Wang Youming, Senior Research Fellow of BRICS Economic Think Tank, Tsinghua University

Sep 29, 2025

Given the profound changes in the international order and governance system, the diversification of international finance is an inevitable trend. Demand for an alternative global currency is becoming increasingly urgent.

Brian Wong, Assistant Professor in Philosophy and Fellow at Centre on Contemporary China and the World, HKU and Rhodes Scholar

Sep 19, 2025

China’s economic struggles have implications for its trading partners across the globe, notably in Europe. What can Beijing’s fight against ‘involution’ tell the world about its future trading prospects?

Lucio Blanco Pitlo III, President of Philippine Association for Chinese Studies, and Research Fellow at Asia-Pacific Pathways to Progress Foundation

Sep 12, 2025

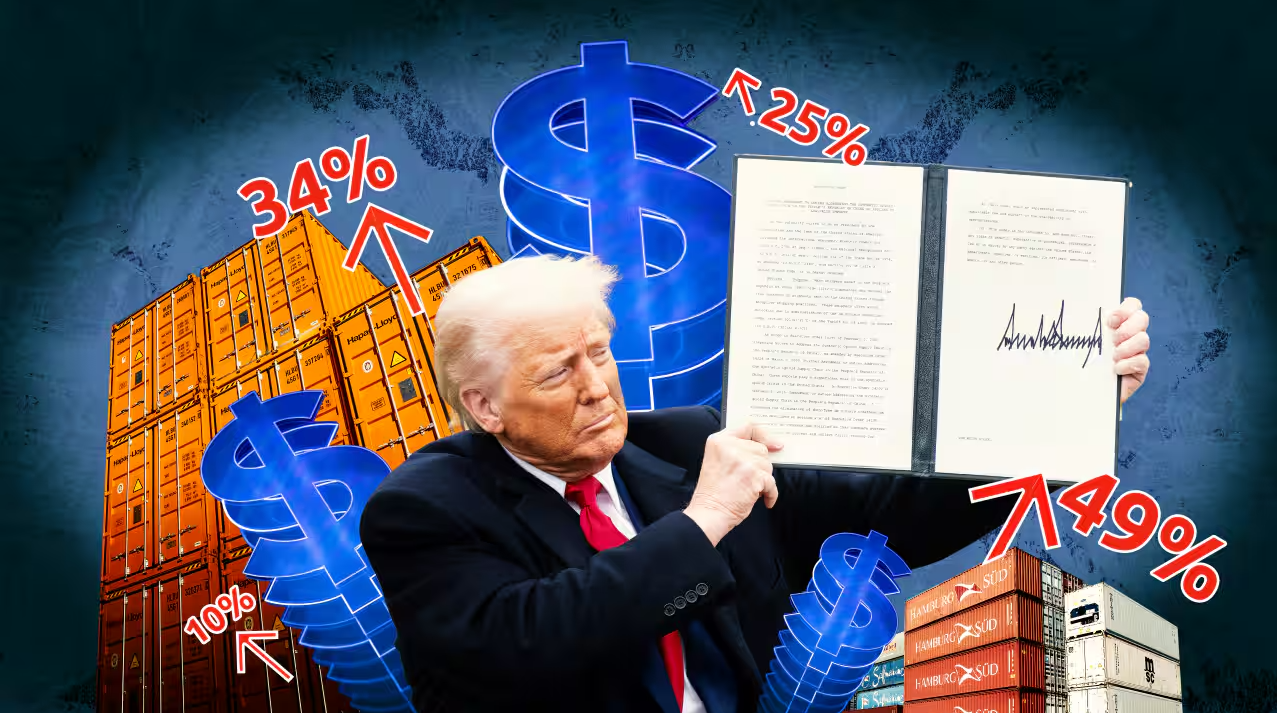

America’s tariffs have remained a centerpiece of discussion in global trade since the White House announced them, with a clear, coherent path forward yet to emerge. In these first few historic months, how has the aggressive trade policy affected U.S. positions in Asia?

Zhang Wenzong, Associate Research Fellow, CICIR

Sep 12, 2025

It should not be difficult for politicians of insight to choose between joining hands to build a community with a shared future for mankind or becoming powerful countries’ pawns to fight and exhaust one another.

Xiao Bin, Deputy Secretary-general, Center for Shanghai Cooperation Organization Studies, Chinese Association of Social Sciences

Sep 02, 2025

Turbulence has overwhelmed the current international system and SCO member states are feeling a profound impact. The Tianjin Summit is designed to further deepen multilateral cooperation and to provide a new center for global strategic stability.

Dong Yifan, Associate Research Fellow, Belt and Road Academy of Beijing Language and Culture University

Aug 22, 2025

The European Union’s ongoing pursuit of an economy-first strategy continues to encounter significant obstacles, especially the erosion of its economic autonomy resulting from the strategic concessions it has made to the United States.

Zhang Monan, Deputy Director of Institute of American and European Studies, CCIEE

Aug 22, 2025

The special administrative region has become a pioneer in institutional and technological innovation. Its recent initiative represents a significant opportunity for the region and a crucial step in China’s broader efforts toward the internationalization of the yuan.

Zhou Xiaoming, Former Deputy Permanent Representative of China’s Mission to the UN Office in Geneva

Aug 12, 2025

Prohibitive penalties on the poorest countries threaten to destabilize these fragile economies and deprive tens of millions of poor people of their livelihoods. Trump’s tariffs are not only unjustified, but also immoral. And this is just the tip of the iceberg.

Richard Javad Heydarian, Professorial Chairholder in Geopolitics, Polytechnic University of the Philippines

Aug 08, 2025

The second Trump administration has combined aggressive diplomatic engagement with a confrontational trade policy that alienates allies and risks triggering a global recession, despite legitimate concerns about America’s industrial decline. While Trump's trade agenda aims to restructure global commerce to favor U.S. interests, its unilateral execution and failure to build a coalition undermine its effectiveness and may isolate the U.S. rather than restore its manufacturing strength.

Alicia Garcia Herrero, Chief Economist for Asia Pacific at NATIXIS and Senior Fellow at Bruegel

Aug 04, 2025

The U.S.’ expanded tariffs under the second Trump administration are reshaping global supply chains by imposing steep, targeted duties and pressuring Asian economies to invest in American production. As manufacturing shifts away from China and its neighbors, countries like Mexico may benefit, while India risks being left behind.

Back to Top

- China-US Focus builds trust and understanding between the U.S. and China through open dialogue among thought leaders.

- Our Offerings

- Topics

- Videos

- Podcasts

- Columnists

- Research Reports

- Focus Digest

- Stay Connected

-

Thanks for signing up!

- Get the latest stories from China-US Focus weekly.