In early July, four large Chinese airlines announced a bulk order of 292 aircraft from the European aircraft manufacturing giant Airbus, totaling US$37.3 billion (RMB 249.3 billion). This “biggest ever single-day jet deal” has provoked much discussion within the international aviation community and beyond.

The title of a widely circulated Chinese news article raised a pointed question: “China can produce its own C919 aircraft, why do we still sign this massive order?” In another online journal, a well-known Chinese left-wing commentator criticized the timing of the order. In his view, the order was made at an inopportune time when the Chinese economy has significantly slowed and the Chinese airlines involved in the transaction––China Eastern, China Southern, Air China, and Shenzhen Airlines––all held huge deficits, partly because of the COVID-19 pandemic.

Not surprisingly, the spokesperson for Boeing, the American aviation giant, expressed the company’s disappointment with China’s Airbus deal. In his words, the order revealed that “geopolitical differences” continue to constrain the export of American jets to the People’s Republic of China (PRC). According to one Chinese official source, from November 2017 to July 2022, China ordered only eight aircraft from Boeing, despite having previously signed a purchase intent agreement for 300 aircraft (totaling about US$37 billion) during President Donald Trump’s visit to China in November 2017. In recent years, China has become more willing to play hardball in responding to Washington’s economic sanctions against Beijing and taking advantage of the commercial interests of EU countries. Against this backdrop, Boeing has suffered from the drastic deterioration of U.S.-China relations.

This recent episode in the aviation industry reflects some of the most important issues in both China’s domestic development and foreign relations. These include tensions between growing techno-nationalism and the continued need for foreign engagement, between the country’s prevailing economic slowdown and enduring large market, and between the challenges posed by the U.S.-led coalition and China’s leverage through commercial incentives. Arguably the most important aspect of this bulk aircraft purchase is the ambitious development plan of the Chinese aviation industry and space development more broadly.

China’s aviation industry: A mainstay of the commercial market

According to the Airbus news release, by mid-2022, the in-service Airbus fleet with Chinese operators already totaled over 2,070 aircraft, accounting for more than half of China’s 4,054 civil aviation passenger aircraft. Overall, the fleet of aircraft in service in China is expected to triple to nearly 11,000 by 2040.

Boeing also made a similar forecast indicating a prosperous outlook for the Chinese aviation market, which “will acquire a total of 8,600 new planes over the next 20 years alone,” as shared in a July 2021 Financial Times article. This would amount to “trillion dollars-worth” of aircraft. Bloomberg News recently characterized the Chinese market as one of the “mainstays of modern commercial aviation.”

Some prominent international professional organizations and consulting firms have offered similar optimistic assessments of the Chinese aviation market. According to the International Air Transport Association (IATA), China is poised to unseat the United States as the largest aviation market—as defined by traffic to, from, and within a country—in the world this year. Furthermore, China is expected to reach a total of 1.5 billion aviation passengers by 2036. This would be an increase of 921 million new passengers from 2016. In comparison, the United States and India, the second and third largest aviation markets in the world, will see new passengers in the same period numbering, respectively, 401 million (totaling 1.1 billion in the United States) and 337 million (totaling 478 million in India).

Given the colossal potential of China’s aviation market, China’s own manufacturer, the Commercial Aircraft Corporation of China (COMAC), is certainly far from ready to hold a large share of the domestic market. Even for single-aisle jets, COMAC’s C919 must share the market with Airbus’s A320 and Boeing’s 737-800. For example, the current production capacity of the COMAC ARJ21, a 78–90 seat regional jet, is merely 50 aircraft per year, despite being a significant increase compared to its initial capacity in 2016. According to an authoritative Chinese source, after the C919 enters operation in 2022, the production capacity is expected to increase at a similar rate and reach an annual production level of 150 aircraft, but that may not occur until around 2030. As for now, COMAC lacks the capacity to mass produce the aircraft, although over 800 orders for the C919 have already been placed by 28 countries, starting as early as 2018.

As the Chinese authorities have recognized, the biggest shortcoming or bottleneck in China’s aviation industry is engine design. To address this major challenge, the Chinese government established the Aero Engine Corporation of China (AECC) in 2016 and appointed Cao Jiangguo (1963), the former president of China Aerospace Science and Industry Corporation (CASIC), an alternate member of the 19th Central Committee of the Chinese Communist Party, as its chair.

The establishment of AECC reflects Xi Jinping’s view that real core technology cannot be bought, and thus China should promote indigenous innovation. As revealed in a detailed Chinese report, the 1995-1996 Taiwan Strait crisis and the 1999 NATO missile attack on the Chinese embassy in Yugoslavia triggered Beijing to inaugurate the production line for large aircraft around the turn of the 21st century. According to this report, Chinese rock scientists, most notably Wang Daheng (1915-2011), played instrumental roles in advocating for a techno-nationalistic approach. In 2007, China announced the launch of the large aircraft project by establishing production lines for the C919 in Shanghai and large transport aircraft in Shaanxi.

The Chinese government has also made major investments in building airports to meet the growing demand over the past two decades. The number of civil airports in the country doubled from 120 in 2000 to 248 in 2021. In addition, 139 civil airports in the country have undertaken major expansion projects during the past decade.

It has been widely recognized that the number of civil airports in China is insignificant when compared with the United States, which has almost 20,000 civil and general airports. But this remarkable fact also suggests the great potential for future airport expansion in China. Li Jiaxiang, former director of the Civil Aviation Administration of China, claimed that “there are more than 2,800 counties in China, and there are only 78 decent general airports. If each county builds a general airport, there will be 2,800 general airports.”

The recent Airbus sale to Chinese airlines poses a major challenge for the American aviation industry. As the Rhodium Group recently estimated, “a complete loss of access to China’s market for U.S. aircraft and commercial aviation services would create U.S. output losses ranging from $38 billion to $51 billion annually. Cumulatively, lost market share impacts would add up to $875 billion by 2038.” This would further aggravate economic problems such as lower U.S. manufacturing output, job losses, and reduced R&D spending. This would undermine rather than enhance American competitiveness in this critical industry.

China’s stance on Sino-U.S. competition in space

The commercial value of space exploration is as enormous as—if not more than—that of the aviation industry. The global space economy in 2019 was estimated to be worth US$350 billion, and it will likely increase to US$2.7 trillion by 2040. Taking the satellite sector as an example, the output value of the global satellite industry doubled from 2006 to 2015, reaching US$208 billion. For China, the annual output value of the satellite application industry in 2016 exceeded 200 billion yuan, according to the China National Space Administration (CNSA). In 2017 alone, the output value of China’s domestic satellite navigation business reached 255 billion yuan. It aimed to exceed 400 billion yuan in 2020.

Not surprisingly, China has significantly increased its spending on the development of space technology over the past decade. In 2014, China’s space development budget was US$4 billion, trailing only the United States and Russia. But three years later, in 2017, China spent about US$8.4 billion on its civilian and military space projects, while Russia cut its space program to US$3 billion.

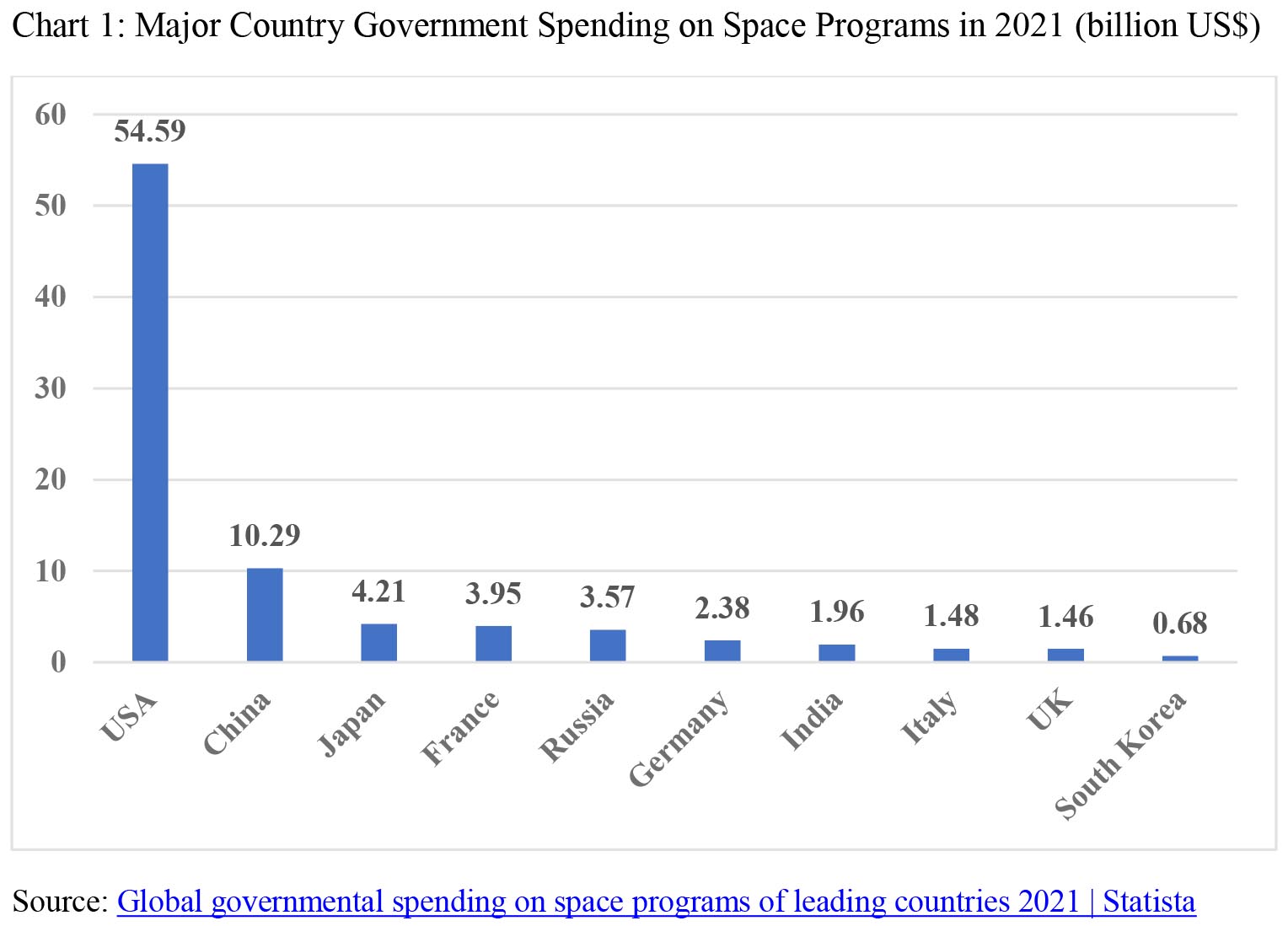

Chart 1 displays government spending on space programs among major countries in 2021. The United States still dominates the global space industry with its annual spending of US$54.59 billion, more than five times that of China (US$10.29 billion), which ranks second. The United States is the strongest space power on Earth. So far, the United States has launched 990 satellites that are in near-Earth orbit, and China has launched more than 300.

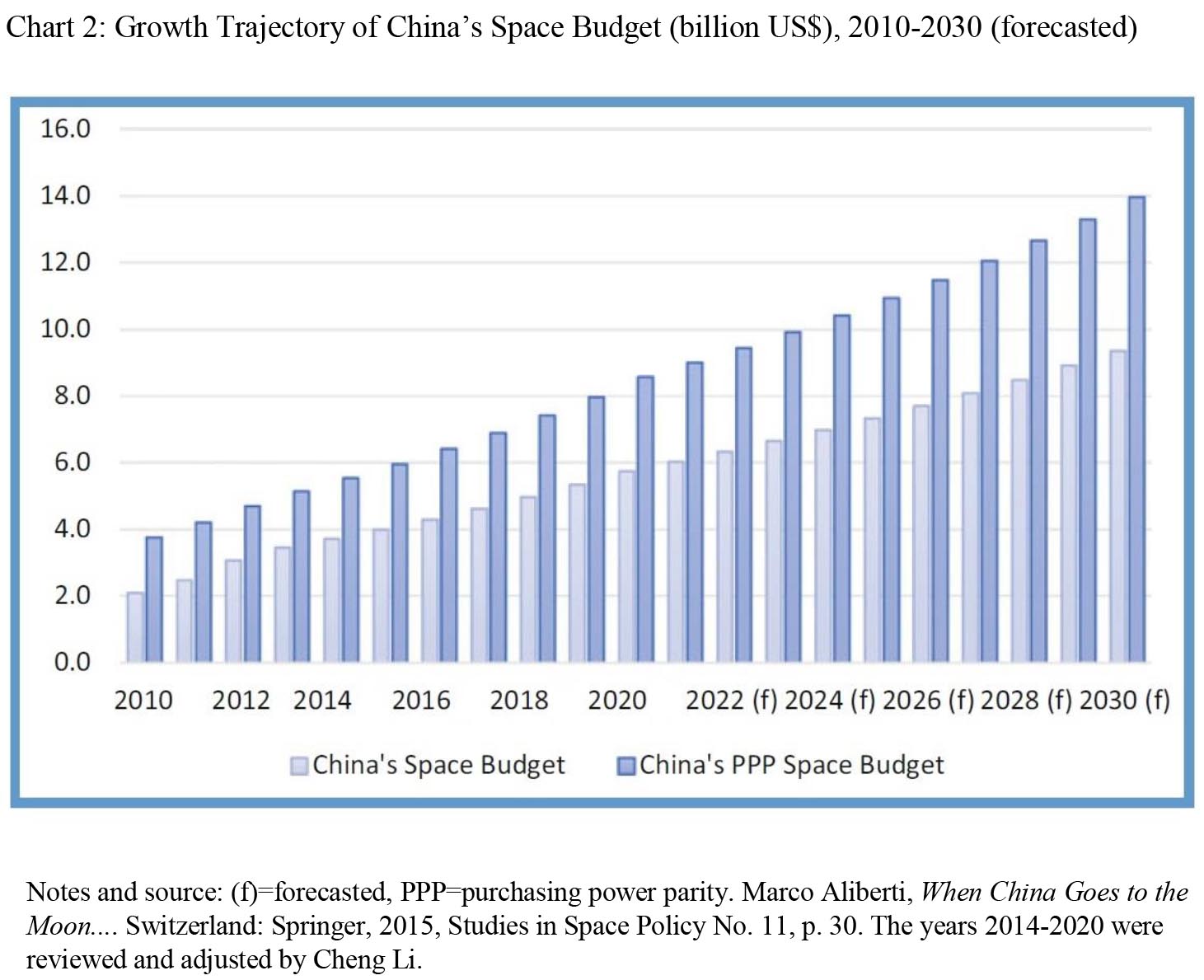

China, on the other hand, is the country with the fastest development in space spending, technology, and activities. With the recent completion of its own space station, China’s space program is progressing at an accelerated speed and scale. Chart 1 shows that China’s annual space spending is more than double that of Japan or France, and nearly triple that of Russia, which until recently was the second strongest space power. A recent study by a European expert on China’s space industry shows that, in terms of both purchasing power parity and growth trajectory, China’s rapid expansion is even more remarkable (see Chart 2).

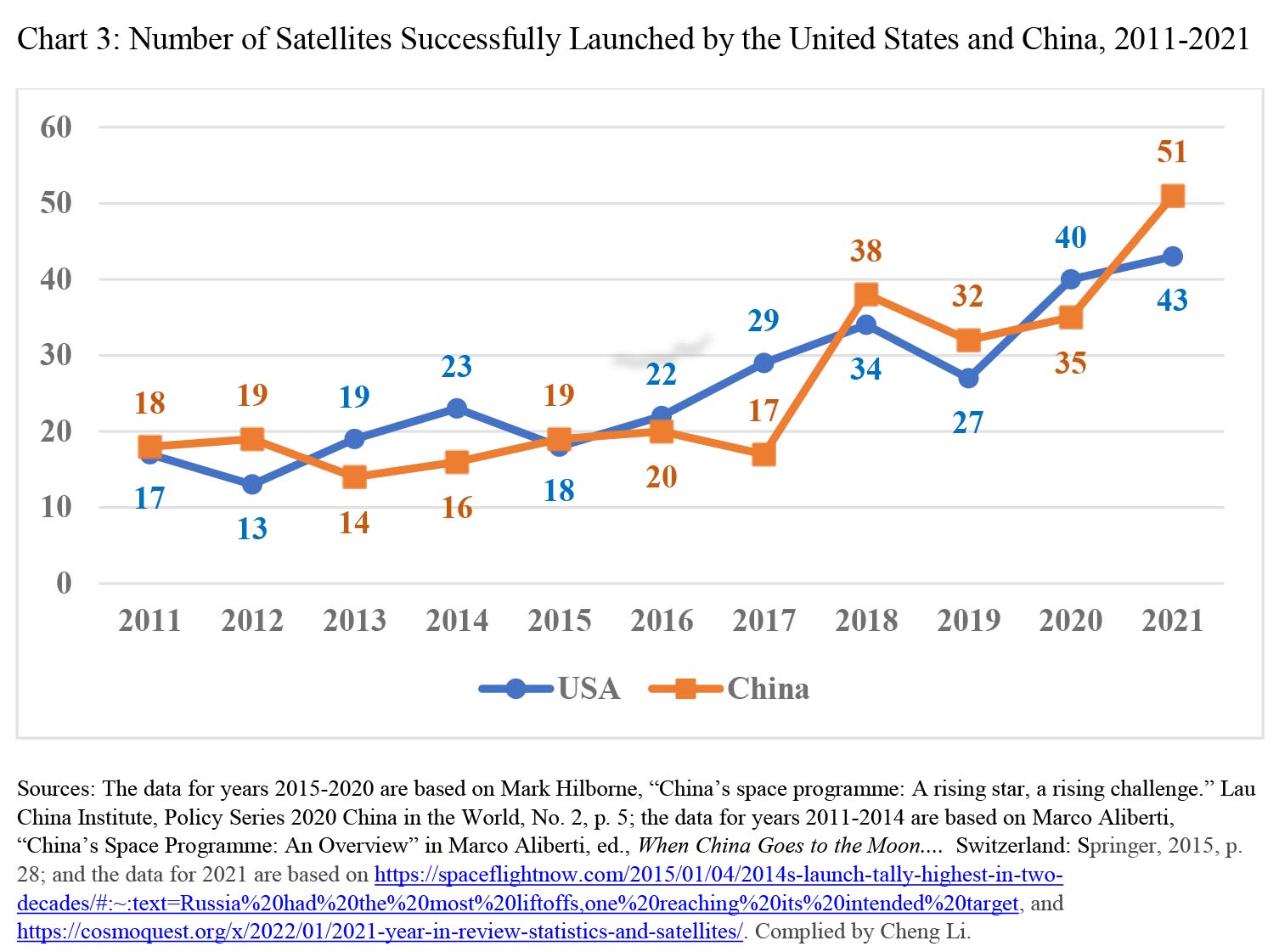

It has been widely noted that China launched more rockets into orbit in 2018 than any other country. China undertook 38 successful launches, compared to 34 by the United States. But a review of the satellite launches by China and the United States over the past decade shows that these two countries have been almost evenly matched in this area over many years (see Chart 3).

Between 2016 and 2021, China completed a total of 207 missions and over 400 launches, of which the Long March series of carrier rockets have completed 183 launches. The success rate of China’s Long March rocket launches is as high as 96 percent, and the Chinese government claims to rank first in the world in terms of overall safety record.

Without any doubt, China’s achievements in space under Xi’s leadership over the past decade have further aroused techno-nationalist sentiments. For Chinese scientists in the field of space exploration, the 2011 U.S. law prohibiting bilateral contact between NASA and Chinese scientists and excluding Chinese astronauts from the international space station has driven them to accelerate China’s space program.

In 2022, China is scheduled to undertake more than 40 space launch missions, including six major manned space missions — two for cargo spacecraft, two for Shenzhou spacecraft, and the launch of the experimental cabin I and the experimental cabin II. Three astronauts will be stationed in the core module and will stay in orbit for six months. Their main mission is to help complete the orbital construction of the Chinese space station late this year.

For decision-makers in Beijing, a crucial area for enhancing China’s capacity in Sino-U.S. space competition is the Beidou Satellite Navigation System (BDS), which is comparable to the American GPS, Russian GLONASS, and the European Galileo systems. On the commercial front, the BDS would drive a market share of 240-320 billion yuan annually. Like other satellite navigation services, BDS will provide services including aircraft, auto, and ship navigation, humanitarian and disaster assistance, agricultural improvement, and weather prediction. As a report by the U.S.-based China Aerospace Studies Institute noted, countries along the Belt and Road Initiative (BRI) could greatly benefit from its services. With all of the 30 BDS global networking satellites in place since July 2020, half of the world (about 120 countries) has begun to use BDS with the number of users exceeding 100 million.

In addition to the enormous commercial value attached to the civilian services of the BDS, its military applications and implications have attracted far greater attention from the United States and its allies. To state the obvious, any differences in accuracy between satellite navigation systems can be critical in warfighting environments. Some recent international events have reinforced the significance of the strategic and military implications of China’s space development.

In March 2021, China and Iran formally signed a 25-year strategic cooperation agreement. This agreement includes three critical clauses: 1) China will increase its investment in Iranian energy facilities and infrastructure construction, which has directly undermined U.S.-led economic sanctions against Iran; 2) the Chinese yuan and China’s newly launched digital currency will be used to settle petroleum and trade exchanges between the two countries, and 3) Iran will use China’s Beidou global positioning and navigation system so that Iranian missiles will no longer be subject to the interference of U.S.-owned GPS. According to some Chinese analysts, the signing of the China-Iran cooperation agreement is a landmark event, showing that China’s strategy abroad has shifted from passive defense to a more proactive approach in the rapidly changing international environment.

A recent study of U.S.-China competition by American analysts rightly asserted that civilian and military personnel is a key variable in the assessment. China’s leapfrog development of its aviation and space industries has been accompanied by its new strategic emphasis on military-civil fusion. Furthermore, one objective of Xi’s military reforms is to promote military technocrats in the defense industry similar to the growing role of rocket scientists in the political leadership as discussed in the previous two articles in the series. Chinese missile and other forces have made greater efforts through multiple “shortcuts” to accelerate talent acquisition. The next article will discuss these topics, which are essential elements of the rise of the “cosmos club” in the Party leadership.