Sun Chenghao, Fellow, Center for International Security and Strategy of Tsinghua University; Munich Young Leader 2025

Feb 26, 2026

The old international order is being dismantled, even as a new one gradually comes into view. The interplay of major-powers, regional cooperation and global practices will continue to reshape that order as the parties attempt to stop the bleeding.

Warwick Powell, Adjunct Professor at Queensland University of Technology

Feb 26, 2026

U.S. Secretary of State Marco Rubio stood before the Munich Security Conference on 14 February 2026 and delivered a speech that will be remembered less for its

Dan Steinbock, Founder, Difference Group

Feb 13, 2026

In a recent speech, Canada’s Prime Minister Mark Carney declared the end of the rules-based order. Yet, U.S. unilateralism began accelerating in the 1980s, and much of the West complied so long as it remained beneficial. Today, that alignment no longer holds.

Tobias Bunde, Director of Research and Policy, Munich Security Conference

Sophie Eisentraut, Head of Research and Publications, Munich Security Conference

Feb 10, 2026

The world has entered a period of wrecking-ball politics. Leaders have risen to prominence by promising sweeping demolition rather than careful reform. They seek to tear down rules and institutions at home and abroad, which they falsely claim hinder both their efforts to build stronger, more prosperous countries as well as to prevent “civilizational decline.”

Wang Youming, Senior Research Fellow of BRICS Economic Think Tank, Tsinghua University

Feb 10, 2026

The U.S. president has been a bull in a china shop over the past year, shaking the international order to the core. Such shocks to the global governance system present new opportunities and challenges for BRICS to grow and leave its mark.

Sun Chenghao, Fellow, Center for International Security and Strategy of Tsinghua University; Munich Young Leader 2025

Bai Xuhan, An analyst at ChinAffairsplus

Feb 05, 2026

For Singapore, the China-U.S. relationship is much more than a bilateral concern. It has profound implications for the sense of security, strategic expectations and assessments of the future by all medium-size states.

Ghulam Ali, PhD, Monash University, Australia

Jan 30, 2026

By January 2026, the first year of the second four-year—and constitutionally final—term of U.S. President Donald Trump was complete. This initial quarter of his tenure has jolted the world, unnerving the global community on economic, trade, and security matters while weakening the post-war international order. The resulting shocks reverberate across the international system, amplified by the scale of U.S. power and global entanglement. This disruption is unfolding in real time.

Christopher A. McNally, Professor of Political Economy, Chaminade University

Jan 30, 2026

Donald Trump’s second-term foreign policy has accelerated the collapse of the postwar liberal international order by abandoning its institutions, norms, and sources of legitimacy. Economic integration is now widely used as a tool of coercion, placing middle powers in an unstable interregnum defined by great-power rivalry, forced alignment choices, and a widening contrast between U.S. unilateralism and China’s defense of globalization and multilateralism.

Lai Yuan, Assistant Fellow, Center for Latin-America Studies, Shanghai Institute for International Studies

Jan 23, 2026

Today’s Venezuela will have a long and unpredictable road to travel before it can escape the shadow of the Noriega era. Operation Absolute Resolve will either bring the United States to the summit of hegemony or act as a fuse that ignites the collapse of the rules-based global order.

Warwick Powell, Adjunct Professor at Queensland University of Technology

Jan 21, 2026

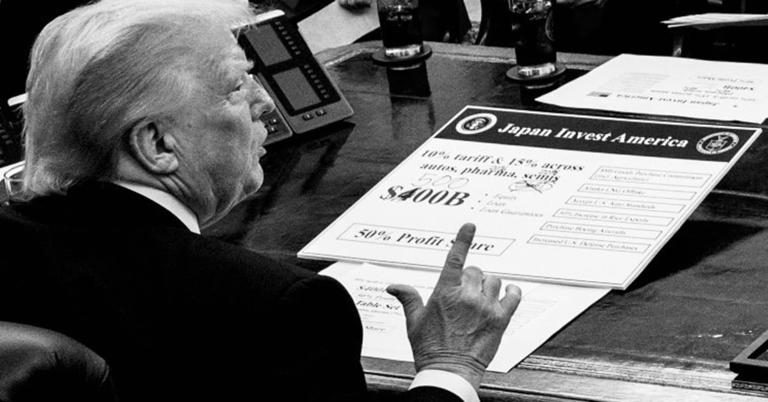

(Social media @realDonaldTrump)In May 2024, I penned an article that framed Europe’s existential dilemma starkly: either fade into obscurity as the "conti

Back to Top

- China-US Focus builds trust and understanding between the U.S. and China through open dialogue among thought leaders.

- Our Offerings

- Topics

- Videos

- Podcasts

- Columnists

- Research Reports

- Focus Digest

- Stay Connected

-

Thanks for signing up!

- Get the latest stories from China-US Focus weekly.