Studies, CCIEE

Jul 30, 2025

The EU and U.S. have agreed to a tactical cease-fire, not a strategic settlement. As long as Europe pursues strategic autonomy and Washington replaces rules-based multilateralism with transactional deals, fresh disputes are inevitable.

Sujit Kumar Datta, Former Chairman of Department of International Relations, University of Chittagong, Bangladesh

Jul 28, 2025

The intent of the United States was to coerce China into making concessions. But this didn’t work. China was only inspired to reach out to other trading partners and become more independent through home-grown technological development.

Yu Xiang, Senior Fellow, China Construction Bank Research Institute

Jul 21, 2025

If the United States can adapt flexibly and prioritize consensus with its trading partners, it may solidify its economic dominance. Otherwise, persistent high tariffs risk deepening global trade fragmentation and will challenge America’s long-term influence.

Back to Top

- China-US Focus builds trust and understanding between the U.S. and China through open dialogue among thought leaders.

- Our Offerings

- Topics

- Videos

- Podcasts

- Columnists

- Research Reports

- Focus Digest

- Stay Connected

-

Thanks for signing up!

- Get the latest stories from China-US Focus weekly.